Lenders holding residential mortgages with loan-to-value ratios (LTVs) exceeding 80% cover their risk of loss on a default with insurance issued by two sources:

- Federal Housing Administration (FHA), the cost called mortgage insurance premiums (MIP); or

- private insurers, the cost called private mortgage insurance (PMI).

The homeowner pays the premium charged for the MIP/PMI insurance, in addition to interest accruing on the mortgage. The MIP/PMI premium is a rate charged on the principal owed and is set based on the LTV for the original mortgage amount, which varies depending on the amount of down payment. However, the rate of interest on the principal charged by the mortgage lender varies little to nothing for any level of down payment less than 20% of the secured property’s fair market value (FMV).

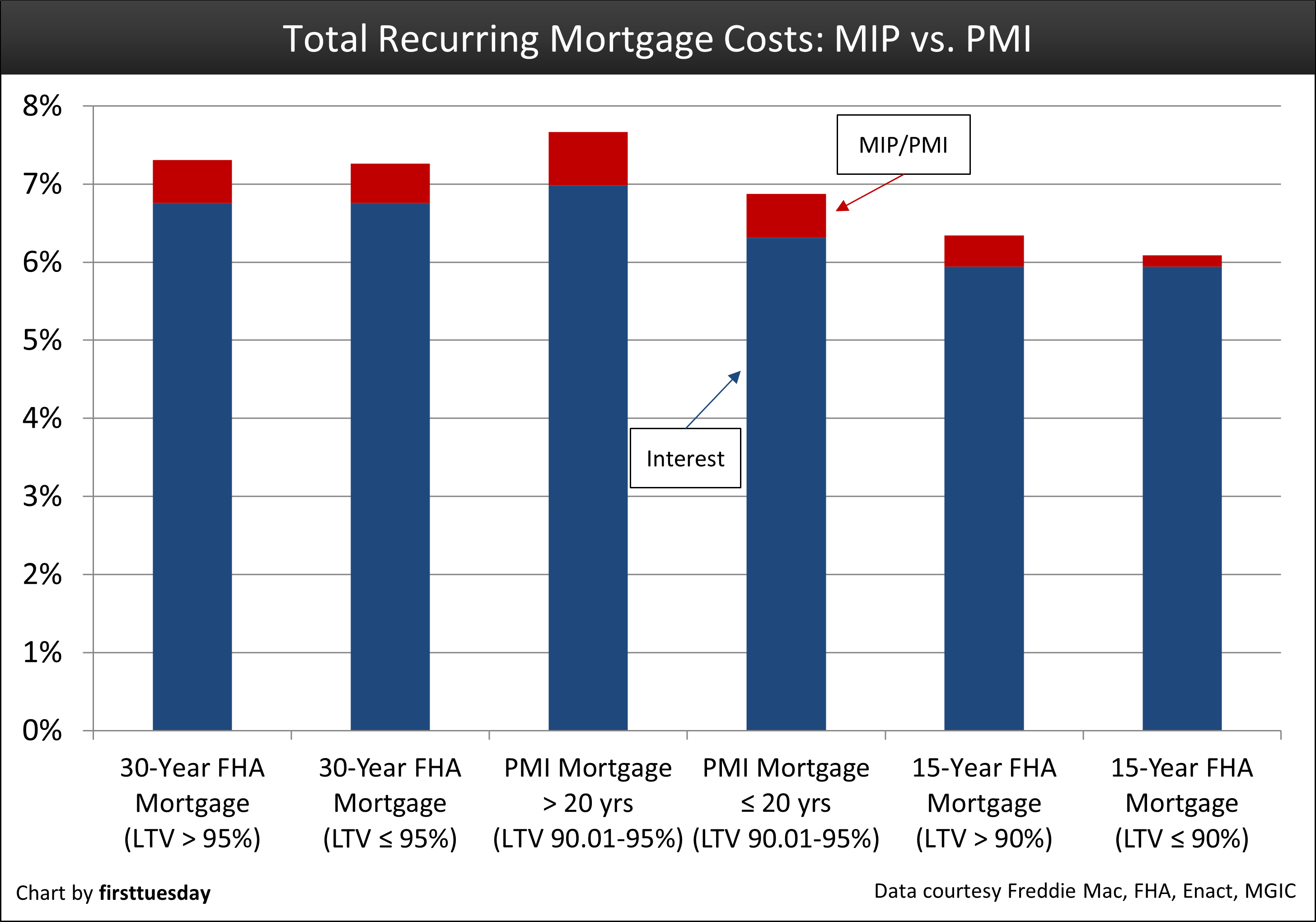

The premium rates charged for mortgage default insurance in March 2025 are:

- 55% MIP rate for an FHA mortgage with a 3.5% down payment

- 68% PMI rate for a similar mortgage with a 5% down payment

The PMI rate is slightly higher than the MIP rate on a similar 30-year FHA-insured mortgage. Since conventional mortgages requiring PMI also tend to have higher mortgage rates than FHA mortgages, FHA-insured mortgages are initially less expensive for buyers.

