This Market Chart presents a comprehensive overview of homebuyer purchasing power vacillation during the last two decades of declining rates, and predicts future trends as mortgage rates rise over the next decades.

Purchasing power, measured by funds available based on the mortgage interest rate of 30-year fixed rate mortgages (FRM), has risen over 10% this year, making this an excellent time to buy a home since more funds can be borrowed for the purchase of an upgraded home based on the same income.

Chart updated 8/1/12

| July 2012 | June 2012 | July 2011 | |

| % Change in Funds Available | 10.94% | 10.42% | 1.96% |

Chart updated 8/1/12

| July 2012 | June 2012 | July 2011 | |

| Average 30-yr. FRM Rate | 3.55% | 3.68% | 4.55% |

Data courtesy of Freddie Mac and Standard & Poors

The perfect home requires perfect timing

Your client’s ability to buy a home depends on more than just the amount of money they possess. Instead, the factors homebuyers can control, such as credit score and down payment size, are balanced by factors beyond the control of any homebuyer, including current mortgage rates offered by local lenders. Collectively, these factors determine a buyer’s ability to buy a home, which we will refer to as his purchasing power.

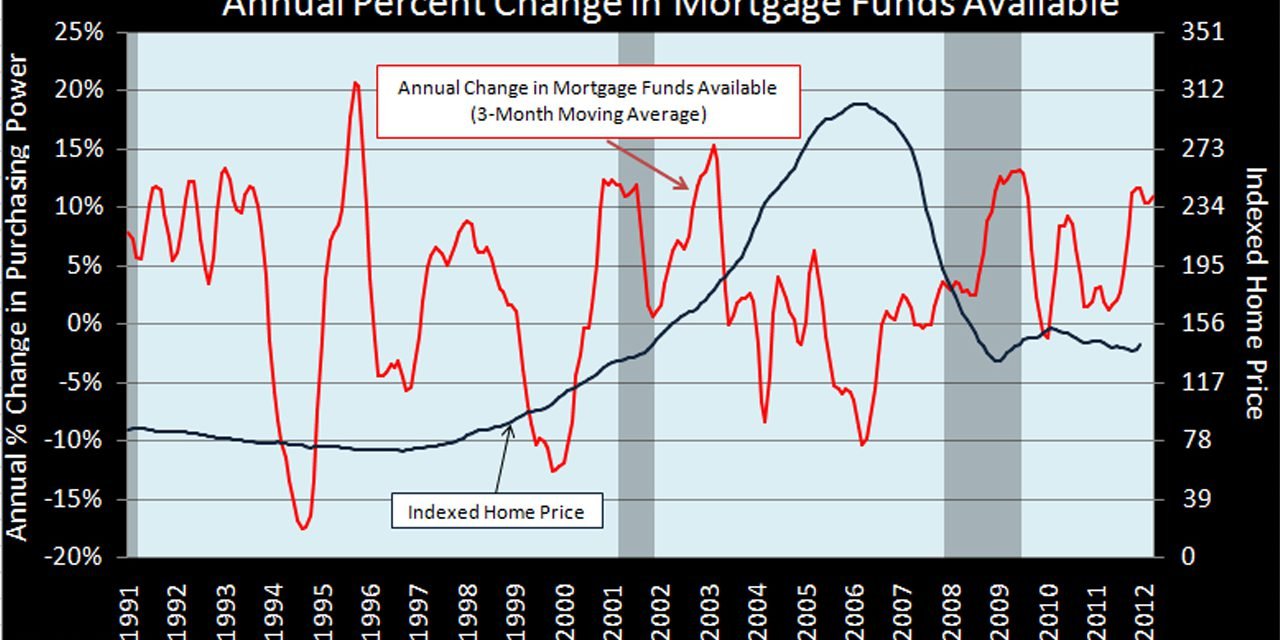

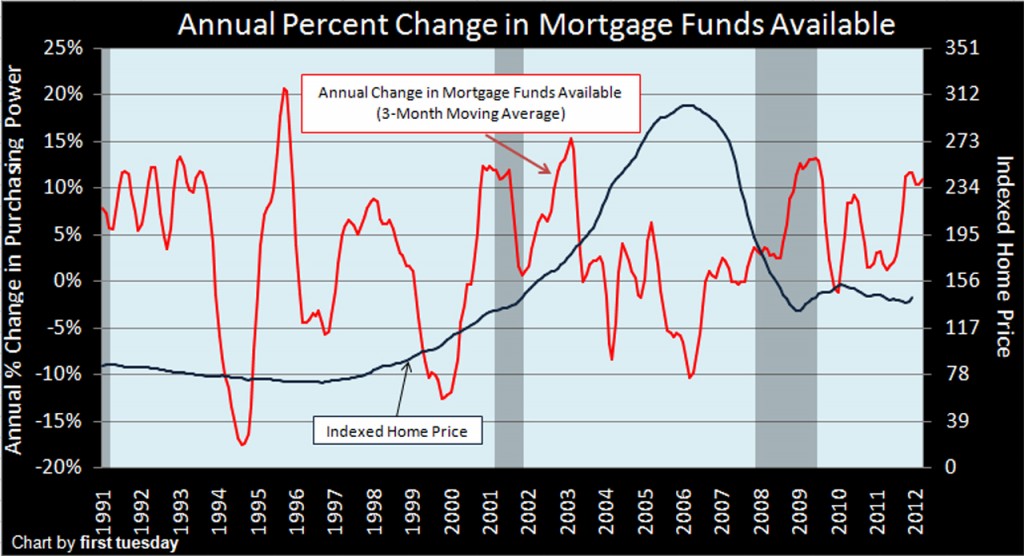

Every year sees shifts in homebuyer purchasing power, the percentage increase or decrease in maximum mortgage money available to a homebuyer from one year earlier. Displayed on Chart 1, these shifts in mortgage amounts are based on mortgage rates and lending standards from month to month, covering the past 20 years.

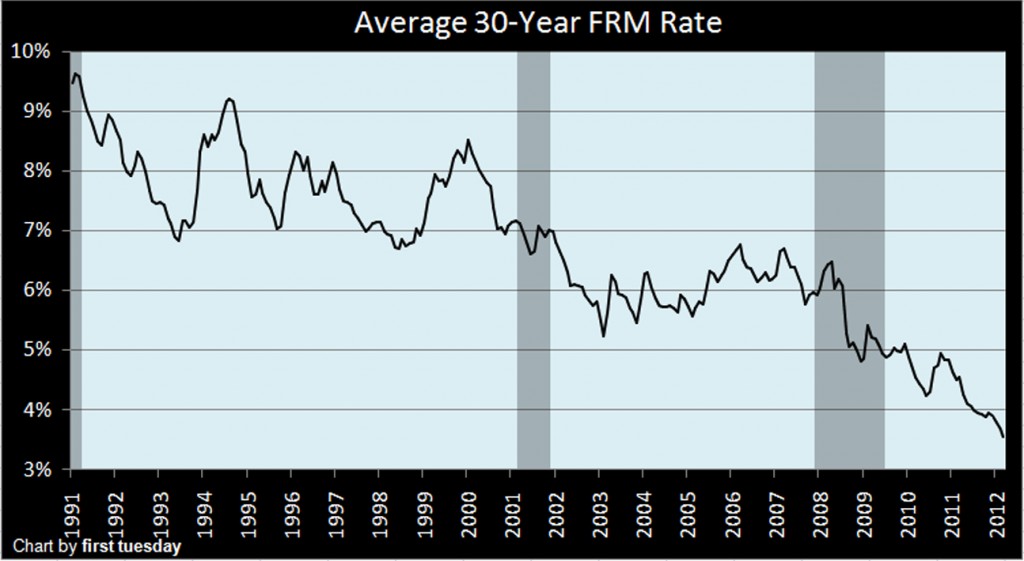

The lower the interest rate on a 30-year fixed-rate mortgage (FRM), the more of the homebuyer’s maximum qualifying payment (31% of gross income) is allocated to principal. Until that lower interest rate is countered by a rise in home pricing, it permits the homebuyer to acquire a higher quality property than he would have qualified to buy at a higher interest rate, say, one year earlier.

