The number of mortgage loan originators (MLOs) increased in each state during 2013, with California leading the way in the number of new MLO licensees. The National Mortgage Licensing System (NMLS) details the findings in their recently released 2013 Annual Mortgage Report. According to the report:

- the California Department of Business Oversight (DBO) licensed 18,550 MLOs by year’s end, growing 25% from 2012; and

- the California Bureau of Real Estate (CalBRE) licensed 19,296 MLOs by year’s end, growing 2% from 2012.

Nationally, the number of MLO licenses swelled by 28%. State-licensed MLOs tend to increase throughout the year and drop off at the start of each year, as MLO licenses (endorsements, in CalBRE parlance) must be renewed by year’s end.

Federally registered MLOs in California increased by 2.7% to 43,118 licensees. This is well above the nationwide average growth of 1%.

Editor’s note: While the number of individual MLO licenses rose across the nation, this report does not offer data on the number of individuals licensed or endorsed as MLOs. Multiple licenses issued don’t necessarily indicate more individuals in the game, as MLOs can hold multiple state MLO licenses.

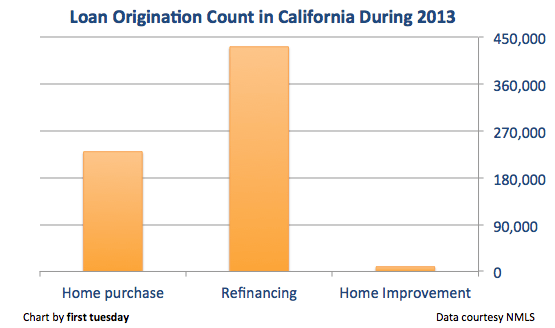

Both the number and total dollar amount of loans originated shrunk across the nation during 2013. This is due primarily to a sharp decline in refinancing, corresponding with the jump in mortgage rates mid-2013. Still, refinances continued to make up the bulk of transactions in 2013. This trend is not expected to continue in 2014. Further, the share of home purchases will rise with the decline in cash purchases experienced thus far in 2014.

| Home purchase | Refinancing | Home improvement | |

| Loan amount | $76,501,673,557 | $140,343,811,919 | $2,980,881,906 |

| Loan count | 230,272 | 432,004 | 9,151 |

An average of 23 loans were originated per licensed MLO in California during 2013. This is the second highest in the nation, right behind 24 loans per MLO in Texas.

2014’s MLO report is likely to show more modest growth in the number of MLOs. This is due to the double obstacle of stubbornly high:

- mortgage rates, which discourage both refinancing and home purchases; and

- home prices, a major deterrent to homebuyers.