Why this matters: Real estate agents and brokers in 2026 will observe another year of substandard home sales volume following the 2021 pandemic buying frenzy. Even as FRM rates dropped over 80 percentage points in 2025, additional buyers did not come forward. Meanwhile, inventories of property for sale grew, and will eventually build up with a vengeance.

Current home sales to depleted buyers

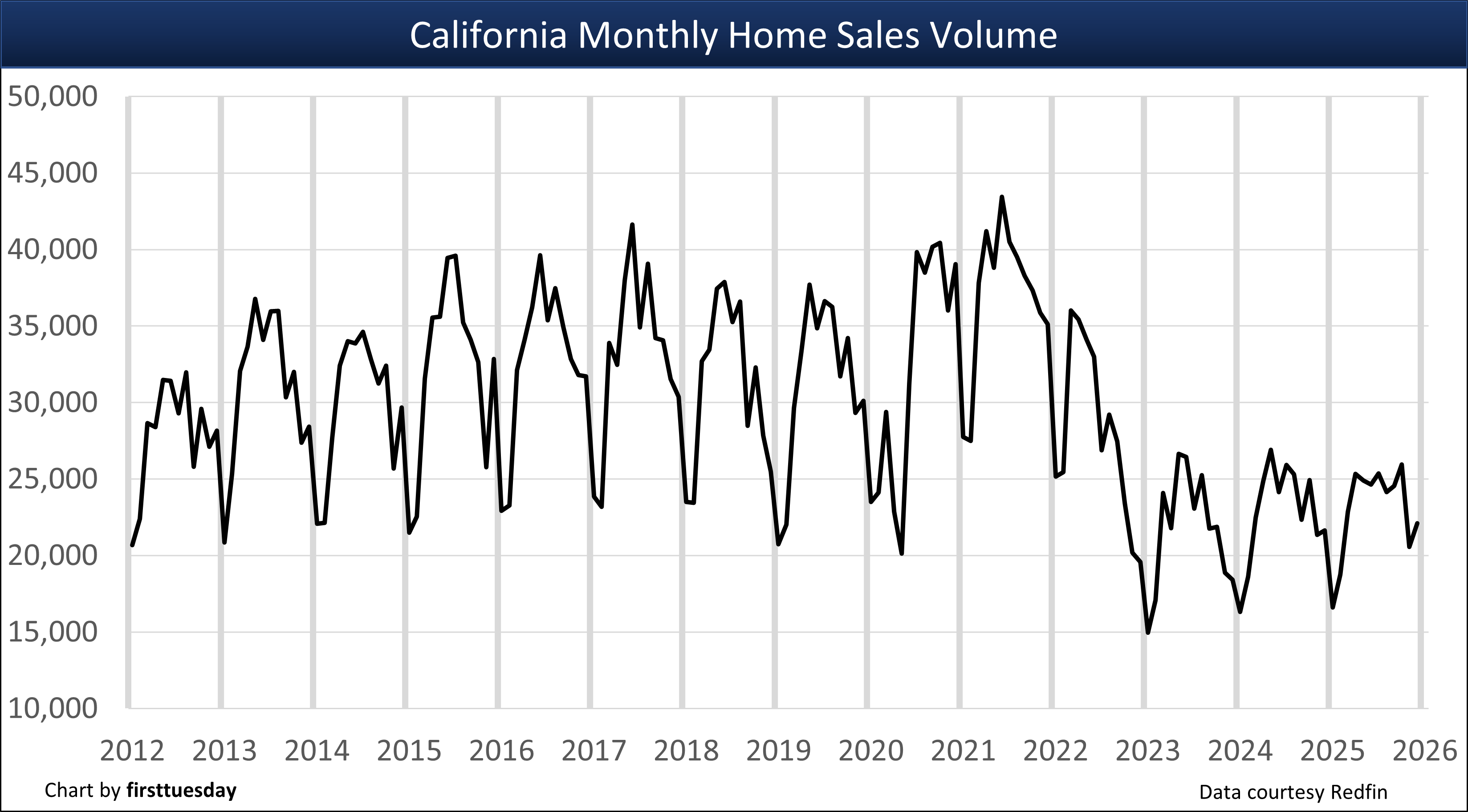

In December 2025, California saw 22,100 escrows close for new and resale home transactions. Sales volume in December dropped 2.2% below the same month one year earlier.

