On the surface, Federal Housing Administration (FHA)-insured mortgages seem like a great deal for everyone. Homebuyers with little cash available receive the opportunity to become homeowners, while sellers and agents benefit from more homebuyers.

But there’s a dark side to FHA mortgages, too.

First, some background.

The most commonly used FHA insurance program is the owner-occupied, one-to-four unit home mortgage insurance program under Section 203(b). This mortgage program induces lenders to grant mortgages to homebuyers with a down payment as little as 3.5%.

The public policy rationale behind the Section 203(b) program is based on the idea that individuals who become homeowners prove in their later years to be less of a financial burden on the government than the burden imposed by lifetime renters. No consideration is given when inducing homeownership to the risks a homebuyer takes on due to the high debt burden accompanying an FHA-insured mortgage and the reduced job mobility during economic downturns.

For the privilege of making a small down payment, the annual cost of borrowing is effectively added to interest. The borrower pays:

- an up-front mortgage insurance premium (up-front MIP) to the FHA of 1.75% of the mortgage amount at closing; and

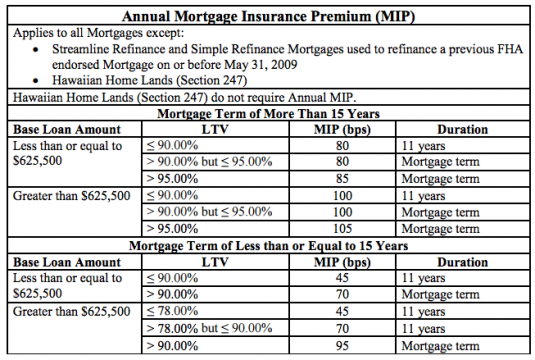

- an annual amount of 0.45%-1.05% of the mortgage amount depending on the mortgage term, mortgage amount and loan-to-value (LTV) ratio. [HUD Handbook 4000.1(II)(A)(2)(e)(i); Mortgagee Letter 2017-07]

At the end of President Obama’s term, the U.S. Department of Housing and Urban Development (HUD) lowered annual MIP rates in an effort to reduce the cost of borrowing and appeal to even more homebuyers. This reduction was canceled the day President Trump took office. [See HUD Mortgagee Letter 17-07]

The current FHA MIP schedule is:

See HUD Mortgagee Letter 17-07

FHA-insured mortgages help sellers

While FHA-insured mortgages are meant to help renters with little cash become homeowners, the real beneficiaries are sellers.

How is that possible?

Homeowners limited by small down payments have two main options to choose from:

- an FHA-insured mortgage with MIP payments; or

- a conventional mortgage with private mortgage insurance (PMI), which tends to come with a higher base interest rate.

In 2015, FHA MIPs decreased even further, making FHA-insured mortgages an even better deal for qualified buyers. The FHA annual MIP premium on a 30-year mortgage for a home purchase less than or equal to $625,000 with a minimum down payment was reduced from 1.35% to 0.85%. This reduction ought to have translated to savings for homebuyers.

However, a recent University of California Los Angeles (UCLA) economic letter examines how this reduction actually played out. The UCLA report found the average buyer in 2015 paid $1,300 more to home sellers due to the premium reduction.

Essentially, the MIP reduction enabled homebuyers to qualify for more mortgage principal. Rather than spending less money each month, the average FHA homebuyer continued to operate at their ceiling, either by paying more for the same home or by shopping for a more expensive home.

What’s more, this reduction was intended to induce 250,000 more homebuyers into the market over three years. In the first year following the MIP decrease, just 35,000 more homebuyers entered the market due to the MIP reduction, according to the UCLA report.

This example is indicative of the FHA’s larger problem for the housing market.

FHA mortgage programs are largely ineffective in attracting more homebuyers and in saving them money. FHA-insured mortgages do prop up home prices, a benefit to sellers and real estate agents.

A better way for the government to make homeownership available to more renters is to encourage more building, increasing the housing supply and bringing home prices in line with homebuyer incomes. This may help bring California’s low homeownership rate closer to the national average.