Santa Clara County was well on its way to a full housing recovery going into 2020, pre-pandemic. Residential construction was booming and buyer incomes were rising at a much quicker pace than the rest of the state. However, annual home sales volume had remained level-to-down since 2012, decreasing each year since 2018.

The past decade of Santa Clara’s successes were due to its strong jobs market, particularly in the Silicon Valley area. However, the region’s high cost of living, reflected in steeply rising home prices, is a heavy drag on buyer demand, consistently holding back sales volume.

Then, in 2020, the economic response to the global pandemic alongside the underlying recession caused job losses to ripple across the state. To counter job losses, mortgage rates were dropped to historic lows which, along with homebuyer fear-of-missing-out (FOMO), reduced available sales inventory and pushed home prices into bubble territory.

Then, in 2022, interest rates jumped, causing buyer purchasing power to plummet, and buyers and sellers to retreat. These rising interest rates heralded the 2023-2024 recession, now causing consternation for real estate agents as they face greatly reduced sales volume, home prices, leasing and mortgage originations.

While today’s high levels of home equity and existing FRMs will cushion the coming rise in foreclosures from being as severe as what followed the 2008 recession, expect an anemic housing market during the next two-to-three years.

Look for the recovery to consistently gain momentum here in Santa Clara around 2026. In the meantime, recession-proofing your practice will ensure the continuing success of your real estate career during the coming slump in fee transactions.

Updated August 21, 2023. Original copy posted August 2014.

