Modifying the note

A note, sometimes called a promissory note, contains the borrower’s promise to pay the lender or carryback seller — called a mortgage holder — the principal amount of the debt incurred, plus any interest.

Critically, the note is not the debt itself, but evidence of the existence of a debt created in an underlying transaction, such as the lending of money or installment sale of property.

In contrast, provisions in a trust deed, besides referencing the note and describing the real estate which secures the debt, primarily addresses the maintenance and preservation of the mortgage holder’s security interest in the real estate granted by the trust deed. Together, the note and trust deed document what is colloquially called a mortgage.

During the life of a mortgage, the mortgage holder and owner of the mortgaged property may agree to modify, add or rescind one or more of the note provisions. [See RPI e-book Real Estate Finance, Chapter 7]

Any change in the terms of a note requires:

- mutual agreement between the property owner and the mortgage holder; and

- consideration given in exchange for the modification, with the exception of bankruptcy. [See RPI Form 426]

Modifications of a mortgage usually arise out of a financial necessity experienced by the owner of the mortgaged property. Conversely, a carryback seller may incur profit taxes on receipt of a payoff of the mortgage which may prompt the seller to bargain for a modification to extend the time for payoff, and thus payment of profit taxes.

Related video:

Negotiating to modify mortgage terms

The modification of a note is controlled by California contract law. Thus, a written contract — in this example, the note evidencing a debt — is modified by:

- a written agreement; or

- an oral agreement. [Calif. Civil Code §1698]

However, for an oral modification to be enforceable, both the mortgage holder and the property owner need to execute the oral agreement by taking action to perform the agreement. To be certain of the terms as modified, the modification needs to be memorialized in a writing.

A property owner best initiates formal negotiations – following an oral discussion – by filling out a form submitted to the mortgage holder as their written offer to modify the note. As with all forms, the form functions as a checklist of issues a well-informed agent considers when negotiating a transaction.

When filled out, the agreement to modify a promissory note sets forth the terms sought by the person initiating the modification effort. A real estate agent traditionally facilitates negotiations with the mortgage holder on behalf of the owner. [See RPI Form 426]

Once the agreement to modify has been negotiated to set the new terms for payment and rates, the agent, broker or escrow officer prepares a Modification of the Promissory Note form. It is the modification form, a sequel to the agreement to modify form, which actually changes the terms of the existing mortgage from those in the original note, called performance. [See RPI Form 425]

Provisions in the modification form act to:

- identify the note which is being modified;

- name the parties to the mortgage; and

- identify the trust deed and the mortgaged property involved.

To complete the paperwork called for in the agreement, the signed modification form is physically attached to the note as an allonge – stapled. The terms of the modification then become part of the original note.

Related video:

Analyzing the agreement to modify a promissory note

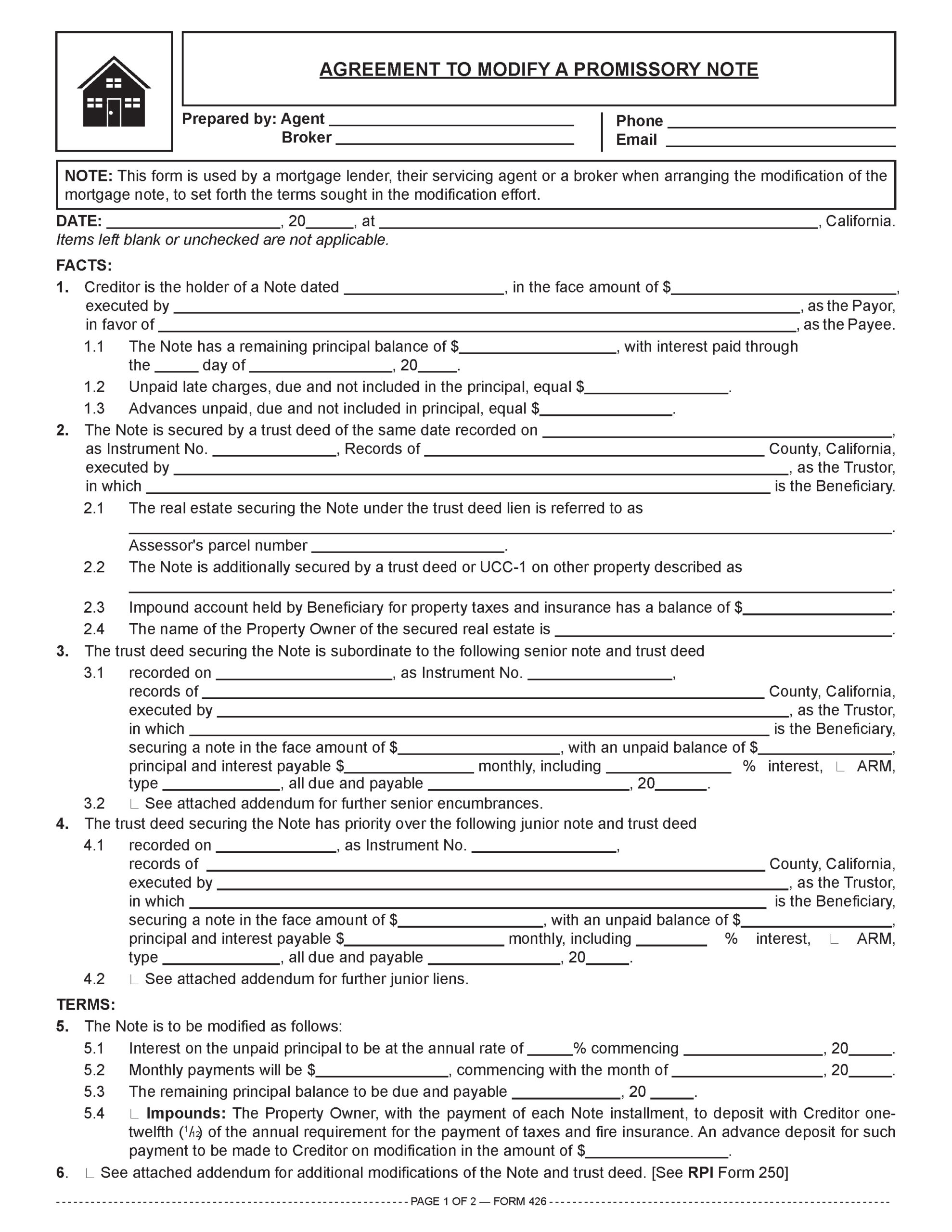

A mortgage lender, their servicing agent or a broker uses the Agreement to Modify a Promissory Note published by Realty Publications, Inc. (RPI) when arranging the modification of the mortgage note. The form allows the lender, agent or broker to set forth the terms sought in the modification effort. [See RPI Form 426]

The Agreement to Modify a Promissory Note contains:

- the promissory note information [See RPI Form 426 §1];

- the trust deed information [See RPI Form 426 §2];

- senior note and trust deed information [See RPI Form 426 §3];

- junior note and trust deed information [See RPI Form 426 §4];

- note modifications [See RPI Form 426 §5 and §6];

- additional considerations the owner will deliver to the mortgage holder [See RPI Form 426 §7];

- an expiration date of the offer [See RPI Form 426 §8];

- the escrow company to be used [See RPI Form 426 §9];

- when escrow will close [See RPI Form 426 §10];

- the title insurance company to issue the title policy [See RPI Form 426 §11];

- the brokerage fee [See RPI Form 426 §14]; and

- signatures of the mortgage holder and property owner. [See RPI Form 426]

Related article:

Analyzing the modification of the promissory note

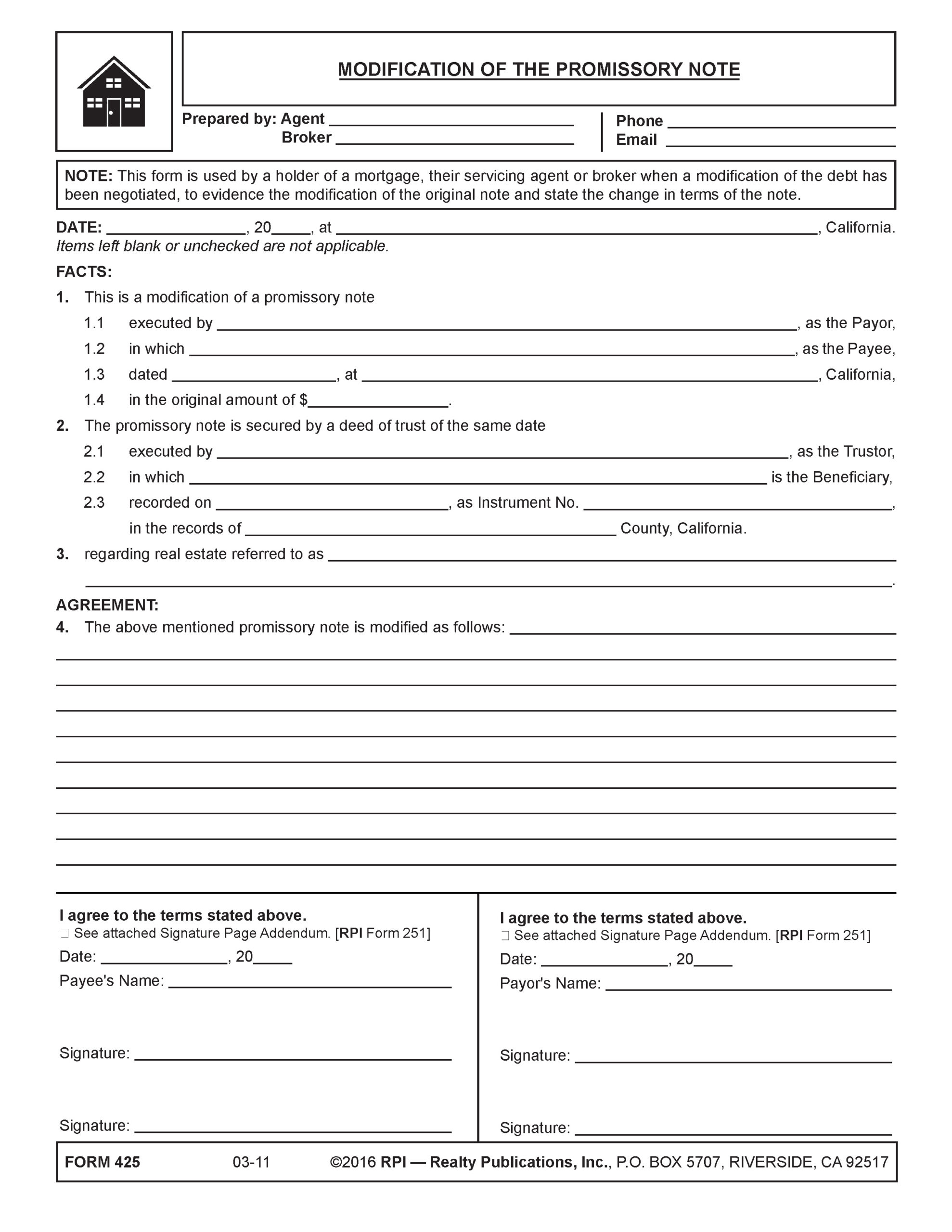

A mortgage holder, their servicing agent or broker uses the Modification of the Promissory Note published by RPI when a modification of the debt has been agreed to through negotiations. The form provides the mortgage holder, agent or broker evidence of the modification of the original note and states the change in terms of the note. [See RPI Form 425]

The Modification of the Promissory Note identifies:

- the promissory note being modified [See RPI Form 425 §1];

- the trust deed securing the promissory note [See RPI Form 425 §2];

- the liened real estate [See RPI Form 425 §3];

- the modifications to the promissory note [See RPI Form 425 §4]; and

- signatures of the mortgage holder and owner. [See RPI Form 425]

Related article:

Want to learn more about receiving and splitting broker fees? Click the image below to download the RPI book cited in this article.