This is the fourth episode in our new video series covering Implicit Bias principles, and provides a sneak peek into the new continuing education (CE) requirements that apply to real estate agents and brokers with licenses expiring on or after January 1, 2023.

This episode deconstructs the source of the homeownership gap and the corresponding wealth gap. Click for the prior episode in series.

A source of wealth

Homeownership is the main source of wealth for American families. To increase household wealth, the U.S. government subsidizes and encourages homeownership through various tax incentives and mortgage programs, like:

- the mortgage interest deduction (MID);

- Federal Housing Administration (FHA)-insured, low down payment mortgages;

- low ceilings on capital gainstax; and

- Proposition 13 (Prop 13) in California.

Yet despite these incentives, some groups have greater difficulty becoming homeowners than others, which leads to an enormous wealth disparity between racial and ethnic groups.

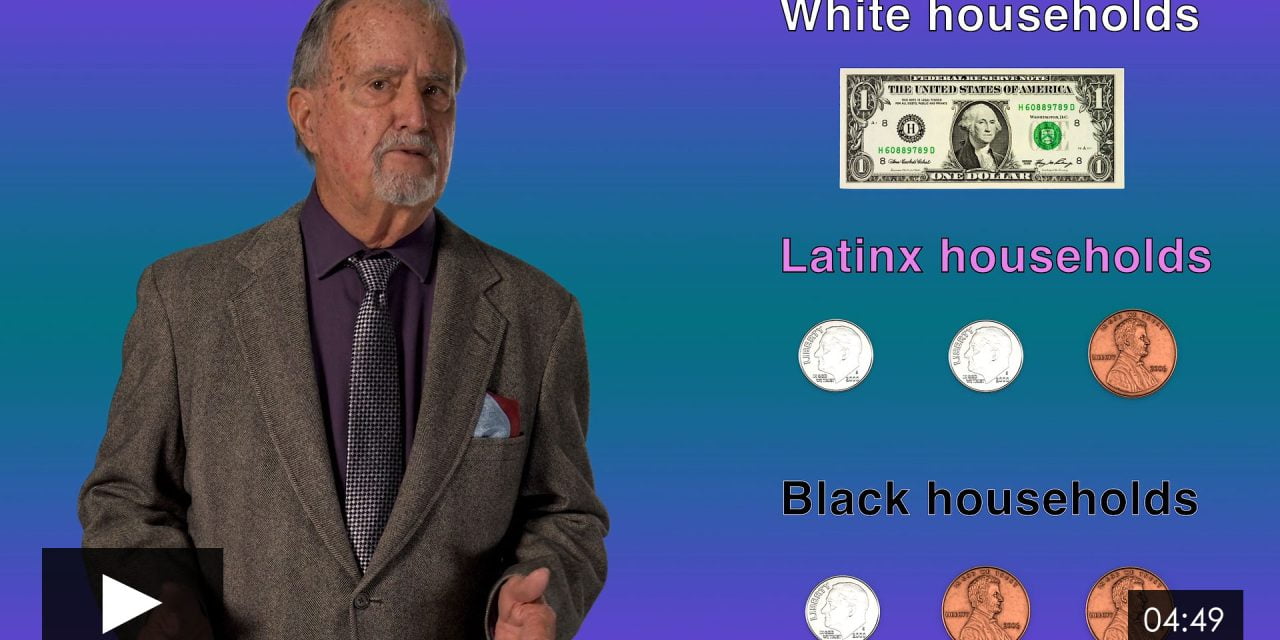

The median household wealth as of 2019 is:

- $184,000 for white households;

- $38,000 for Latinx/Hispanic households; and

- $23,000 for Black households. [Kent, Ana Hernández & Ricketts, Lowell. (2021) Wealth Gaps between White, Black and Hispanic Families in 2019]

Put another way, for every dollar held by white households, Black households hold only 12 cents, and Latinx households hold only 21 cents.

While all types of asset ownership are greater for white households, the majority of this racial wealth gap can be explained by lower homeownership rates among Black and other minority households.

Why minority households steer clear of homeownership

If homeownership is the key to wealth, why don’t more minority households buy homes?

If past experience has taught minority communities anything, it’s that for Black and Latinx households, homeownership is not the “safe investment” many vociferously proclaim it to be.

The National Bureau of Economic Research (NBER) published a study on the impact of the 2008 Millennium Boom and subsequent Great Recession on the homeownership rates of Black and Latinx households compared to white households (Asian households were excluded from the study). [Bayer, Patrick; Ferreira, Fernando & Ross, Stephen L. (2013) The Vulnerability of Minority Homeowners in the Housing Boom and Bust]

It found the 2009 foreclosure crisis had a greater effect on Black and Latinx homebuyer communities compared to white communities. The share of homeowners who lost their homes to foreclosure during this time was:

- over 1-in-10 Black and Latinx households; and

- just 1-in-25 white households.