Importantly for trends, year-to-date (YTD) sales volume through December 2025 only increased 0.3% from the 2024 YTD sales figure. A third year of flat sales, with aggressive consumer inflation and static property prices insufficient to attract more buyers.

Recent home sales trends

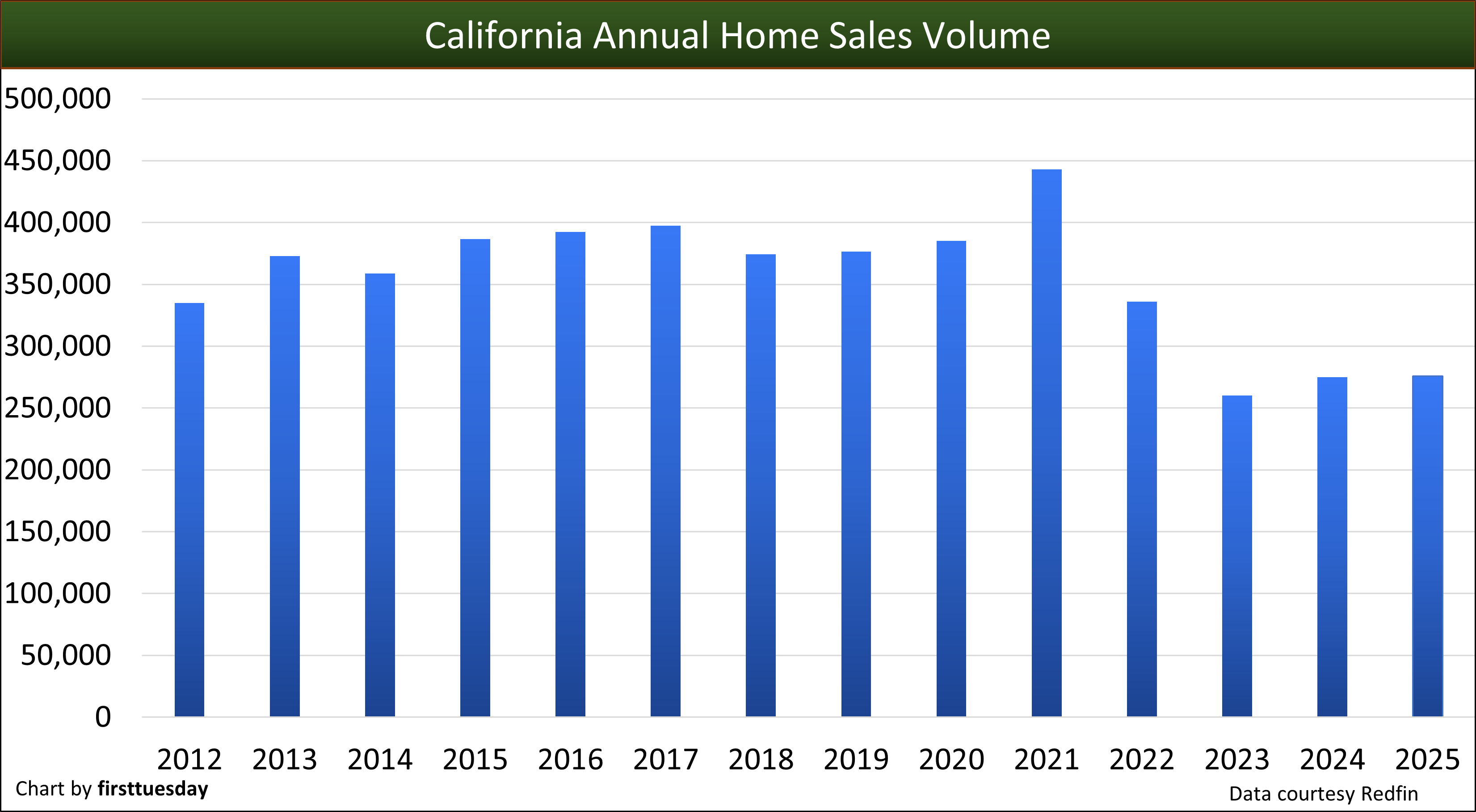

Consider that annual home sales experienced literally no change from 2024 to 2025. More critically, sales volume in 2025 matched 2024 at 27% below 2019 — the last year in the past sales cycle.

Today, buyers are waiting until they sense the decline in pricing has passed, evidenced when prices bottom and begin to rise. Be aware your typical homebuyer today knows their math for income-to-mortgage leveraging to set home pricing, thanks to readily available insight.

