This form is used by an agent when negotiating a sale, lease or mortgage of property and otherwise undisclosed compensation arising out of the transaction will be received by the agent, to disclose to their client the form, amount and source of the additional compensation.

What is a conflict of interest?

A conflict of interest arises when a broker or their agent, acting on behalf of a client, has a competing professional or personal bias which hinders their ability to fulfill the fiduciary duties they have undertaken on behalf of their client.

A conflict of interest addresses the broker’s personal relationships which are potentially at odds with the agency duty of care and protection owed the client.

Thus, a conflict of interest creates a fundamental agency dilemma for brokers; it is not a compensation or business referral issue.

Unless timely disclosed and the client consents, the conflict is a breach of the broker’s fiduciary duty of good faith, fair dealing and trust owed to the client when the broker continues to act on the client’s behalf.

Prompt, upfront disclosure is used to create transparency in the transaction. [See RPI Form 527]

It reveals to the client the bias held by the broker which, when disclosed, allows the client to fully take the bias into consideration in negotiations.

The disclosure and consent do not neutralize the inherent bias itself. However, it does neutralize the element of deceit which breaches the broker’s fiduciary duty when left undisclosed. [See RPI Form 527]

When to disclose a conflict of interest

A conflict of interest arises and is disclosed to the client when the broker:

- has a pre-existing relationship with another person due to kinship, employment, partnership, common membership, religious affiliation, civic ties, or any other socio-economic context; and

- that relationship might hinder their ability to fully represent the needs of their client.

A conflict of interest, whether patent or potential, is disclosed by the broker at the time it occurs or as soon as possible after the conflict arises.

Typically, the conflict arises prior to providing a buyer with property information or taking a listing from a seller.

A broker or their agent uses a Conflict of Interest Disclosure form to disclose the potential conflict of interest which may interfere with their ability to represent their client as agreed. [See RPI Form 527]

By disclosing the potential conflict of interest to the client and obtaining their signature, the client agrees to the broker or agent’s representation. [See RPI Form 527]

Simultaneously, by providing the disclosure and receiving the client’s consent, the broker or agent remains compliant with state regulations regarding a real estate professional’s disclosure to their client of the kinship, position or undue influence held by the broker or agent. [Calif. Business and Professions Code §10177(o)]

Potential overlaps of allegiance or prejudice which cause a conflict that a broker or their agent needs to disclose include situations when:

- the broker or their agent holds a direct or indirect ownership interest in the real estate, including a partial ownership interest in a limited liability company (LLC) or other entity which owns or is buying, leasing or lending on the property;

- an individual related to the broker or one of their agents by blood or marriage holds a direct or indirect ownership interest in the property or is the buyer;

- an individual with whom the broker or a family member has a special pre-existing relationship, such as prior employment, significant past or present business dealings, or deep-rooted social ties, holds a direct or indirect ownership, leasehold, or security interest in the property or is the buyer;

- the broker or their agent’s concurrent representation of the opposing party, a dual agency situation; or

- an unwillingness of the broker or their agent to work with the opposing party, or others, or their brokers or agents in a transaction.

To disclose or not to disclose?

As comprehensive rules do not yet exist which delineate all those instances where a conflict of interest may theoretically arise and need to be disclosed, brokers are left to draw their own conclusions when conflicting situations regarding a property or a transaction with or involving third-parties arise. [See RPI e-book Real Estate Practice Chapter 6]

In practice, brokers, and especially agents, all too often err on the side of nondisclosure — putting their broker fee, and potentially their license, at risk. [Bus & P C §10177(o)]

Usually, when a broker even questions whether it is appropriate to disclose a potential conflict of interest to a client, it’s best to disclose it. The existence of any concern is reason enough for a prudent broker to be prompt in seeking their client’s consent to the potential conflict.

By timely disclosing a conflict of interest and obtaining consent, the broker immediately creates an honest working relationship with their client — the epitome of transparency and fair dealing.

Ultimately, a conflict of interest needs to be disclosed to the client when the broker has a pre-existing relationship with a person other than the client which might hinder their ability to fully represent the needs of their client. Notice that the potentiality itself creates a conflict — even when in practice the agent’s duties are not compromised. [See RPI Form 527]

This pre-existing relationship may be based on any form of:

- kinship;

- employment;

- partnership;

- common membership;

- religious affiliation;

- civic ties; or

- any other socio-economic context.

In a professional relationship, a broker’s financial objective of compensation for services rendered is not a conflict of interest.

However, fees and benefits derived from conflicting sources are required to be disclosed to the client. [See RPI Form 119]

This includes compensation in the form of:

- professional courtesies;

- familial favors; and

- preferential treatment by others toward the broker or their agents. [See RPI Form 119]

Similarly, the referral of a client to a financially controlled business, owned or co-owned by the broker, needs to be disclosed.

