Leasing agents use commercial lease agreements in transactions involving industrial, retail, office and other types of commercial income-producing property. The forms are prepared by the leasing agents to document the rent and maintenance arrangements negotiated between the owner and the tenant.

Several variations of the commercial lease exist:

- gross to net rent paid to the owner, distinguished by who is responsible for the payment of operating costs and maintenance;

- rent adjustment provisions, to keep rent consistent with prevailing market rents; and

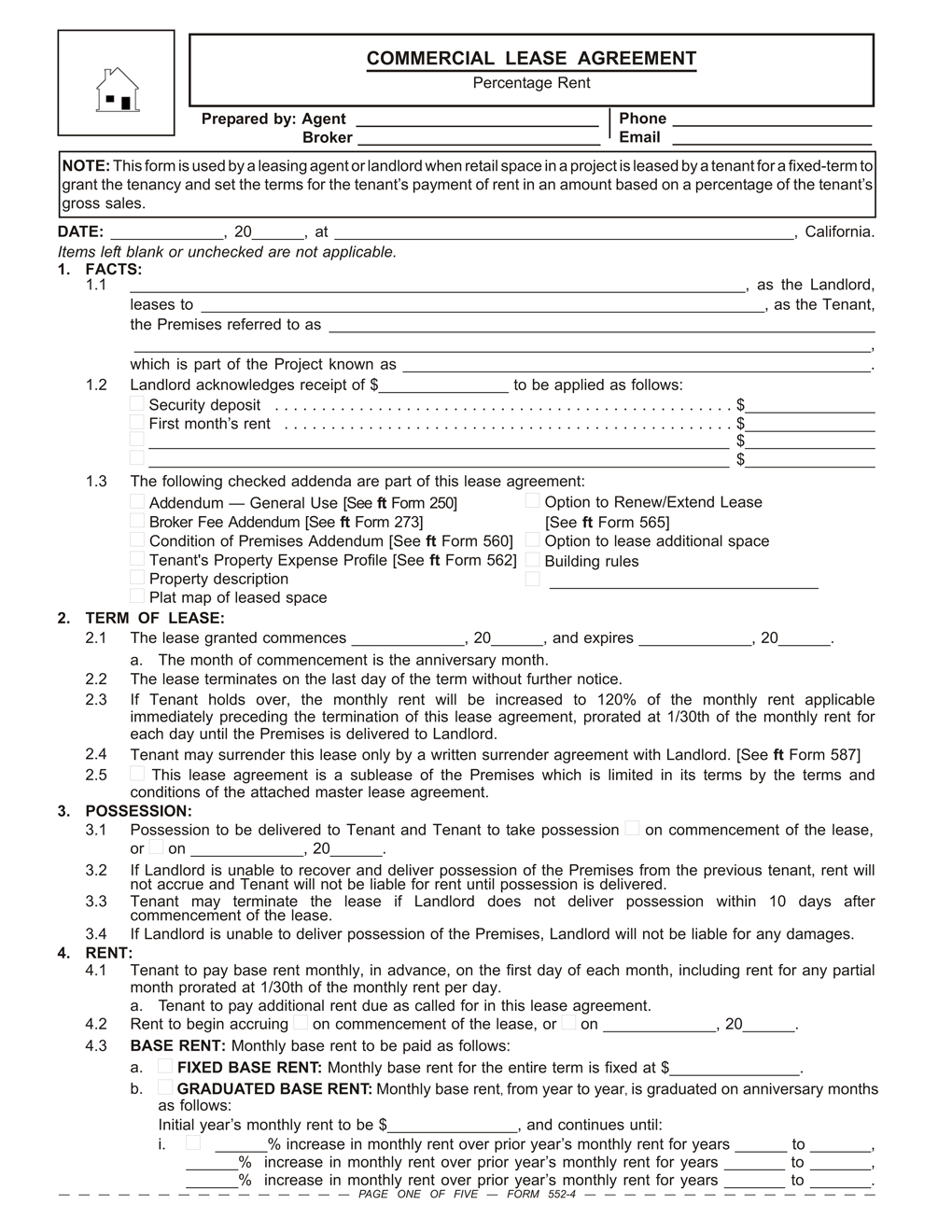

- percentage rent provisions for high traffic profitable retail locations. [See RPI Form 552 – 552-4]

Financial goals of commercial landlords

Rent received by the owner from leased space is income on the capital invested in the real estate. Conceptually, rent is economically similar to a lender’s receipt of interest for the use of money loaned. In both scenarios, the property and the money lent are both returned at a future time.

