This form is used by a seller’s agent when analyzing the basis and reportable profit on the sale of a listed property in a proposed §1031 reinvestment plan, to determine on a worksheet the tax consequences of the §1031 transaction for review with the client.

A can-do agent provides tax advice to clients

Income tax knowledge held by real estate agents is an engaging and practical tool for assisting clients with their decision to sell a property they no longer want to own.

Specifically, an agent’s tax knowledge passed on to clients about transactions becomes business goodwill, an indicia of the agent’s brand. In turn, the earning power of goodwill through referrals generates further employment by members of the public seeking the use of their services, i.e., superior listings, larger dollar transactions and an expanded base of clientele.

Counseling a client on the tax aspects of a sale, purchase or reinvestment in the early stage of an agency relationship typically excites an ongoing tax discussion. Tax consequences are of constant concern to all participants in a real estate transaction — material facts which weigh heavily on their real estate decisions when considered.

Of course, the objective of a discussion on taxes is to achieve the most favorable tax result available to the client without altering the financial underpinnings and risks deemed acceptable in a sale or purchase. While material, tax consequences are the least important in the hierarchy of fundamental factors when deciding to buy or sell in a real estate transaction.

The earlier in the client relationship an agent begins the tax discussion, the more likely the client will consult with other competent professionals about their agent’s tax-related discussions. The agent’s discussion becomes the focal point – the nexus – influencing the client’s conversations with other advisors, professional or otherwise.

A client’s early consultation with others allows the client to follow up on their agent’s advice, such as a carryback sale or the purchase of replacement property in a §1031 reinvestment plan or the actual magnitude of unrecaptured and capital gains taxes.

Encouraging a client to discuss the transaction with other advisors available to the client — or the client authorizing the agent to do so on their behalf — results in increased coordination between the client and agent.

When a client involves other professional advisors, the agent’s duty of care owed a client is not relinquished to their other advisors. The agent’s duty is to present their client with information about a transaction the agent believes may impact the client, information the client needs to consider when making decisions. The agent’s counseling might well be contrary to advice given to the client by others, such as the client’s attorney or accountant, which then needs a negotiated resolution. [Brown v. Critchfield (1980) 100 CA3d 858]

Although an agent’s opinion is not conclusive, it is relevant and important as it alerts the client to a fundamental aspect of the contemplated transaction. Further, agents negotiating a transaction need to maintain influence over a client’s decisions so the client’s goals known to the agent are attained.

Changing market conditions and the innuendos and nuances of real estate negotiations are best known and managed by agents. Agents are regularly involved in real estate transactions — clients only rarely, and then only as principals. Thus, agents are often more likely to be involved in transactions than other client advisors. Also, agents giving advice routinely develop professional relationships with individuals from other professions who will remember the agent long after the transaction is closed.

Finally, an agent’s failure to coordinate activity in a transaction with the client’s other advisors can prove detrimental for the agent. An agent who persuades a client to rely on their advice to the exclusion of contrary (and correct) advice of other professionals is liable for any losses suffered by the client due to the agent’s unsound advice.

It is best to let the client sort out and prioritize all the advice they receive (including the agent’s) and make their own decision regarding whose advice is the most informed and ought to be followed. [In re Jogert, Inc. (1991) 950 F2d 1498]

Disclosures benefit the agent

As all agents and sellers know, the sale of every parcel of real estate, except dealer property, produces a profit (or loss as the flip side of that coin) for a seller when the price exceeds the seller’s cost basis in the property. Further, agents know a sale at a price above the cost basis produces a tax liability.

However, an agent handling a one-to-four unit residential property is not obligated to mention tax consequences or disclose any part of their tax knowledge to their buyers or sellers of this class of properties. The exculpatory provisions in the state mandated agency disclosure law eliminate any affirmative duty to disclose the tax aspects in one-to-four unit transactions. This permissive non-disclosure is part of the “dumb-agent rules” for one-to-four unit sales dear to large single family residential (SFR) brokerage operations. [See RPI Form 305]

However, an agent with knowledge of the tax aspects of real estate transactions does not leave their buyer or seller to their own devices, nor need they, not even on one-to-four residential units.

