Why this matters: Mortgage loan originators (MLOs) and other real estate licensees are observing a long-term trend of rising mortgage interest rates negatively affecting refinancing and purchase-assist mortgage originations. DRE MLOs have the market advantage as they are the go-to gatekeepers for all types of real estate transactions. DFPI MLOs do not share this authorization.

The return from the peak

Three variations of individual mortgage loan originators (MLOs) are employed as mortgage representatives in each state of the nation. Each is regulated by different governmental agencies:

- banks and other depositories hire MLOs who are registered and overseen by federal agencies but not licensed in any state;

- state agencies like the California DRE which oversees real estate licensees who operate as MLO endorsees; and

- state agencies like the California DFPI which licenses and oversees mortgage banking operators and their employed MLOs.

In other words, federally-registered MLOs work for big banks like Wells Fargo or Bank of America among others without state agency oversight. State-licensed MLOs are federally registered and employed as mortgage brokers and mortgage bankers. In California, MLOs who are state-licensed are regulated by either the California Department of Real Estate (DRE) or the Department of Financial Protection and Innovation (DFPI).

Updated June 27, 2025.

Chart update 6/27/25

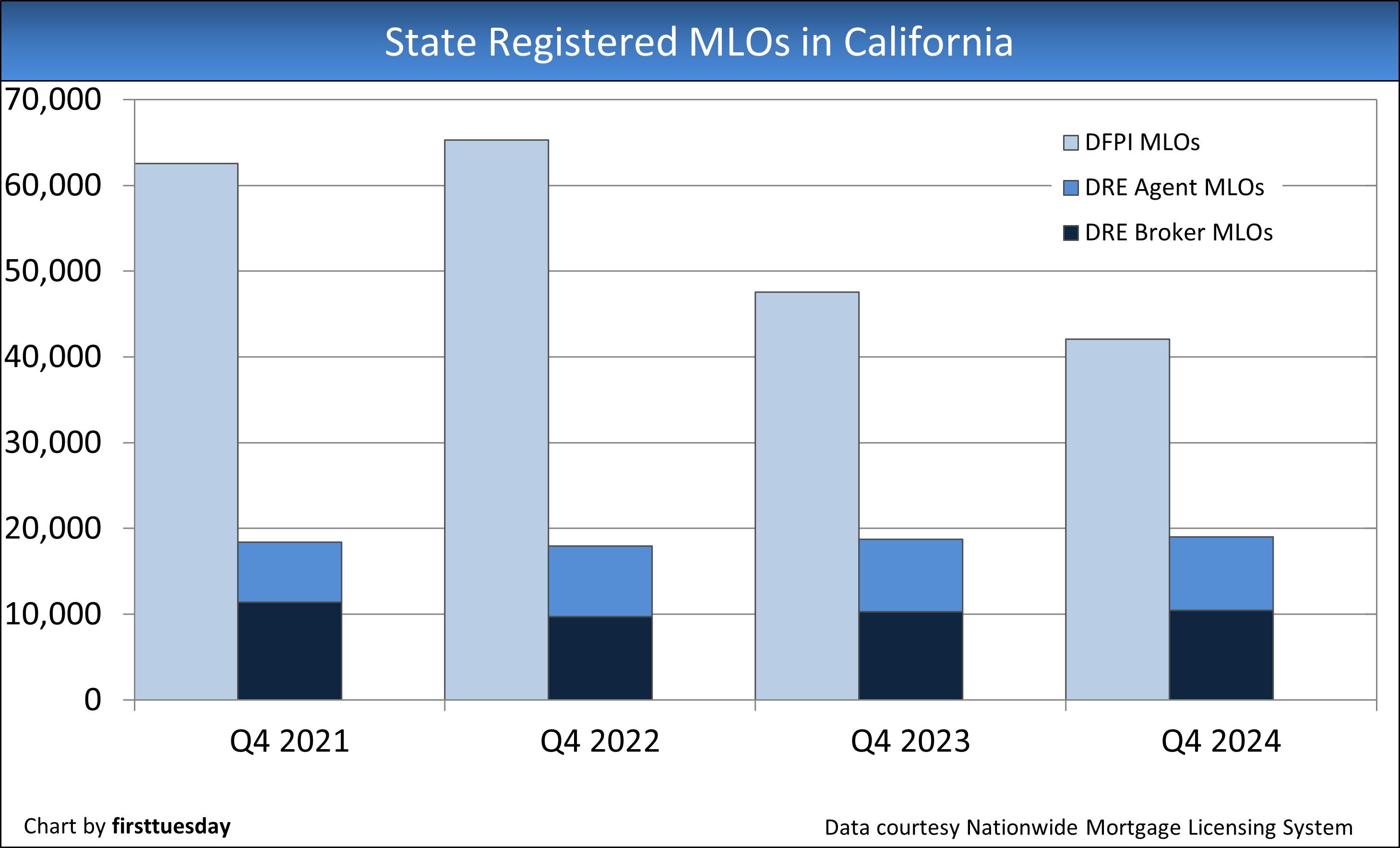

| Q4 2024 | Q4 2023 | Annual change | |

| DFPI MLOs | 42,100 | 47,500 | -11.5% |

| DRE endorsed Brokers | 10,400 | 10,300 | +1.3% |

| DRE endorsed Salespersons | 8,600 | 8,400 | +1.4% |

DFPI decline for lack of fee generating services

The number of state-registered MLOs in California has declined from its 2022 peak, but the drop is not shared evenly across its two oversight agencies. While DFPI MLO numbers continue to fall away, dropping 11.5% in 2024 compared to 2023, the DRE increased its share of MLOs within its pool of licensees, sales agent MLOs growing 1.3% and DRE endorsed brokers 1.4%.