Why were Black and Latinx homeowners more than twice as likely than White homeowners to lose their homes? Three factors converged to increase the likelihood of foreclosure:

- aggressive subprime or predatory lending;

- high debt-to-income ratios (DTIs) allowed by lenders; and

- high cases of employment instability.

Millennium Boom: the perfect storm for minority homebuyers

The most dangerous factor that increases the likelihood of foreclosure for Black and Latinx homebuyers is predatory lending.

The largest recognized case of predatory lending was settled by Bank of America (BofA) in 2012 for their subsidiary company, Countrywide’s, discriminatory lending practices. BofA paid $335 million to roughly 200,000 victims of Countrywide’s actions.

Countrywide discriminated against minority homebuyers in two ways, by:

- charging higher fees to minorities than white homebuyers with equivalent qualifications; and

- steering minority homebuyers into subprime mortgage products, even though the targeted homebuyers had equal or better credit histories than other white homebuyers who were not shown bad mortgages.

Higher upfront fees and subprime mortgages induced the minorities targeted by Countrywide to ultimately pay much more than similarly qualified white homebuyers. Therefore, when the housing market and the economy went bust following the Millennium Boom, it was more difficult for minority homebuyers to make mortgage payments than the white homeowners who took our mortgages with Countrywide — the mortgages themselves were already less favorable and posed more risk.

Lenders also deliberately encouraged minority homebuyers to take on more debt than they would reasonably be able to carry — in effect, steering them to a mortgage product with a higher DTI that would provide the greatest benefit to the lender. The higher a homebuyer’s DTI, the greater the risk and the less likely the buyer will be able to make future mortgage payments.

Lenders of the Millennium Boom era did not seem to care about this axiom, and knowingly pushed minority homebuyers into mortgages they were unable to pay. This resulted in higher immediate fees for lenders, who jettisoned the risk to other investors by selling the bad mortgages on the secondary mortgage market — out of sight, out of mind.

Lastly, homeowners were more likely to lose their home following the Great Recession due to the statistical fact that the heads of Black and Latinx households are more likely to be employed in professions more susceptible to economic downturns, like manufacturing and other hourly jobs. In other words, the heads of these households are more likely to lose their jobs than their white counterparts.

Job loss and the inability to pay are the biggest reasons homeowners default on their mortgages. Other financial shocks also contribute to the decision to strategically default, which is typically a struggling household’s last resort. [Gerardi, Kristopher; Herkenhoff, Kyle F.; Ohanian, Lee E. & Willen, Paul. (2015) Can’t Pay or Won’t Pay? Unemployment, Negative Equity, and Strategic Default]

The problem for California real estate

California is a large, diverse state. Nearly 40% of the population identifies as Latinx (Hispanic or Latino/Latina), according to the U.S. Census. Roughly 16% identify as Asian and 7% identify as Black or African American. Therefore, discrimination in the mortgage and housing markets has a far-reaching influence on our state.

Another issue for minority homebuyers, not mentioned in the NBER report, is the discriminatory behavior practiced by some real estate agents.

Compared to similarly qualified white clients, the U.S. Department of Housing and Urban Development (HUD) finds real estate agents show fewer rental and for-sale listings to Black, Asian and Latinx clients. [Aranda, Claudia L.; Levy, Diane K; Pitingolo, Rob; Santos, Rob; Turner, Margery Austin; Wissoker, Doug; The Urban Institute. (2013) Housing Discrimination Against Racial and Ethnic Minorities 2012]

Why do some real estate agents tend to show minority homebuyers fewer listings than their white counterparts?

It’s usually implicit bias on behalf of the real estate agent. For instance, some real estate agents may think they’re doing their Black clients a favor by only showing them homes in neighborhoods predominately full of other Black residents (an unlawful practice). Or agents may not realize they’re slower to respond to requests by minority homebuyers, exercising a lesser degree of urgency than they would normally provide.

This perpetuates neighborhood segregation, which limits minority household access to higher quality jobs, better schools and other resources that disproportionately benefit white households.

The only way to stop a California real estate agent from discriminating against minority clients? The California Department of Real Estate (DRE) may enforce anti-discrimination laws. However, the DRE will only pursue an agent for ethics violations after first receiving a formal complaint.

In cases of discrimination, most homebuyers, sellers and renters do not know how to take appropriate action by contacting the DRE. Therefore, it is up to fellow agents and brokers to report discriminatory practices to the DRE. Aggrieved individuals may report complaints on the DRE’s website using their online complaint form.

Editor’s note – firsttuesday was one of the first schools in California to obtain DRE-approval for the new implicit bias training and expanded Fair Housing course.

To enroll, visit the order page.