Consider that an agent’s interests are best served when they assist their client by:

- Giving tax advice on the transaction to the best of their knowledge with the understanding tax-related information is confidential – not released or discussed with other agents;

- disclosing the basis for their opinion as the advice given;

- encouraging (or requiring) the client to consult other advisors about the tax advice given; and

- conditioning the transaction on the client’s right to cancel the purchase agreement by including a further-approval contingency provision regarding clearance of the transaction’s tax consequences.

Before entering into a tax discussion with a seller about a proposed sale, the agent needs to prepare an Individual Tax Analysis (INTAX) form for review with the seller. By using it, the agent clearly breaks down the profit taken on a sale into the two types of gains, called batching. Without first batching the gains, the agent is unable to develop an accurate estimate of the seller’s tax liability generated by closing a sale they negotiated. [See RPI Form 351]

During a review of the profit tax liability estimated on the INTAX form, the agent discusses variations for the client to consider on a sale to exclude or exempt profit from taxes or to defer profit reporting and taxes on the proposed sale.

Thus, the seller who initially sought only to “cash out” their ownership of real estate they no longer want, might consider a §1031 reinvestment plan and acquire a replacement property — with their agent’s assistance.

Alternatively, the seller might structure a sale as a carryback transaction. Here, the seller retains the earning power of their profits, untaxed, until years later when the deferred profit from the sale is reported and taxed.

The top half of the INTAX form is a review of the seller’s taxable income and profit or loss. The agent needs the client’s estimate of their taxable income before they can estimate the profit tax on a sale. Further, the client’s estimated ordinary income is needed to determine how much of the client’s taxable income remains to be taxed at the lower unrecaptured and capital gains rates.

The profit review first takes place at the listing stage, and again when a purchase agreement offer or counteroffer is submitted and reviewed. The agent’s tax discussion with the seller on each occasion may be limited to the amount of profit on the sale, the batching of the gains and any tax liability exposure due on those gains. Also, a high-income seller is more likely to respond favorably to a tax discussion than a low-income seller.