The developing public uncertainty about political upheaval, trade taxes and immigration hostilities tamps down owner and tenant turnover, and thus sales volume. The property sales volume will suffer from this status quo type rigor mortis until speculators turn to the real estate market and stop prices from dropping.

Today’s sales volume strikes at pricing

Watch for home sales volume to remain flat or further trail off during 2026, as the likely trend of another disappointing spring season results from buyer caution around increasingly troubling employment conditions. More changes are underway as the U.S. is shifting into an economy not unlike the mid-1960s or 1980s stemming from a heightened focus on building the military-industrial complex even further which suppresses user turnover.

When home prices decline across all pricing tiers, not just the high tier now underway, recent homeowners with little down payment can only watch as the equity in their home slides underwater. This pricing-to-mortgage crossover event is not likely to begin until a nationwide economic recession brings on a further drop in the number of Californians employed. Also, keep an eye on the slow upward trend currently underway with mortgage foreclosures, a force compelling owners to sell.

Sales agents can expect the current real estate recession to eventually bring about a return of real estate speculators after prices drop to produce a “dead cat” bounce in both sales volume and pricing. Within 12 months following the speculator-driven market bounce, home prices historically slip as homebuyers wait and watch as prices bottom during that period. It is then that a sustainable sales volume and pricing recovery takes over with the return of end-user homebuyers – and temporarily lower mortgage rates.

Updated January 2026.

Chart 1

Chart update 1/23/26

Dec 2025 | Dec 2024 | YoY change | |

| California home sales volume | 22,100 | 21,600 | +0.3% |

Home sales fluctuate from month to month for a variety of reasons, all worth an agent taking time to consider. The most significant reason is the volatility of homebuyer demand. Several factors constantly at work moving the California homebuying market include:

- seasonal motivational differences, an annual cycle [see Chart 2];

- job market fluctuation;

- mortgage interest rate movement;

- homebuyer saving rates;

- home pricing sought by sellers;

- turnover rates for tenants and owners;

- negative equity property financials; and

- investor and speculator opportunity perceptions.

Seasonal differences in annual sales volume

It’s normal for home sales volume to rise in the first half of the year and fall after peaking around June.

Chart 2

Chart 2 shows average home sales volume experienced from 2011-2018, the recovery period following the Great Recession. As depicted, the month with the most homes sold monthly during a year close escrow in June. Another upturn takes place in December, as homebuyers seek to wrap up their financial activities before the end of the year.

Real estate agents need not fuss when they hear of falling month-to-month sales volume in the latter half of the year. It is the normal cycle of seasonal progression taking place. What to watch for is year-over sales, to compare recent months this year to the same months last year or compare another period such as year-to-date to best see a trend.

As a rule, current market activity, whether up or down, is reflected first in sales volume, followed in nine to 12 months by price adjustments in the same direction.

Chart 3

Chart update 1/26/26

| 2025 | 2024 | 2023 | Annual change | |

| Annual home sales volume | 275,900 | 274,900 | 260,200 | +0.3% |

To set the stage for a forward look, a review of sales volume in the recent past is helpful:

- 2022 home sales volume peaked early in March and lost all ground gained in the pandemic year of 2021, ending the year 24% below 2021, but only 12% below 2019, the last “normal” year for home sales before the pandemic upended market dynamics;

- 2023 home sales volume lost a further 22% over the prior year, the consequence of buyers pulled forward to buy in 2021 using historically low mortgage rates for funding;

- 2024 home sales stabilized from the prior year, suggesting the end of the ripple effect from pandemic economics; and

- 2025 continued the stagnant sales trend of the prior two years.

Chart 4

Chart update 1/26/26

| Dec 2025 | Dec 2024 | Dec 2023 | |

| Home sales volume year-to-date | 275,900 | 274,900 | 260,200 |

Year-to-date (YTD) home sales volume through December 2025 was substantially the same as the year prior. As of December 2025, YTD home sales volume is 0.3% above a year earlier. Compared to 2019, home sales volume YTD is 27% lower in 2025 as of December. 2019 was the last “normal” year for property transactions before the pandemic economy took over. The present annual trend in sales volume is flat.