Like interest rate provisions in a note, rent provisions in a commercial lease agreement are structured to anticipate future market changes that affect the investment (value, income, expenses and mortgages).

Fixed-rent leases do not anticipate future changes in the investment’s fundamentals. However, variable- or adjustable-rent leases do anticipate market changes. Properly structured, variable- or adjustable-rent leases shift increased costs to the tenant and positive demographic influences to the owner by way of a related increase in rent.

To accomplish this feat, the owner selects rent and use-maintenance provisions for a lease agreement that will deliver the maximum net operating income (NOI) through the life of the lease. In the course of negotiations, the owner wants to captures the future benefits of the local market in the rent schedule agreed to. This is the only method for staying in line with price inflation and demographic-driven appreciation.

Net income from an income-producing property’s operations sets value and thus pricing. The owner’s attention to shifting future cost increases to the tenant and capturing positive demographic changes brought on by the property’s location further enhances future value. These objectives are sometimes overlooked in times of economic recessions in a desperate effort to get vacant properties rented before the market has recovered.

Types of rent adjustments

The three basic types of commercial lease rent adjustment provisions (also known as rent escalation clauses) are:

- graduated rent provisions;

- inflation-adjusted rent provisions paired with periodic appreciation-adjusted rent provisions; and

- percentage rent provisions.

The financial goals of a commercial landlord when negotiating provisions for future rents include:

- adjustments for the lost purchasing power of the past year’s rent amount due to on-going consumer price inflation, a monetary policy issue;

- adjustments in rent to reflect the rate of economic appreciation enjoyed by comparable properties (beyond the rate of inflation), a demographics issue; and

- the absorption or pass-through of increased operating expenses and interest adjustments on mortgage debt.

Percentage rent for high traffic retail

The percentage rent provision in a commercial lease agreement is conceptually very different from other provisions for calculating rent. Percentage rent provisions are used exclusively by owners of income-producing properties who rent to retail businesses.

Percentage rent provisions are most commonly negotiated with pricy restaurant and retail tenants dependent on high vehicular or foot traffic to drive their sales. [See RPI Form 552-4 §4.4]

Percentage rent provisions override a similar financial outlook presented by the use of periodic market-rent adjustments provisions in industrial or office properties which are based on comparable rents. Percentage rent provisions rest on the inherent quality of the location and ability of the tenant (and landlord) to drive up the tenant’s total revenues at the premises.

While various lease agreements use different formulas for adjusting rent, their rent provisions have one common feature — the base rent — an amount below which monthly rent does not drop. The base rent is the minimum rent paid by the tenant to the owner each month in the event future comparable rent or percentage rent amounts fall lower than the base rent. [See RPI Form 552-4]

Percentage rent provisions are calculated using a formula calling for an amount of additional rent to be paid separately from and in addition to the monthly base rent, called percentage rent or overage rent. Percentage rent due is typically calculated as a percent of the tenant’s annual gross sales, less the amount of base rent paid monthly during the year.

When the point of crossover between owing only base rent and incurring overage rent is the same, the percentage rent provisions is called a natural breakpoint arrangement as used in our example below. Depending on the owner’s or the tenant’s superior bargaining strength (location versus tenant’s brand), the percentage rent is occasionally negotiated to kick in before or after the natural breakpoint — the point at which the base rent equals the percentage for commencement of percentage rent due.

Pairing the base rent amount with a percentage rent formula assures the owner a full return at the appreciated rental value for the property due to the amenities of its location. Thus:

- the base rent provides the owner with a minimum return on investment for the tenant’s use of the property; and

- the additional percentage rent provides the owner with a return on their investment based on the contribution of the property’s location to the tenant’s operating success.

