Over the next three years, mortgage rates will:

- continue to rise (53%, 26 Votes)

- flatten out, neither rising or falling (27%, 13 Votes)

- decline gradually (20%, 10 Votes)

Total Voters: 49

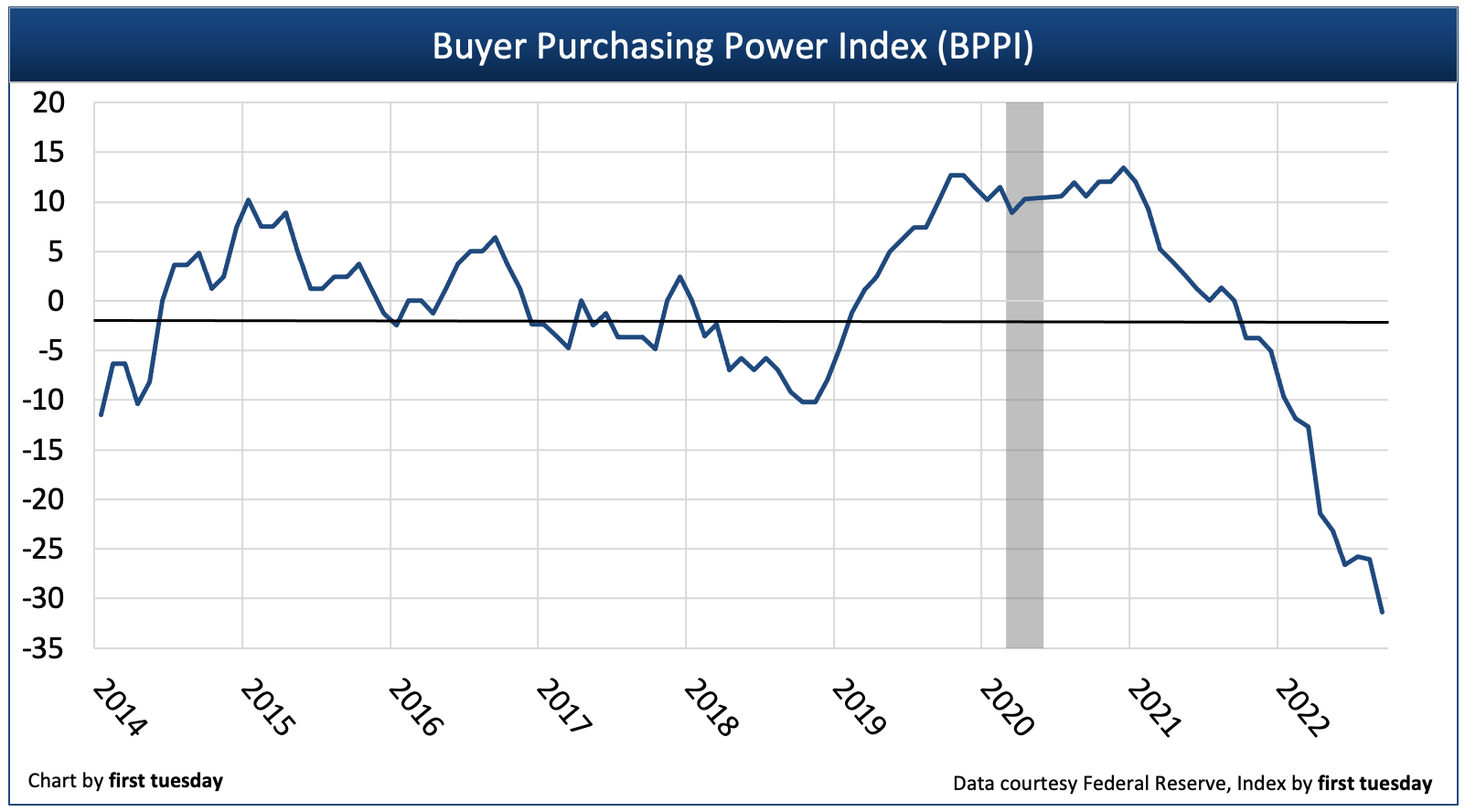

The California Buyer Purchasing Power Index (BPPI) figure tumbled to -31.3 in the third quarter (Q3) of 2022. This figure tells us a homebuyer with the same income is able to borrow 31.3% less purchase-assist mortgage money than a year ago when mortgage interest rates were still near historic lows.

