Real estate agents who have suspected homes are sitting on the market longer these days — consider your suspicions confirmed. Where homes used to be snatched up within days or even hours of hitting the market, now buyers are taking their time.

For example, in the four weeks spanning mid-August to mid-September, the percentage of listings that had an offer accepted in two weeks or less dropped:

- in San Jose, from 58% in 2017 to 31% in 2018;

- in San Francisco, from 45% to 40%; and

- in Sacramento, from 38% to 32%, according to Redfin.

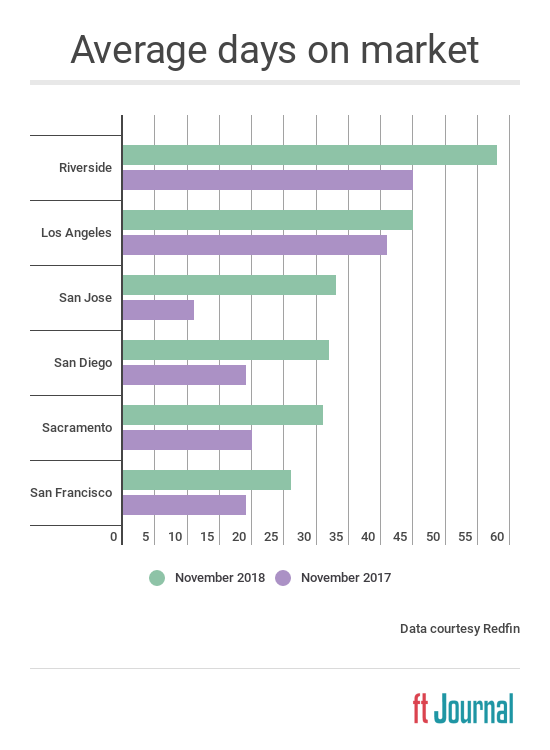

This translates to homes sitting longer on the market. Even accounting for the seasonal slowdown at the end of the year, the average days a listing sits on the market is up over a year earlier. As of November 2018, the average days on market is:

Another, more tangible way this slowdown is being felt is in the pockets of real estate professionals. Listings slower to sell means a reduced sales volume, which has slowed the flow of agent fees.

September alone saw a 14% year-over-year drop in home sales volume across California, followed by another 4% drop in October.

Interest rates to blame?

What’s behind the sudden slowdown in home sales?

One major anchor on home sales volume in 2018 has been the financial shock of rising interest rates.

In California, the average 30-year fixed rate mortgage (FRM) rate was 4.74% in November 2018, up nearly a percentage point from a year earlier when it averaged 3.82%.

These higher interest rates translate to higher mortgage payments — if homebuyers continue to shop at the same price point. In other words, if a homebuyer is unable to absorb the increased cost of the higher interest rate, they are forced to lower their price point. This dynamic is called buyer purchasing power, and dictates the price buyers are able to pay for property.

Related article:

But higher interest rates aren’t the only problem holding back home sales in California. The fact is, home sales volume has been stuck in the post-recession years, never rising beyond 465,000 annual sales since 2008. This mediocre figure is depressingly low compared to the 754,000 sales that took place in California in 2005, at the height of the Millennium Boom. Considering that interest rates just started to rise significantly within the past year, there is another factor at work that has held down home sales volume for over a decade.

This factor is insufficient residential construction. From 2007-2015, construction was well below statewide household growth, resulting in a rapidly shrinking vacancy rate. With not enough new homes to fill demand, inventory shrank and prices rose beyond incomes, keeping sales volume low.

The good news is construction continues to increase each year, though this increase is mostly occurring in the high tier, leaving out the important low-tier sector where first-time homebuyers are most active.

While interest rates will continue on their upward climb in the coming years, reigning in price increases, home sales volume will find more support in rising construction numbers. Several pieces of state legislation are in the works to encourage more construction of low- and mid-tier homes, boosting inventory and sales volume.

Related article:

California worst in the nation for new affordable construction