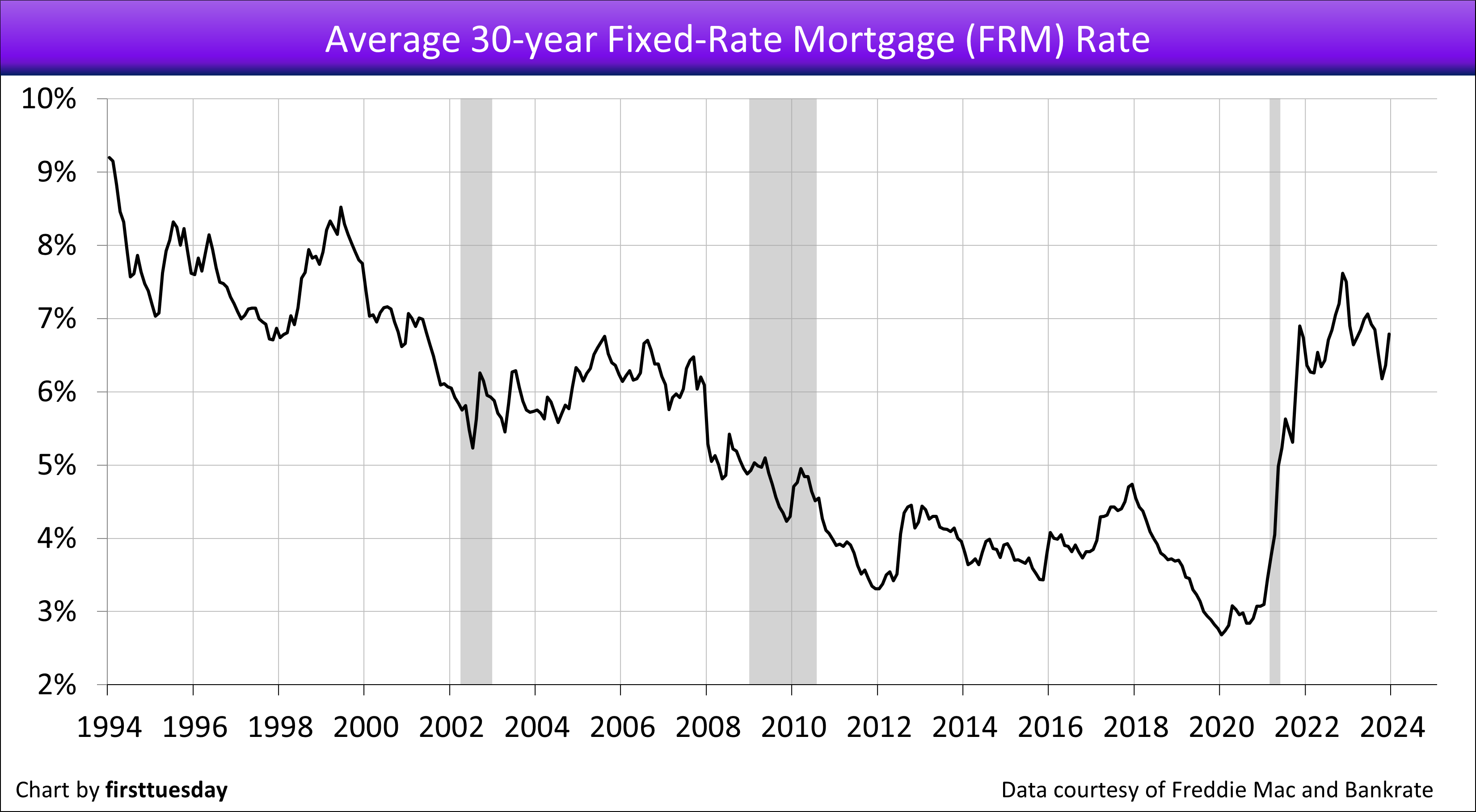

The rate on an average 30-year fixed rate mortgage (FRM) lifted slightly to 6.72% in the week ending December 20, 2024. The average 15-year FRM inched up to 5.92%.

Watch for FRM rates to generally work their way lower in 2025 as the Fed completes its job to fully stabilize consumer inflation (and job growth) following the pandemic disruption. The FRM rate decrease through 2025 is expected to be followed by a long-term upward trend, which began in 2013 at the outset of a half-cycle with some 30 years of rising rates on all borrowing.

That said, current political interference with the economy may spill over into 2025. That might cause bond investors to drive 10-year T-Notes further up as seen in the past few months. A perception of rising future inflation has hit the bond market, which directly drives up mortgage rates.

In the long term, property sellers suffer from higher FRM rates. Asking prices are primarily supported by the amounts buyers can borrow to fund a purchase. Thus, an increase in the FRM rate forces most sellers to eventually drop prices or exit the market.