Home sales volume now in 2026 will remain weak as in 2025, due to:

- job uncertainty in the wake of the federal shutdown, geopolitical disturbance and a disjointed low rate of job growth;

- high mortgage rates reducing homebuyer ability and willingness to pay seller asking prices;

- a consistent quantity of all-cash buyers undeterred by interest rates or asking prices;

- reluctance of sellers to reduce asking prices to offset high mortgage rates;

- buyer agent failure to advise buyers to disregard asking prices and make offers at prices they qualify to pay;

- a steadily increasing inventory of property available for sale across the state causing buyers to wait to make a selection; and

- the real estate recession, yet to be declared, but four years underway throughout California.

Home sales in the coming years

The forward trend in California home sales is one of caution and delay for both buyers and sellers. Homebuyer income is growing but only keeping up with inflation, much improved from the less-than-inflation pace during the decade preceding the pandemic.

While wage increases caught up with consumer inflation, they were nowhere near enough to catch up with the peak home prices and mortgage rates remaining today from 2022. Home prices remain far above the mean price trendline but the gap is narrowing as property prices flatten and wages increase.

The necessary price adjustment required to bring buyers to the table will be especially resisted by sellers’ pricing stubbornness, known as the sticky pricing phenomenon. The likely result is continuing the post-2022 plateau of flat pricing in order to meet the rise in the mean price trendline rather than prices dropping in 2026.

firsttuesday forecasts annual home sales volume will remain at recent levels in 2026, as buyers continue to wait on the sidelines. The sales slump in 2026 will be the result of the tandem high levels of asking prices and mortgage rates. Sellers are also competing against the rising strain potential buyers experience today from high rents charged by landlords for similar housing which further reduces turnover.

The timeline for a real estate turnaround faces complications not experienced in recent decades. Government trade wars are raising the cost of both domestic and imported construction materials. Costs of owning real estate are compounded by the federal attack on the necessary migratory labor force for construction and maintenance of homes.

The competitive broker

What’s a broker reliant on home sales to do until home sales volume provides abundance again?

SFR brokers and agents might consider adding transaction-related services to supplement their income in the present buyer’s market. Those who do add related services, provided only when the client signs a representation agreement, will restructure their practice as “all-service brokers.” Transaction-related services originate primarily due to representing buyers, not sellers. When an office operation includes any of the services provided to buyers, their agents maintain a standard of living, remain solvent and position the office for eventual growth.

Related video:

thanks

The wisest policy for growth has been shot down over and over. The idea is logical: require higher density building around transportation hubs. Incentivize more people to use public transport. Reduce wasteful commuting and expansion of the highway system. Blaming low inventory on regulations is a shallow, threadbare shibboleth. Developers want tax breaks, freedom to cut corners, and the right to ignore environmental impacts. They are not victims. Californians who move to Texas will not put up with the Medieval regime of the extreme right, the destruction of marsh lands, and the flooding that results when concrete covers every available space. They will not put up with the backward assault on women’s rights. California is still the nation’s innovation hub. California is moving forward, and rumors of its demise are just plain wrong.

There’s always speaks and valleys in housing and consumer cycles. sometimes people make more income and other times they don’t,some of it does have to do with wealthier people overpaying for homes on the coast.

I had some horrible experiences with Real Estate agents in the past, therefore would never sign an exclusive right to buy with an agent. So, if an agent insist I do that, I would just carry on to the next agent and first agent would lose a potential sale with me.

Treat me right, and I will treat you right.

Too many hungry agents out there for me to need you.

I learned the hard way.

That’s really how other Virginia Ganskie agents exploit us just to sell. but someone recommended my agent and he was also an advisor and I witnessed how sincere he was. not only so that he can sell but he also wants to satisfy his client and be happy.

Please update the article, it has stale information.

so im thinking to hold onto my fathers house til 2024? looks like market is spiraling slowly to me and if i sold now id take a loss…

Inventory is climbing, but very slowly because California makes it SO hard and SO expensive. The permit fees, the school fees and their processes are not reasonable. They make it so hard for contractors to turn a profit because they want it all. It’s very discouraging and demoralizing to many small and mid-sized residential builders. In some cases they want nearly twice the value of a given lot, just in permit fees. So a guy might look at a lot, and think… okay, that lot is probably worth $150k, building costs, escrow/title, etc…, and they might think they can turn a reasonable profit for their time and risk. But wait… then the government comes in and tells them they want upwards of $60,000 or more…. there goes all of the builder’s profit and there goes another house that CA needs. Instead of worrying about rent control, I cannot understand why CA doesn’t just make it easier and more affordable… they already get so much in property taxes. Why do they have to take so much from each house BEFORE it even gets built. Very exasperating….

