Why this matters: When real estate agents look into readily available market data, they become more capable advisors for clients. The current deepening uncertainty about all factors affecting property value is best resolved by considering information about the behavior of real estate consumers and transaction providers.

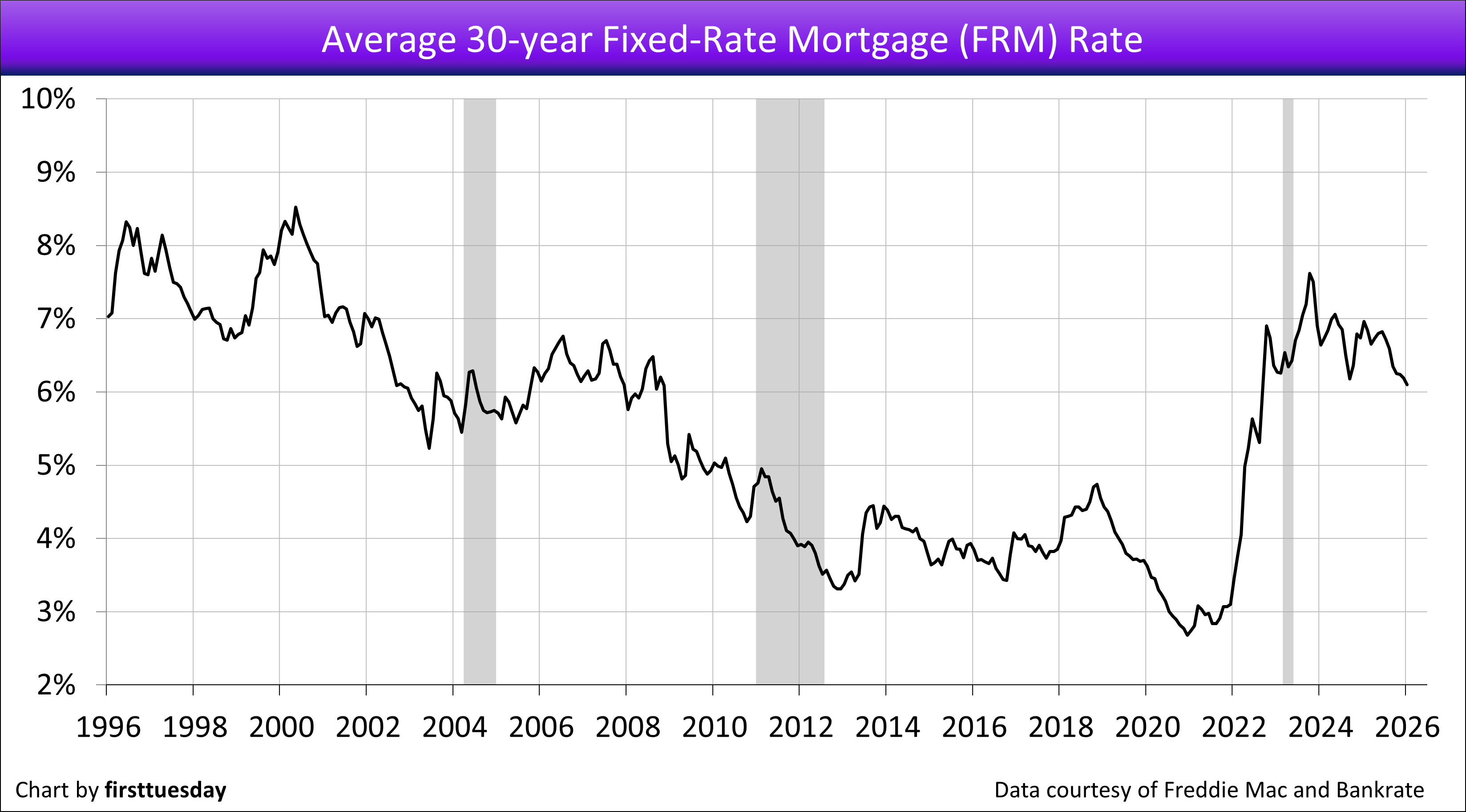

The long-term trend in rising mortgage rates is holding

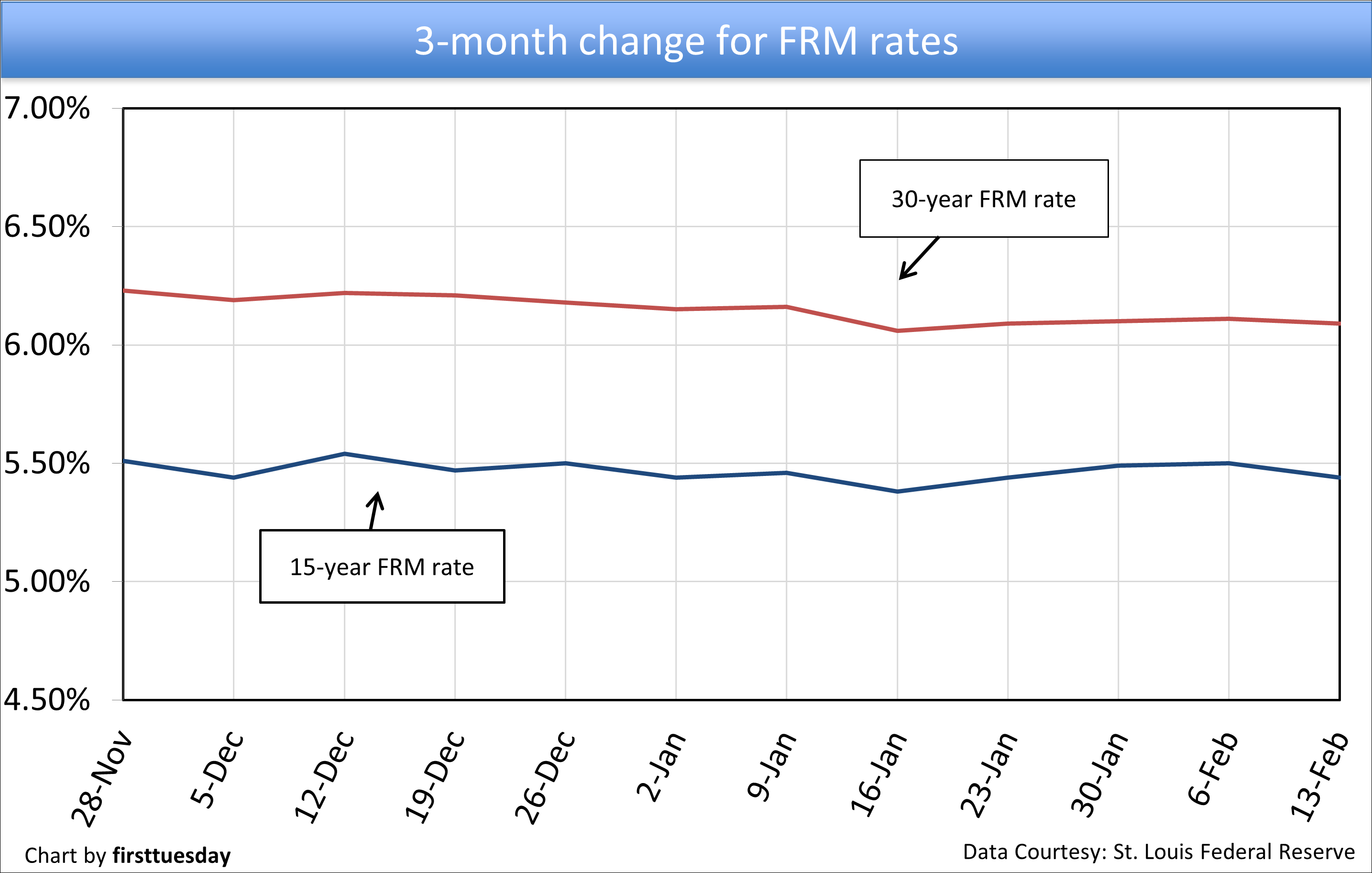

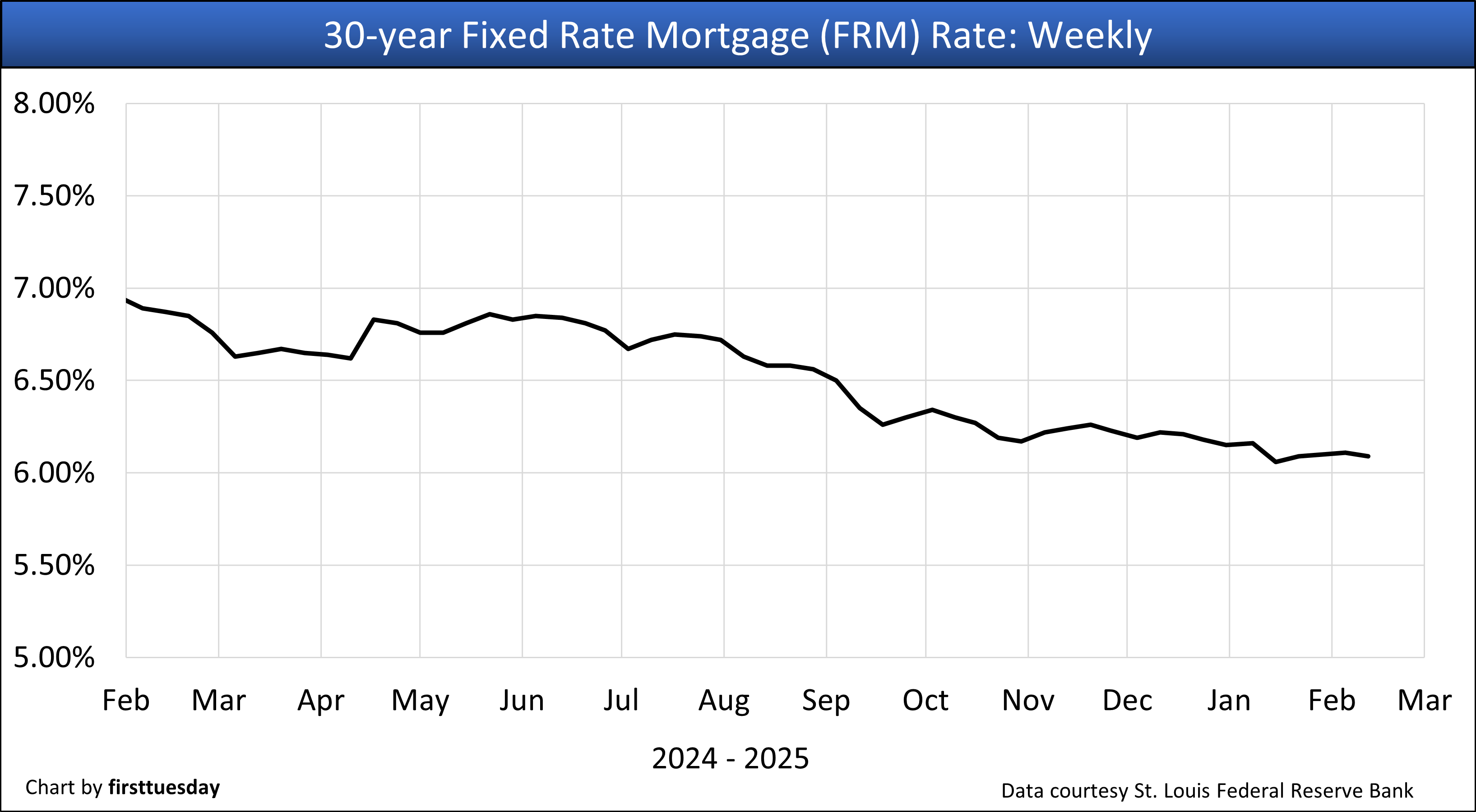

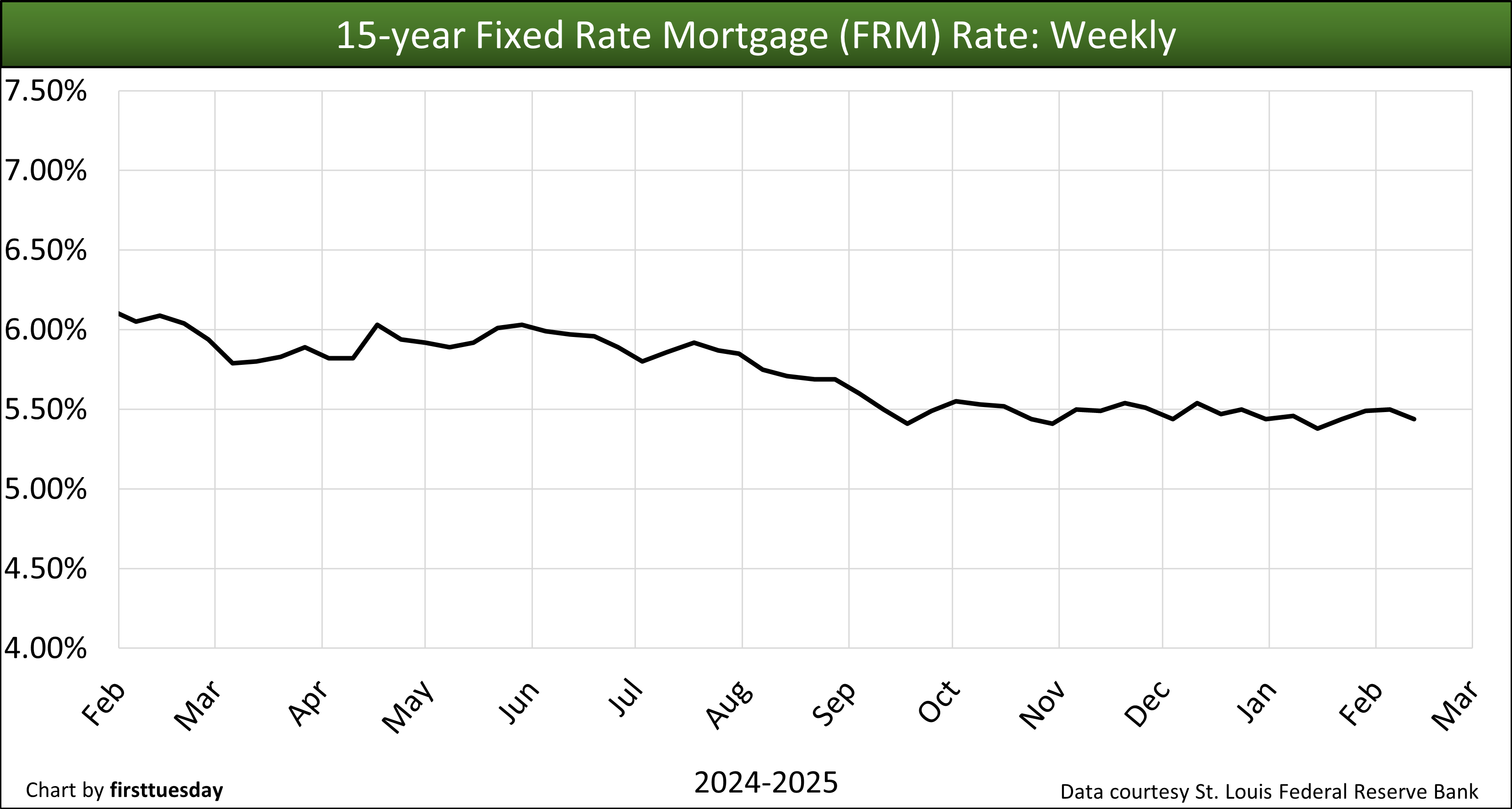

The rate on an average 30-year fixed rate mortgage (FRM) hovered at 6.09% in the week ending February 12, 2026. The average 15-year FRM dipped to 5.44%. For those able to switch, the 15-year FRM is one-ninth less expensive than the 30-year FRM — though principal is more quickly amortized in larger monthly payments.

Watch for FRM rates to gradually work their way lower in 2026 when the Fed is able to complete its job stabilizing job growth (and consumer inflation), adjusting to tariff taxes manifesting in consumer prices and thus transition into consumer inflation — a unique one-off condition with the ability to influence a temporary upturn in FRM rates.

The Fed task for setting short-term interest rates is tormented by disruption remaining from the pandemic and current government-administrated trade and migratory labor interference. The latter issues have moved through wholesale pricing and now into the consumer end of the economy. Until reversed, they will manifest as reduced consumer purchasing capacity, increased personal debt, and eventually a reduction in pricing of both assets and consumer goods (and less highway traffic as home-brewed beer flourishes).

Regardless of FRM rate movement in the 2026 real estate recessionary period, expect a long-term upward trend in mortgage rates to follow. The trend commenced in 2013 with the onset of a half-cycle of rising rates on all borrowing and is likely to run for around two more decades.