As for buyers dependent on purchase-money mortgage funding, they either:

- reduce their standard of living or investment goals and acquire property in a lower price tier, or,

- wait out the drop in asking prices until pricing matches their reduced purchasing power, the more likely situation.

Buyers increasingly sense current economic conditions are incompatible with the purchase of over-priced property due to mortgage funding at high rates. The result is more buyers are heading for the sidelines — ready, but not willing or able. However, patient buyers and their agents will, maybe by 2027, discover their situation greatly improving. Watch for-sale inventories to grow, sellers forced to cut prices to unload property they no longer want, and mortgage rates to then lower.

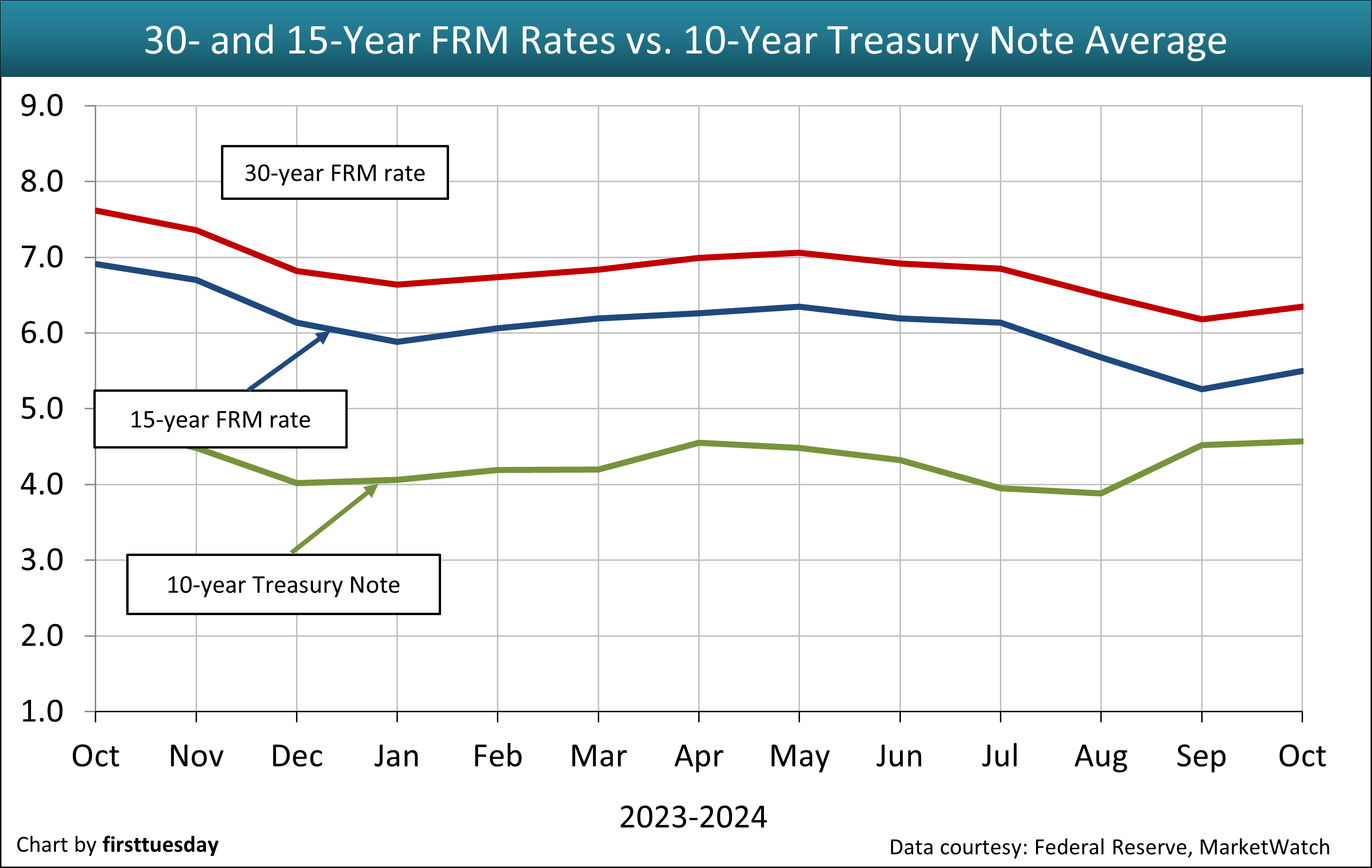

Fundamentally, FRM rates are tied to the 10-year Treasury note market, as are capitalization (cap) rates for setting income property prices. The 30-year FRM rate moves in tandem with the 10-year Treasury note rate, plus the lender’s risk premium of between 1.5% and 3.0%, based on risk of default. Historically, the risk premium spread between the 10-year T-Note rate and the 30-year FRM rate in normal times is 1.5%. The spread is far greater for cap rates.