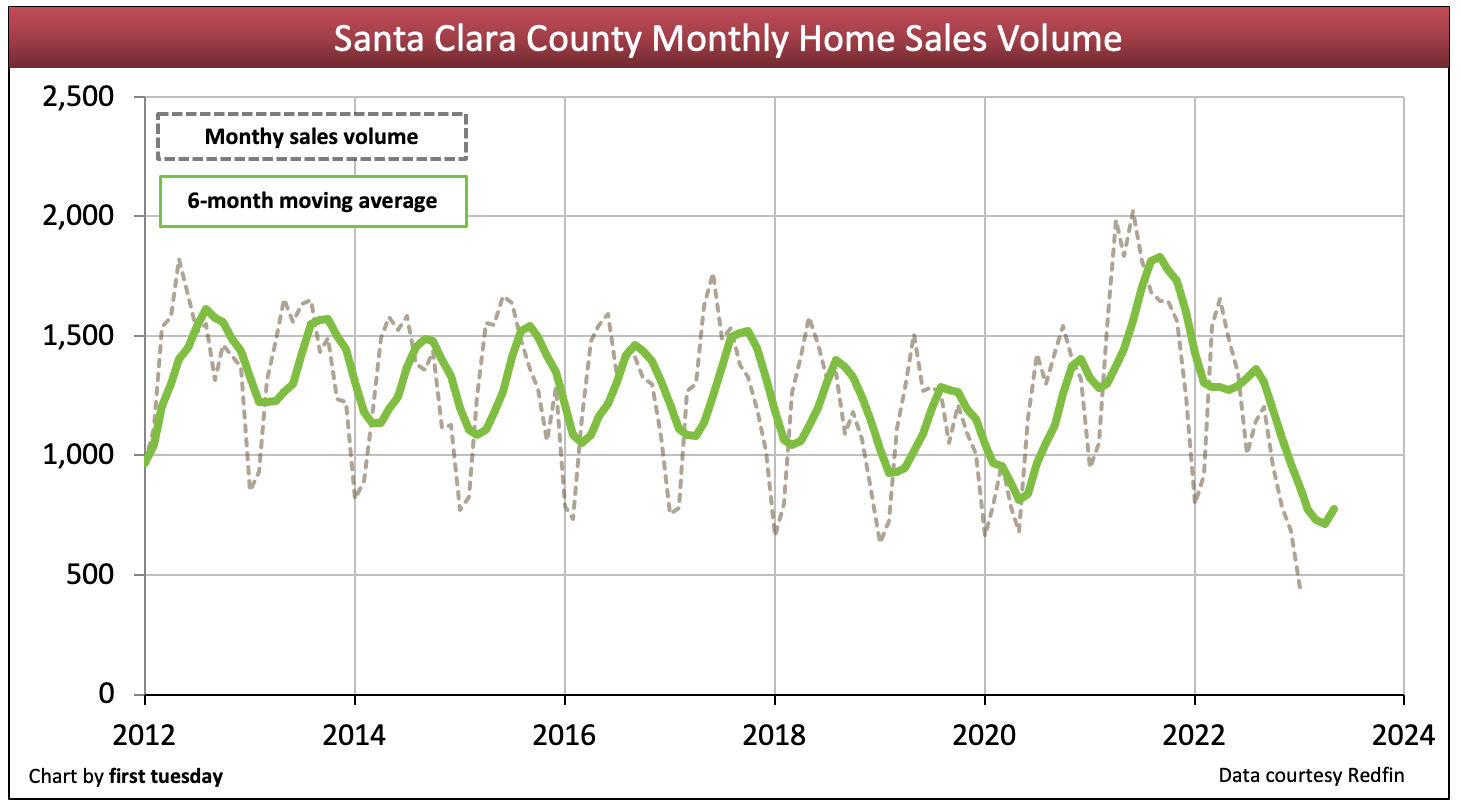

Home sales volume heads down

Chart update 08/21/23

| 2022 | 2021 | 2019 | |

| Santa Clara County home sales volume | 13,500 | 19,000 | 13,400 |

Constrained by tight inventory and high home prices, the path to transaction fees is narrow for agents practicing in the Santa Clara region. However, 22,900 home sales closed in Santa Clara County during 2021, a rapid 37% increase from 2020. This significant increase followed years of flat-to-down sales volume in the region.

Yet, the jump was temporary. Home sales volume declined 29% from the prior year in 2022, a return to “normal” pre-pandemic levels. Worse, as of May 2023, year-to-date (YTD) sales volume is 36% below 2022 and a whopping 42% below 2019 — the last normal year for sales volume.

The main reason for Santa Clara’s typically flat-to-down home sales volume? Home prices in the Santa Clara/San Jose area are inflated well beyond income raises, sending end users further afield where they are able to buy more home for the same amount of money. Held down by strict zoning regulations, inventory is unable to rise to meet homebuyer demand, meaning buyers end up paying more and more each year for the same home. These unhealthy, shuttering price gains are not what local real estate agents want.

Personal incomes have risen at a much slower pace than home prices. Personal incomes rose 7.9% in 2020 in the county. While this is a significant annual increase, it was well below the year-over-year increase in Santa Clara County home prices that year. After years of rising, home prices have hit a peak.

Expect sales volume and prices to bottom following today’s as-yet undeclared recession. Homebuyers will sit out the market until it’s clear prices have bottomed, likely to occur around 2024-2025.

Related article:

Inventory returns to historic lows

Chart update 08/21/23

| May 2023 | May 2022 | Annual change | |

| Santa Clara County for-sale inventory | 2,200 | 3,000 | -25% |

Multiple listing service (MLS) inventory had risen from the historic low reached at the end of 2021, but quickly reversed course in the second half of 2022. After two years of steep decline, for-sale inventory in Santa Clara averaged 25% below a year earlier as of May 2023. A symptom of buyer reluctance to list on top of the region’s already low inventory, today’s low inventory continues to keep price declines somewhat in check.

Looking forward, expect inventory to climb in 2023-2024. Recent interest rate increases have slashed buyer purchasing power, making it nigh on impossible for mortgaged homebuyers (and sellers seeking to purchase replacement property) to compete. Along with high inflation, the signs are pointing to a rapidly approaching downturn in the housing market — of which homebuyers and sellers are well aware. Today’s seller’s market has fully tipped, with prices to follow heading into 2023 as inventory grows and homebuyers choose to wait out the declining market.