The two paths to MLO endorsement under the DRE and DFPI, formerly known as the Department of Business Oversight (DBO), are structured similarly. Both agencies’ applicants need to:

- complete 20 hours of NMLS-approved pre-licensing education;

- pass the nationwide SAFE Mortgage Licensing Act Exam provided by the NMLS with a 75% or higher;

- agree to a criminal background check; and

- complete eight hours of NMLS-approved continuing education (CE) annually.

However, the DRE endorsement is significantly more difficult to obtain than a DFPI license. DRE MLOs must maintain either a sales agent or broker license along with renewing their MLO license endorsement with the DRE. This higher standard empowers DRE MLOs with numerous other opportunities to offer fee generating real estate services not permitted by an DFPI license.

After obtaining an individual MLO license under the DFPI, the licensed individual may work as a mortgage representative under either the:

- California Residential Mortgage Lending Act (CRMLA) [Fin C §§50000 et seq.]; or

- California Financing Law (CFL). [Fin C §§22000 et seq.]

In contrast, a DRE licensed individual with an MLO endorsement is authorized to also work for a CRMLA or CFL company and can make or arrange all types of mortgages. The reverse is not true. For example, a DFPI MLO licensed to service consumer mortgages applications representing a CFL company cannot negotiate business purpose mortgages under a CRMLA licensed company and cannot be employed by a DRE licensed broker to deal with the public without first being DRE licensed.

The more adaptable DRE licensee endorsed as an MLO also derives income for services as a real estate agent or broker. Thus, a DRE licensee endorsed as an MLO has a cushion of income available from other types of real estate services when a recession puts pressure on the state-licensed MLO population to seek additional income.