However, the 10-year T-Note rate was 4.57% on December 20, 2024. Thus, the spread between the 10-year T-Note and 30-year FRM rate is 2.15%, above the historical risk premium spread of 1.5%. Today’s generous spread indicates lenders continue to pad their risk premiums in anticipation of future rate increases — and foreclosures due to defaults.

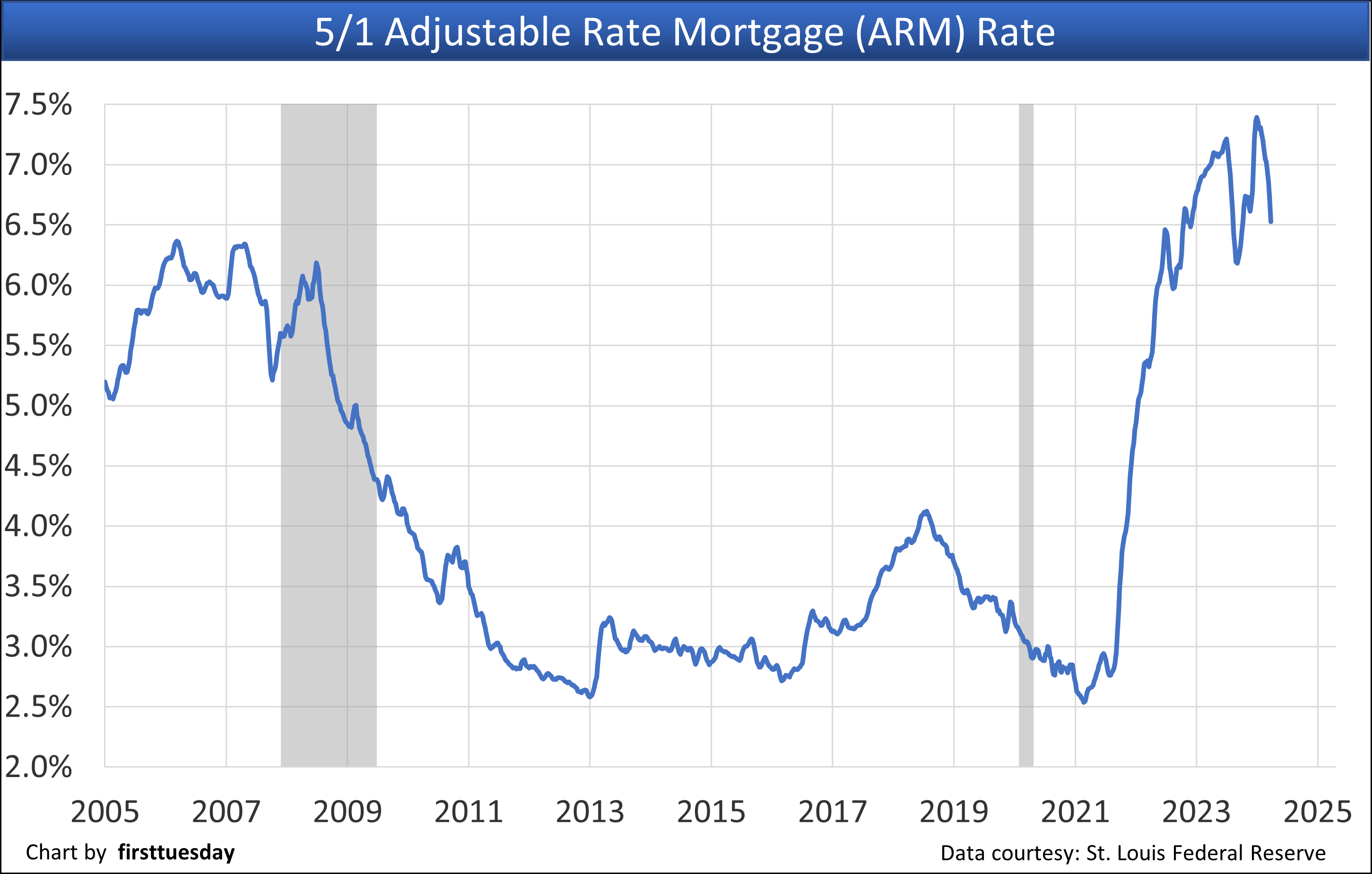

The average monthly rate on adjustable rate mortgages (ARMs) is less steady, spiking up to 6.88% on December 19, 2024 after briefly dropping to 6.26% at the start of December following a summerlong trough.

The interest rate on the ARM is higher than the 15-year FRM and 0.16 percentage points lower than the 30-year FRM rate — with the limited advantage of a 30-year ARM not worth the significant forward risks of loss inherent in ARMs. Today, a riskier ARM is rather useless to buyers seeking to increase their borrowing capacity when purchasing low- or mid-tier price homes.

This inversion in ARM rate over the FRM rates has eliminated the appeal of ARMs except in mortgage-financed high-tier housing and commercial property.

The following was updated December 23, 2024.

Click the link to go directly to a chart, or browse the charts by scrolling below.

