One in four renters struggle to make rent each month, according to a nationwide survey by Zillow.

Survey respondents were also asked to identify what they consider to be an appropriate percentage of their monthly income to allocate to rental payments. In the Western region of the U.S., respondents reported 36% was an appropriate amount, though they are willing to spend up to 43% on rent.

In contrast, Zillow shows most homeowners spend an average of 15% of their monthly income on housing costs.

In case you weren’t paying attention, that’s less than half what renters think is appropriate. Of course, this figure doesn’t account for large payments that occur less often, like the down payment, upfront transaction expenses or large scale maintenance projects. Thus, while homeowners spend less on housing costs on a monthly basis, they need to save more each month for those big costs.

Does it always make more sense to buy than rent?

As all veteran real estate practitioners surely know, it’s complicated by several factors unique to the potential homebuyer’s situation. The most significant factor is the length of time an owner plans on owning the home.

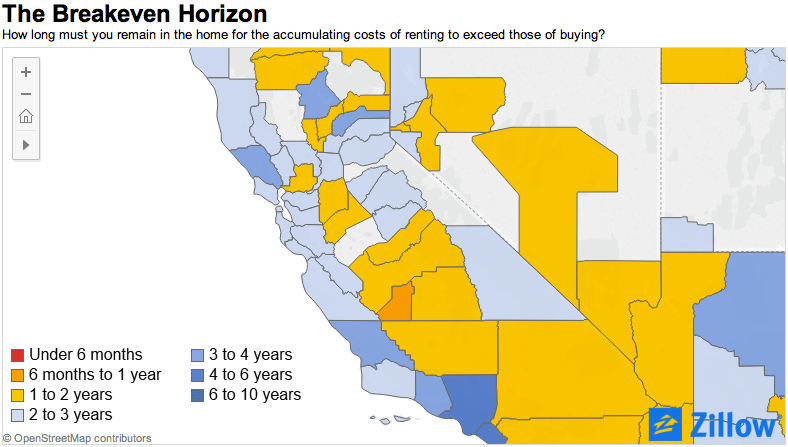

This map from Zillow shows the needed length of time to reach the breakeven horizon. This reveals how long a homeowner needs to own a home before selling it to financially justify owning versus renting. In California, homeowners need to own for longer along the coast (three years or more) than inland (two years or less).

The breakeven horizon of California’s largest metro areas varies wildly:

- Los Angeles has the fifth longest breakeven horizon in the entire nation, at 5.1 years;

- San Francisco is much lower at 2.6 years, as while it does have high home prices in the region, the stratospheric cost of renting is even harder to swallow;

- San Diego’s breakeven horizon is 3.8 years; and

- Riverside is very short, at just under 1.5 years, due to its low home prices.

Of course, these breakeven horizons are merely estimates by Zillow and can be swayed by months or even years due to unexpected changes in local home values or rents. However, they do offer an approximate idea of how long a homebuyer ought to plan on sticking around before upgrading or relocating for a new job, etc.

Aside from being uncertain about staying in the same area for long, what else is stopping renters from buying?

In the same Zillow survey, nearly 60% of those who currently rent in the Western region of the U.S. are doing so because of income or affordability issues. 27% said they preferred to rent rather than buy. Finally, 13% said they lacked savings for a down payment (without specifying the size of the desired down payment), a problem exacerbated by high rents (and no doubt student loans in the case of potential first-time homebuyers).

Real estate agents: if your town has a short breakeven horizon (like Riverside), be sure to let renters know.

Otherwise, if you work in a place with a long breakeven horizon (like Los Angeles), don’t despair. You’ll want to focus on renters who plan on living in the area for a while, which may mean middle-aged adults, rather than those younger members of Generation Y who are still settling down. Even if potential homebuyers don’t do the breakeven math, they’ll have a very good idea of what they can and can’t afford to get themselves into. Not everyone is ready for homeownership – now you just need to find those who are.

Check back for a form comparing the tax savings of owning versus renting, coming soon: first tuesday Form 320-4 Buy Versus Rent Comparison Analysis.