San Francisco is a unique region in California’s housing landscape. Here, jobs and home values were recovered quickly following the 2008 recession due to the presence of the high-paying tech industry.

All the same, the high competition stemming from high prices and limited inventory have shut out many residents, causing a housing crisis for renters and homebuyers alike. Further, the region’s enviable jobs recovery from the 2008 recession did not shield San Francisco residents from the impacts of the 2020 recession, with job losses just regained at the end of 2022.

San Francisco’s infamously high home prices began to tumble in June 2022, the result of rising interest rates which immediately cut buyer purchasing power. Further, the remote work trend caused an increasing number of San Francisco residents to flee the metro area for less expensive, nearby suburbs, reducing homebuyer competition in the city. Absent Spring 2023’s tepid seasonal bounce, the housing market will begin a more consistent recovery in the years following the 2023-2024 recession here in San Francisco and across the state.

In the meantime, expect price declines to continue here until bottoming in 2025-2026. The exception will be high-tier homes, which are always the first to rise following a recession, expected to bottom in San Francisco by 2025.

View the charts below for current activity and forecasts for San Francisco’s housing market.

Updated August 15, 2023. Original copy posted March 2013.

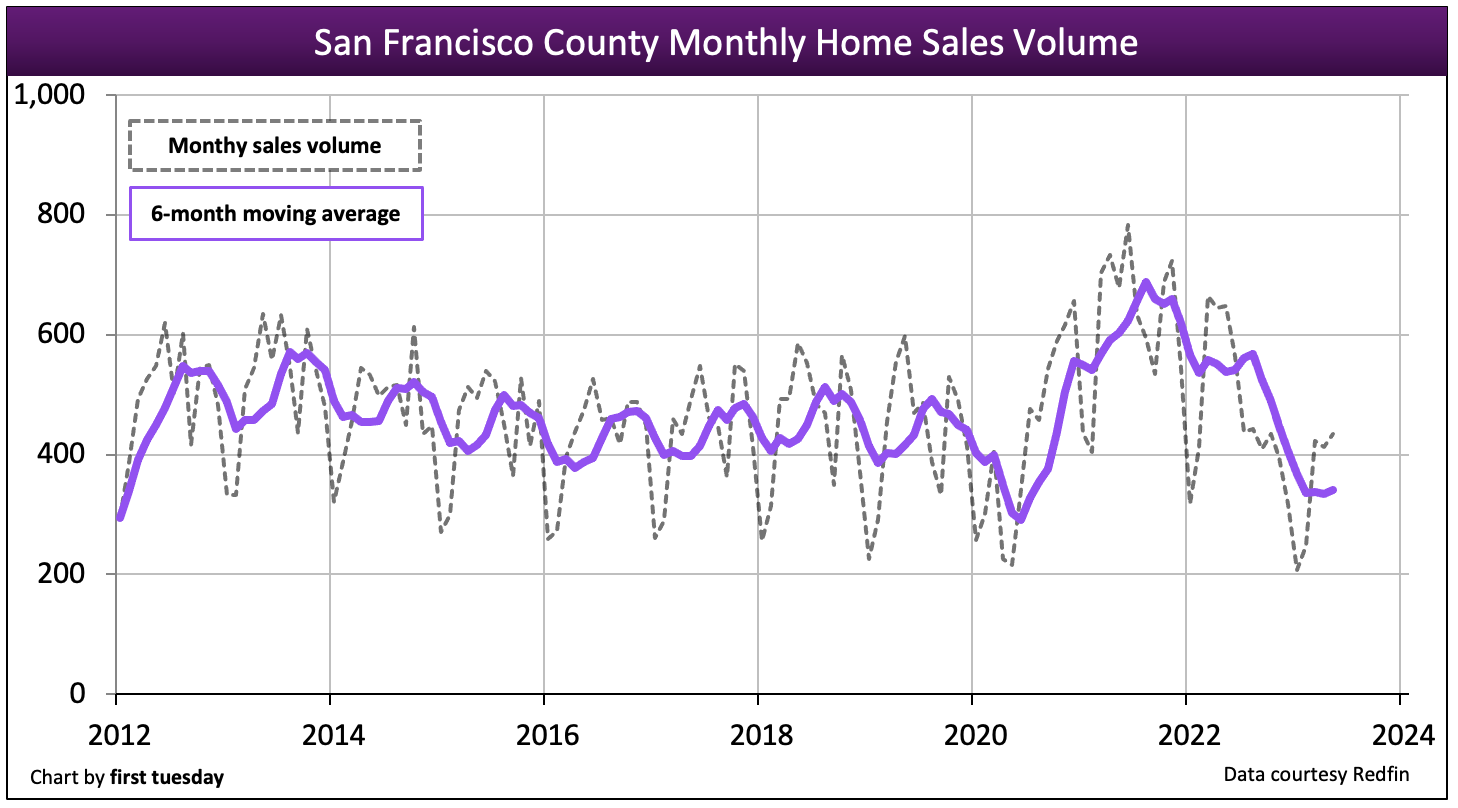

Volatile home sales volume

Chart update 08/15/23

| 2022 | 2021 | 2019 | 2004: Peak Year | |

| San Francisco County home sales volume | 5,700 | 7,500 | 5,200 | 8,100 |

Home sales volume in San Francisco County is volatile, but has tended to run a step ahead of the rest of the state in terms of trends. San Francisco home sales volume peaked in 2004 — a year before the statewide peak — before receding in 2005-2006. Home sales volume bumped along at a relatively level-to-down annual pace in 2012-2016, but fell significantly in 2017, a signal of the statewide downturn in sales taking place in 2018. But this decrease reversed course in 2018, with year-end totals increasing slightly, to level out in 2019.

In 2021, annual home sales volume was a volatile 47% above a year earlier. While this annual increase is steep, the rising trend quickly fell back, with 2022 home sales volume totaling 24% below a year earlier and 9% below 2019 (the last “normal” year for housing).