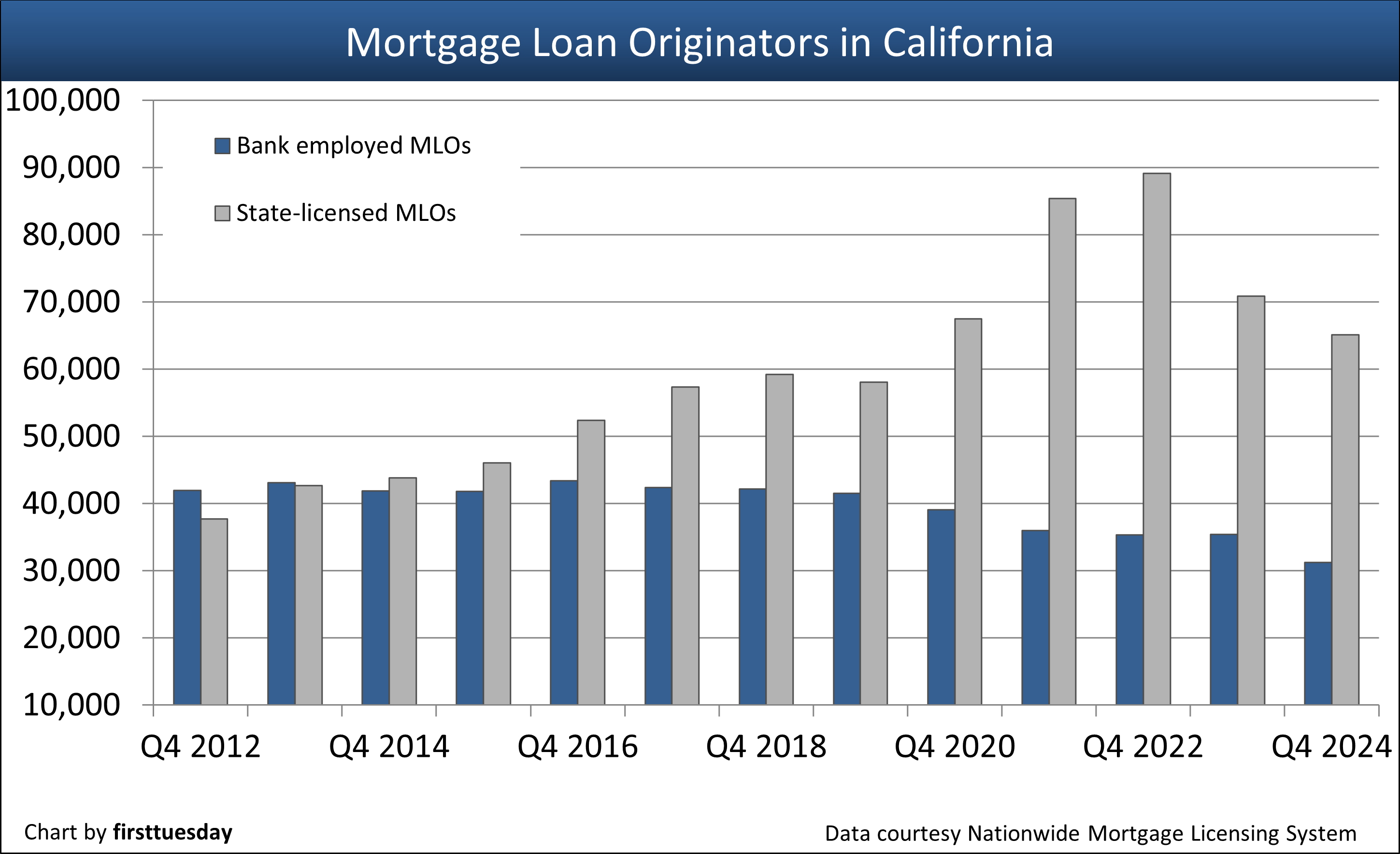

Chart update 6/27/25

| Q4 2024 | Q4 2023 | Annual change | |

| Bank employed MLOs | 31,200 | 35,400 | -11.7% |

| State-licensed MLOs | 65,100 | 70,900 | -8.1% |

MLOs on the decline, with DRE exception

For depository institutions – banks – operating in California in December 2024, they employed 31,200 federally-registered mortgage loan originators (MLOs). Bank MLO employment is down 11.7% from a year earlier. A similar decline for state-licensed DRE and DPFI MLOs in California totaled 65,100 in December 2024, down 8.1% from a year earlier, the decline being solely with DFPI MLOs.

Without a surge in falling interest rates or a rise in property values to induce refinancing, MLOs rely mostly on end use homebuyers which is the market dominated by DRE endorsed MLOs. However, both refinancing and purchase-assist mortgage originations have diminished since mid-2022 and continue to slide. This trend in originations does adversely affect renewal rates for MLOs and new MLO NMLS registrations. Clearly, DRE licensees with MLOs endorsements are an exception.

Loan originations going forward

Some of the headwinds facing originations by MLOs include:

- public awareness and reaction to the current real estate recession well underway;

- annually declining home sales volume now three years running and worsening; and

- home prices belatedly in decline, with a likely 30% or greater drop before prices bottom (for hindsight the price drop in the 2008 recession was near 50%).

Mortgage rates began their half-cycle trend upward after the 2013 zero-bound level – except for the 18 months of the pandemic period when Wall Street’s mortgage bond market collapsed until returning in late 2021. As the years pass, the idea of solvent owners refinancing during a cycle of upward trending mortgage rates is fantasy, except for very short periods when mortgage rates drop below the rate on any existing mortgage.

Also, buyers are growing increasingly cautious following the pandemic upheaval. Their caution is causing the demand for purchase-assist mortgage originations to slip. Worse is coming: two or three years of property price declines which freeze homebuyer willingness and greatly diminish purchase offers until buyers see a bottom in pricing and a clear rise takes place in pricing.

Getting licensed – and keeping it

Are you interested in obtaining your MLO license or endorsement? Any individual who, for financial gain, takes a loan application, negotiates or offers a consumer purpose loan secured by a one-to-four unit residential property is required to be federally registered as an MLO. In California, registered MLOs are required to have:

- a valid DRE license with an MLO endorsement;

- an MLO license issued by the DFPI; or

- employment with a bank or other depository.

Related article:

Question…If there are approx. 100,000 Licensed Real Estate Brokers in CA and Approx 42,000 Licensed MLO’S in CA.

Do you happen to know how many Brokers/Agents hold Both License? I hold both and was wondering how many others do?

Thanks for your time and I love your STUFF