1. 30-year fixed rate mortgage (FRM) rate, weekly — Chart update 12/20/24

2. 30-year FRM rate, monthly — Chart update 12/13/24

3. 15-year FRM rate — Chart update 12/20/24

4. 5/1 adjustable rate mortgage (ARM) rate, monthly — Chart update 11/01/24

5. 10-year Treasury Note rate — Chart update 12/20/24

6. Combined FRM and 10-year Treasury Note rates — Chart update 11/15/24

7. 91-day Treasury bill rate — Chart update 12/20/24

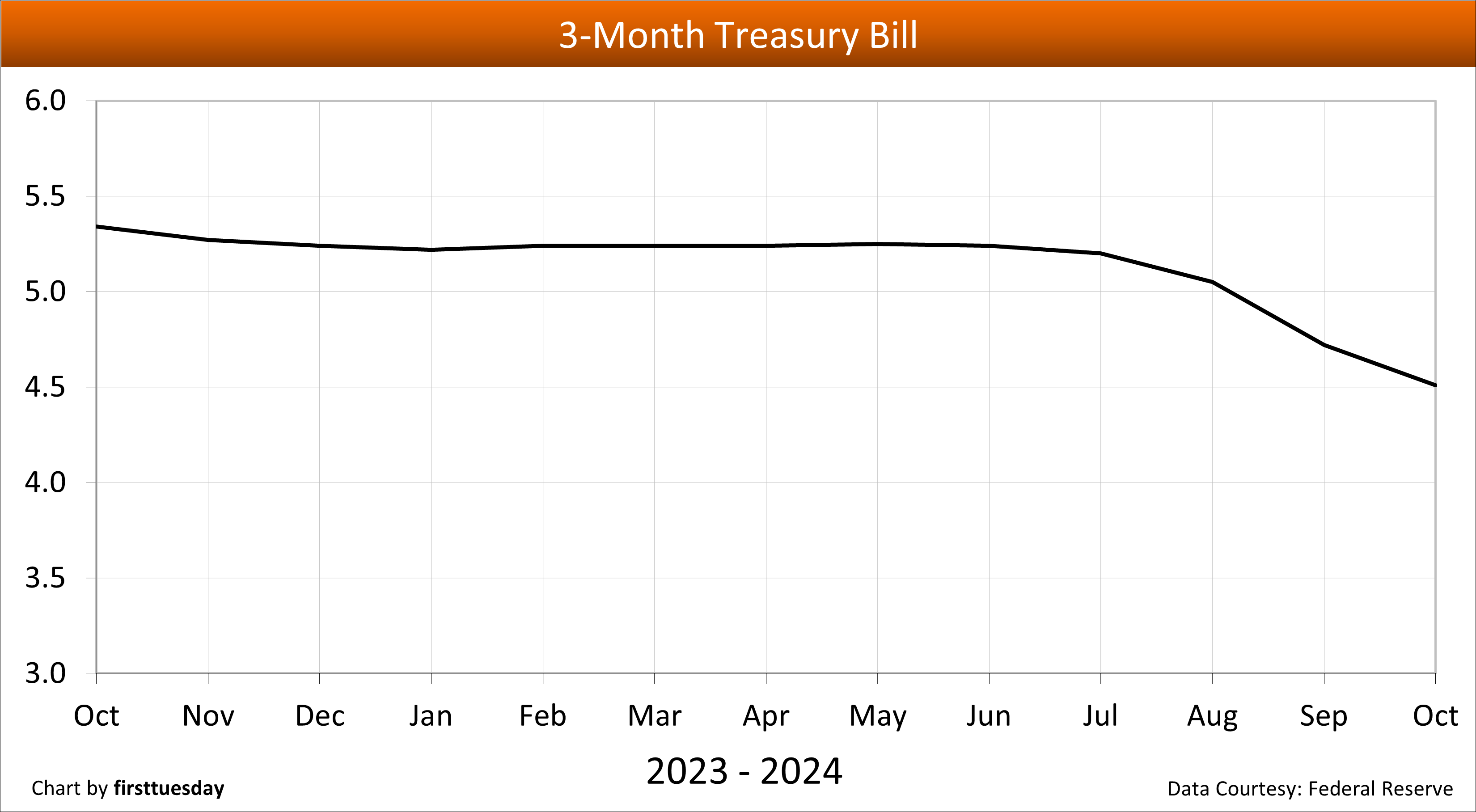

8. 3-month Treasury bill — Chart update 11/15/24

9. 6-month Treasury bill — Chart update 11/15/24

10. Treasury Securities average yield (CMT) — Chart update 11/15/24

11. 12-month Treasury average — Chart update 11/15/24

12. Secured Overnight Financing Rate (SOFR) — Chart update 12/20/24

13. Applicable federal rates — Chart update 11/15/24

| ||

| Chart update 12/20/24 | ||

Current | Month ago 11/22/24 6.84% | Year ago 12/22/23 6.67% |

The average 30-year FRM rate in California is provided by the St. Louis Federal Reserve Bank.