Worse, as of May 2023, home sales volume in San Francisco is a whopping 36% below a year earlier and 40% below 2019 — and falling.

San Francisco, with its heavy concentration of high-paying tech jobs and depressingly low housing inventory, is almost an economy unto itself. Decreased economic expectations and still-high home prices in the region caused homebuyer enthusiasm to wane sharply in 2022. As we make our way into the 2023 economic recession, look for home sales to fall back further.

Related article:

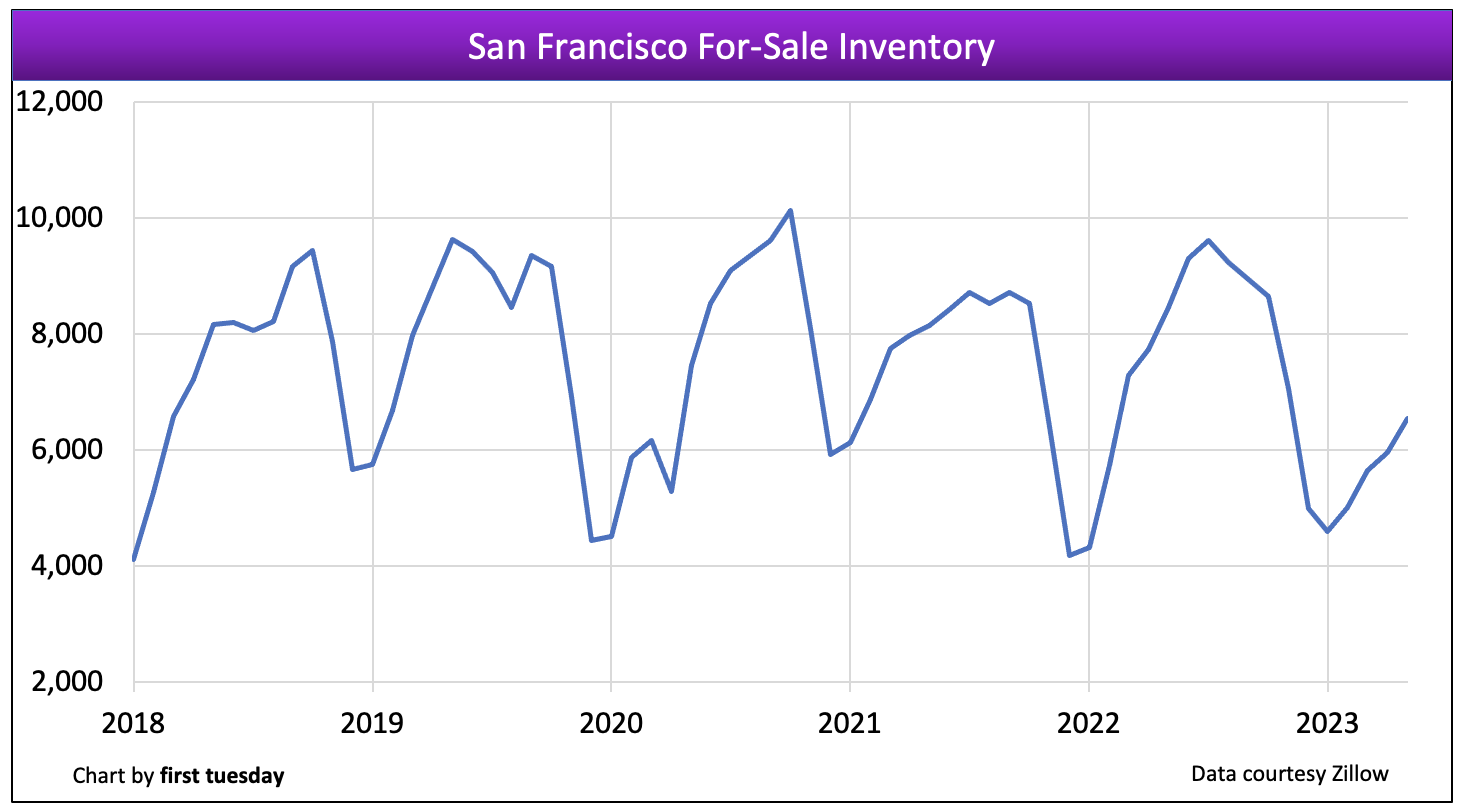

Inventory rises from historic lows

Chart update 08/15/23

| May 2023 | May 2022 | Annual change | |

| San Francisco County for-sale inventory | 6,600 | 8,500 | -23% |

Multiple listing service (MLS) inventory has increased just slightly from the historic low reached at the end of 2021. After two years of decline, for-sale inventory in San Francisco averaged 23% below a year earlier as of May 2023. This rise represents the reluctance of sellers to list due to a combination of higher interest rates and falling prices.

The winter months typically see the lowest inventory of homes for sale, peaking around mid-year.

Looking forward, expect inventory to continue to climb in 2023-2024. The significant interest rate increases of 2022 have slashed buyer purchasing power, making it nigh on impossible for mortgaged homebuyers to compete. Along with high inflation, the signs are pointing to a rapidly approaching downturn in the housing market — of which homebuyers and sellers are well aware. Today’s seller’s market has fully tipped, with prices to follow heading into 2023 as inventory grows and homebuyers choose to wait out the declining market.