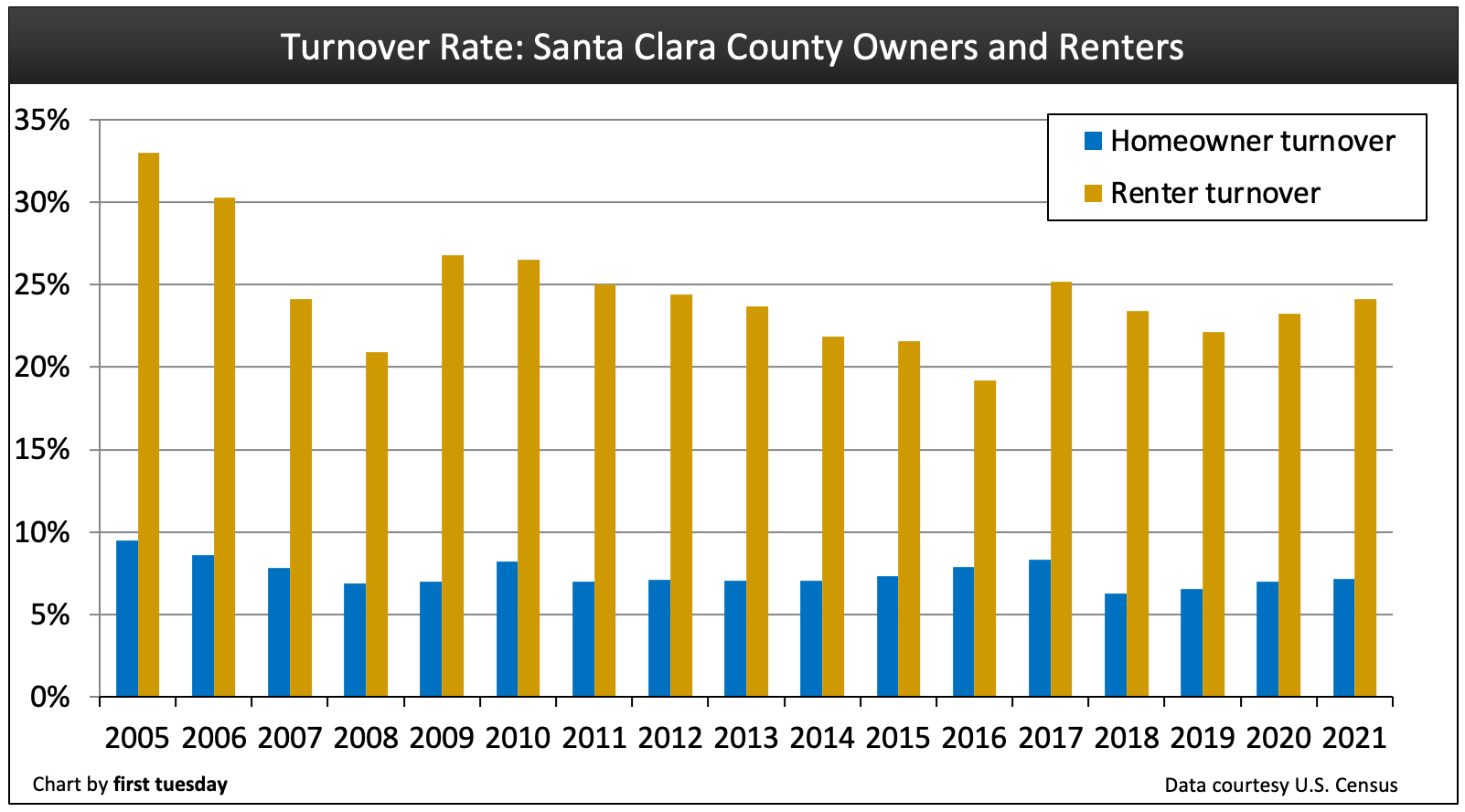

Turnover rebounds following pandemic

Chart update 11/09/22

| 2021 | 2020 | 2019 | |

| Santa Clara County homeowner turnover rate | 7.1% | 7.0% | 6.6% |

Santa Clara County renter turnover rate | 24.1% | 23.2% | 22.1% |

It’s no surprise Santa Clara County’s homeowner turnover rate is relatively stagnant, given the county’s resulting flat home sales volume. With home prices now in a free fall, it’s simply not the prudent time to buy in 2022-2023. However, the area’s solid jobs recovery has ensured new residents continue to pour in at a rapid rate, and this added stress is shown in the high renter turnover rate. In 2017, one-in-four renters moved in Santa Clara, rising slightly each year since 2019.

Santa Clara’s quick pace of population growth will help churn Santa Clara County’s turnover rate, first as increased renter turnover followed by a rise in homeowner turnover – once residential construction catches up to the demand. The caution in these forward observations is the tech and information bubble developing in the area and whether it will come to the point of bursting and putting end to further job growth in the 2023 recession.