That said, current government interference with the economy is spilling over into real estate by adversely affecting homebuyer willingness, user turnover rate, and costs of residential construction. A real estate rigor mortis is settling in. Collectively, today, real estate pricing conditions are producing a continuing industry-wide reduction of fee-earning transactions likely into 2028 even as the GDP grows to support the military.

An increase in federal tax revenues — or Federal Reserve bond buying — will soon be needed to offset government demand for cash, unless the people who pay taxes pay more taxes. In turn, expect long-term rates to generally increase, and in turn so will mortgage rates.

Further, privatizing quasi-government mortgage agencies like Freddie Mac will enhance mortgage lender profit-sharing while increasing mortgage lender risk of loss. However, mortgage losses are socialized by government mortgage guarantees and not borne by the lenders. Both causes for mortgage rates to stay high.

Remember the rule: All financial deregulation goes up in flames. Our last reminder was 2005 which did not go well, but we forget.

Buyers increasingly stay away, until when?

In the long term, property prices experienced today are undermined by high FRM rates in recent years. Further, all income property values decline as capitalization rates rise fundamentally with long-term interest rates, the product of yields demanded from real estate assets. Increased FRM rates and cap rates reflect the pattern of rising long-term interest rates that took root in 2013.

In application, property pricing is primarily supported by the amount a buyer can borrow to fund a purchase. Higher and higher mortgage rates translate into reduced ability to buy.

The annual increases in FRM rates experienced since 2013 force sellers to eventually drop prices or exit the for-sale market as for-sale and for-lease inventories rise. An exception is the annual spring bounce in sales volume, which has weakened annually beginning mid-2022.

As for homebuyers dependent on purchase-money mortgage funding, and particularly first-time buyers under the age of 35, they either:

- reduce their standard of living and acquire property priced in a lower tier, a less likely choice going forward; or

- wait out dropping property prices until pricing matches the reductions in buyer purchasing power brought on by the high mortgage rates, a match now well on its way since property pricing peaked in Q1 2022.

Buyers increasingly sense current economic conditions are incompatible with the double whammy of purchasing an over-priced property with mortgage funding at high FRM rates. The result is prospective buyers are increasingly heading for the sidelines — ready and able, but more often less willing to borrow and buy.

However, today’s low-down-payment buyers – and their agents – who are patient, stay involved and round up a 20% down payment will discover greatly improved future market pricing conditions for property acquisition, likely by 2028.

In the meanwhile, watch for a recession-generated window period of growth in for-sale inventory, price cuts by sellers and slightly lower mortgage rates to fund acquisitions. Continued buyer reluctance will end when a bottom level in property pricing is well established. This process evolves slowly over a period of around 30 months.

