Why this matters: Real estate professionals need to understand the principles of market forecasting and know how to use available data to guide their practice and advise clients on transactions during different phases of the business cycle — especially when global influences create uncertainty in California’s real estate market.

Know how your market evolves

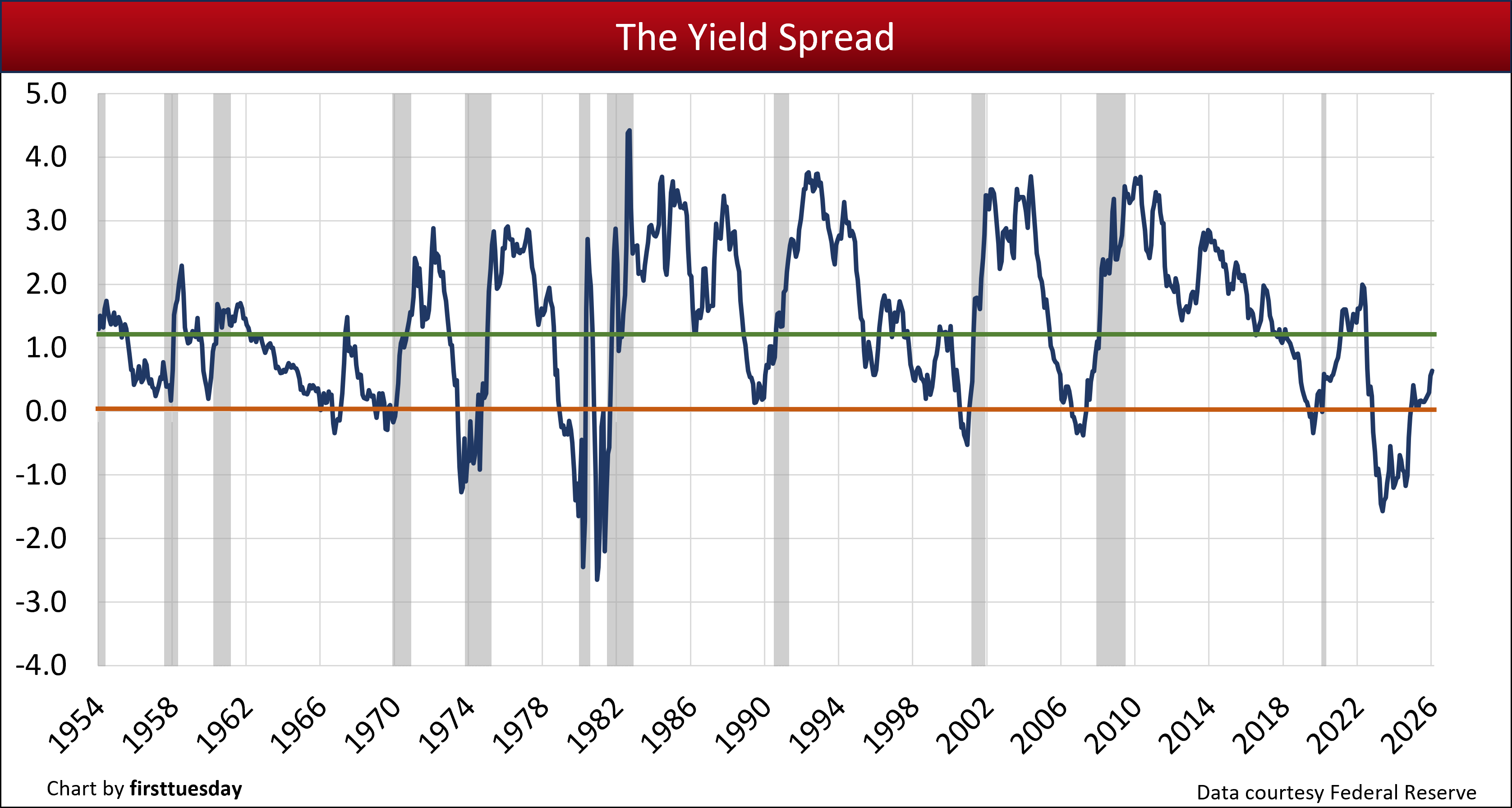

The yield spread is a tool you use to form an opinion forecasting the likelihood of a recession one year forward. The yield spread is a figure representing the percentage point difference between interest rates in two bond market tiers:

- short-term interest rate controlled by the Federal Reserve (the Fed); and

- long-term interest rate on the 10-year Treasury note, determined by bond market participants worldwide.