You really have to wonder with all the aggressive lending 5-percent down up to $2.5 million, second mortgages making a come back at higher loan to values, and no tax returns loans down to 500 credit scores that when sales volume decreases it’s an ominous sign.

January 2008 was not in the midst of a great recession. The recession didn’t start until fall of 2009.

Everything is very open with a very clear

clarification of the issues. It was definitely

informative. Your site is extremely helpful. Thank you for sharing!

Great Article, it is great to know what the statistical data says but statistics are interpreted in multiple ways. Owning a home is an individual choice in response to individual circumstances and needs so sales continue regardless of what the market is doing. If people were willing to once pay rates upwards of 10% to own a home, they’ll continue to do so, especially now with rates still under the highest average rate of 6.19% according to another “statistic”, rents continue to rise, most new construction are apartments and live/work developments where everyone it’s crowded living, people want their own piece of America. Many people are also taking advantage of higher loan limits in high cost areas $679,650 and Down Payment Assistance Programs that cover the down payment and closing costs up to that amount, without having to be a first time buyer!!

Is there a difference between Northern and Southern California markets concerning vulnerability? I have been under the impression that if the economy dips, SoCal prices drop sooner and faster than NorCal prices because there is more supply down there. Isn’t that what happened in the early 90s? And is the desert more vulnerable than the rest of SoCal?

I ask because we are hoping that our home in the Sacramento-Tahoe region will hold its value and that the desert prices will drop first so we can retire to Palm Springs with an advantage. We would like this to happen in about 5-8 years from now.

This next crash is coming much sooner than 5-8 years…

When the Governor, himself, plans to ration water to 50 gallons a day per person, can you really expect people to pay premium prices to live in such a state? A man made drought dries up home sales and the California economy

There was a decline, starting in 2008, along the I-5 corridor of the Central Valley, as environmental issues effected home sales. The shut down of the Harvey O. Banks Pumping Plant, which delivered water for 400 miles of homes and farmland created housing market chaos as over 50 towns lost water for showers and toilets, businesses, hospitals, schools and prisons. Unemployment increased to 40%. (Search online , Dead Harvest, Devin Nunes for details) Valley Farm prices and land values predictably dropped, as water prices increased to $2000 per acre foot.

Dust bowl conditions and migration out of the valley continued as the Federal government, faced with litigation, turned the problem over to the State. Major cities found lower cost housing prices rising due to an influx of displaced agricultural workers and industries. As the state’s tax base eroded, necessary college tuition increases created more interest in low cost rental properties in campus cities.

Shortages of low cost rental property and homes, including trailer parks developed as an influx of new immigrants pushed moderate cost homes to continue raising in value in the major cities. Wild fires, made possible by laws controlling the clearing of underbrush, effected populations along the mountain ranges and in the northern portions of the state.

Displaced home owners were greeted with a housing shortage and increased prices. Drug cartels attempting to control marijuana farms also contributed to the fire danger. The northern portions of the state, were affected by mandated water control issues, while, at the same time, dams and reservoirs were removed to limit hydroelectric production and promote the state’s goal of windmills and solar panels sales. The mandated requirement for homes to buy into solar panels prior to resales, pushed prices up.

Laws requiring state wide rationing of drinking water in less than 2 years will have a predictable impact. The newly mandated water divisions, recently mapped by Sacramento, with ability to add unlimited taxes on properties, within these divisions, should impact home sales between L.A. and San Francisco along the coastal valley and Salinas River. The scheduled removal of the Diablo Power Plant which serves much of California is predicted to have a heavy impact especially in SLO County.

It’s crazy how much home values differ from east coast to west. We are on the Atlantic side of the US and have the same issues but our home prices are much less. Funny to see everyone has problems

Great resource. Thank you.

Statistics can be interpreted in many ways but it’s important to at least start with hard data and not just opinion.

Just another bubble, worse than the others – and I’ve witnessed quite a few.

When THIS one goes, it will be ugly.

~ Occams

Based on what? The real estate market is much stronger and more stable compared to 2006-2007.

Based on what you just said. I’m sure you asked and said the same thing back in 2006-2007, that you think the real estate market was much stronger and more stable compared to the previous recession.

The real estate market will be surprised when rates rise causing a drop in prices. Rates can’t stay this low forever. Even with a recession due t Biden’s more regulatory policies will bring back a Jimmy Carte economy.