Q3 2022’s basement level BPPI figure reflects a worsening situation for homebuyers reliant on mortgage financing, as the BPPI was positive during 2019-2021 due to consistently lower mortgage interest rates.

In the coming decade or two, the annual BPPI figure will generally remain negative due to continually rising interest rates, a turnaround in long-term interest rate movement which began in 2012. The impact to homebuyer mortgage funding has been devastating — and the inevitable shockwave to home prices arrived in Q3 2022, pushing prices to rapidly implode.

Chart update 10/06/22

| Q3 2022 | Q2 2022 | Q3 2021 | |

| Buyer Purchasing Power Index (BPPI) | -31.3 | -26.6 | 0.0 |

As the BPPI declines, so goes support for home prices.

In this decade’s rising mortgage interest rate environment, both the BPPI and homebuyer participation in the home sales market are adversely affected. Homebuyers qualify for a maximum mortgage amount based on their incomes and shifting interest rates. Thus, any rise in mortgage rates instantly cuts the amount they can borrow, and the price they pay for a home is reduced.

Here in California, home prices began to decline on a monthly basis in July 2022. As of August 2022, average California home prices are still 11%-to-16% higher than one year earlier. But this spread is narrowing rapidly, expected to turn negative by 2023. Without the support of falling interest rates, additional stimulus or income boosts, home prices will continue to fall back in 2023-2024.

2022’s rapid mortgage rate increases have already made their mark on home sales volume, as market momentum built up during the Pandemic Economy has frozen over. At the outset of the pandemic, interest rates descended to historic lows in 2020 due to efforts to stimulate lending despite job losses and tightening access to credit.

Beginning in Q1 2020, the Federal Reserve (the Fed) began purchasing mortgage-backed bonds (MBBs), fulfilling their role as lender of last resort to ensure mortgage originations continued.

In March 2022, the Fed finally bumped up its benchmark rate and announced the gradual sell-off of its MBB holdings. In anticipation of the Fed’s bond taper, investor activity began to push rates slightly higher in Q3 and Q4 2021, with a rate surge arriving in Q1 2022 — still going as we head into 2023.

firsttuesday expects mortgage interest rates to continue to increase slightly heading into 2023, causing the BPPI figure to remain deeply negative through Q2 2023. However, as the consumer inflation rate trends back toward 2% expect the 10-year treasury note and mortgage rates to edge downward in 2023, causing the BPPI to return toward zero by 2024.

Still, the long-term outlook for the BPPI is a decades’ long period of descent as mortgage rates continue to rise with the economic recovery, likely to gain strength around 2025. Thus, sellers can expect continued downward pressure on home prices.

Buckle up for 2022’s undeclared recession, which unofficially arrived in Q3 2022 following two quarters of negative gross domestic product (GDP). The housing market will see declining sales volume in 2022-2024, with prices bottoming around 2025.

Watch for a return of real estate speculators in 2025 to stop the price decline and provide a “dead cat” bounce during the coming slump, with a sustainable recovery taking off with the return of end user homebuyers around 2026-2027.

About the BPPI

The Buyer Purchasing Power Index (BPPI) is calculated using the average 30-year fixed rate mortgage (FRM) rate from Freddie Mac (Western region) and the median income in California.

A positive index number means buyers can borrow more money this year than one year earlier.

A negative index figure translates to a reduced amount of mortgage funds available.

An index of zero means there was no year-over-year change in the amount a buyer can borrow with the same income.

At a BPPI of zero, homebuyers cannot purchase at higher prices than one year before unless they resort to adjustable rate mortgages (ARMs) to extend their borrowing reach or greater down payment amounts.

As long-term BPPI trend declines, the capacity of buyers to borrow purchase-assist funds is reduced. In turn, buyers needing purchase-assist financing on average can only pay a lesser price for a home. To keep the inventory of homes for sale moving at the same pace, sellers will need to lower prices to accommodate buyer purchasing power or pull their properties off the market.

—

first tuesday journal online is a real estate news source. It provides analyses and forecasts for the California real estate market, and has done so since 1978.