The yield spread figure ran negative in most of 2024, indicating a coming recession likely in 2026. However, the trade wars of early 2025 caused investor attitude about investment opportunities to change course, reflected in the volatility of the 10-year T-Note rate. The mortgage rate for an FRM is set on the 10-year T-Note plus a risk premium margin of between 1.5% and 3%.

The yield spread figure became zero before gradually increasing, averaging +0.64 in January 2026.

2024’s profoundly negative yield spread was near its lowest level since 1981, when the Fed was waging its last acute battle against inflation and the economy was tilting into a deep recession.

Today’s slightly positive yield spread under 1.0 is the result of:

- buoyed expectations as lower-than-expected tariffs rippled through to consumer pricing;

- the current static position of short-term interest rates directly influenced by the Fed for fear of rising consumer inflation and excessive job growth; and

- fluctuating long-term rates heading lower as bond market investors see fewer safe alternative investment opportunities.

The Fed will continue the slow decrease in 3-month rates, while keeping an eye on the effect deceases have on consumer inflation. Only when the Fed senses inflation is again under long-term control will they lower their rate, a likely 2026 event, to match economic conditions of a one-off jump in consumer price inflation passing through from the government’s trade wars.

Meanwhile, property markets are nearly 45 months into their own recession due to:

- a decade plus of increasing FRM rates since 2013 (except for the “one-off” pandemic stimulus);

- a strangled MLS inventory for lack of SFR owner turnover and construction; and

- the unrelenting cooling of the property market after mid-2022.

Updated February 5, 2026.

Chart update 2/5/26

| January 2025 | December 2025 | January 2025 | |

| Yield Spread | +0.64 | +0.56 | +0.41 |

Reading the chart and current trends

In the above chart:

- The blue line tracks the yield spread from January 1954 through today.

- The yield spread dips below zero when the short-term rate rises above the long-term rate. This is the inversion point.

- +1.21 is the point at which the probability of recession begins, as calculated by Fed economists. Yield spreads smaller than 1.21% predict successively greater probabilities of recessions one year forward.

The last time the yield spread was negative was in mid-2019, signaling the coming 2020 recession which was declared in February 2020. However, in March 2020, the covid pandemic crashed the economy, leaving income from jobs and business decimated. Massive stimulus and general economic disruption rippled for three years up to 2024 before mostly disappearing.

Each time since 1960 when the yield spread went negative we were in a recession approximately 12 months later.

Going through 2025 we did not get the recession the yield curve indicated for this year, but something else.

It is likely we will soon see a rapid decline in jobs as business that held off passing the tariff taxes onto their customers now increase prices of goods sold domestically. Thus, incomes and standards of living, as well as a jump in the level of insolvency of households and businesses, are affected when job numbers decline.

Confidence about what the year will bring

To you stalwart members of the real estate profession, a gift: the ability to forecast the probability of future recessions and rebounds, one year forward. This famed and reliable crystal ball is the yield curve spread, also simply called the yield spread.

Don’t let the name yield spread put you off. It is not related to the deceptive yield spread premium (YSP) kickback mortgage lenders paid in times before the MLOs.

The yield spread reflects economic conditions as interpreted by Fed economists and bond market investors.

The spread figure is generated, on the one hand, by the Fed using its short-term rate to combat unacceptable inflation in consumer prices and wages; and on the other, by the collective wisdom of global investors who set the 10-year Treasury Note rate based on long-term inflation expectations—two diametrically opposed economic perspectives.

To use the yield spread, all the layperson has to do is locate the current yield spread figure and apply their understanding about what the figure relays about the future.

That knowledge is provided to you in this article.

