This form is used by a leasing agent or landlord as an addendum when the landlord negotiating a commercial lease wants flexibility for meeting lender demands for mortgage financing, to add provisions in an addendum to the lease agreement for an existing mortgage lender’s future subordination to the lease, lender attornment rights to the lease on foreclosure and the landlord’s refinancing of the property.

Commercial lease agreement

A lease agreement conveying possession to real estate for a period exceeding one year is only enforceable when evidenced in a written document signed by the landlord and the tenant — a statute of frauds requirement. [CC §1624(a)(3)]

In an analysis, provisions in a lease agreement are separated into three categories of landlord and tenant activities:

- conveyance of the leasehold interest;

- money obligations of the tenant for payment of rent and property operating expenses; and

- responsibility of the tenant and the landlord for care and maintenance of the property. [See RPI Form 552]

Further, commercial lease agreements exist in many variations. The landlord and tenant choose one based on:

- whether the property is for single or multi-tenant use;

- the type of tenancy conveyed; and

- who is responsible for maintenance.

Realty Publications, Inc. (RPI) publishes and maintains gross and net lease agreements tailored to common variations in commercial rental and lease agreements, including:

- Single Tenant Gross Lease [See RPI Form 552];

- Multi-Tenant Gross Lease [See RPI Form 552-1];

- Single Tenant Net Lease [See RPI Form 552-2];

- Multi-Tenant Net Lease [See RPI Form 552-3];

- Percentage Lease [See RPI Form 552-4]; and

- Month-to-Month Tenancy. [See RPI Form 552-5]

A landlord and tenant may further customize and modify their lease agreements with different addenda, such as:

- Maintenance Modification Addendum [See RPI Form 552-6];

- Alienation Addendum [See RPI Form 552-7]; and

- Subordination Addendum. [See RPI Form 552-8]

To be enforceable, a lease agreement:

- identifies the location of the leased premises with reasonable certainty;

- sets forth the term of the tenancy conveyed; and

- states the rental amount and other sums due, and the time, place and manner of payment. [Levin Saroff (1921) 54 CA 285]

Overview of the commercial lease addenda

Addenda are used to modify, clarify or add terms to an existing boilerplate lease agreement form.

Landlords and property managers have multiple options available to modify a commercial lease agreement, including:

- use a pre-printed form tailored to the specific purpose requiring the addendum [See RPI Form 552-6, 552-7 and 552-8]; or

- use a generic addendum form to enter terms when a boilerplate addendum does not contain those terms. [See RPI Form 550-1]

The boilerplate addenda used with a commercial lease agreement include:

- Maintenance Modification, which allocates the responsibilities and expenses for maintenance of the leased property between the landlord and tenant when they differ from the terms set out in the boilerplate lease agreement. [See RPI Form 552-6];

- Alienation of Leasehold, which requires the landlord’s consent for the tenant to assign, sublet or further encumber their leasehold interest in the property [See RPI Form 552-7]; and

- Lender Subordination and Attornment Provisions, which repositions the priority of the tenant’s leasehold rights as junior or senior to a mortgage encumbering the property and requires the tenant to recognize the lender or buyer in a foreclosure of a mortgage on the landlord’s fee interest as the new landlord. [See RPI Form 552-8]