The broker accomplishes this through using an affiliated business arrangement (ABA) disclosure. [See RPI Form 519]

Disclosing compensation in a real estate transaction

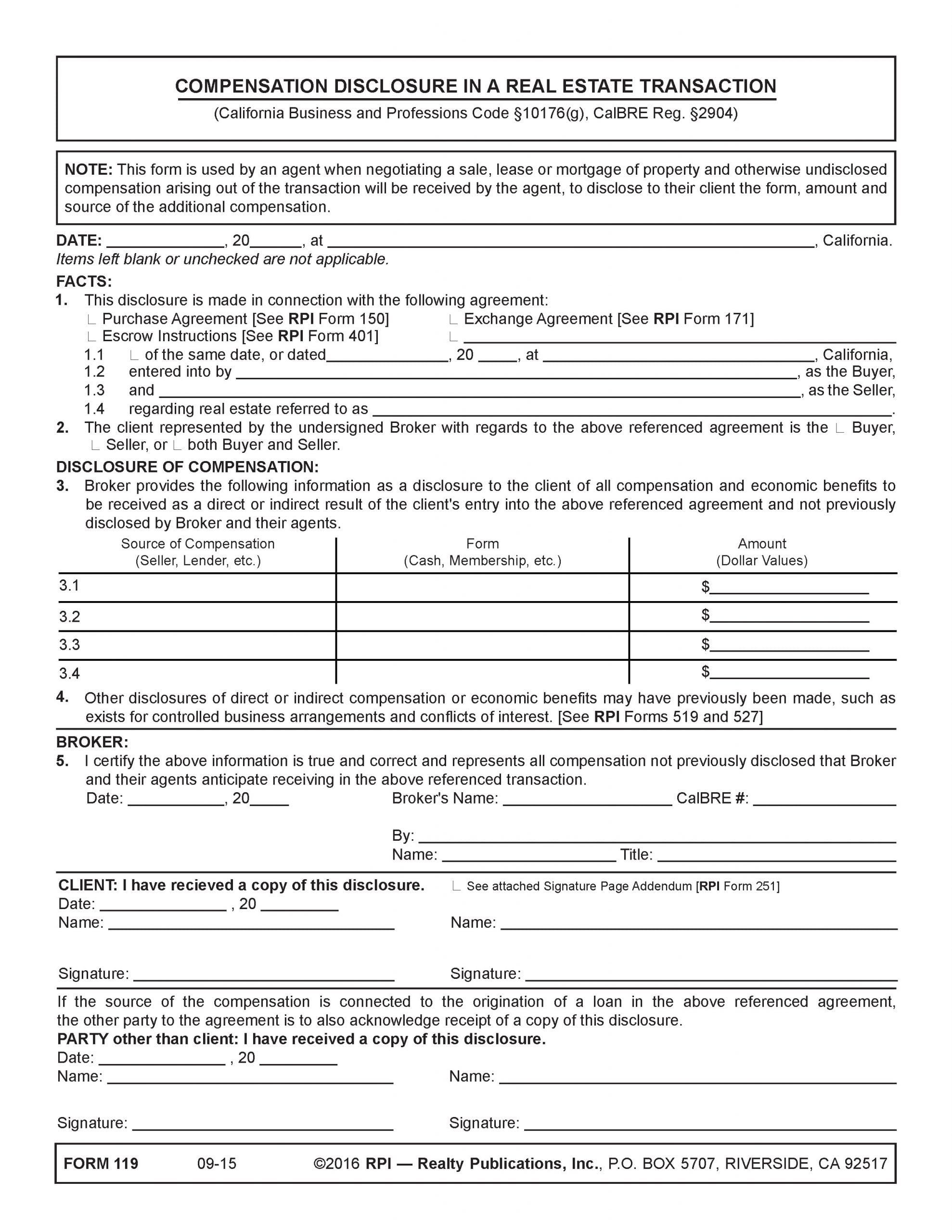

An agent uses the Compensation Disclosure in a Real Estate Transaction form published by Realty Publications, Inc. (RPI) when negotiating a sale, lease or mortgage of property and otherwise undisclosed compensation arising out of the transaction will be received by the agent. The form allows the agent to disclose to their client the form, amount and source of the additional compensation. [See RPI Form 119]

The contents of the form include the:

- Facts, such as:

- which type of transaction the disclosure is connected with [See RPI Form 119 §1];

- the date of the transaction [See RPI Form 119 §1.1];

- the identities of the buyer and seller [See RPI Form 119 §§1.2 and 1.3];

- a description of the real estate involved in the transaction [See RPI Form 119 §1.4]; and

- a check to indicate whether the disclosure pertains to the buyer or seller [See RPI Form 119 §2];

- Disclosure of Compensation information, presented in a columnar format which lists:

- the source of compensation, naming who is responsible for providing the additional compensation, such as a seller or lender [See RPI Form 119 §3];

- the form of compensation, detailing the currency given or alternative method of value received (cash, membership, etc.) [See RPI Form 119 §3]; and

- the amount of compensation, represented in dollar values [See RPI Form 119 §3];

- Signature of the broker, certifying the information is true and correct, and represents all compensation not previously disclosed that the broker and their agents anticipate receiving in the particular transaction [See RPI Form 119 §5]; and

- Signature of the client, certifying they have received a copy of the disclosure.

Editor’s note — A third signature needs to be collected from an additional party when the source of the compensation is connected to the origination of a loan. For all other sources of compensation, the additional party signature may be left blank.

Form navigation page published 03-2022.

Form last revised 2016.

Form-of-the-Week: Conflict of Interest Disclosure and Compensation Disclosure in a Real Estate Transaction — Forms 527 and 119

Form-of-the-Week: Conflict of Interest and Dual Agency Disclosure — Kinship, Position or Undue Influence — Forms 527 and 117

Form-of-the-Week: Disclosure of a Conflict of Interest and Affiliated Business Arrangement — Forms 527 and 519/205

Article: Disclosure of buy-side fees: a compliance blindspot for some real estate brokers

Article: How real estate agents are compensated

Brokerage Reminder: Disclosing a conflict of interest — the counterpoint mitigating a bias

Letter to the Editor: Do buyer’s agents have control over their fees?

Word-of-the-Week: Conflict of Interest

Word-of-the-Week: Fiduciary duty