For instance, a homebuyer with a gross monthly income of $5,074 (the median household income of Californians in 2011) will have $1,572 available monthly for payments of principal and interest (PI) on the loan. Lenders accept 31% of gross monthly income when determining maximum PI payments the homebuyer can reasonably pay.

By application of a pre-selected loan-to-income multiplier (based on a current mortgage rate of 3.9%), we can determine that the total loan amount available for this homebuyer in December of 2011 was $333,463. Together with a 20% down payment, this homebuyer should be able to purchase a home at a price of up to $416,800. A smaller down payment requires payment of mortgage default insurance premiums, which will lessen the loan amount and thus prevent purchase of a high-priced home.

In contrast, a homebuyer with equivalent income who purchased a home one year earlier in December of 2010, when mortgage rates were at 4.7% instead of 3.9%, was eligible for a loan of only $303,263: a 9% reduction in homebuyer purchasing power from one year later. When purchasing power is on the rise and home prices are dropping or remaining constant, as was the case in 2011 and early 2012, homebuyers are able to obtain larger loans, and acquire more valuable homes.

Related articles:

Purchasing power through the years

February of 2012 featured a 3.9% rate on 30-year FRMs, the lowest on record, setting the upper bar on historical homebuyer purchasing power. Meanwhile, the venerable Case-Shiller home pricing index indicated that average pricing in California’s three major cities (San Diego, Los Angeles and San Francisco) remained near their lowest levels in over a decade.

In early 2012, the likely midpoint of what has been referred to as an ongoing Lesser Depression, homebuyers are better positioned than ever to purchase the property they desire. Any further slip in home prices or interest rates (which are both at historic lows) will lead to a still greater increase in purchasing power.

This moment stands in contrast to the historical low of buyer purchasing power in the early 1980s. At that time, a homebuyer with an equivalent income (adjusted for inflation) would have been able to obtain a loan — and therefore, a home — of only half the value available to a homebuyer at today’s rates. This was the fate suffered by much of the Baby Boomer generation in the 1980s.

Mortgage rates increase in part due to demand for mortgage financing, the same factor which leads to increases in home pricing. As Chart 1 demonstrates, the amount of purchase money available tends to fluctuate in an inverse relationship to home prices. When home prices experience a prolonged rise, mortgage rates tend to go up as well, creating a two-fold decrease in purchasing power. On the other hand, rates tend to drop when home prices are low, as monetary policy encourages reluctant homebuyers to take out mortgages.

In upcoming years, as employment increases and home sales volume begins to recover, both prices and FRM rates are expected to rise. This was the case in the mid-2000s, when both 30-year FRM rates and housing prices peaked simultaneously in late 2005 and early 2006.

first tuesday predicts rates will remain near their present lows going into 2014, before rising slowly as jobs, construction and consumer prices stabilize and begin to test the limits of Fed-permitted inflation. The rise in all interest rates is expected to be still more dramatic in 2018-2020, as the economy enters its next boom. On the other hand, too sharp an increase in prices will risk provoking a mild recession in the early 2020s at the hands of our central bankers.

Related articles:

California tiered home pricing

Dependence on consumer sentiment

As Chart 1 demonstrates, it is now a rare opportunity for homebuyers to purchase and finance a home, if they have the income, accumulated savings and career stability necessary to do so.

The latest consumer confidence figures indicate that potential homebuyers are aware of the excellent homebuying conditions. The survey of consumer sentiment conducted by the University of Michigan indicates the majority of potential homebuyers continue to believe today is an excellent time to buy a home.

Already, those with cash on hand have been quick to take advantage of the dynamite combination of low property prices and low mortgage rates. These buyers have consisted primarily of speculators, investing with confidence that prices will soon rise dramatically.

Moreover, according to the same Michigan survey, the population’s perception of its own financial condition has shown signs of improving, meaning that many potential buyers may soon feel fiscally ready to take advantage of these opportune times. After all, one should never let a crisis to go to waste.

Employment, the first prerequisite for financial stability, has improved gradually since 2010. first tuesday expects a further dramatic improvement in employment to take place from 2013-2016, a repetition of the mid-1990s for California. With jobs, homebuyers will become able to acquire properties—at least until mortgage rates and prices rise, and reduce purchasing power once again.

Related articles:

Homebuyers feel ready and willing to buy, but not financially able