However, PMI permits the homeowner to cancel once they achieve 20% equity in their home. On the other hand, FHA-insured mortgages originated with a down payment of less than 10% of the purchase price may not be canceled unless the mortgage is prepaid by refinancing with a different type of mortgage or by selling the home. In today’s era of high rates, with mortgage rates trending higher in a 30-year half cycle beginning in 2013, refinancing will not reduce most homeowner’s mortgage payments.

The ongoing 2025 – 2027 real estate slowdown in transactions is causing for-sale inventory to bulk up. The enlarged inventory gives first-time homebuyers some relief from the steep competition that characterized the housing market in the low-price tier during the pandemic years.

However, first-time homebuyers reliant on PMI/MIP are likely to continue renting until prices demonstrate they have bottomed, expected to take place around 2027-2028. In the meantime, potential homebuyers continue to save for their 20% down payment to eliminate the need for mortgage insurance and be able to negotiate a lower mortgage rate.

Updated March 20, 2025.

Chart update 3/5/25

| Mortgage Type and Term | Average MIP/PMI |

| 30-Year FHA Mortgage (LTV > 95%) | 0.55% |

| 30-Year FHA Mortgage (LTV ≤ 95%) | 0.50% |

| PMI Mortgage > 20 Years (LTV 90.01-95%) | 0.68% |

| PMI Mortgage ≤ 20 Years (LTV 90.01-95%) | 0.56% |

| 15-Year FHA Mortgage (LTV > 90%) | 0.40% |

| 15-Year FHA Mortgage (LTV ≤ 90%) | 0.15% |

This chart tracks the cumulative annual percentage rate paid by homebuyers for their purchase-assist mortgage financing when the principal amount of the mortgage funds on origination is in excess of 80% LTV. The cumulative rate comprises the premium rate for mortgage default insurance and the interest rate on a 30- or 15-year FRM.

A simple reason exists for the tandem total rate rather than a single rate the borrower incurs as the annual cost of borrowing mortgage funds on a less than 20% downpayment transaction. Mortgage lenders are unable to determine the interest rate they need to charge to include the risk premium to cover their exposure to loss due to defaults on mortgages with an LTV greater than 80%. So the risk is shifted to insurers who will take that bet for the premium they charge to cover the risk.

Editor’s note – Mortgage rates were obtained from an independent source to compare 30- and 15-year FHA FRM rates with conventional 30- and 20-year FRM rates.

The chart includes interest and premium rates charged for both:

- mortgage default insurance provided by the Federal Housing Administration (FHA), called mortgage insurance premium (MIP); and

- private mortgage insurance (PMI), an alternative form of default insurance provided by private insurers.

Rates shown are sample rates for mortgage commitments in the U.S. as reported by Freddie Mac. PMI rates listed on the chart are the average rates offered by California’s two largest PMI providers: MGIC and Enact.

The PMI rates are for 25% loss coverage on 30- and 20-year conforming FRMs originated at a loan-to-value ratio (LTV) of 90.01-95% on appraised value, secured by the single family residence (SFR) occupied as the primary residence of a homebuyer with an average credit score of 700.

Mortgage choices for the homebuyer

As a general rule, mortgage lenders use a qualifying debt-to-income (DTI) ratio of 31% of the buyer’s gross income to set the buyer’s maximum permissible monthly mortgage payment. The total monthly payment on an MIP/PMI-insured mortgage includes:

- principal and interest (PI);

- impounds (TI) for MIP/PMI, and

- possibly hazard insurance premiums, property taxes, HOA assessments and payments on Mello-Roos improvement bonds.

Thus, the inclusion of MIP/PMI in the total monthly payment diminishes buyer purchasing power by reducing the amount the buyer can borrow due to their inability to make at least a 20% down payment.

Related article:

The MIP offered by the FHA covers the mortgage holder’s losses on a default in mortgages originated with homebuyers who pay a low down payment — typically 3.5%.

PMI is the only alternative to mortgage insurance issued by the FHA on home mortgages. PMI insurers along with the mortgages they insure require a higher down payment and more stringent credit score requirements than the FHA. However, PMI insurers tend to offer a lower premium rate with a greater percentage down payment.

Also, unlike the FHA’s MIP, PMI can be removed when the mortgage balance is reduced to an LTV of 80% of the home value at the time the mortgage was originated and is automatically cancelled at an LTV of 78%.

However, removal of FHA mortgage MIP relates back to the original LTV, such as for:

- an original LTV greater than 90%; the MIP remains payable for the life of the mortgage, or 30 years, whichever occurs first; or

- an original LTV 90% or less; the MIP can be removed after 11 years.

Thus, use of PMI offers homebuyers the advantage of ending the PMI premium payments earlier than the FHA’s MIP payments.

In August 2014 — the last month of available data — 19% of Southern California mortgages were insured by the FHA, according to Dataquick. This is level with one year earlier. The remainder were either uninsured (meaning they made a down payment of over 20%) or covered by PMI.

