After two days in meetings, Federal Reserve (Fed) chair Janet Yellen announced today the Fed will increase the target Federal Funds rate.

The target Federal Funds rate, also known as the short-term rate, has remained in the 0%-0.25% range since 2009. By keeping the short-term rate at unprecedented lows, the Fed has indirectly kept other key interest rates low, including mortgage rates.

The Fed’s new target rate is 0.25%-0.5%. This will be implemented beginning December 17, 2015.

While the short-term rate is scheduled to increase, the Fed’s target rate remains below what they consider to be a “normal” level. Their cautious approach indicates the short-term rate will continue to increase gradually over the coming months and years.

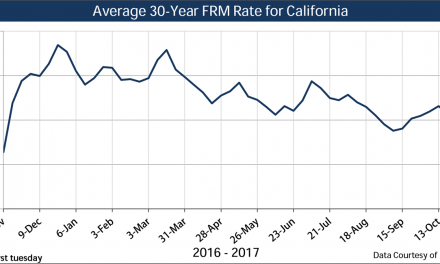

As the short-term rate rises, interest rates on adjustable rate mortgages (ARMs) will be affected immediately. However, fixed rate mortgages (FRMs) won’t likely feel the influence of increased rates until mid-2016 or after. This delay is for a number of reasons, including uncertainties in the global economy, which you can read about here: Why fixed mortgage rates won’t rise (yet), despite Fed action.

To view current interest rates key to California’s real estate market, see: Current market rates.