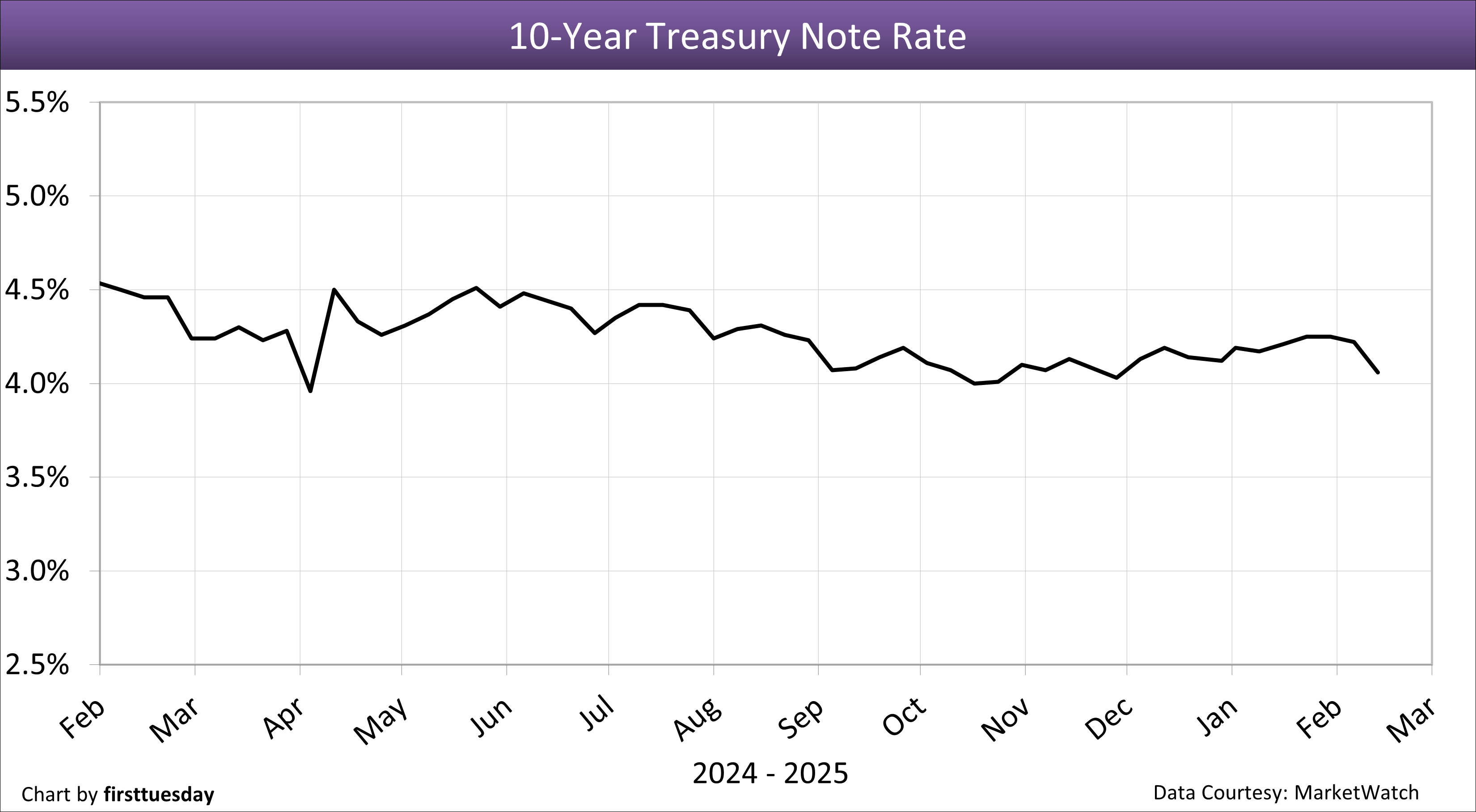

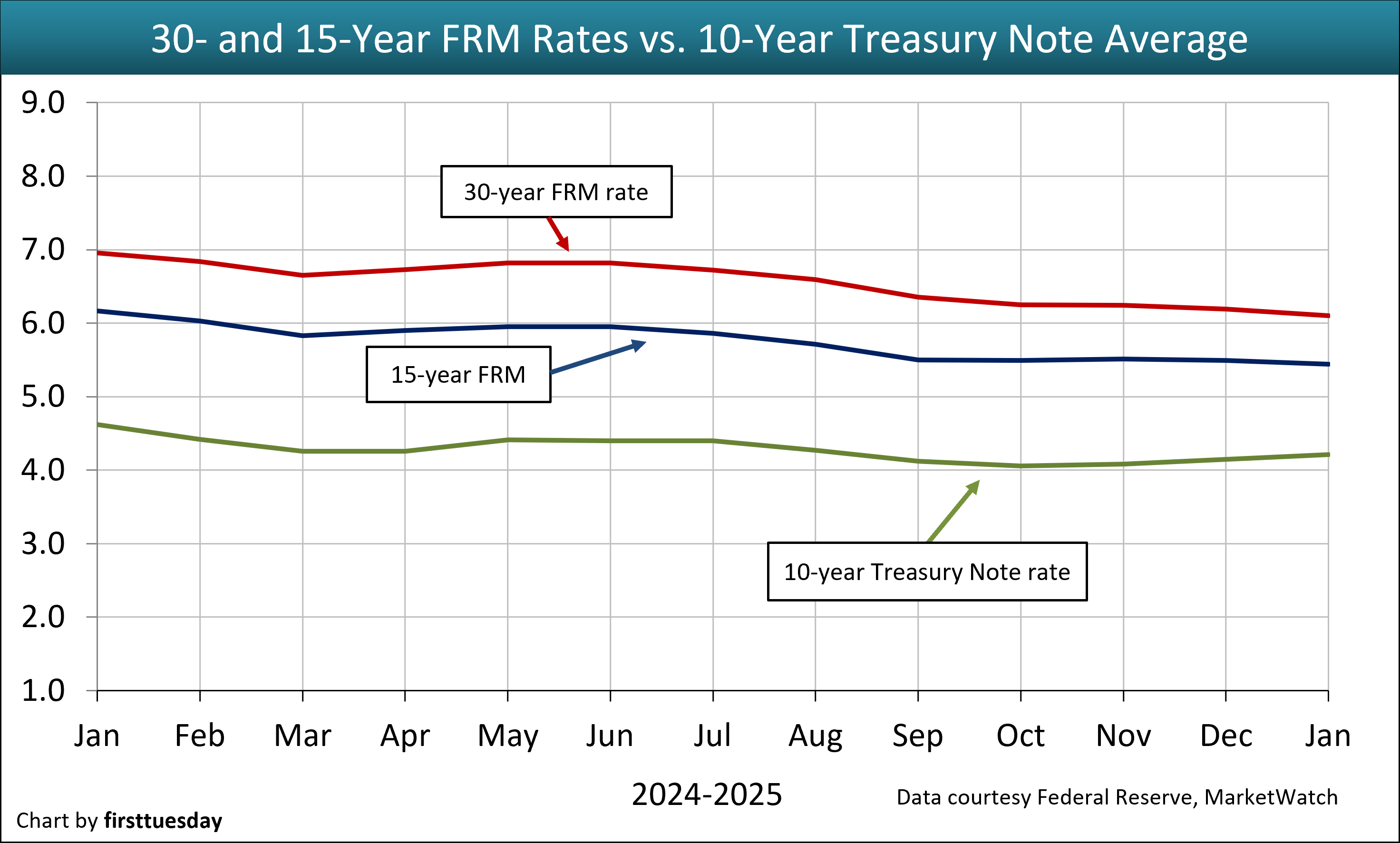

Fundamentally, FRM rates are tied to the 10-year Treasury note market, as are capitalization (cap) rates for setting income property prices. The 30-year FRM rate moves in tandem with the 10-year Treasury note rate, to which MLOs add a risk premium of between 1.5% and 3.0% based on a perceived risk of loss on mortgage defaults. Historically, the risk premium spread between the 10-year T-Note rate and the 30-year FRM rate in normal times is 1.5%. The spread is far greater for property investor cap rates.

The 10-year T-Note plunged to 4.06% on February 13, 2026. Now generally enlarged, the spread between the 10-year T-Note and 30-year FRM rate is 2.03%, but gradually returning to the historical risk premium spread of 1.5%.