| ||

| ||

| Chart update 12/13/24 | ||

Nov 2024 Average 6.79% | Oct 2024 Average 6.36% | Nov 2023 Average 7.50% |

| ||

| Chart update 12/20/24 | ||

Current 12/19/24 5.92% | Month ago 11/15/24 5.99% | Year ago 12/22/23 5.95% |

The average 15-year FRM rate in California is provided by the St. Louis Federal Reserve Bank.

| ||

| ||

| Chart update 11/01/24 | ||

Oct 2024 6.55% | Sep 2024 6.12% | Oct 2023 7.18% |

The 5/1 average adjustable rate mortgage (ARM) rate shows the average rate for the first five years after origination. After the initial five-year period, the ARM rate is adjusted annually based on an index figure, such as a certain Treasury Bill rate (which reflects Federal Reserve rate movements) or the Secure Overnight Financing Rate (SOFR). The average ARM rate is provided by Freddie Mac’s survey of the Western Region of the U.S. | ||

| ||

| Chart update 12/20/24 | ||

Current 12/20/24 4.52% | Month ago 11/22/24 4.41% | Year ago 12/22/23 3.91% |

This rate is a leading indicator of the direction of future Freddie Mac rates. The 10-year rate historically runs closer to 4% during a stable money market. The rate is influenced by worldwide demand for the dollar and anticipated future domestic inflation. | ||

| ||

| Chart update 11/15/24 | ||

Avg 15-Year Oct 2024 5.50% | Avg 30-Year Oct 2024 6.35% | Avg 10-Year T-Note Oct 2024 4.57% |

The average 15- and 30-year conventional commitment rates are the rates at which a lender commits to lend mortgage money in the United States-West/California for the duration of the life of each respective mortgage as reported by Freddie Mac. The green line reflects the 10-Year Treasury Note Average, a leading indicator of the direction of future Freddie Mac rates. It is comprised of the level of worldwide demand for the dollar and anticipated future domestic inflation.

| ||

| ||

| Chart update 12/20/24 | ||

Current 12/20/24 4.36% | Month Ago 11/22/24 4.53% | Year Ago 12/21/23 5.42% |

This rate determines the minimum interest rate the seller must use in a delayed §1031 transaction and report when not receiving interest on §1031 monies held by a facilitator/accommodator. This rate also sets the amount of the ordinary income the facilitator/accommodator must report. | ||

| ||

| Chart update 11/15/24 | ||

Oct 2024 4.51% | Sep 2024 4.72% | Oct 2023 5.34% |

The 3-Month Treasury Bill is the rate heavily influenced by the Federal Reserve through the Fed Funds Rate as the base price of borrowing money in the short-term. It is used in determining the 3-month:10 year yield spread used to predict the likelihood of a recession one year forward. The posted rate is the monthly average for the listed month. Rates are released with a 1-2 month reporting delay.