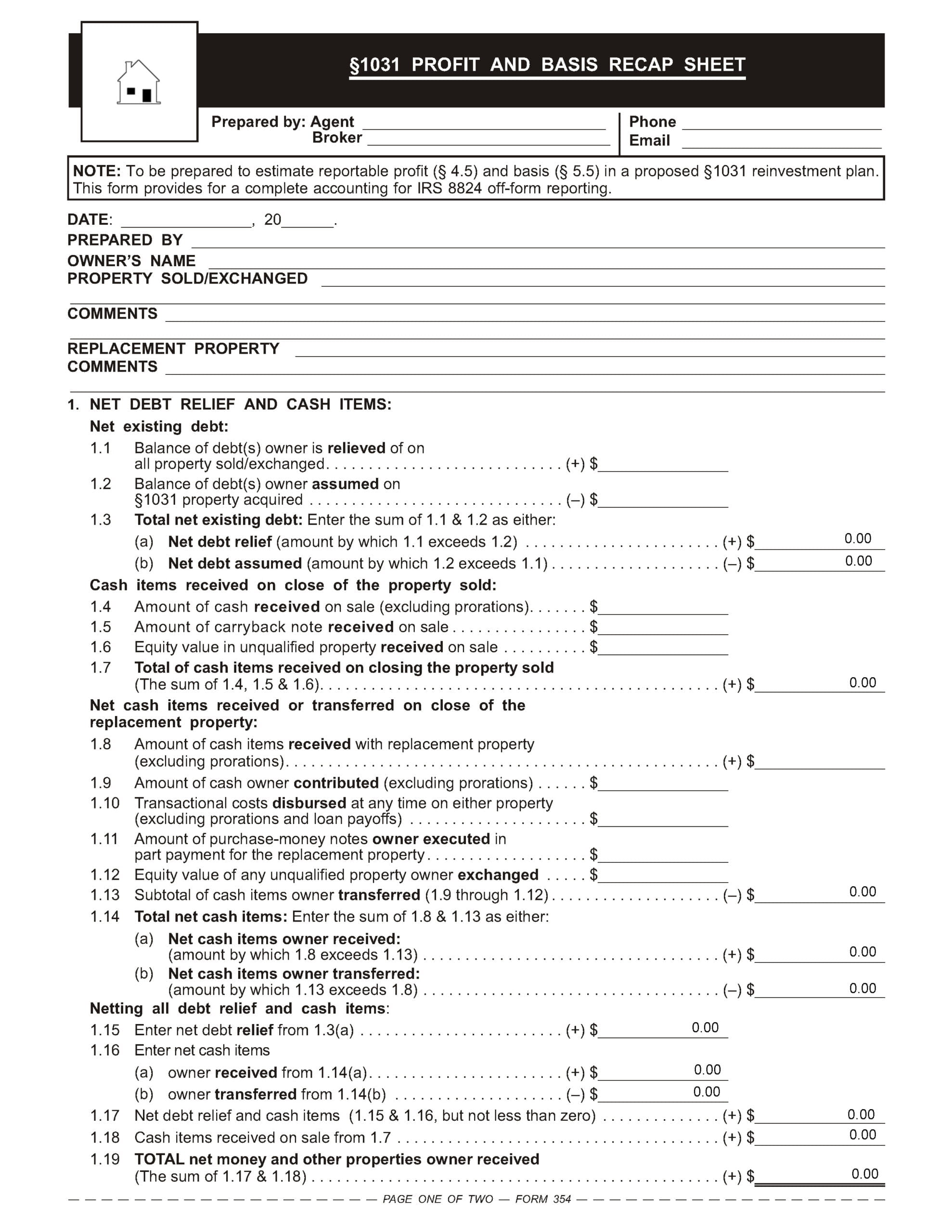

When a seller acquires like-kind replacement property in a §1031 reinvestment plan, they avoid profit taxes on some or all the profit realized on the property sold. In §1031 situations, an agent need only prepare a Profit and Basis Recap Sheet to calculate the profit tax the client avoids. [See RPI Form 354]

Occasionally, the seller’s §1031 reinvestment plan might qualify them for a partial §1031 exemption. Their withdrawal of cash, receipt of a carryback note or a reduced amount of mortgage debt on the reinvestment causes part of the profit they realize to be taxed, called recognized income. Cash-like items withdrawn before acquiring all replacement property cannot be offset, and the profit allocated to them is taxed. Here, the INTAX form section for batching taxable profit incudes profit taxed in the partial §1031 transaction. [Internal Revenue Code §1031(b)]

Breaking down the §1031 Profit and Basis Recap Sheet

An agent uses the §1031 Profit and Basis Recap Sheet published by RPI to analyze the flow of capital invested, withdrawn or contributed by an investor when selling and buying properties in a §1031 reinvestment plan. [See RPI Form 354]

The Recap Sheet contains five sections.

Section One nets out the capital withdrawn from existing mortgage and cash items on the sale or exchange of the property sold and capital contributed to purchase the replacement property. [See RPI Form 354 §1]

Section Two analyzes any unqualified properties an investor contributes to purchase the replacement property, such as personal property or dealer property held by a developer or flipper. The contribution of unqualified property produces a taxable profit or loss as though sold for cash. [See RPI Form 354 §2]

Section Three calculates the profit realized on the sale. Here, the amount of profit taken by the investor on the property sold in their §1031 reinvestment plan is determined. [See RPI Form 354 §3]

Section Four calculates the profit recognized and thus reported and taxed on the §1031 reinvestment. [See RPI Form 354 §4]

Section Five establishes the cost basis for the replacement property. The cost basis is allocated to land and improvements based on their respective percentages of the property’s value. The cost basis allocated to improvements is a requisite to calculating the annual depreciation deduction allowed the investor acquiring replacement property. [See RPI Form 354 §5]

Form navigation page published 04-2023. Updated 01-2026.

Form last revised 2011.

Form-of-the-Week: INTAX and §1031 Profit and Basis Recap Sheet — Forms 351 and 354

Article: Tax Benefits of Ownership: The §1031 reinvestment plan

Article: Tax Benefits of Ownership: Tax aspects advice

Article: Using the INTAX form to calculate the seller’s federal tax liability on a real estate sale

Article: Capital gains on real estate sales, explained

Article: The truth about giving tax advice to clients

The votes are in: May agents give tax advice?