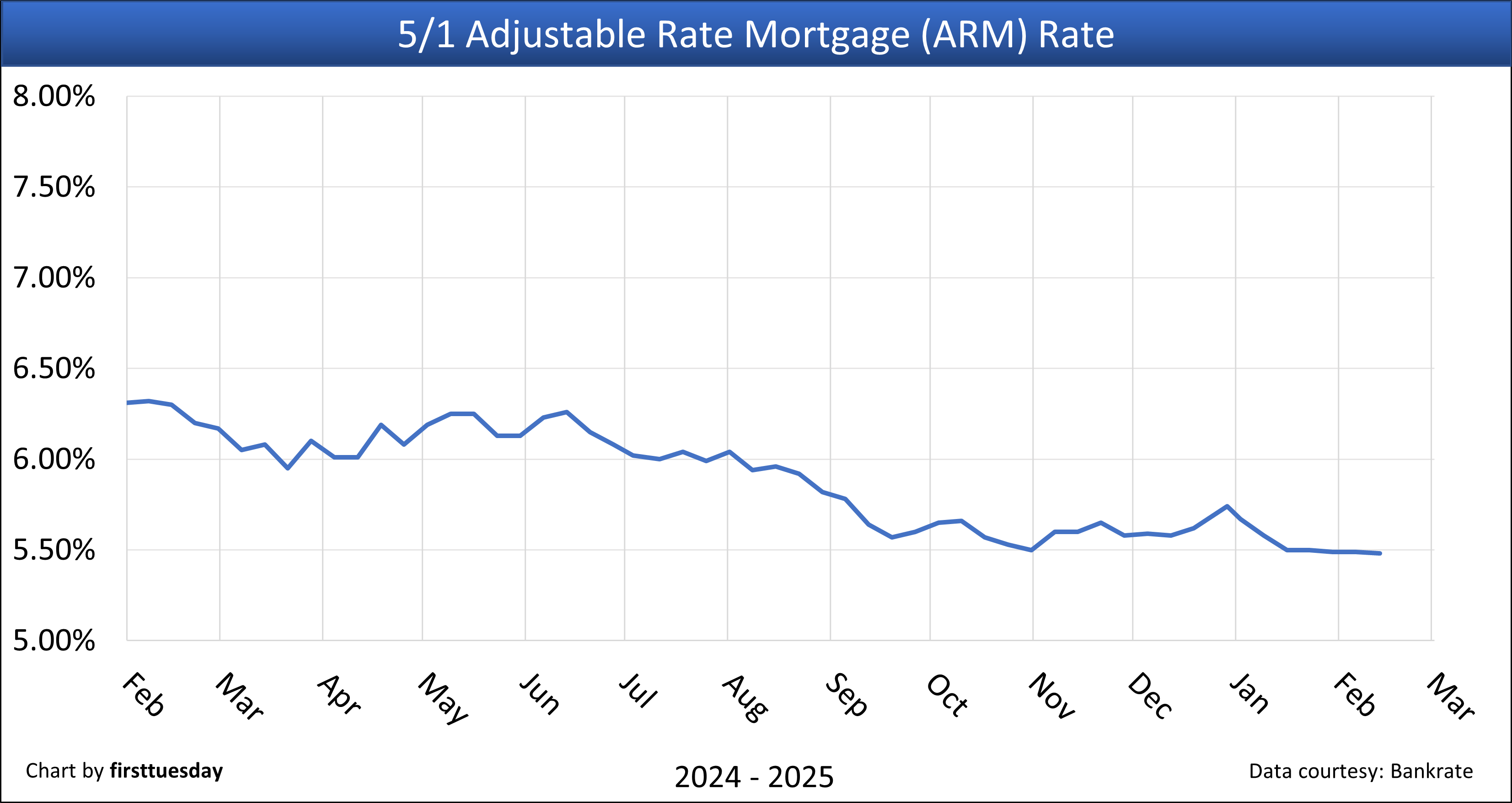

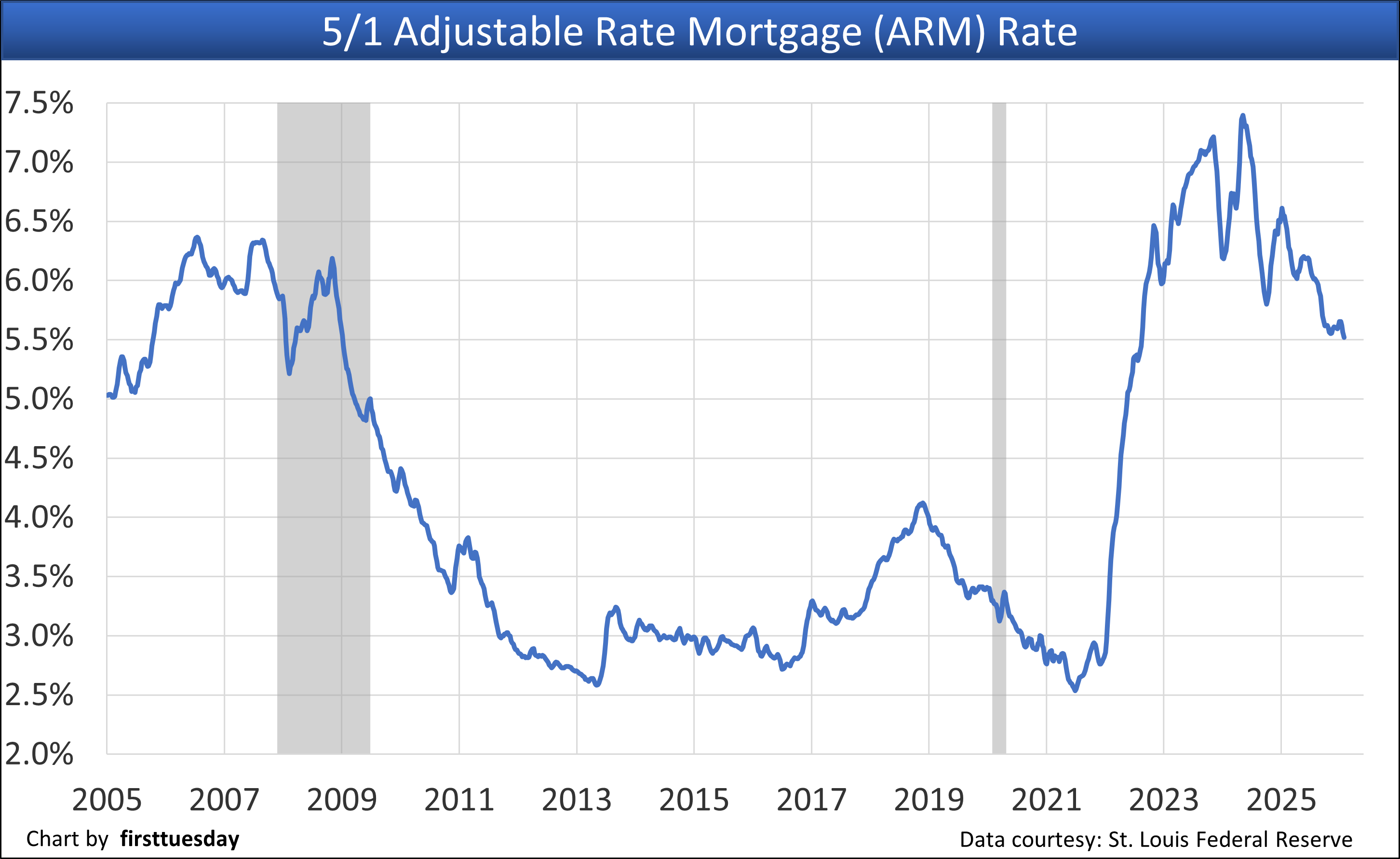

The average monthly rate on adjustable rate mortgages (ARMs) hovers at 5.48% on February 13, 2026.

The interest rate on the ARM is slightly higher than the 15-year FRM but 61 percentage points lower than the 30-year FRM rate. The rising 30-year ARM-to-FRM spread gives a homebuyer or owner a bump in the amount they can borrow by taking out an ARM. The downside is the significant forward risks of loss-by-foreclosure inherent in ARMs when rates trend higher. Unchanged, an ARM is the mortgage available to finance high-tier housing and commercial property.

The following was updated February 13, 2026.

Click the link to go directly to a chart, or browse the charts by scrolling below.

