Refinances — including cash-out and no-cash-out refinances — increased to 43% of all mortgage originations nationwide in August 2016. This was up from 37% in July and 37% a year earlier, according to the Ellie Mae Origination Insight Report.

The increase widens when excluding Federal Housing Administration (FHA)-insured and U.S. Department of Veterans Affairs (VA)-guaranteed mortgages, as 54% of all conventional mortgage originations were refinances in August 2016, up from 47% in July and 48% a year earlier. The vast majority of FHA-insured and VA-guaranteed mortgages are originated for home purchases.

The closing rate for refinances was just over 67% in August, a relatively high percentage compared to the past couple of years. Traditionally, refinances close less often than mortgages originated for purchase. For instance, in August 2016 the closing rate for purchase mortgages was nine percentage points higher than refinances at 76%.

Refinances’ tie to mortgage rates

The number of homeowners who refinance has an inverse relationship with interest rates. In other words, when rates are down, refinances are up.

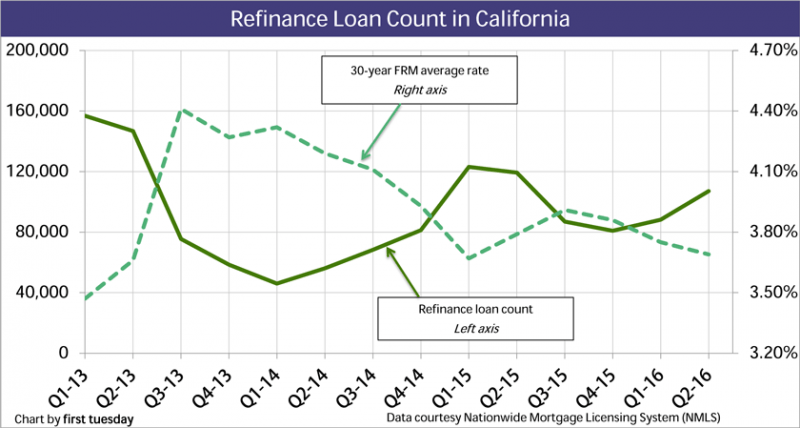

For example, take a look at the last three years of refinance activity:

Since 2013, the average fixed rate mortgage (FRM) rate has oscillated between 3.5%-4.5%. When it was at its most recent peak of around 4.4% in the third quarter (Q3) of 2013, the number of refinances fell steeply from the prior quarter, and bottomed half a year later in Q1 2014 when 46,000 refinances occurred in California. For reference, just a year earlier when mortgage rates were averaging 3.5% it was over three times that number at 160,000 refinances.

In Q2 2016, a modest 107,100 refinances closed in California. The average FRM rate was 3.7%, and continued to decline throughout the summer, causing refinances to rise.

What’s in store for refinances

There is a coming headwind to today’s upward trend in refinancing.

The Federal Reserve (the Fed) has indicated it will increase the short-term rate sometime in the coming months. It initially bumped up this rate in December 2015, increasing the target rate from essentially zero to a minor 0.25%-0.5%. At the time, key interest rates controlling adjustable rate mortgage (ARM) rates also increased due to this Fed action. However, FRM rates stayed low.

In fact, FRM rates actually decreased through much of 2016, primarily due to the lack of other safe investment options outside of long-term U.S. Treasuries. Global investors poured money into the 10-year Treasury note, keeping this key interest rate low, and holding down average FRM rates, too.

All of this interest in Treasuries won’t last forever though. As soon as global markets begin to show signs of stability, investors will reject the low rates of return they are currently receiving in exchange for the safety of investing in Treasuries. At the same time, the Fed, finding evidence that the economy can handle another rate increase, will increase the target short-term rate again. ARM and FRM rates will rise, removing the main attraction for homeowners considering refinancing (a lower rate than they currently pay).

first tuesday forecasts this next rate bump will occur sometime in the first half of 2017. Therefore, agents with clients who are thinking of refinancing will do well to recommend they begin the refinance process sooner rather than later. Once rates begin to rise, they won’t return to 2016 levels for many years. Such is the interest rate cycle, in which we are currently at the bottom of an upswing — 20-30 years of rising rates followed by 20-30 years of falling rates.