Analyzing the lender subordination and attornment provisions

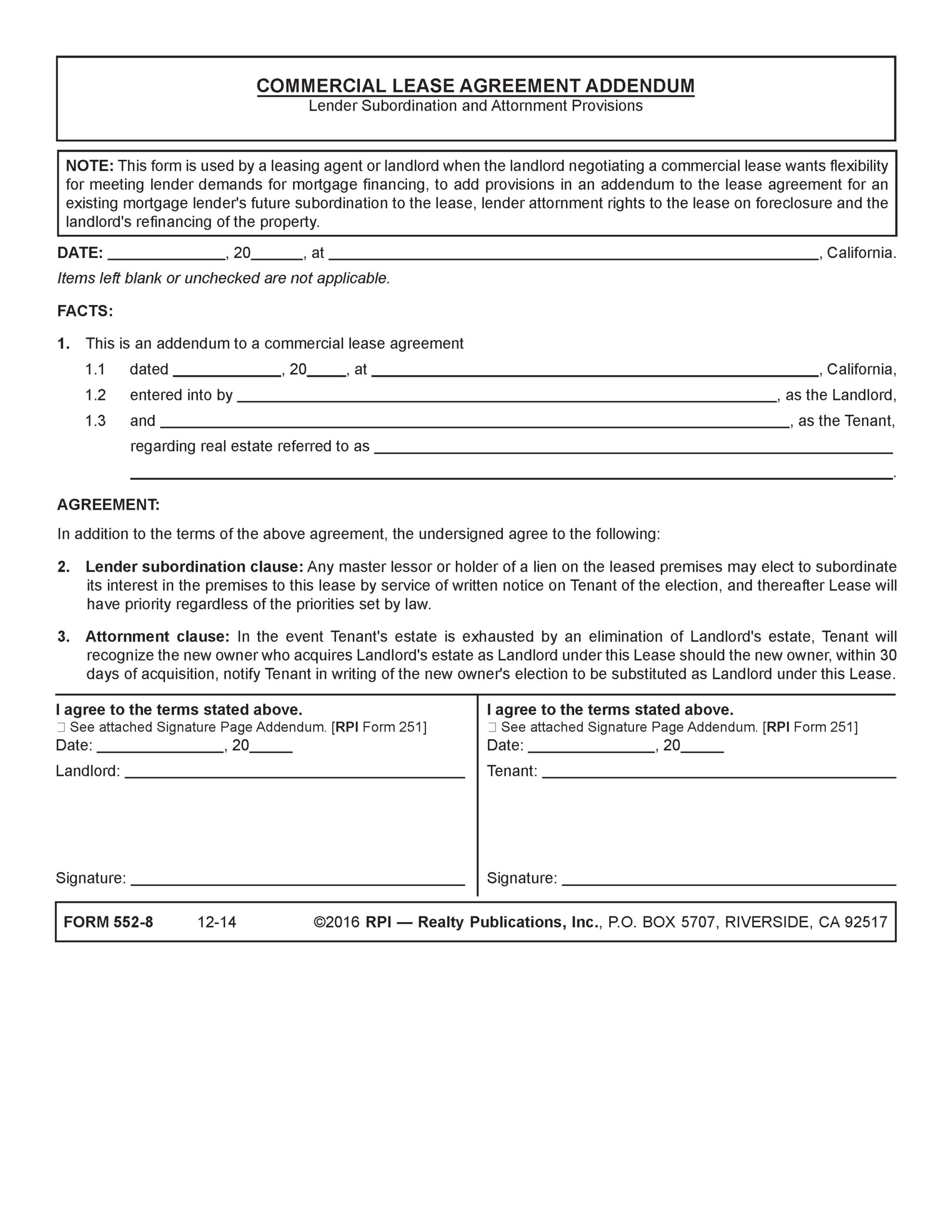

A landlord or property manager uses the Commercial Lease Agreement Addendum — Lender Subordination and Attornment Provisions published by RPI when the landlord negotiating a commercial lease agreement wants flexibility for meeting lender demands for mortgage financing. The addendum adds provisions to the lease agreement for an existing mortgage lender’s future subordination to the lease, lender attornment rights to the lease on foreclosure and the landlord’s refinancing of the property. [See RPI Form 552-8]

The Commercial Lease Agreement Addendum — Lender Subordination and Attornment Provisions contain:

- Facts: the date of the commercial lease agreement, the landlord’s and tenant’s names, and the real estate involved [See RPI Form 552-8 §1];

- Agreement:

- Lender subordination clause: A lienholder of the commercial property may choose to make their interest junior to the tenant’s and give the commercial lease agreement priority by service of written notice on the tenant —otherwise, the lienholder has priority [See RPI Form 552-8 §2];

- Attornment clause: In the event of a foreclosure, the tenant will recognize the foreclosure buyer as the new landlord when the foreclosure buyer notifies the tenant in writing of the buyer becoming the landlord within 30 days of acquisition [See RPI Form 552-8 §3]; and

- Signatures: the landlord and tenant sign and date the form. The addendum is then attached to the commercial lease agreement.

Form navigation page published 12-2025. Updated 01-2026.

Form updated 2016.

Form-of-the-Week: Commercial lease agreement addenda — Forms 552-6, 552-7 and 552-8

Article: SoCal’s commercial property market struggles to find tenants — Q2 2025

Article: Surrender cancels the lease agreement

FARM: Introduction letter from a commercial property management company to a commercial property landlord

FARM: Commercial tenant relocation

Page: Property Management 101

Video: Rental Market Influences