The additional rent is triggered when the tenant’s gross income from sales exceeds a negotiated dollar threshold (the breakpoint).

To negotiate the figures for calculating additional rent under a percentage rent provision, the owner relies initially on an estimate of the tenant’s gross sales for the first 12 months of operations, as well as:

- the traffic count and traffic patterns at the premises;

- the dollar amount of anticipated sales and average dollar sales; and

- the price range of the goods and services to be offered by the tenant.

The owner then negotiates with the tenant to set the percentage of the tenant’s annual gross sales for calculating the additional rent. With a natural breakpoint, when the percentage amount exceeds the base rent paid, the tenant pays the excess amount as additional rent.

Percentage rent is typically due monthly based on the prior month’s gross sales. To annualize the rent, it is further adjusted within a month or two after the end of the year, when the tenant’s gross income for the period is known. The frequency of the additional rent payment is negotiable, based on:

- whether the tenant’s sales trends are constant or seasonal; and

- the durability of the tenant’s financial strength.

Calculating percentage rent

Consider a lease agreement calling for a base rent of $60,000 per year ($5,000 per month). The percentage rent provision calls for the payment of rent equal to 6% of the tenant’s gross sales. The tenant pays rent monthly at the base rent amount. Any balance due as additional rent is calculated annually on a final accounting. Thus, the landlord and tenant have agreed to a natural breakpoint.

At the end of the year, the tenant’s gross sales income is $1,500,000. The total rent due at the percentage rate is $90,000 ($1,500,000 x 0.06). The percentage rent exceeds the annual base rent paid by $30,000. Thus, the total rent owed the owner for the year is:

- $60,000 in base rent, paid monthly during the year; and

- $30,000 in additional percentage rent, paid within 30 to 60 days after the end of the lease year.

Base rent options for setting annual minimums

The monthly base rent under a percentage rent provision may be:

- fixed for the term of the lease [See RPI Form 552-4 §4.3(a)];

- graduated annually over the term of the lease [See RPI Form 552-4 §4.3(b)]; or

- inflation adjusted based on the Consumer Price Index for All Urban Consumers (CPI-U) throughout the term of the lease. [See RPI Form 552-4 §4.3(c)]

To keep the property’s base income — and its value — from losing ground to consumer inflation when percentage rent is not earned, the base rent needs to be adjusted annually. To make the adjustment to base rent, a graduated or inflation-adjusted rent provision is included in the lease agreement.

Base rent may also be adjusted to reflect an increase every few years in the property’s dollar value brought about by local appreciation of comparable properties. This is accomplished in long-term leases by including an appreciation-adjusted rent provision in the lease agreement. These market-rent provisions call for the adjustment to be made every few years, commonly five. [See RPI Form 552-4 §4.3(c)(v)]

Graduated base rent from year to year

The most common base rent adjustment provision used in short-term commercial lease agreements is the graduated rent provision. [See RPI Form 552-4 §4.3(b)]

Graduated rent provisions increase the monthly base rent due in each year following the first year’s payment of a base rent. The adjustments are made annually, or sometimes semi-annually. The periodic upward adjustment is either:

- a specific dollar amount as the rent due; or

- a percentage of the base year rent or rent paid during the previous period.

When setting the base rent adjustment amount, be it a dollar or percentage figure, the owner takes into account:

- the expected rate of future inflation;

- local market conditions; and

- the tenant’s evolving use of the premises and its burden on the property and improvements.

Rather than being tied to a formal index, the rent increases set by a graduated rent provision are negotiated. No paradigm exists other than the expectations of future consumer inflation under anticipated monetary policy. However, increases of 3% are customary in some markets.

For the owner, graduated rents often provide an increase in rents exceeding reasonably anticipated inflation (the 2015 10-year bond market indicates less than 2% annually for a decade). Graduated rental rates are also put to use as teaser rates to attract very desirable tenants, or during periods of high vacancy rates and recession-like rents to adjust rents to market over a three to five year period.