1. 30-year fixed rate mortgage (FRM) rate, weekly— Chart update 2/13/2026

2. 30-year FRM rate, monthly — Chart update 1/30/2026

3. 15-year FRM rate — Chart update 2/13/2026

4. 5/1 adjustable rate mortgage (ARM) rate, monthly — Chart update 1/30/2026

5. 10-year Treasury note rate — Chart update 2/13/2026

6. Combined FRM and 10-year Treasury note rates — Chart update 1/30/2026

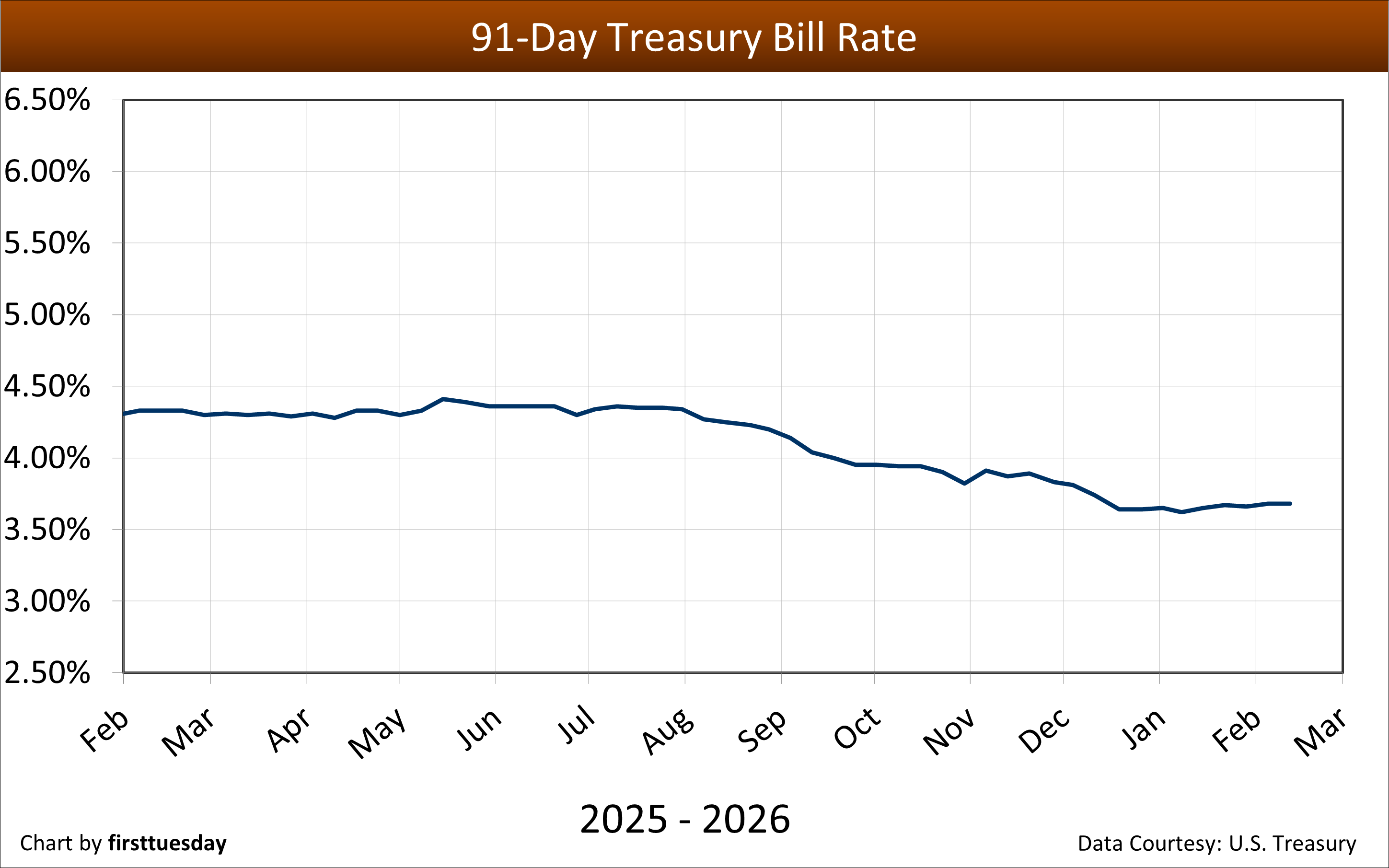

7. 91-day Treasury bill rate — Chart update 2/13/2026

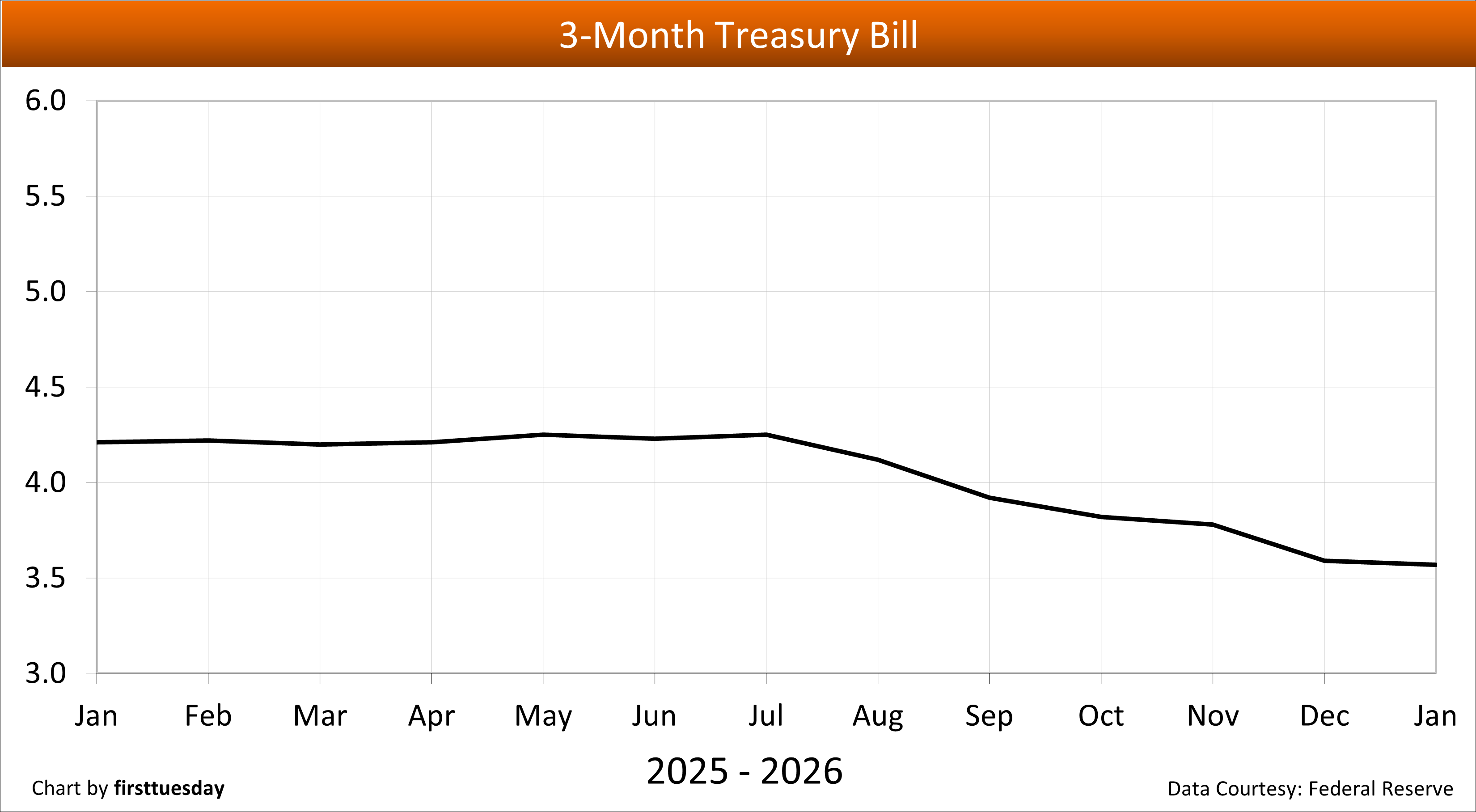

8. 3-month Treasury bill — Chart update 2/6/2026

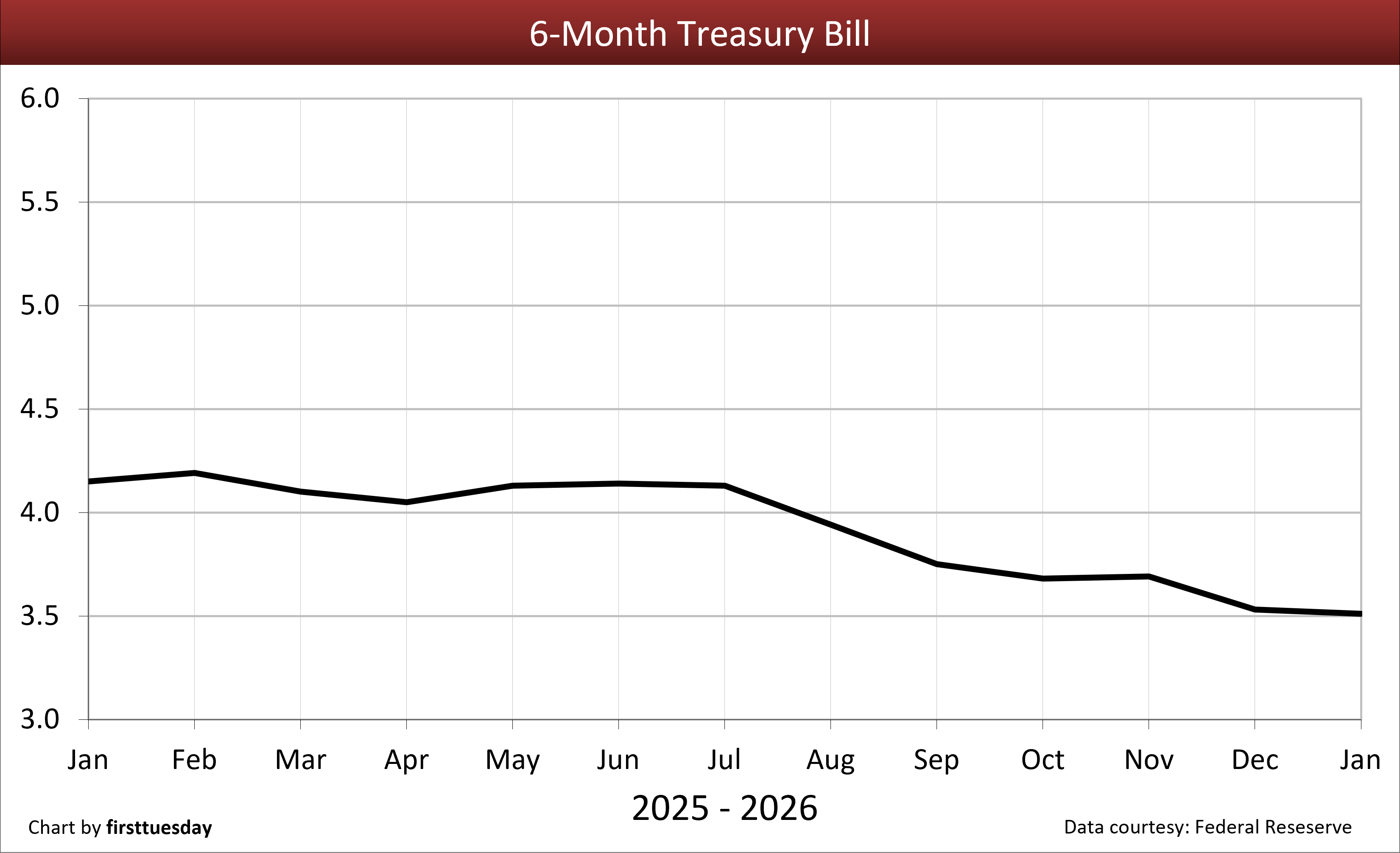

9. 6-month Treasury bill — Chart update 2/6/2026

10. Treasury Securities average yield (CMT) — Chart update 2/6/2026

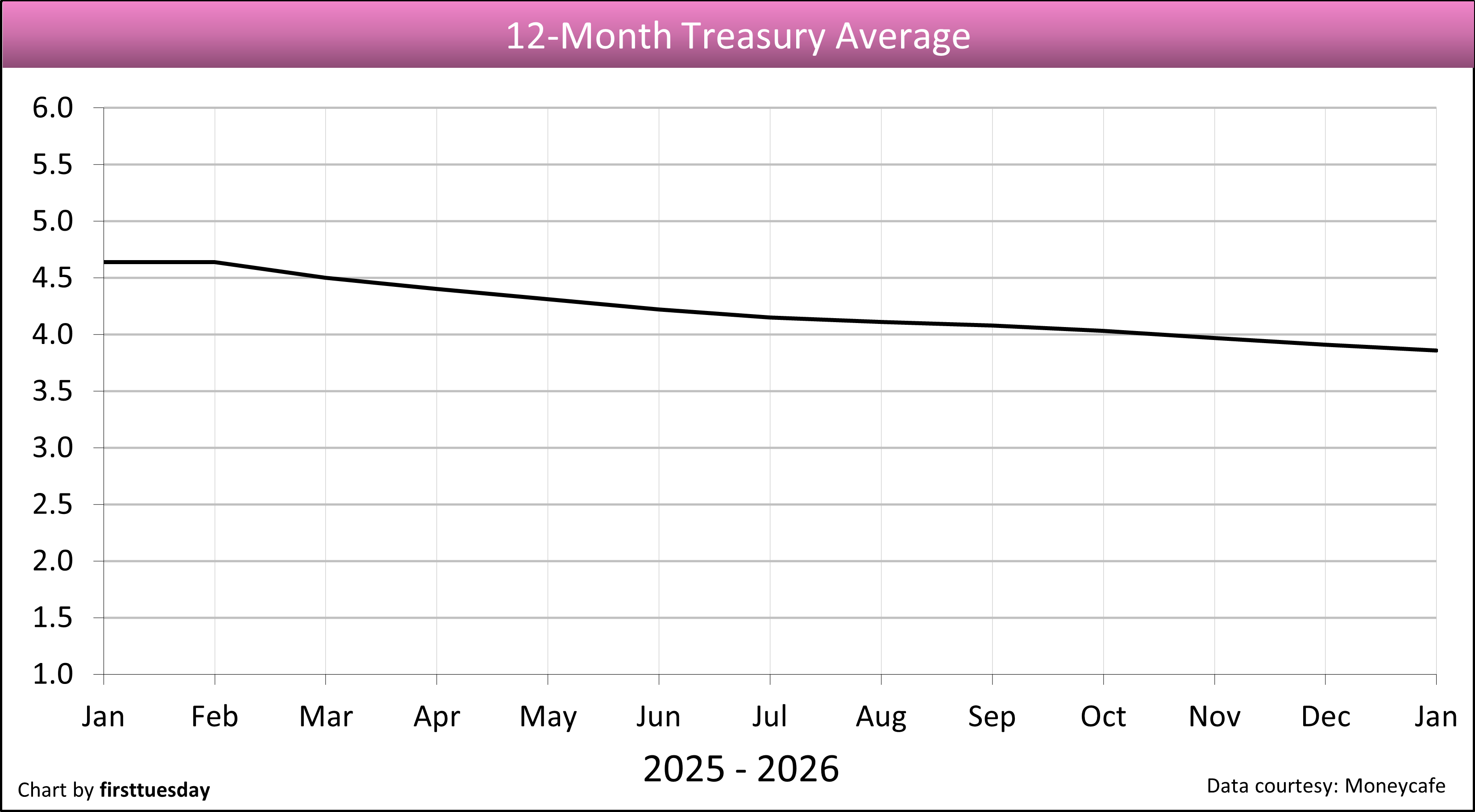

11. 12-month Treasury average — Chart update 2/6/2026

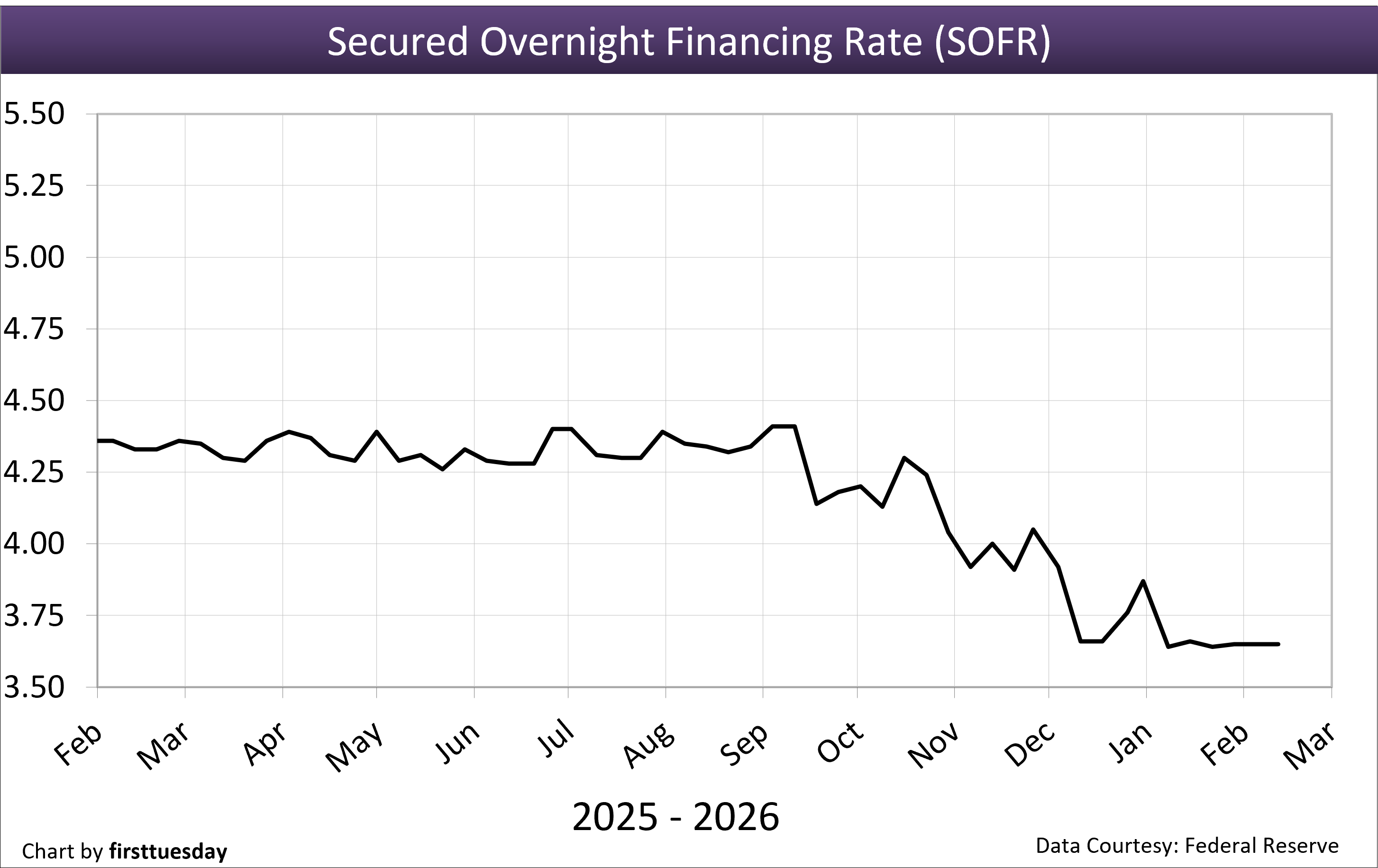

12. Secured Overnight Financing Rate (SOFR) — Chart update 2/13/2026

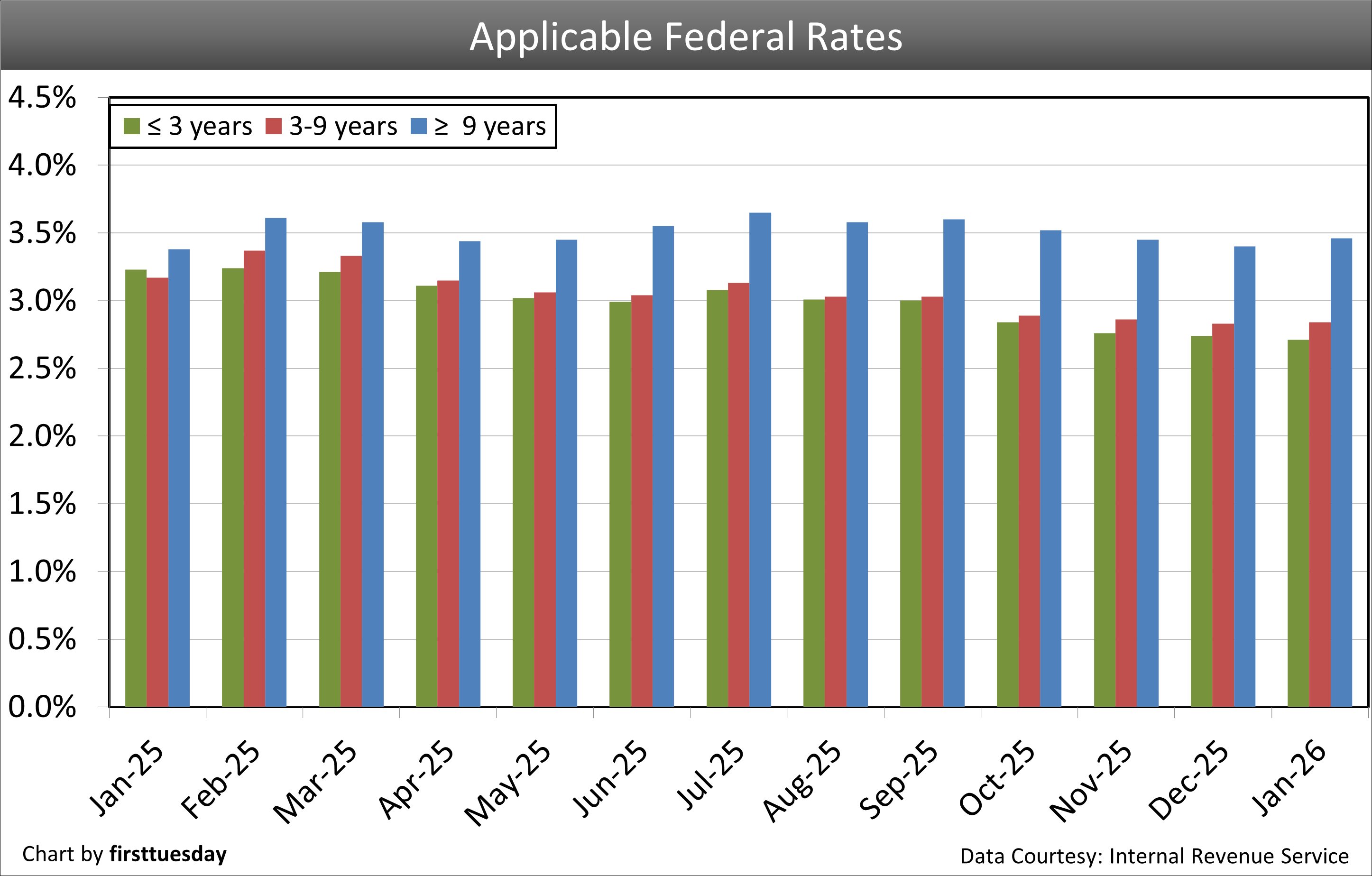

13. Applicable federal rates — Chart update 2/13/2026

| ||

| Chart update 2/13/26 | ||

Current | Month ago 1/15/26 6.06% | Year ago 2/13/25 6.87% |

The average 30-year FRM rate in California is provided by the St. Louis Federal Reserve Bank.

| ||

| ||

| Chart update 1/30/26 | ||

January 2026 Average 6.10% | December 2025 Average 6.19% | January 2025 Average 6.96% |

| ||

| Chart update 2/13/26 | ||

Current 2/12/26 5.44% | Month ago 1/15/26 5.38% | Year ago 2/13/25 6.09% |

The average 15-year FRM rate in California is provided by the St. Louis Federal Reserve Bank.

| ||

| ||

| Chart update 1/30/26 | ||

January 2026 5.55% | December 2025 5.63% | January 2025 6.50% |

The 5/1 average adjustable rate mortgage (ARM) rate shows the average rate for the first five years after origination. After the initial five-year period, the ARM rate is adjusted annually based on an index figure, such as a certain Treasury Bill rate (which reflects Federal Reserve rate movements) or the Secure Overnight Financing Rate (SOFR). The average ARM rate is provided by Freddie Mac’s survey of the U.S. | ||

| ||

| Chart update 2/13/26 | ||

Current 2/13/26 4.06% | Month ago 1/16/26 4.21% | Year ago 2/14/25 4.46% |

This rate is a leading indicator of the direction of future Freddie Mac rates. The 10-year rate historically runs closer to 4% during a stable money market. The rate is influenced by worldwide demand for the dollar and anticipated future domestic inflation. | ||

| ||

| Chart update 1/30/26 | ||

Avg 15-year January 2026 5.44% | Avg 30-year January 2026 6.10% | Avg 10-year T-Note January 2026 4.21% |

The average 15- and 30-year conventional commitment rates are the rates at which a lender commits to lend mortgage money in the United States-West/California for the duration of the life of each respective mortgage as reported by Freddie Mac. The green line reflects the 10-year Treasury Note Average, a leading indicator of the direction of future Freddie Mac rates. It is composed of the level of worldwide demand for the dollar and anticipated future domestic inflation.

