The Federal Reserve (the Fed) is walking a tightrope in 2022. A misstep will result in either further entrenching today’s high inflation — or setting in motion another recession.

The tightrope lies between two competing concerns: persistent job losses, alongside high consumer price inflation (CPI) and asset prices. Asset price increases are immediately apparent for housing market participants, as California home prices average 19%-24% above a year earlier as of January 2022.

The Fed has a limited box of tools with which to influence the economy and achieve its goals for stable inflation and maximum employment. In 2022, these goals are at odds with one another, with inflation high and jobs trailing a full recovery.

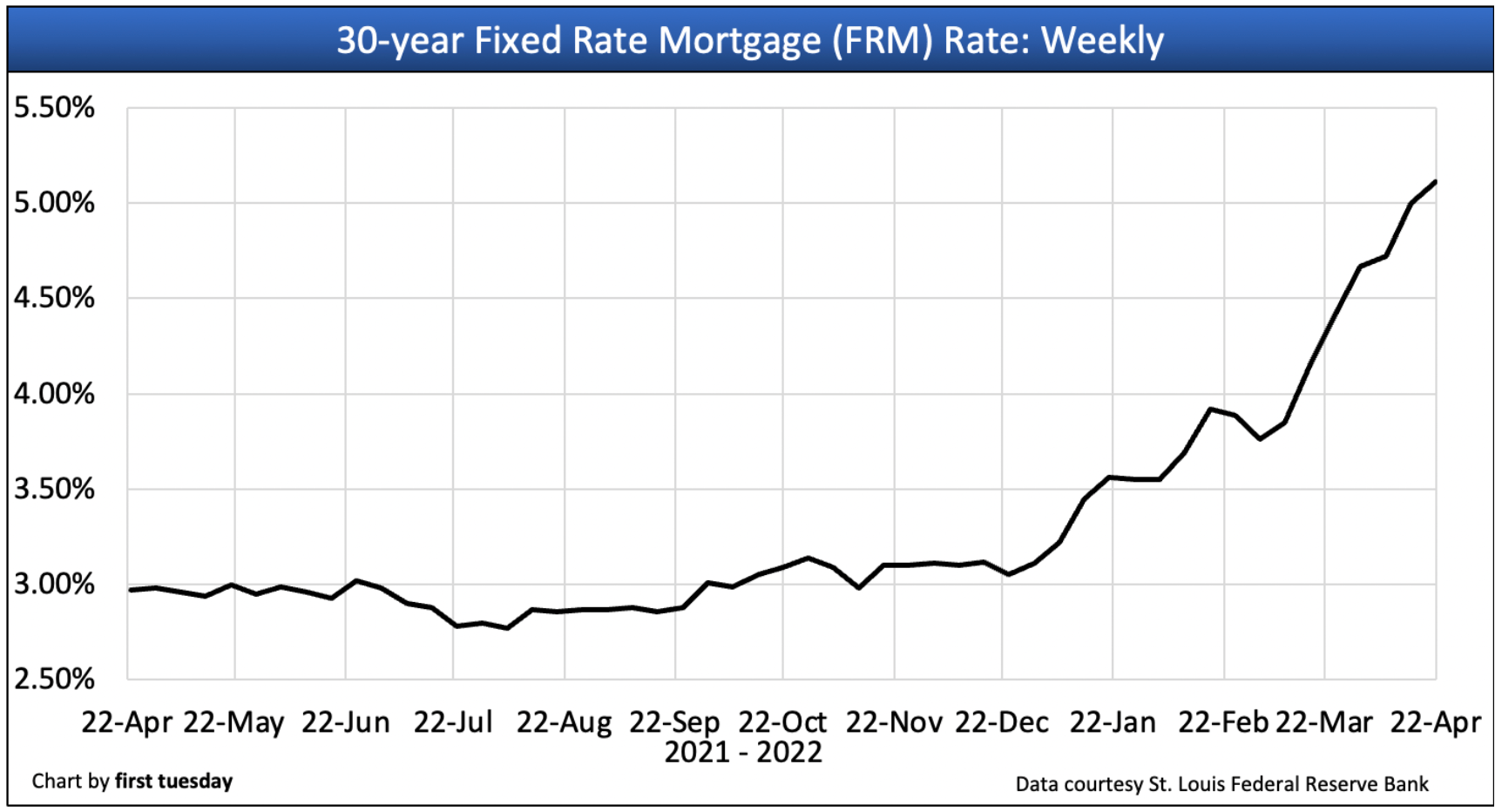

Despite the economy’s mixed signals, the Fed is sufficiently worried about an overheated economy to make a shift in its policy implementations, prioritizing its fight against high inflation over creating jobs. The impact on interest rates has been fast and extreme:

View all of firsttuesday’s current market rates charts.

This chart displays the average 30-year fixed rate mortgage (FRM) rate, which has increased over two percentage points in the past six months alone, now above 5.0%. This abrupt decrease in buyer purchasing power has slashed homebuyers’ budgets and forced many to quit the market altogether.

With the housing market already an impossible arena for buyers reliant on mortgage financing to compete, some question the Fed’s decision to increase rates in the first place — are their actions to cool down the economy too great, too fast?

The implications for the housing market are already emerging, as higher interest rates push out homebuyers and are expected to reduce home sales volume and prices in 2022.

But today’s Fed action will slow down the economy on a broader scale, too — perhaps just enough, or perhaps to the point of a recession.

Related article:

The double-dip recession is on the way

Typically, when the Fed begins to increase its benchmark interest rate, a recession is imminent. With the employment impacts of the 2020 recession still with us, firsttuesday expects this coming economic slowdown to constitute a double-dip recession.

But what other choice does the Fed have, given the Fed’s limited box of tools with which to fight inflation?

A congressional alternative to raising interest rates is to instead raise taxes on the wealthy. This reaches the Fed’s goal to reduce borrowing for major corporations, without constraining access to credit for mortgaged homebuyers. Although, bogged down by political polarization, this is unlikely to the extreme to ever happen, as noted by economist Paul Krugman.

Another way inflation may slow is by creating a more balanced supply-and-demand. 2021 saw supply chain disruptions and material shortages which drove up costs in the face of high consumer demand. The same is occurring in the housing market, with an inventory shortage which existed long before the 2020 recession, but has since only grown worse.

But given the Fed’s lack of options — and since they need to slowdown today’s overheated economy — a recession is likely in order.

Consider the shallow 1980 recession, which was followed up by a second, deeper recession in 1981-1982 when the Fed amped up its fight against inflation. The Fed is well aware 2022 is experiencing the highest levels of inflation since the early 1980s, and they need to counter it any way they can. This was officially the last instance of what is coined a double-dip recession, though another is on the way.

firsttuesday forecasts the second act to the 2020 recession will arrive in late-2023. For real estate, prices will begin to drop in late-2022, dragged down by today’s ruthless interest rate increases and slowing sales. However, today’s ongoing inventory shortage will cushion some of the blow for sellers, preventing a crash the likes of 2006-2009.

Still, now is not the time to buy. For investors, the next predictable buy phase will arrive around 2024-2025 once prices have bottomed, jobs have fully recovered, and home sales volume begins to pick up.

Real estate professionals: Want some advice on how your career will survive the next recession? Prepare now to ensure financial success during any slump.