More reasoning for a 20% down payment

Buyers with sufficient cash on hand for a down payment of 20% or greater avoid:

- PMI; and

- MIP, except in the rare instance a borrower with a 20% or greater down payment only qualifies for FHA financing.

The homebuyer with the financial ability to make a 20% down payment avoids the MIP and PMI and achieves a better financial result due to their ability to either:

- borrow a greater amount of purchase-assist mortgage money, usually at a lower interest rate than when MIP/PMI is involved; or

- make a lower monthly payment without borrowing a greater amount.

An MIP/PMI premium of 1% of the mortgage balance turns into a cost to the homebuyer of 6% to 16% on the down payment funds unavailable to fund a 20% down payment.

Of course, the cash used to fund a 20% down payment no longer earns interest in a savings account. Here, the amount of interest earned on savings is compared to the opportunity cost lost for not moving funds from savings into the equity in a home to avoid PMI premiums (and avoid interest on what would be the mortgage amount exceeding 80% LTV eliminated by a 20% down payment).

The homebuyer gains some interest earnings by holding onto their cash savings. However, the cost of holding onto the cash, for whatever reason, rather than avoiding the PMI/MIP, is far greater than the earnings on that cash in a savings account.

Example: Different down payment amounts

For instance, consider the homebuyer who purchases a property priced at $300,000 with a 5% down payment ($15,000). To fund the remainder of the purchase price, the homebuyer considers a 30-year FRM with PMI premiums.

With a down payment of less than 20%, the premiums for the required PMI add an annual expense — in March 2025 — equal to 0.68% of the mortgage balance.

The homebuyer has savings or access to funds for another $45,000 which are available to increase the down payment to the 20% mark and avoid PMI.

Applying this mortgage leveraging at our 95% financing of $285,000, the PMI premium charge payable for the first year will be roughly $1,940. The homebuyer entirely avoids the premium when $45,000 is withdrawn from savings and used to increase the down payment to 20% of the price.

The $45,000 is earning 1% in a bank account — $450 annually — which will be forgone on use of the savings to increase the down payment.

Here, the use of the additional $45,000 to increase the down payment to 20% earns $1,940 in cost saved during the first year of ownership by eliminating PMI premiums. For analysis, this savings is a 4.31% annual rate of return on the $45,000, four times more than earnings on the cash had the funds remained in the savings account.

Each year following will realize slightly lesser amounts “saved.” When the mortgage principal is reduced to 80% of the home’s value, PMI is no longer required and thus no further savings of PMI premiums in the following years. Should an appraisal show the home increased in value to an LTV of 78%, the homeowner will have needed to own the home for at least five years before mortgage insurance is no longer required.

Editor’s note — Consider also: The yield on the down payment earned by PMI avoidance is in addition to the implicit rent a homeowner “receives” for their use of the home they own. The rent payment avoided – implicitly received as an owner occupant — is a return on the price paid for the property, of which a 20% portion is attributed to the down payment.

Homebuyers able to make a 20% down payment need advice from their agent about the financial options available to them in a transaction. With information, the buyer can consider whether to make the greater down payment. The result: a higher rate of return received on the amount of the homebuyer’s savings when used to increase the down payment and reduce the cost of ownership by the amount of the MIP/PMI.

Additionally, the 20% down payment avoids interest on the mortgage amount exceeding 80% LTV which was not borrowed, at, say, a rate of 7%, and thus earned by the greater down payment.

Thank you for sharing the informative article.

AS a Mortgage Banker who has closed many Short Sale Purchases with a 2nd loan in California I see a 10% buy out to the holder of the 2nd. Although I am not in on the up front paper work concerning the Short Sale Agreement I do see the final Agreement and Bank Approvals on the Short Sale. What I am seeing here is a 10% buyout either all from the holder of the First or a combined 10% buy out with the holder of the first and the new buyer. On a $30,000 2nd loan the $3,000 buy out on that 2nd could be paid by the new Buyer or paid 1/2 each from the holder of the first note and the new buyer. I have also seen the Real Estate Agent for the Seller and the Buyer agreeing to a small reduction in Commission on that 10% buy out on the 2nd to make the Short Sale Purchase happen. I do not understand why some lenders who hold the 2nd note would decide to take nothing over a little must center around some kind of a tax advantage that I have not heard about. I too would love to know why this is taking place. In California the lenders have no recourse on collecting either way unless they agree to a short pay off of the loan, so why not go for it. I do not get it.

Hello Bradley,

Im not sure if you can answer my question, have you had any experience with GMAC FIXED SECOND (E-TRADE) IS THE INVESTOR.My client has lost 1 buyer because they will only release the lien and not the liability (this is a investment property) and they are now on there 2nd buyer and e-trade is demanding 11,000.00 on a 30,000.00 second.The first has offered them 3,000.00 and theseller has offered 5,000.00 to settle.The luck as of yet. The selling agent is at a lost and has no idea how to proceed,should we just throw our hands up and say ill be sending the keys in …start the forclousure process and E-TRADE geys no money.Thanks for your time.