| ||

| ||

| Chart update 2/13/26 | ||

Current 2/12/26 3.68% | Month Ago 1/15/26 3.65% | Year Ago 2/13/25 4.33% |

This rate determines the minimum interest rate the seller must use in a delayed §1031 transaction and report when not receiving interest on §1031 monies held by a facilitator/accommodator. This rate also sets the amount of the ordinary income the facilitator/accommodator must report. | ||

| ||

| Chart update 2/6/26 | ||

January 2026 3.57% | December 2025 3.59% | January 2025 4.21% |

The 3-Month Treasury Bill rate is heavily influenced by the Federal Reserve through the Fed Funds Rate as the base price of borrowing money in the short-term. It is used in determining the 3-month:10-year yield spread used to predict the likelihood of a recession one year forward. The posted rate is the monthly average for the listed month. Rates are released with a one-to-two month reporting delay.

| ||

| ||

| Chart update 2/6/2026 | ||

January 2026 3.51% | December 2025 3.53% | January 2025 4.15% |

The six-month T-Bill rate is one of several indices used by lenders to periodically adjust the adjustable rate mortgage (ARM) rate. The adjusted rate equals the indexed rate (at the time of adjustment or an average of several prior rates) plus the lender’s profit margin. The posted rate is the monthly average for the listed month. Rates are released with a one-to-two month reporting delay. | ||

| ||

| Chart update 2/6/26 | ||

January 2026 3.51% | December 2025 3.54% | January 2025 4.18% |

This index is one of several indexes used by lenders as stated in their ARM note to periodically adjust the note’s interest rate. The ARM interest rate equals T-Bill yield, plus the lender’s profit margin. The index is an average of T-Bill yields with maturities adjusted to one year. | ||

| ||

| Chart update 2/6/26 | ||

Current January 2026 3.86% | Month ago December 2025 3.91% | Year ago January 2025 4.64% |

This index is one of several indices used by lenders as stated in their ARM note to periodically adjust the note’s interest rate. This figure is an average of the one-year T-Bill rates for the past 12 months. The ARM interest rate equals the 12-Month Treasury Average yield plus the lender’s profit margin. There is a one-to-two month lag in data reporting for the 12-Month Treasury Average. | ||

| ||

| Chart update 2/13/26 | ||

Current 2/12/26 3.65% | Month ago 1/15/26 3.66% | Year ago 2/13/25 4.33% |

This index is one of several indices used by lenders as stated in their ARM note to periodically adjust the note’s interest rate. It replaced the LIBOR in 2021, which was found to be manipulated in the years leading up to the 2008 recession and financial crisis. The ARM interest rate equals the SOFR rate plus the lender’s profit margin. The rate is based on overnight borrowing in the U.S. Treasury repo market. The SOFR is produced in a transparent manner and is based on observable transactions, rather than models, and, unlike the LIBOR, is not dependent on bank estimates. | ||