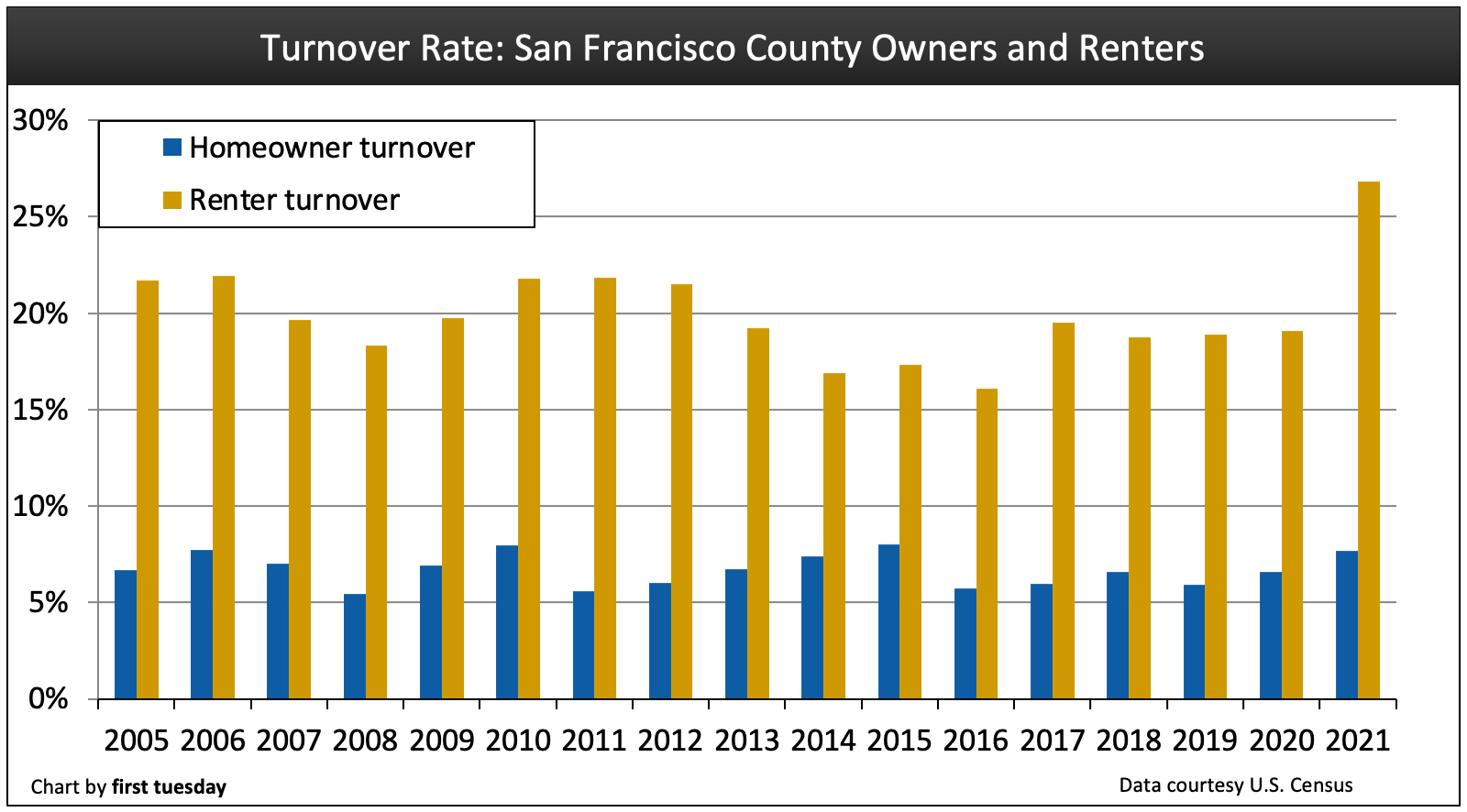

Turnover rates jump during pandemic

Chart update 11/09/22

| 2021 | 2020 | 2019 | |

| San Francisco County homeowner turnover rate | 7.7% | 6.6% | 5.9% |

San Francisco County renter turnover rate | 26.8% | 19.1% | 18.9% |

San Francisco’s renter turnover rate rose significantly in 2021 to nearly 27%, meaning over one-in-four San Francisco renter households moved in 2021 alone. The homeowner turnover rate (producing sales and relocating buyers) also jumped sharply in 2021 to 7.7%. This high turnover rate is reflected in the leap in sales volume also experienced in 2021.

Renter and homeowner turnover rates indicate both the willingness and corresponding ability of renters and homeowners to move. With the loss of jobs and income during the Financial Crisis and 2008 Great Recession, turnover rates in San Francisco fell. However, both renter and homeowner turnover rates recovered more quickly in San Francisco than elsewhere in the state due to the region’s swift jobs recovery and high concentration of employers.

Following the 2008 recession, renters in particular regained a higher level of mobility, as the young professional class inhabiting San Francisco is often more inclined to rent than own. However, the significantly high rents in San Francisco are now swiftly pushing renters out of the city and into the nearby counties of Alameda and Contra Costa. Those with rent-controlled apartments strive to stay put which kills turnover and new construction.

Looking forward, turnover rates will fall back in 2022-2023 in reaction to the brakes being rapidly placed on the economy heading into 2023. Already, prices and sales volume have plummeted in this region, which is hyper-sensitive to changes in the stock market.