Inflation-adjusted base rent

Inflation-adjusted base rent provisions increase a property’s annual rental income sufficient to match the annual rate of consumer price inflation. An inflation provision calls for annual upward rent adjustments based on figures from an inflation index, such as the CPI-U. [See RPI Form 552-4 §4.3(c)]

The CPI-U is an index of fluctuations in the dollar price the local population pays for consumable goods and services which includes residential rental rate changes. An owner’s use of CPI-U figures to adjust rents recovers the dollar’s annual loss of purchasing power to pay for goods and services the owner acquires with rental income. Occupancy of property is the service which the owner delivers and is consumed by the tenant using dollars to pay rent in exchange.

Here are some basic guidelines to follow when using CPI-U figures to retain the rent’s purchasing power:

- set a base rent payable monthly during the first year of the lease, also called the minimum rent (floor);

- indicate the index which is the source of the figures to be used for the CPI-U adjustment (e.g., the Los Angeles-Riverside-Anaheim CPI-U);

- indicate an alternative index if the one selected is discarded or altered;

- note the month for the CPI-U figure to be used to compute annual adjustments (the third month prior to commencement); and

- state the month payments begin at the adjusted amount (e.g., anniversary month for the commencement of possession under the lease agreement).

A good practice is to use CPI-U figures for the third month preceding commencement of the lease to compute periodic adjustments. Using a CPI-U figure for the third month prior to the adjustment guarantees an actual figure is available with sufficient time to calculate the rent adjustment and timely inform the tenant of the adjusted rent amount.

Appreciation-adjusted rent – local demographics

Rents are also forged by public appreciation for a property’s location. The human behavior driving property appreciation results from a combination of:

- local demographics (population density and income levels set the demand for space);

- government investments and social programs in the community; and

- supply of available units or space in the local market, an issue of proper zoning activity. [See RPI Form 552-4 §4.3(c)(v)]

Long-term commercial lease agreements need rent provisions which capture from year to year the financial benefits these conditions create for property owners (and tenant businesses). For an owner to garner the value of evolving local economic conditions, an appreciation-adjusted rent provision is included in commercial lease agreements.

Through the provision, it is agreed the base rent is adjusted every three to five years to capture any increase in rents brought about by the economic effect of local appreciation, increasing rents beyond any graduated or inflation-adjusted increase in base rent.

In areas experiencing significant growth, the longer the lease term, the more likely an appreciation-adjusted rent provision will be negotiated and included in the lease agreement.

Appreciation-adjusted rent provisions work in tandem with the inflation-adjusted rent provisions. The inflation adjustment is annual; the appreciation adjustment takes place every three to five years.

Form navigation page published 07-2015.

06-2018 Revisions:

Added the following provision for a landlord to indicate whether they have knowledge a property is located in a special flood hazard area or an area of potential flooding

23.9 Notice: Landlord has actual knowledge the property is located in a special flood hazard area or an area of potential flooding. Tenant may obtain information about flood and other hazards at http://myhazards.caloes.ca.gov/. Landlord’s insurance does not cover Tenant’s possessions. Tenant may purchase renter’s insurance and flood insurance to insure their possessions from loss. Landlord is not required to provide additional information about flood hazards beyond this notice.

06-2015 Revisions:

Provisions 4.3 and 4.4 covering the payment of rent have been better structured to accommodate the separate payment of:

- base rent, either fixed, graduated or CPI adjusted; and

- additional percentage rent calculated as a percent of the tenant’s annual gross sales, less the amount of base rent paid monthly during the year.

Article: Agency law for commercial brokers – shedding light on conduct

Real Estate Property Management Chapter 41: Nonresidential lease agreements

Real Estate Property Management Chapter 42: Rent provisions in nonresidential leases

Real Estate Property Management Chapter 43: Adjustable rent provisions

Real Estate Property Management Chapter 44: Rent increases and CPI

Real Estate Property Management Chapter 45: Percentage lease rent provisions

Real Estate Property Management Chapter 46: Nonresidential use-maintenance provisions