Again, the yield spread figure is the difference between two key interest rates:

- 3-month Treasury bill rate (or short-term rate) set by the Federal Reserve (the Fed) activity; and

- 10-year Treasury note (T-Note) rate (or long-term rate) set by bond market investor outlook.

Related chart:

The short-term market rate

The initial piece of information needed to calculate the yield spread is the interest rate on the 3-month Treasury bill. This interest rate is influenced exclusively by the Fed as the base price of short-term borrowing. It is the Fed’s primary tool for keeping the U.S. economy balanced.

The Fed has direct control over this short-term rate through its Federal Funds Rate. The Fed can:

- lower interest rates and stimulate economic growth to stave off deflation and economic stagnation; or

- raise interest rates and slow economic growth to fight inflation and excess demands for labor.

Collectively, the Fed’s use of short-term interest rates and other infusions and withdrawals of dollars to control the economy is known as monetary policy.

Related article:

The long-term market rate

To make a profit on their long-term investments, bond market investors generally consider how the Fed’s current monetary policy will impact the future performance of markets. These millions of world-wide individual and institutional investors forecast future economic conditions which translate via the 10-year T-Note bond markets into a ready gauge for determining future market conditions (and mortgage rates), the wisdom of the crowd call out.

These 10-year T-Note investor considerations encompass two discrete elements:

- desired fixed rate of return on the investment before adjustments for risks, called the real rate of earnings;

- perceived future rate of inflation, called the inflation risk premium; and

- collectively, the rates are built into the 10-year T-Note rate.

Interplay between the treasury rates = the yield spread

Calculating the yield spread is simply a matter of subtracting the 3-month T-Bill rate from the 10-year T-Note rate. Never the other way around.

Generally, a low or declining yield spread indicates a less vigorous economy one year forward, the outlook of the crowd. A declining yield spread is a result of bond market investors seeing less future growth resulting from the Fed’s short-term rate activity and other economic interruptions or stimulus – the global economy’s relationship to ours.

On the flip side of an economic cycle, a higher or rising yield spread indicates a more vigorous future economy. While good for bond market investors with their money parked, whose actions are full-speed-ahead into investment opportunities for profit, a too-high yield spread (and its resulting boom) suggests the danger for increased consumer inflation. When the spread is unacceptably high, the Fed acts to curtail the growth of future jobs and stabilize consumer prices by raising short-term rates — which reduces the spread.

An over-correction has the potential to send the yield spread into low or negative levels. When the yield spread goes negative for a period of around four months, called an inversion, a recession follows 12 months later. Most recessions are Fed instituted to correct for economic distortions. Periods of pandemics and wars (think trade wars in 2025) are recessionary periods by themselves and chaotic in behavior.

A yield spread inversion is the result of the:

- bond market envisioning a future downturn in the economy; and/or

- Fed raising short-term interest rates to correct consumer inflation or loosen money market conditions.

Sometimes even a near-inversion is enough to signal a recession.

That crossover moment in the yield spread gives the real estate broker and agent another signal to adjust their business conduct. At the crossover into a negative yield spread, agents can expect a reduced volume in sales (which have likely already slipped), lending and leasing one year forward.

Then, in a further 12 months, a drop in prices, mortgage rates and rents is experienced. This 12-month delay after sales volume turns downward is the result called the sticky price phenomenon, brought about by money illusions held by sellers and landlords.

Related chart:

Real estate’s stake

Going forward, more and more brokers and agents need to understand the workings of the yield spread as a gauge of the economy’s direction for the coming 12 months. Only then, with this insight, will industry-wide frenzies to over-build, over-price and over-acquire property of all types be tempered.

Brokers and agents who track the yield spread glean the foresight needed to shift their advice given to clients and personal spending before the changes in the market actually occur. In doing so they will seek out recession-proof niches of real estate (such as services needed for real estate owned (REO) sales, MLO endorsement for originations, an escrow department, notary service, or property management) in which to weather the storm.

Related chart:

Buyer Purchasing Power Index (BPPI) hints at rising as home price adjustment sets in

I appreciate your extremely illuminating response.

I didn’t read anything in this piece that indicates a recession is imminent or approaching in the next 6 months. The pandemic uprooted a lot of chart forecasters.

after the curve in march 2020 we see again it’is going under the 0?

does it mean another correction?