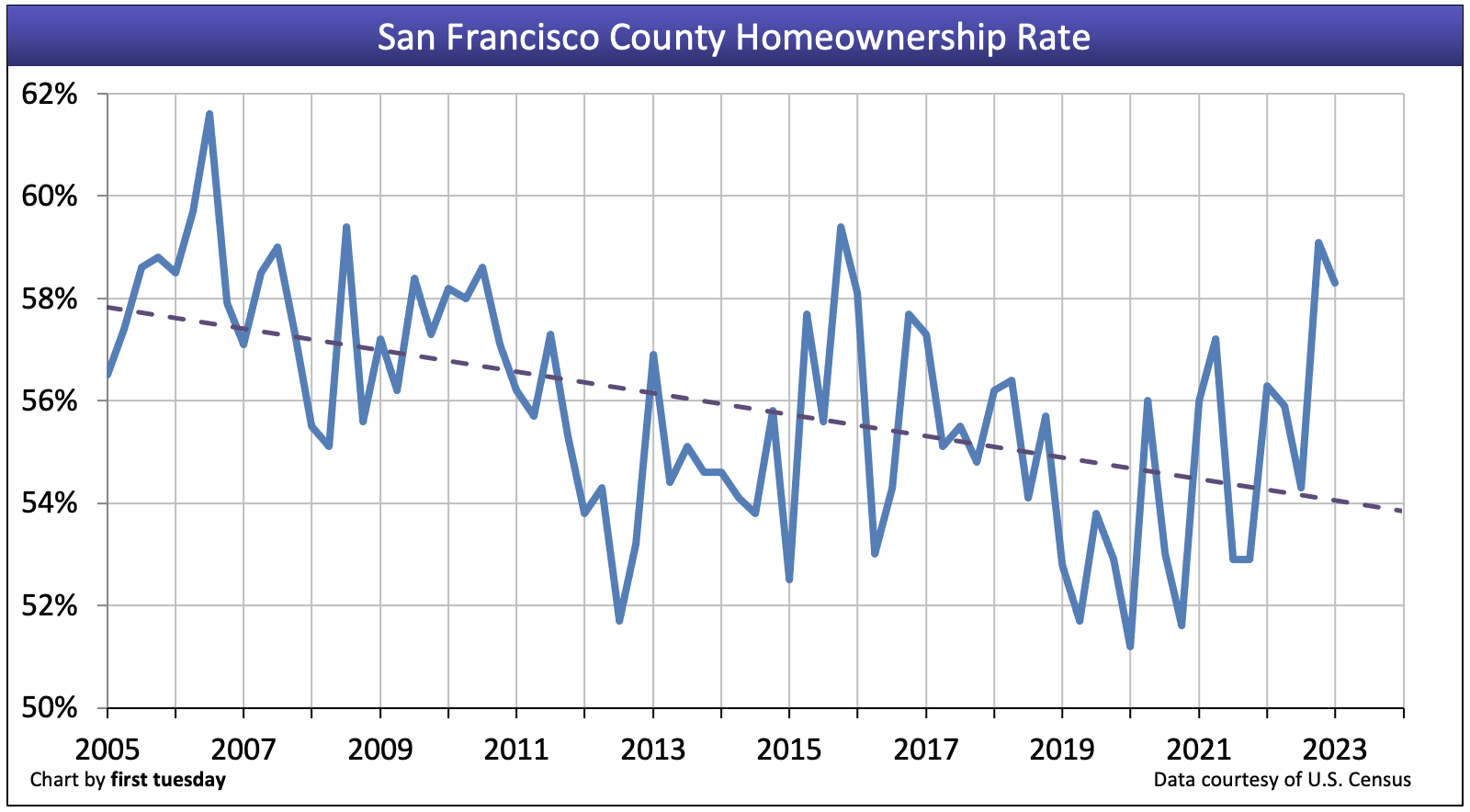

Homeownership trends up from bottom

Chart update 08/15/23

| Q1 2023 | Q4 2022 | Q1 2022 | |

| San Francisco County homeownership | 58.3% | 59.1% | 56.3% |

The homeownership rate in the Bay Area tends to vary more wildly than other parts of the state. However, the general trend from the end of the Millennium Boom until 2015 had been down. Since 2020, the homeownership rate in San Francisco has trended up, though it remains volatile from quarter-to-quarter. As of Q1 2023, the homeownership rate is 58.3%, above the statewide average of 55.3%.

Overall, the homeownership rate in San Francisco has not suffered quite as much as the rest of the state during this protracted recovery due to the job support delivered by its successful tech industry. All the same, due to the high cost of housing and the allure of city living, renting is often preferred in San Francisco.