| ||

| Chart update 2/13/26 | ||

Short (3 years or less) January 2026 2.71% | Medium (3 to 9 years) January 2026 2.84% | Long (9+ years) January 2026 3.46% |

These rates determine minimum interest yield reportable on carryback financing. The applicable federal rate (AFR) category is determined by the carryback due date. Rates are for monthly payments, reported for the coming month.

| ||

Excellent Set of GRAPHS 4 THE PUBLIC! 2 BAD THEY CAN’T UNDERSTAND IT UNLESS THEY HAVE A BUSINESS DEGREE LIKE ME!

Invest in property …while the rates are extremly low and our market prices in Ca.are half of the price as a home or piece of land 8-9 years ago. It may be years before we have a total recovery and the home price may not go up to where it was, butit is the best way to invest and cheaper to buy then to rent.

How low can it go? The U.S. government–up to its ears in debt–is still able to borrow at unbelievably low rates (well under 2%) from foreign investors. That ability is currently based solely on the belief that American will always pay its debts and is a good investment risk.

How about a little glimpse of macro-economics?

Now could that perception ever change? If ever the foreign investors come to decide that America might not pay its debts, then we would see a sudden rise in interest rates that would boggle the mind, kicking off a massive inflation in consumer goods or plunging us into a deeper depression with deflation—take your pick.

The U.S. government runs on borrowed money—borrowed from foreign investors.

FACT: The massive U.S. debt as it currently stands, could NEVER be paid off. But if the dollar were devalued (as Roosevelt did in 1934) the debt might be paid off in cheaper dollars. This would be concomitant with a rise in the Chinese yuan.

Here’s the catch: This would be done on the backs of the American people, as it would likely spur massive inflation and cause a spike in interest rates.

With rates so low, and other investment vehicles so turbulent, it would make perfect sense to invest in housing for rental income at this time.

ditto

Concise information, clearly explained. Good stuff!

Still more good news”

helpful Synopsis

You guys are great and I look to you for unadulterated truth.

No fear of me straying with great articles like this.

Next time I renew u can bet its with your program.

Really appreciate your continued current info on all types of market rates, sales, home prices, etc. Very useful for those of us working this business every single day.

Thank you for all of the great info and data each month!

Hi ,

This is a very helpful analysis. Keep it up monthly for those that are serious about following ARMs.