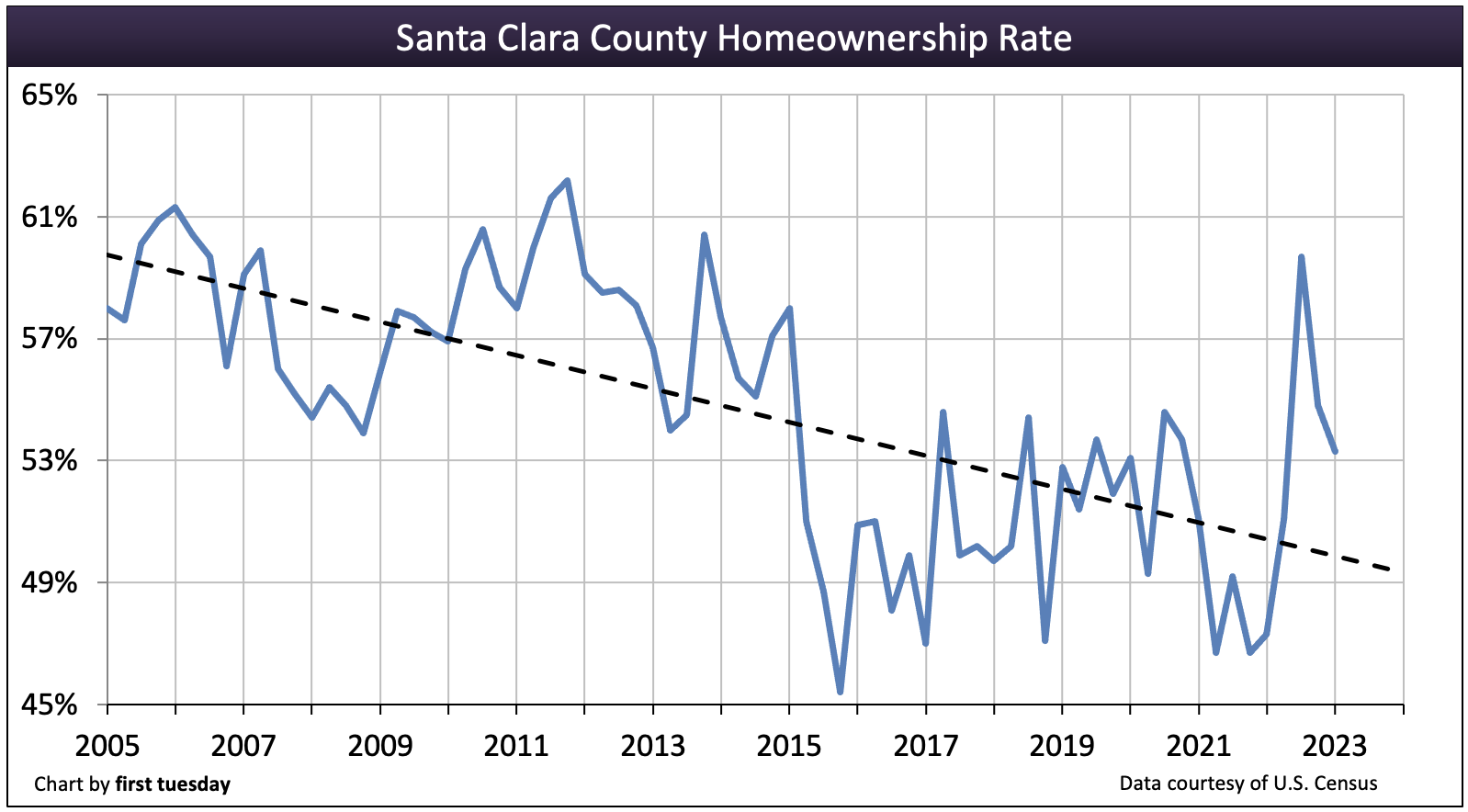

Homeownership feels the pressure of high prices

Chart update 08/21/23

| Q1 2023 | Q4 2022 | Q1 2022 | |

| Santa Clara County homeownership | 53.3% | 54.8% | 47.3% |

While varying greatly from quarter to quarter, Santa Clara County’s long-term homeownership rate trended downward from 2005 through 2015, when homeownership bottomed at a very low 45%. Since then, the region’s rate of homeownership continues its volatile swings, at a high 53.3% in Q1 2023.

The rest of the state has experienced a swift decline in homeownership since the 2008 recession, peaking at over 60% in 2006, at 55.3% in Q1 2023. Santa Clara’s long-term rate of homeownership is mostly stable, due both to its successful jobs market and high home prices. Elevated prices keep homeowner turnover from rising to unsustainable levels (as occurred across the state during the Millennium Boom). Likewise, Santa Clara County’s strong jobs market bolsters its homeownership rate, which will be tested in the next couple of years as the state continues to claw its way out of the ongoing recession.