Home prices’ seasonal reprieve

Chart update 08/15/23

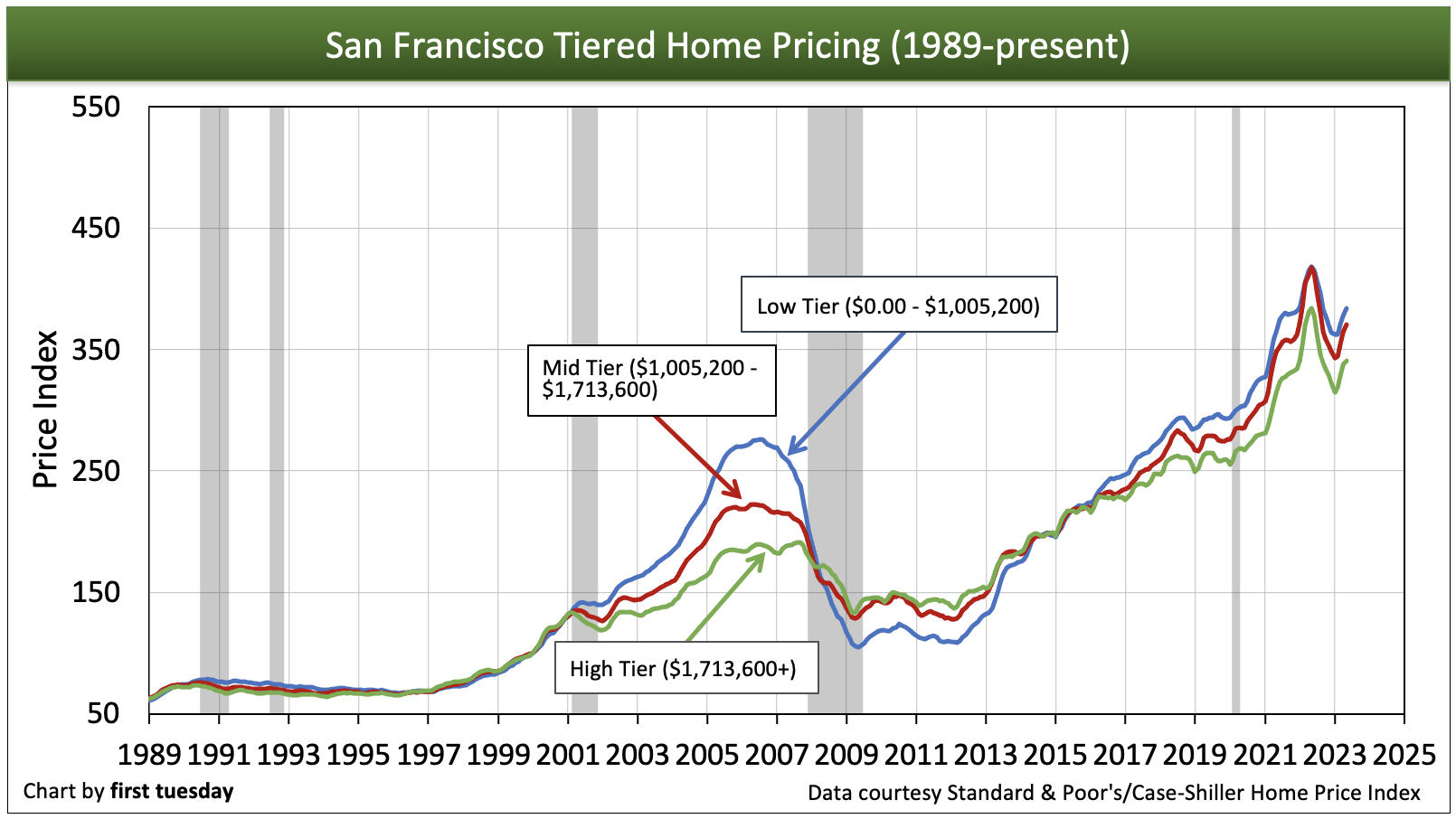

| Low-tier annual change | Mid-tier annual change | High-tier annual change | |

| San Francisco County home pricing index: May 2023 | -8% | -11% | -11% |

San Francisco home prices are characterized by rapid starts and stops, as viewed in the bumps in the chart above — particularly in the mid- and high-tiers. In contrast, pricing in Southern California markets tend to form a smoother line. San Francisco’s low supply situation is partly to blame, creating a volatile home sales market. The city’s preference for low-density zoning restricts builders from meeting the ever-increasing demand for local housing.

As of May 2023, low-tier prices are 8% lower than a year earlier, and mid- and high-tier prices are both 11% lower. While prices briefly bounced during Spring 2023 due to seasonal forces, this interrupts months of falling prices following May 2022’s price peak. However, as interest rates have jumped from historic lows and the economy is heading into the 2023 recession, home price reports are expected to show a downward spiral in the second half of 2023.

Accurate home price reports run about two months behind current events. Even when caught up, sticky prices tend to persist several months beyond the moment when home sales volume begins to slow.

In the coming months, higher interest rates and the dwindling economy will put additional pressure on home prices. Home prices will continue to trend down in 2024, the result of an economy caught in an as-yet undeclared recession. Watch for low- and mid-tier prices to hit bottom alongside the rest of the state near 2025. However, high-tier prices will recover sooner when the wealthiest jump back into the housing market here in San Francisco and in other coastal areas of the state, likely around 2025.

Related article:

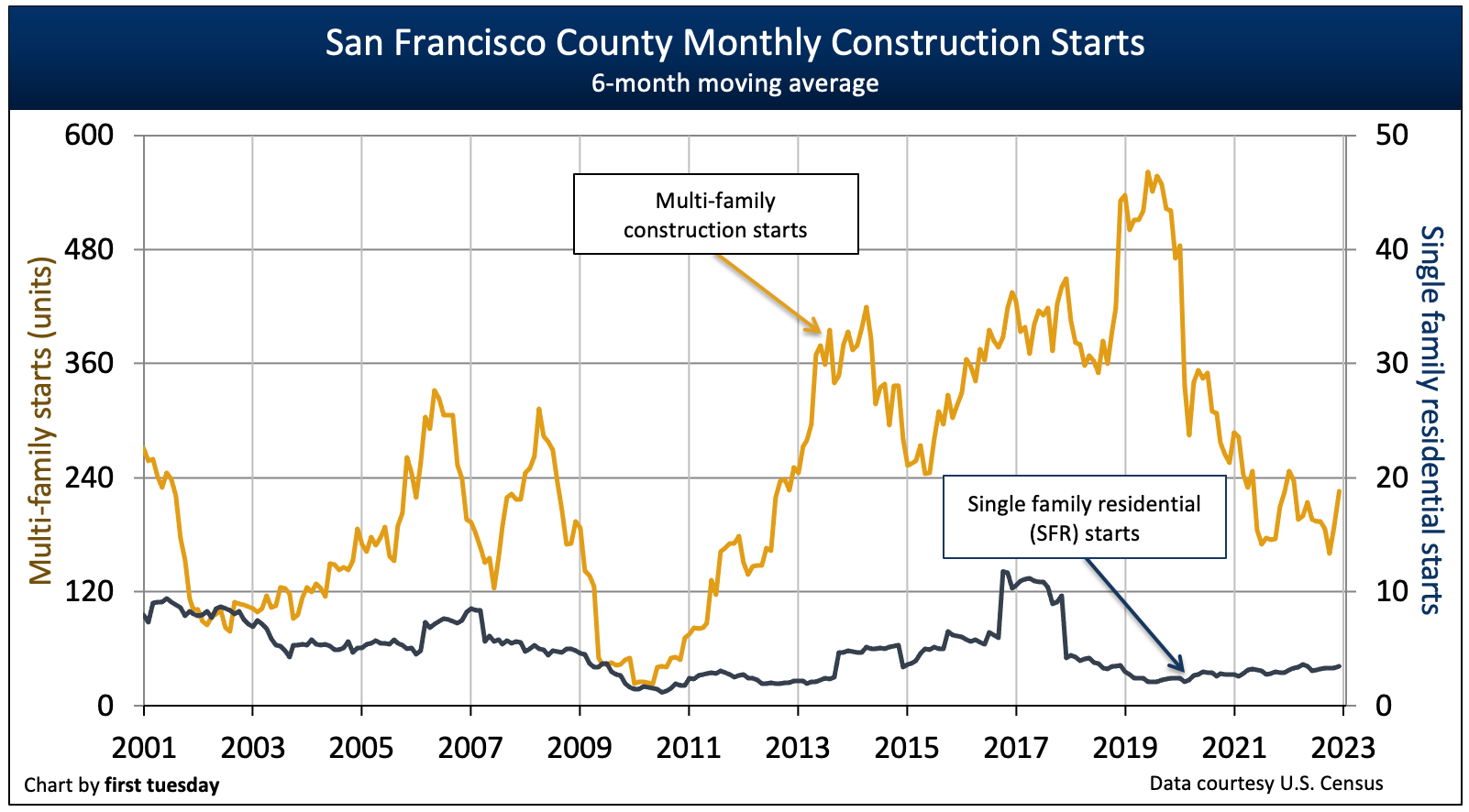

Multi-family construction gains

Chart update 02/16/23

| 2022 | 2021 | 2020 | |

| San Francisco County single family residential (SFR) starts | 37 | 33 | 26 |

San Francisco County multi-family starts | 1,700 | 2,500 | 2,900 |

Very few single family residences (SFRs) are built in San Francisco County each year, and this number has continued to remain irrelevant in recent years.

Multi-family construction starts, on the other hand, have swung wildly from year-to-year, though the general trend has been up since their bottom in 2010, hitting a wall and reversing course in 2020-2022. Multi-family construction continued to plunge in 2022, down 30% from the prior yer. The long approval and permitting process in San Francisco holds down construction starts of all types, though legislative changes have continued an attempt to loosen the process and make it easier for builders to meet demand.

As jobs continue to be centered in San Francisco, multi-family construction may feel the benefits. San Francisco’s high-paying tech industry draws a younger population (members of Gen Y and Gen Z), who are most likely to reside in multi-family structures close to the urban amenities San Francisco offers.

However, archaic zoning limiting building height and the density of units in each structure will impair multi-family starts, population mobility and job growth going forward while driving up rents and causing employers to consider other communities.

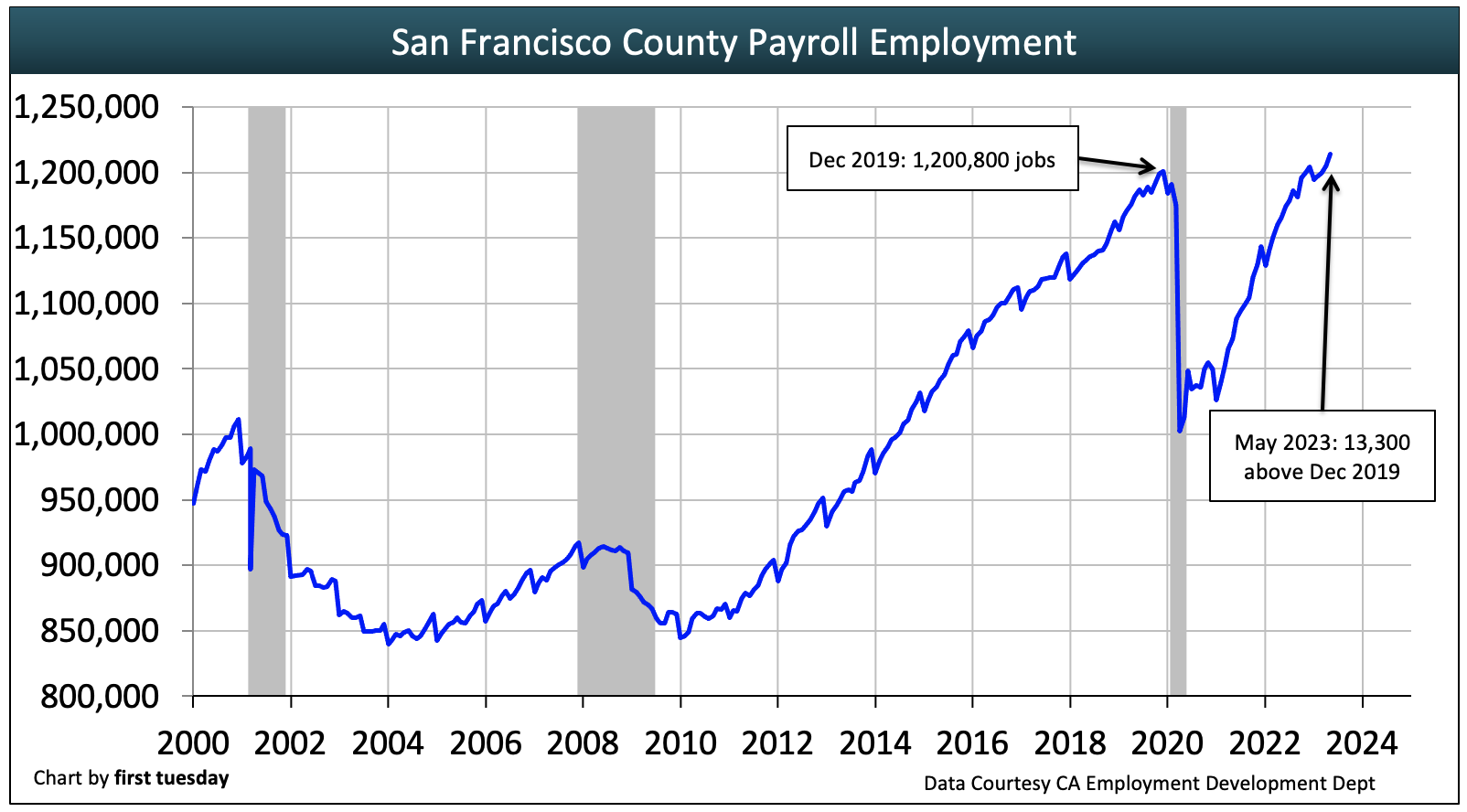

Jobs recover slowly from 2020 losses

Chart update 08/15/23

| May 2023 | May 2022 | annual change | |

| San Francisco County employment | 1,214,100 | 1,165,300 | +4.2% |

Unlike most of the state, San Francisco’s jobs market was well passed the point for recovery from the 2008 recession when the 2020 recession hit. Homeowners and renters require income (generally from employment) to make mortgage or rent payments. As a result, San Francisco’s housing market has grown more swiftly than the rest of the state due directly to its quick healing and expansion in the jobs market over the past decade.

