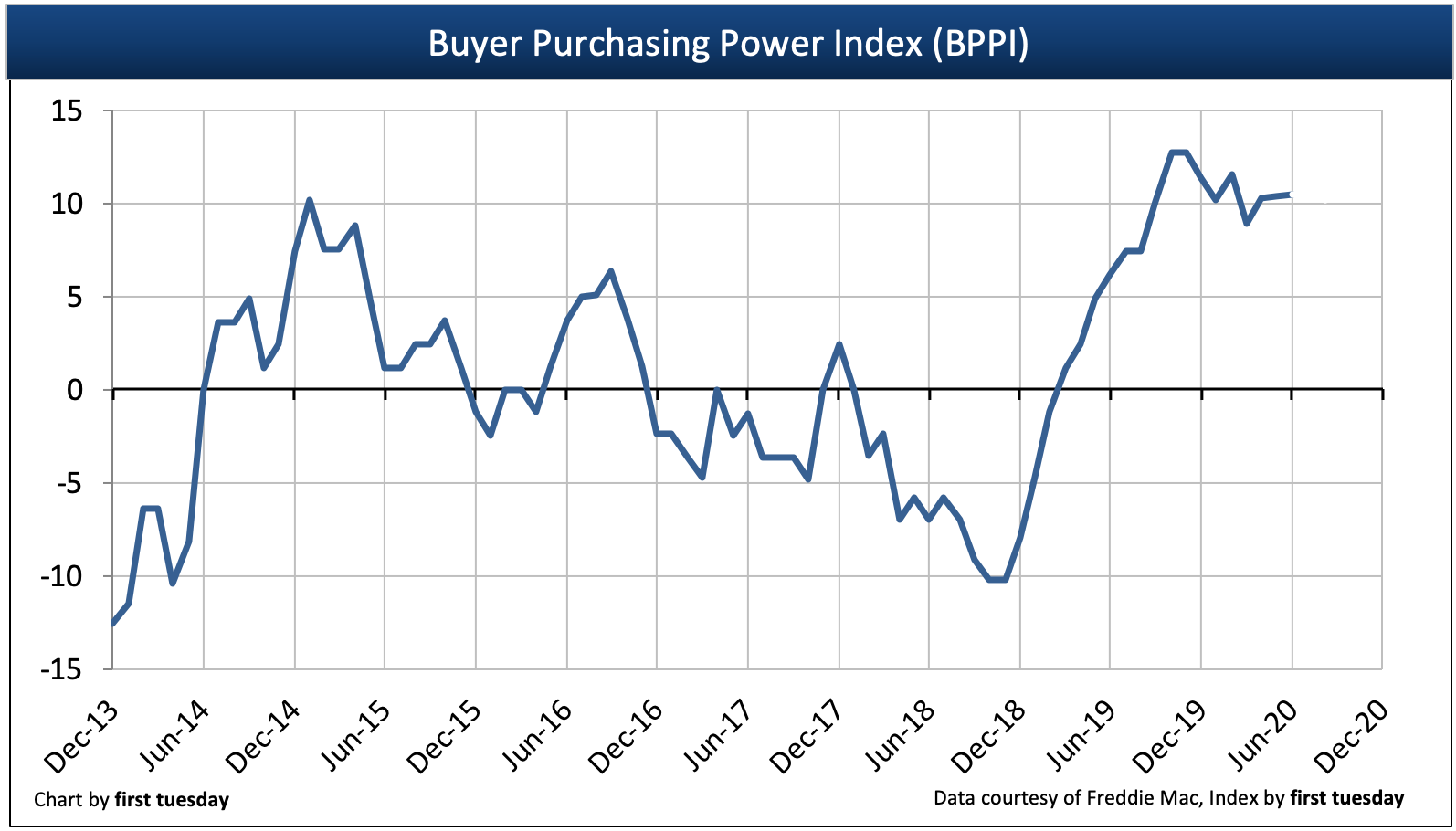

The California Buyer Purchasing Power Index (BPPI) figure was +10.5 in June 2020. This positive figure tells us a homebuyer with the same income is able to borrow 10.5% more today than a year ago. The BPPI figure has remained positive throughout 2019-2020 as a result of consistently lower mortgage interest rates.

Interest rates have descended to historic lows due to efforts to stimulate lending despite job losses and tightening access to credit. Beginning in Q1 2020, the Federal Reserve (the Fed) dropped their benchmark interest rate to zero and began purchasing mortgage-backed securities, fulfilling their role as the lender of last resort to ensure mortgage originations continue. As a result, interest rates will continue their gradual decline over the next several months.

first tuesday expects mortgage interest rates to remain at or below their present low level in the months ahead, causing the BPPI figure to remain positive in 2020 and the first part of 2021, eventually flattening out once interest rates find a bottom. As we make our way through the 2020 recession, home sales volume will continue to decline, with prices following.

While positive today, the long-term outlook for the BPPI is a decades’ long period of descent as mortgage rates rise when the economy starts to recover, likely to begin around 2022. Sellers can expect downward pressure on home prices in the coming years, first due to today’s decreased sales volume and then, when interest rates begin to rise, due to decreased buyer purchasing power.

Chart update 07/16/20

| Jun 2020 | May 2020 | Jun 2019 | |

| Buyer Purchasing Power Index (BPPI) | +10.5 | +10.4 | +6.2 |

About the BPPI

The Buyer Purchasing Power Index (BPPI) is calculated using the average 30-year fixed rate mortgage (FRM) rate from Freddie Mac (Western region) and the median income in California.

A positive index number means buyers can borrow more money this year than one year earlier.

A negative index figure translates to a reduced amount of mortgage funds available.

An index of zero means there was no year-over-year change in the amount a buyer can borrow with the same income. At a BPPI of zero, homebuyers cannot purchase at higher prices than one year before unless they resort to adjustable rate mortgages (ARMs) to extend their borrowing reach or greater down payment amounts.

As long-term BPPI trend declines, the capacity of buyers to borrow purchase-assist funds is reduced. In turn, buyers needing purchase-assist financing on average can only pay a lesser price for a home. To keep the inventory of homes for sale moving at the same pace, sellers will need to lower prices to accommodate buyer purchasing power or pull their properties off the market.

—

first tuesday journal online is a real estate news source. It provides analyses and forecasts for the California real estate market, and has done so since 1978.