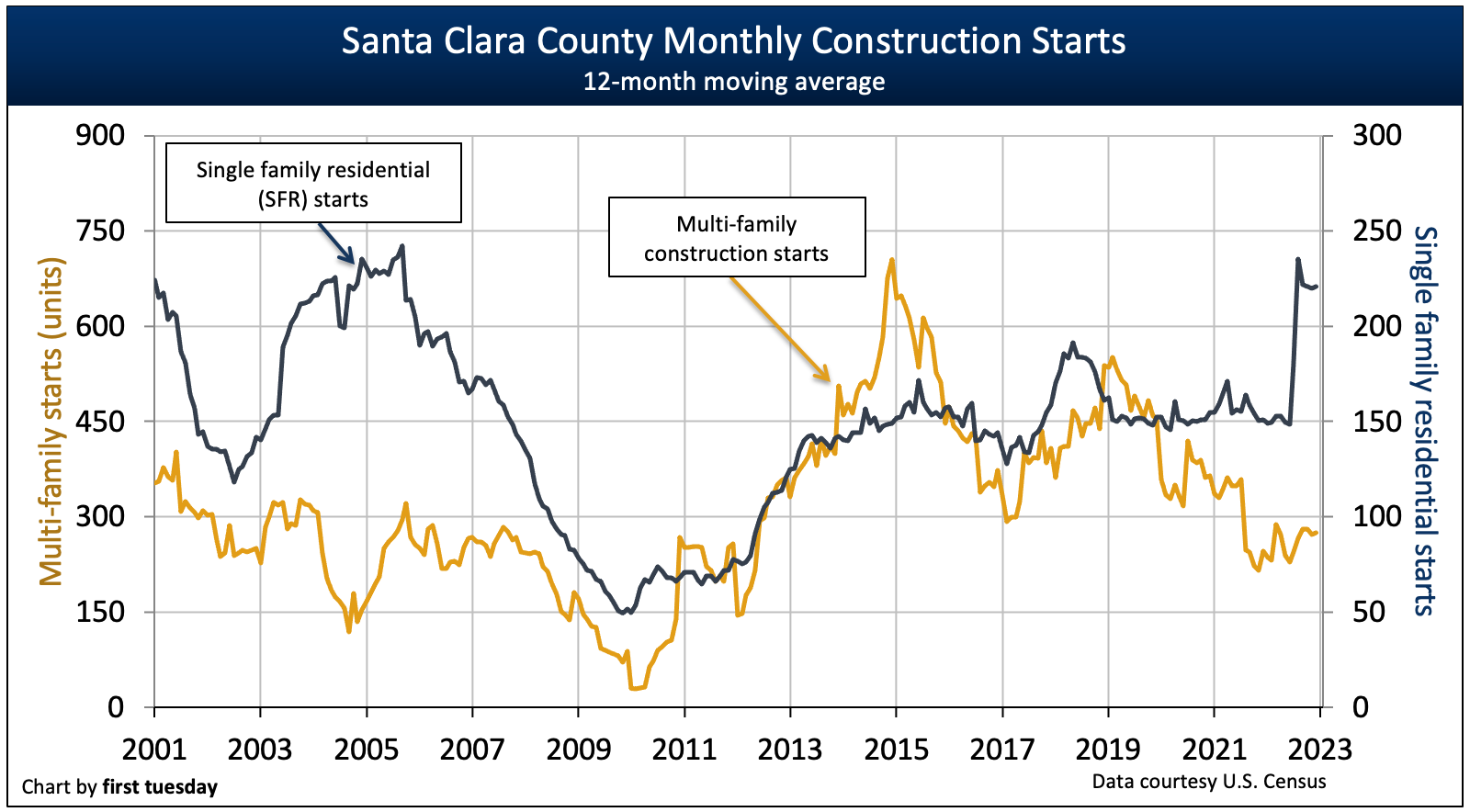

Regional construction boom defies expectations

Chart update 02/16/23

| 2022 | 2021 | 2020 | |

| Santa Clara County single family residential (SFR) starts | 2,700 | 1,800 | 1,900 |

Santa Clara County multi-family starts | 3,400 | 3,100 | 4,200 |

After a setback year in 2021 in Santa Clara County, residential construction starts of all types took off during 2022. Single family residential (SFR) starts jumped 52% from the prior year, while multi-family rising 33%.

Santa Clara County’s high cost of living makes it more cost-effective to reside in a multi-family dwelling with communal amenities, as opposed to a large suburban SFR. And while multi-family construction has overall increased since the Millennium Boom years, it’s still insufficient to keep up with demand from the region’s ever-growing population.