Jobs have met and exceeded residents’ need for employment, even including San Francisco’s population increase of roughly 70,000 working-age individuals during the recovery from the 2008 Great Recession. By a statewide comparison, California just caught up to pre-recession levels in mid-2014, finally meeting the intervening population increase in 2019.

However, what was gained was quickly lost, and the jobs recovery from the 2020 recession lagged, with jobs finally exceeding pre-recession levels at the end of 2022. The economic response to COVID-19 on top of the underlying recession has caused record job losses across the state, and San Francisco is no exception. Expect to see additional job losses pull down prices in 2023-2024 as those who are jobless with a mortgage find their bills come due.

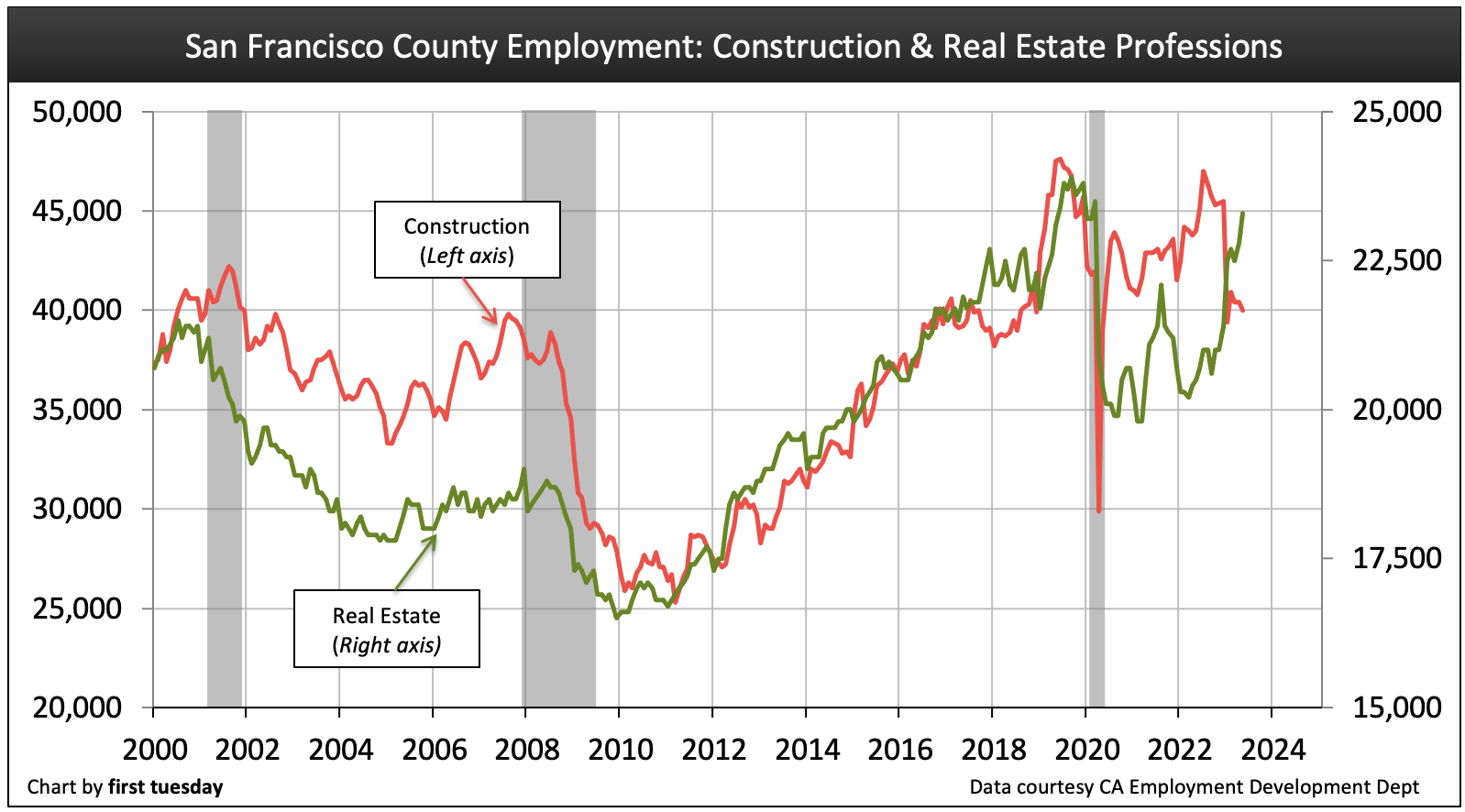

Jobs by real estate industry

Chart update 08/15/23

| May 2023 | May 2022 | Annual change | |

Construction | 45,500 | 41,500 | +9.6% |

Real Estate | 21,400 | 20,700 | +3.4% |

The number of people employed by each of San Francisco’s top employing industries has increased over the prior year. However, employment in the real estate industry remains well below pre-2020 levels and faces a prolonged recovery ahead. The construction industry also suffered greatly during 2020, the result of shelter-in-place orders that were often been more restrictive in the Bay Area compared to the rest of the state.

However, the dire need for more residential construction continues. Thus, residential construction will continue to see growth throughout this decade.