| ||

| ||

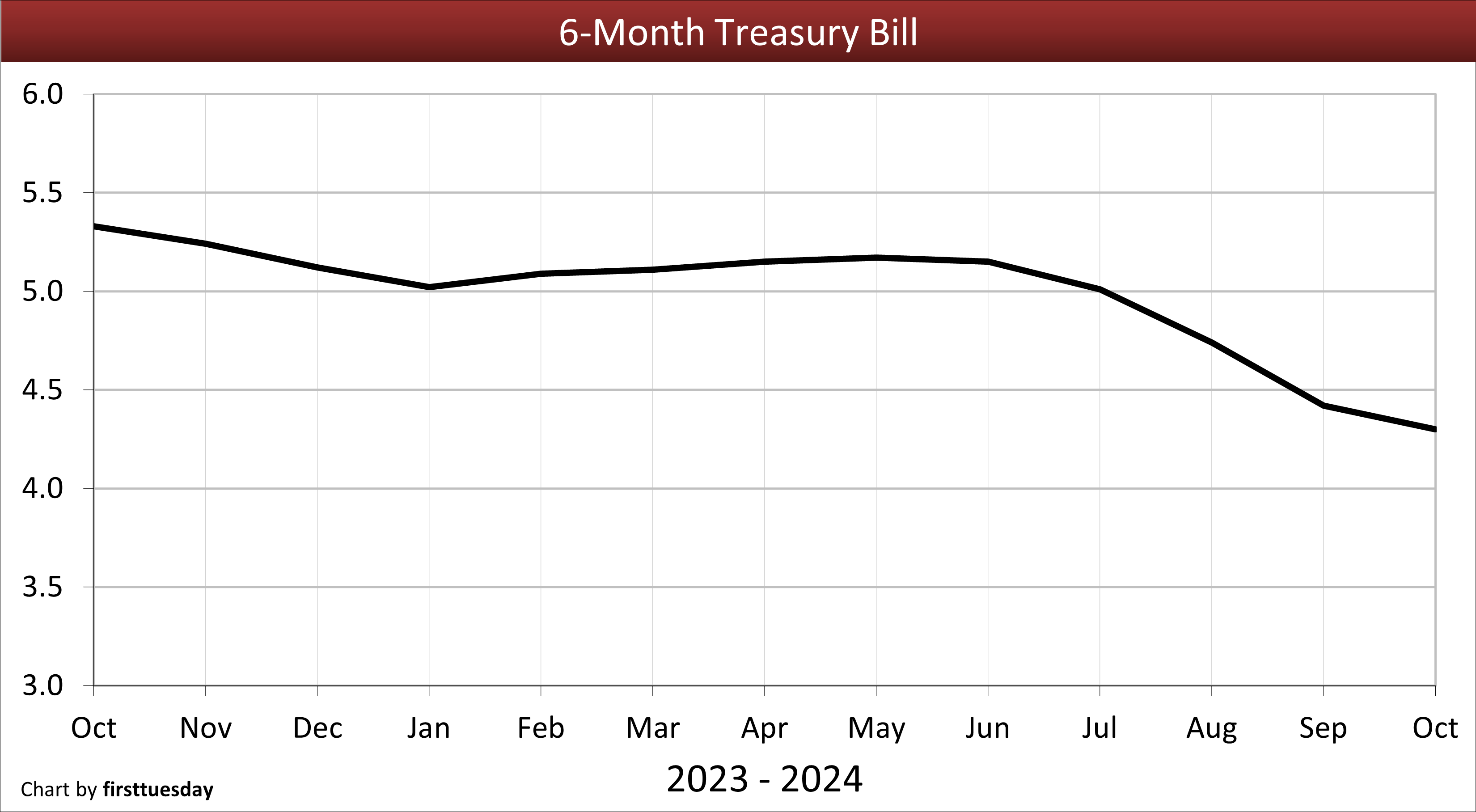

| Chart update 11/15/24 | ||

Oct 2024 4.30% | Sep 2024 4.42% | Oct 2023 5.33% |

The six-month T-Bill rate is one of several indices used by lenders to periodically adjust the adjustable rate mortgage (ARM) rate. The adjusted rate equals the indexed rate (at the time of adjustment or an average of several prior rates) plus the lender’s profit margin. The posted rate is the monthly average for the listed month. Rates are released with a 1-2 month reporting delay. | ||