SFR and multi-family starts will likely hit their peak following the recovery from the 2023 recession. This will be helped along by new legislation intended to combat the growing housing shortage by fostering more construction.

Santa Clara jobs nearly recovered

Chart update 08/21/23

| May 2023 | May 2022 | Annual change | |

| Santa Clara County jobs | 1,180,700 | 1,151,100 | +2.6% |

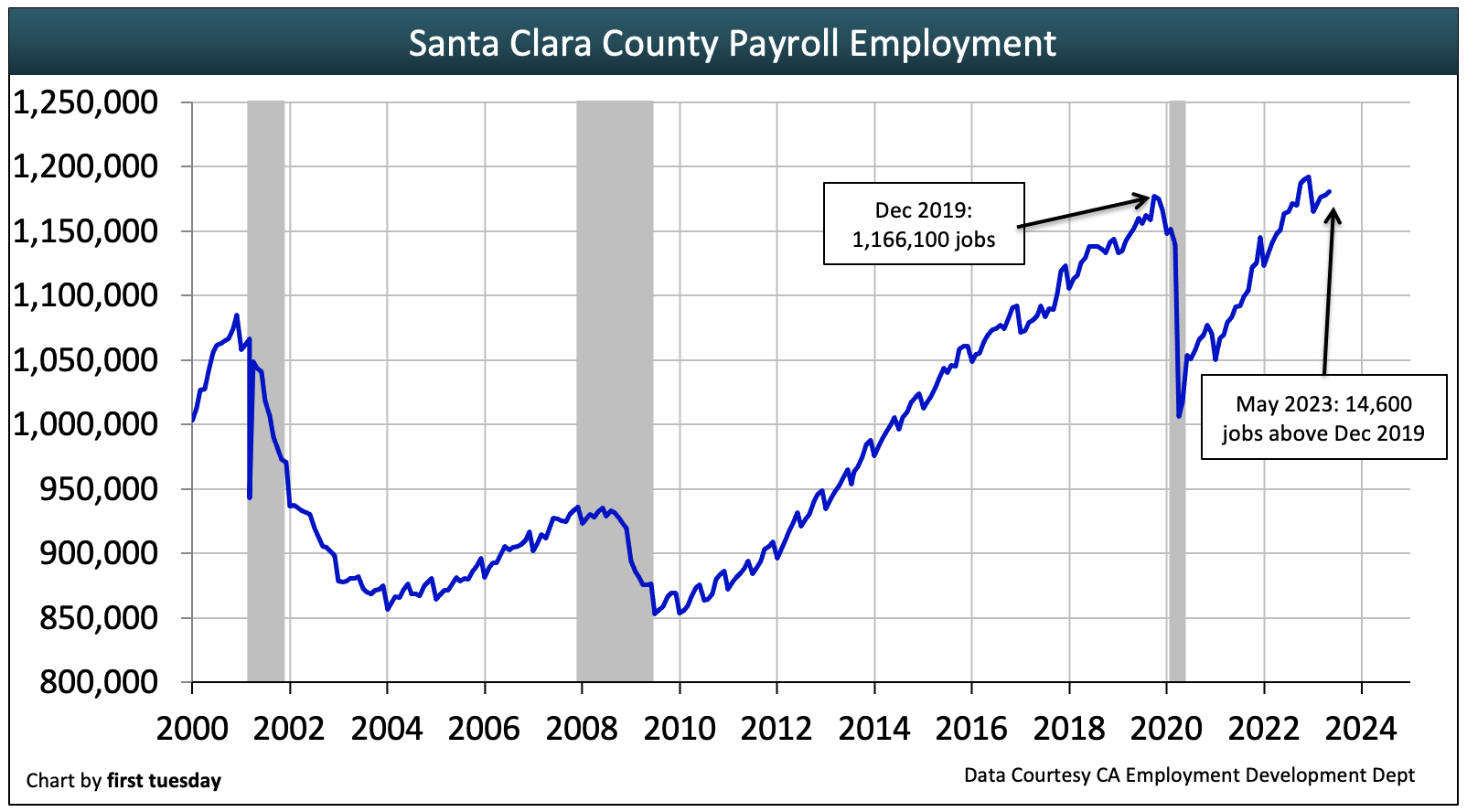

Without access to quality jobs, residents cannot qualify to buy or rent. Thus, employment is a leading indicator of the strength of Santa Clara’s housing market.