After learning about the Yield Spread, its pisses me off once again that the Alan Greenspans and Hank Paulsons of the world were telling us everything was great and our economy would continue to boom and 1 minute later, we crashed. I’m now wondering what Yield Spreads were they looking at? Just a thought.

we see another curve going uinder the 0 in 2021

Things are different this time. A large part of the world is near zero growth, and government treasuries are negative yield in many countries. This makes our 10 year treasury unusually attractive, and explains the low rate on the long side of the equation,

If the 10 year rate was at historical levels given our rate of growth in the economy, your recession indicator would be flashing green instead of red.

Sorry to disappoint you, but it is different this time. No recession in 2020.

“but it is different this time.” – Famous last words.

Sorry but we’re DEFINITELY going into recession 1st 1/2 2020. The moron and his birdbrain sycophants don’t know which way is up, penze also gonna be impeached and removed AND, even the IDIOT greenspan couldn’t predict previous recession despite having all his data, charts and info. Lest one forget, it’s all about confidence and most Americans are fed up with the rigged system, including health care, stock market riggings by feds, skyrocketing rents, cost of food, student loans and day to day struggles of the average Joe + Jane just to pay bills and survive.

CASH IS KING!!!

Maybe the air is bad in Concord, or Mike has merely failed to read the clear article by the Journal staff analyzing basic facts. The Journal consistently lays down the facts and soberly analyzes. The Yield Spread has been one of the Journals best pointers. The Yield Spread has gauged the market shifts accurately for many many decades. We usually see that some lost soul upon receiving the true sign facts, will lash themselves to the whale of their blinkered beliefs and proclaim the opposite.

That must be how America got a pathological liar installed in the White House. As history has already shown to Concord Mike, the recession he was so sure would not happen because “…it is different this time…” is here and will stretch out towards the end of 2020.

Maybe this 2020 Moby Dick moment will help open Concord Mike’s eyes. Maybe not.

I have found the Journal to be a reliable, un-biased, clear-eyed source from mature observers in the form of their tireless staff.

Lol…. lol lol lol.

Recession 2020 says hi to you little kid.

SO,so many commentators. Real estate activity has always been a great indicator of the economy, first one going into the toilet and the first one to come-out Question, could any one tell us when will it happen?? It feels that we are already in a recession (perhaps stagnation), how long will it take?? will it be like in Japan – long slow death??.

Lets remember the economic recovery was orchestated by the FED-keeping rates artificially low (yes, smoke and mirrors) and they have run out of ammunition while Congress and Executive Branches have been on vacation.

Not sure what data you published in your graph, but the 10 year dropped below the 3 month in 1989 even though your chart doesn’t show that. It would inspire a bit more confidence if you chart agreed with the St Louis Fed’s data.

Is there data that is more regional in nature, for instance, CA? Or, does it matter?

Dear Barry Weiss,

Thank you for your question. The yield spread is a national figure and there is no state-level equivalent. As such, it forecasts U.S. economic conditions. California may see some variance from national trends. We dissect these differences in this article and elsewhere on this site.

Best regards,

ft Editorial Staff

Now that the 10 year Treasury Note has replaced the 30 year Bond, we will always be just floating above the threat of financial disaster forecasts

thankyou very enlightening .

In the past you used to show past recession periods overlayed on the yield spread graph – can you please go back to that view as it’s very helpful to quickly identify the timing and length of past recessions. Thanks!

Ryan,

Thank you for your suggestion, we are now including recession lines on the yield spread chart.

Best regards,

ft Editorial Staff

It would be much more helpful and insightful if your yield spread historical chart had the median sales price data of a single family house as well as the economic indicator of a recession overlayed on the same X axis of time. This would help to see if there are any correlations that can be used for predicting the housing market.

On stock market web sites I’ve seen use of a yield spread between the 10 yr and 2 yr rates. Which is most commonly used, the yield spread you refer to (10 yr and 3 month) or this other one?

Refer to the article on the Federal Fund Rate are referring to 3-months time or the 2-years yield duration ?