| ||

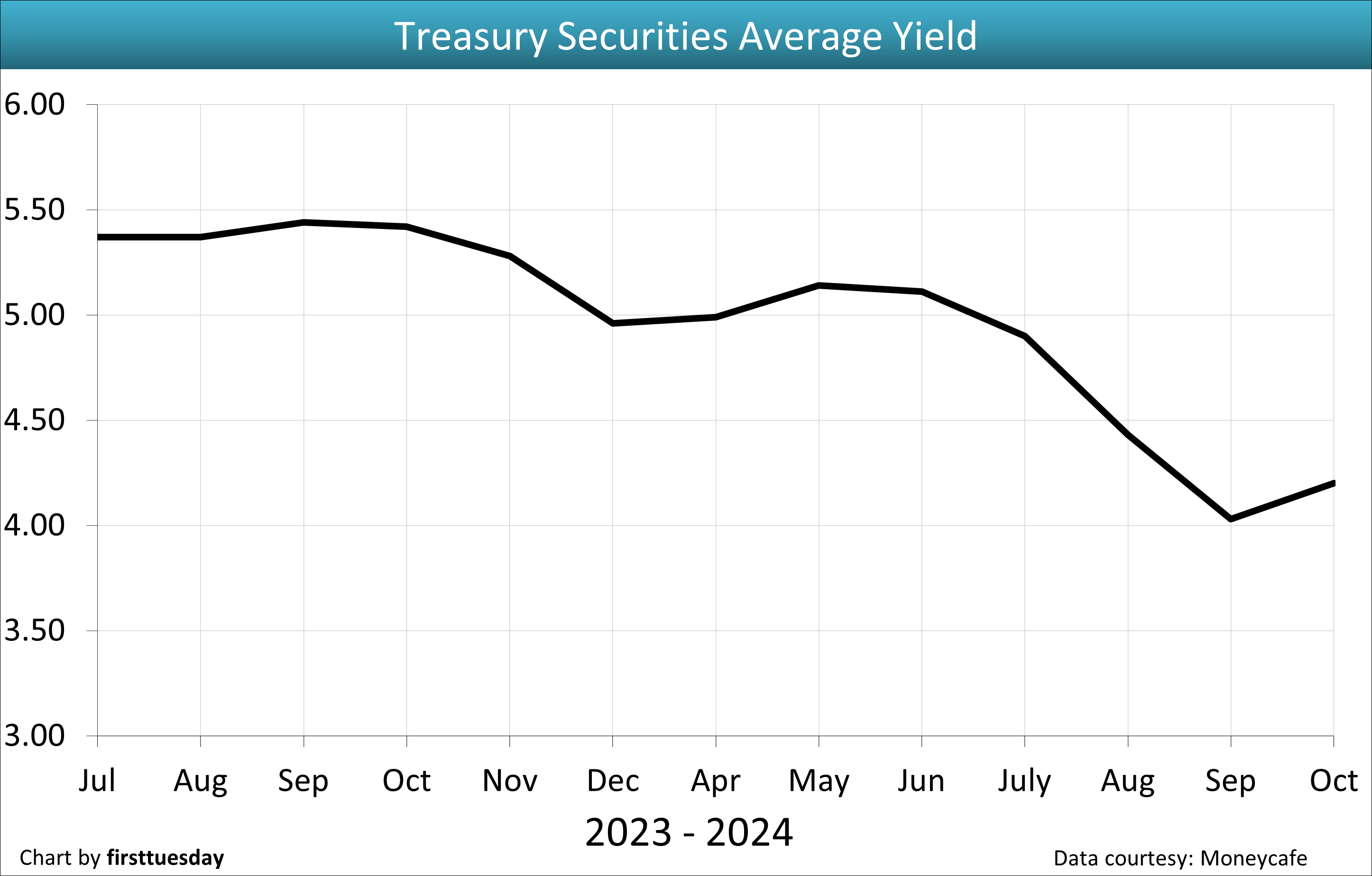

| Chart update 11/15/24 | ||

Oct 2024 4.20% | Sep 2024 4.03% | Oct 2023 5.42% |

This index is one of several indexes used by lenders as stated in their ARM note to periodically adjust the note’s interest rate. The ARM interest rate equals T-Bill yield, plus the lender’s profit margin. The index is an average of T-Bill yields with maturities adjusted to one year. | ||

| ||

| Chart update 11/15/24 | ||

Oct 2024 4.83% | Sep 2024 4.93% | Oct 2023 5.01% |

This index is one of several indices used by lenders as stated in their ARM note to periodically adjust the note’s interest rate. This figure is an average of the one-year T-Bill rates for the past 12 months. The ARM interest rate equals the 12-Month Treasury Average yield plus the lender’s profit margin. There is a one-to-two month lag in data reporting for the 12-Month Treasury Average. | ||

| ||

| Chart update 12/20/24 | ||

Current 12/20/24 4.3% | Month ago 11/22/24 4.57% | Year ago 12/21/23 5.31% |

This index is one of several indices used by lenders as stated in their ARM note to periodically adjust the note’s interest rate. It replaced the LIBOR in 2021, which was found to be manipulated in the years leading up to the 2008 recession and financial crisis. The ARM interest rate equals the SOFR rate plus the lender’s profit margin. The rate is based on overnight borrowing in the U.S. Treasury repo market. The SOFR is produced in a transparent manner and is based on observable transactions, rather than models, and, unlike the LIBOR, is not dependent on bank estimates. | ||