Santa Clara County passed the milestone of its pre-recession employment peak in early 2013. Accounting for a population gain of just over 100,000 individuals in Santa Clara County since the 2008 recession, it finally reached a full jobs recovery for its population in Q1 2015.

In contrast, the state of California only just reached pre-recession employment numbers at the end of 2014 and didn’t reach a post-population-gain recovery until 2019.

Why did Santa Clara’s job market recovered more quickly than the rest of the state, and did it do the same following the 2020 recession? Roughly one-quarter of the jobs added since the recovery from the 2008 recession have been in the Professional-Business Services industry. This includes all of those tech industry jobs. The bulk of other new jobs can be found in industries that support the tech industry.

However, what was gained can be lost. The economic response to COVID-19 caused record job losses across the state, and the San Jose metro area was no exception. As of May 2023, Santa Clara County has just finally recovered, now 14,600 jobs above its December 2019 peak. But gains are leveling off quickly, expected to decrease later in 2023 with the recession. Any measure of job losses holds back regional economic growth and withholds stability from the housing market.

Employment by industry

Chart update 08/21/23

| May 2023 | May 2022 | Annual change | |

Construction | 55,400 | 54,300 | +2.0% |

Real Estate Rentals & Leasing | 16,500 | 14,600 | +13.0% |

While the 2020 recession caused job losses across all industries, jobs are gradually returning. In the construction industry, jobs are well over the pre-recession peak. Expect the construction industry to rise further in the coming years as construction starts rise in response to ever-present demand for local housing, spurred on by California legislative efforts to induce more residential construction.

Further, the number of real estate professionals is experiencing a rebound in 2023. However, expect the number of real estate professionals decrease to continue in 2023-2024, reflective of rising interest rates and decreasing sales volume.

Related article:

Home sales volume impacts sales agent licensing and renewals

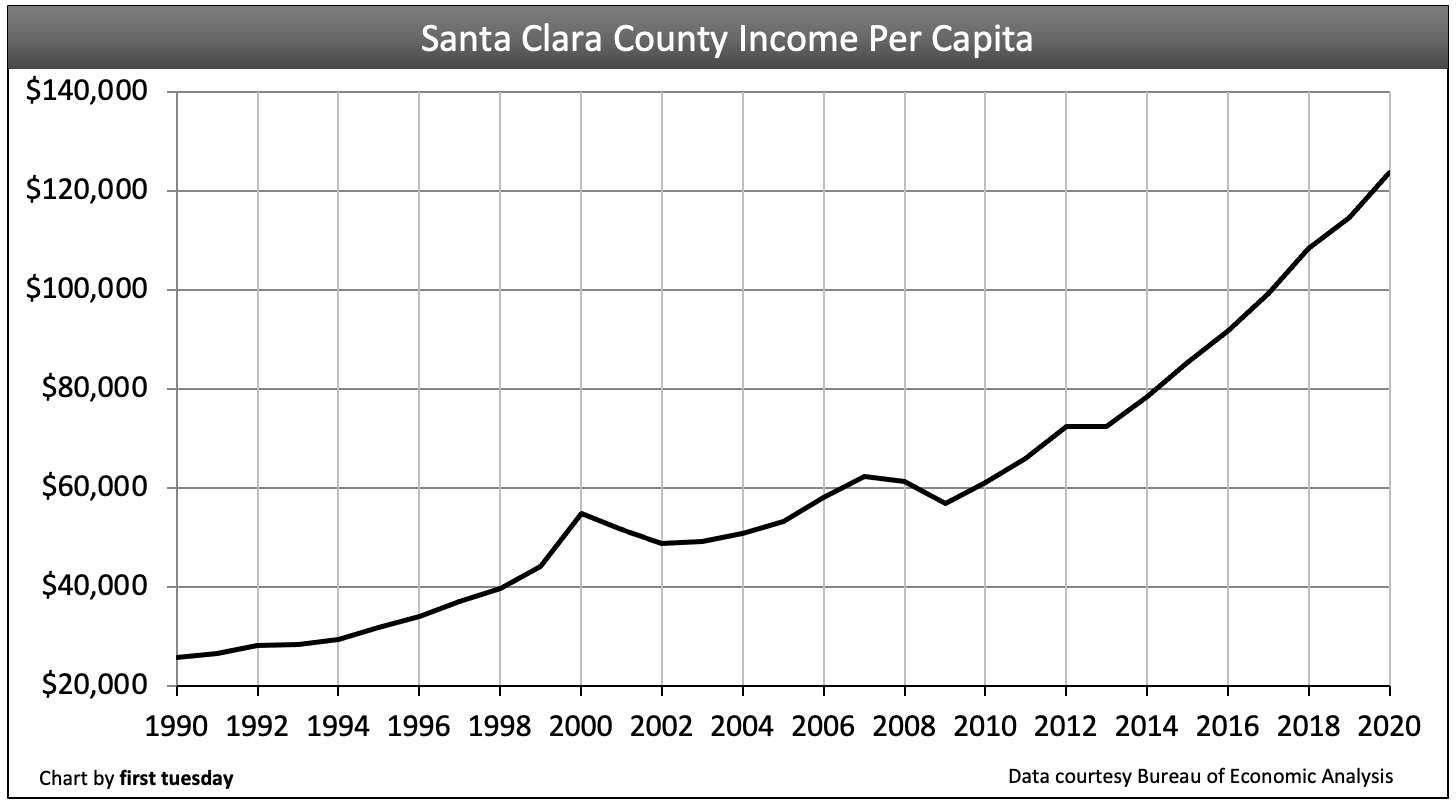

Income rising quickly

Chart update 05/11/22

| 2020 | 2019 | Annual change | |

| Santa Clara County per capita income | $123,700 | $114,600 | +7.9% |

| California per capita income | $70,700 | $65,300 | +8.3% |

Santa Clara County personal incomes are well above the statewide average. From 2019 to 2020, incomes increased 7.9% in the region, slightly less than the state average but still a significant increase.

But these income increases are not all that they seem. The high cost of housing in Santa Clara has pushed out many low- and moderate-income residents. So, while average incomes have increased in the region, the rapid pace of increase is at least partly due to many residents being forced to move to less costly areas.

Despite these relatively large income boosts, incomes actually need to increase much faster to meet the area’s rate of home price rise if home prices and rents are to be maintained. Home prices will need to fall in line with homebuyer incomes, especially as rising mortgage interest rates reduce buyer purchasing power in 2022. Along with global economic uncertainty and still-high home prices, homebuyer enthusiasm is beginning to be tempered by caution. Therefore, expect home prices to trend down in the second half of 2022 as we head into the next economic recession, forecasted to arrive by the end of 2023, bottoming in 2024.

Related article:

Can the Fed cool inflation without implementing another recession?

Despite limited inventory limiting sales volume, the Bay Area still seems to be heading for or going above the bubble zone.

Regardless of low inventory hurting sales volume, the Bay Area continues to look like it is approaching or extending into bubble territory.

I have renewed my license with First Tuesday . I started Real Estate in 1978.. I would like to ad First Tuesday to my face book friends and associates.

I read all your real Estate updates and would like to share them. Wanda J Birdsong

Wanda,

Thank you for renewing with first tuesday! If you would like to follow our Facebook page, you can find it here.

Regards,

ft Editorial

I get it. You repost as new (see the only comment – mine from 6 months ago). The premises found in the first two paragraphs are even more incorrect now than back then.

1) Housing recovery not ‘on its way.’ It reached new peaks and continued upward as of two years ago.

2) If high cost is a drag on demand then I would hate to see the 100+ offers per property that might occur instead of the 10-20 we have now for the northwestern quadrant (the most expensive part of the Valley). Send one of your staff here and I’ll drive them around for a half day to demonstrate my points.

Low home sales volume is not due to cost. It is due to inventory. (Perceived) Low demand is not due to cost. It is due to inventory. The basic concept of supply and demand might be a little low-brow for this article but it works a lot better than the theories postulated here.

Steeply rising prices are not a drag on sales volume. A lack of inventory is a drag on sales volume. No one wants to sell when their investment is going up 15-20% per year (for the last 4 years). Most properties coming on the market at or above the median of $900K will receive 3-10 offers or more. Some cities have less than 3 weeks of inventory compared to 4.5 months nationwide. It will slow down and volume will pick up when appreciation settles back to 4-7%.

Silicon Valley (Santa Clara County and half of San Mateo County) is a destination. Most homebuyers do not have an exit plan. They plan to stay indefinitely. They have 25% to 50%+ down payment the majority of the time and are tolerant of market cycles. It is mostly built out despite stories of new construction. Those locations have 1-2 hour commute times (each direction) to major employers along the Peninsula.