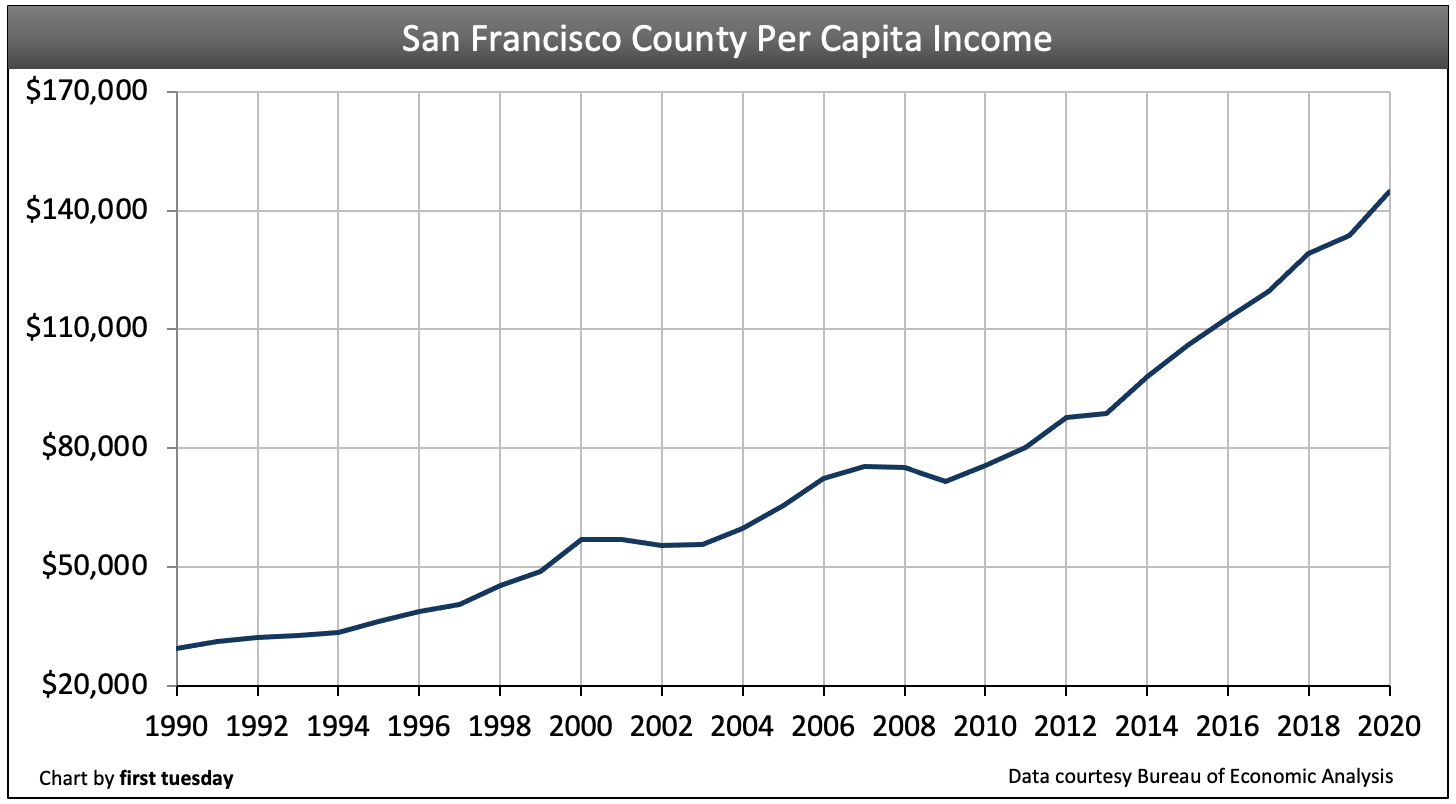

Per capita income has recovered

Chart update 05/10/22

| 2020 | 2019 | Annual change | |

| San Francisco County per capita income | $144,800 | $133,900 | +8.2% |

| California per capita income | $70,700 | $65,300 | +8.3% |

Per capita income in San Francisco is double that of California’s average income, having increased at a significantly quicker pace that most of California in recent years.

However, San Francisco residents spend on average a debilitating 41% of their income on housing expenses. Many more simply cannot afford to live in the city and are forced out to the suburbs, the only place where their paycheck qualifies them for housing.

If you’re looking for indications of where California’s housing market will be in two to three years, take a look at San Francisco County. Here, jobs and income have fully recovered. All the same, home sales volume remains stuck in its bumpy plateau — flat. Sales are likely to fall back due to to too-high home prices relative to incomes and an unstable global economy. For, even though incomes here are higher than virtually anywhere else in the state, rising incomes still don’t keep up with the cost of housing here in San Francisco.

These are some interesting statistics, thanks!

It’s interesting that there was no mention of overseas buyers of San Francisco real estate. ZIRP and the availability of mortgages are what have generated the current housing bubble, and inflation and an increase in interest rates are the only things that will collapse it. However, there may not be statistics to track such metrics, or the article may simply be being politically correct.

What are the total multifamily construction starts for 2020?

Interesting, not a word about foreign investors into the SF real estate market. Or perhaps there is no data to track such metrics or the article is just being pc. ZIRP and mortgage availability is what has caused the current housing bubble, inflation and a rise in interest rates are the only things that will pop it.

This is crap, why? Most of the sale price increases have not come from “real” buyers, just speculation. Speculation is very unhealthy and will lead to a sell-off. The recent massive of building projects, condos, will lead to a glut. Speculators are exiting, high paying jobs are starting to leave.

Has anyone done the math on how a median home income of 84,000 can be useful to buy a house in San Francisco? Or, how will these people come up with 267,000 down payment, let alone, qualify for a loan. The median household income is only good for paying up 450,000, not 1.2 million…How come the media ignores this?

I don’t think more than 1 percent of people under 45 can qualify for any kind of jumbo loan, who will buy the homes, where are the “real “buyers?

Get ready for the biggest property crash in American history. We are being lied to and manipulated

We already had the biggest property crash in American history. The next one will be different. The last one was a collapse in over-inflated entry level housing. The next one will see a crash in over inflated high end housing.