| ||

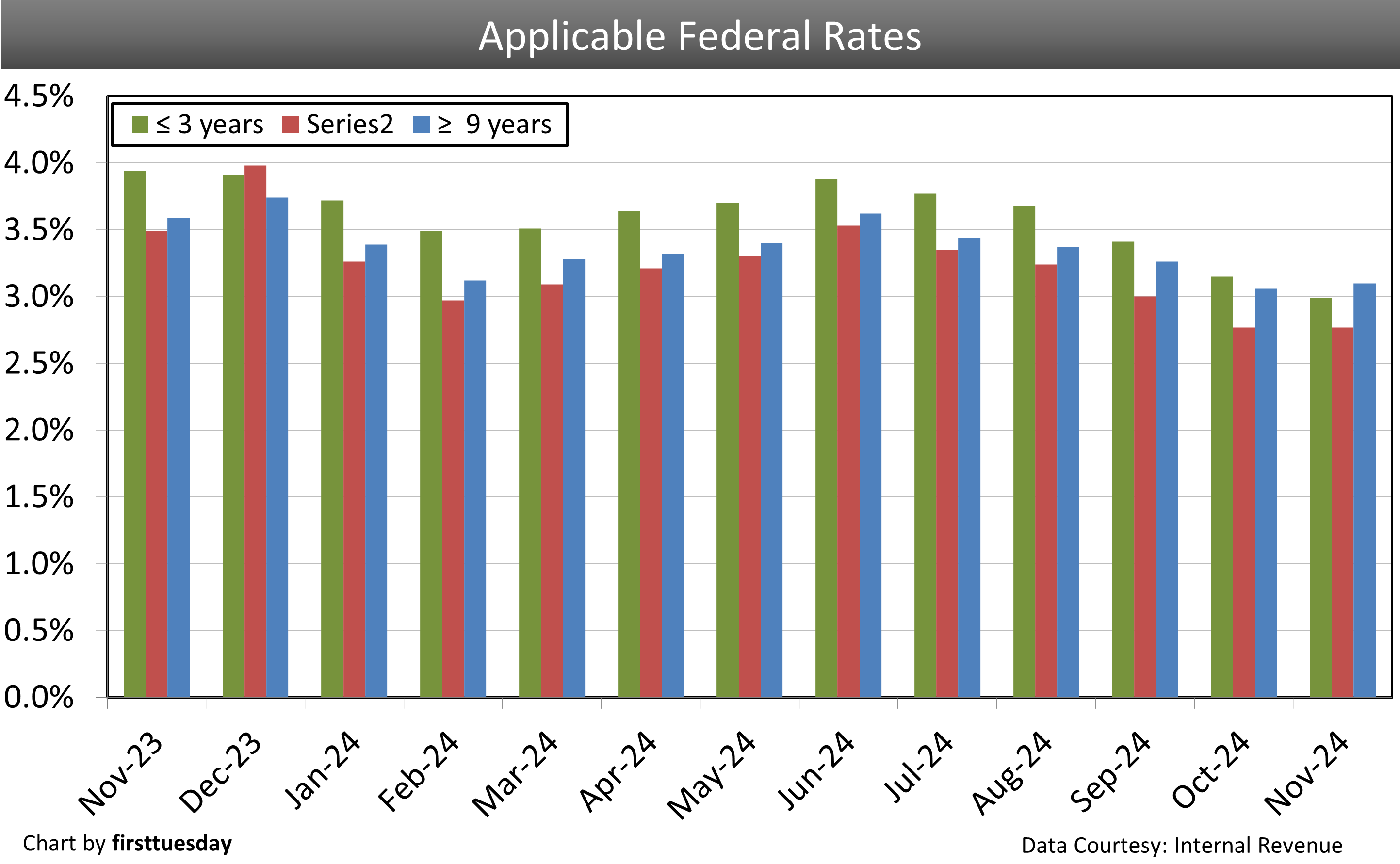

| Chart update 11/15/24 | ||

Short (3 years or less) Nov 2024 2.99% | Medium (3 to 9 years) Nov 2024 2.77% | Long (9+ years) Nov 2024 3.10% |

These rates determine minimum interest yield reportable on carryback financing. The AFR category is determined by the carryback due date. Rates are for monthly payments, reported for the coming month.

| ||

Trending mortgage rates are the best, and it provides us with what we need to know. Also, when I got the best services that are bringing the right results I found the solutions.

I appreciate your monthly delivery of excellent information and statistics.

If you’re looking for a mortgage, keep in mind that 7.36 percent is only an average rate – some lenders promote lower-than-average rates on Bankrate.

I am learning more and more about all the good information in this chapter from first tuesday thank you.

Lots of charts and graphs with little meaning beyond that rates are and have been historically low . They provide Zero proof that a recession is imminent. Even the time frame is incorrect for predictive analysis. News Flash: CA is not the canary in the coal mine for the US Economy. Your problems there are unique to CA and how it has been mismanaged for decades.

Interest rates will remain relatively low for MANY years to come. The United States has such a large amount of debt that a significant increase in interest rates would leave the US government unable to make the payments on our debt. Defaulting on the deficit is not an option. Therefore rates will remain low.

Jeff Gundlach (the new bond king) says otherwise. IMO we will see 6% rates on 30yr mortgages in the next few years. The national economy is spiking now since money is still cheap to borrow but rates ARE going up so it makes sense to do some things now with cheaper money. Overbuilding due to speculation is a constant theme in our economy and recessions do happen. IMO mid 2019 will be the start of our next recession and the question is how shallow or severe it will be. To soon to tell due to to many factors, trade war, election results, foreign entities buying USA debt (or not).

Thank you. I love this article. Complex issues presented with clarity..

This is an awesome site with great information…

No matter if some one searches for his required thing, therefore he/she desires to be available that in detail,

therefore that thing is maintained over here.

KISS – Keep it Simple & Stupid. Before, I sell almost everything: pots & pans, Insurance: property & Casualty; life & disability. All kinds of licenses; broker & agent licenses, even dog’s & cat’s license, I let them expired. Are we trying to be expert on extraneous matters of limited application; or to concentrate on practical & substantive issues of social engineering, better understanding, & dedicated service to clients? Let computer-brain-knowledge be ready for, far & between instant use, when needed. But, emphasis should be on KISS. After all, we are only salesmen; although, treated as professionals.

Very useful and concise information. It really tells the story very well.

I’ll have to admit the information overload is a factor in understanding, however it is good to know that First Tuesday continues to track these indices. Each chart references a brief explanation of its meaning. With continued support like this, outside of the Lending Industry interpretations, I’m starting to catch-on. First Tuesday,

you rock!