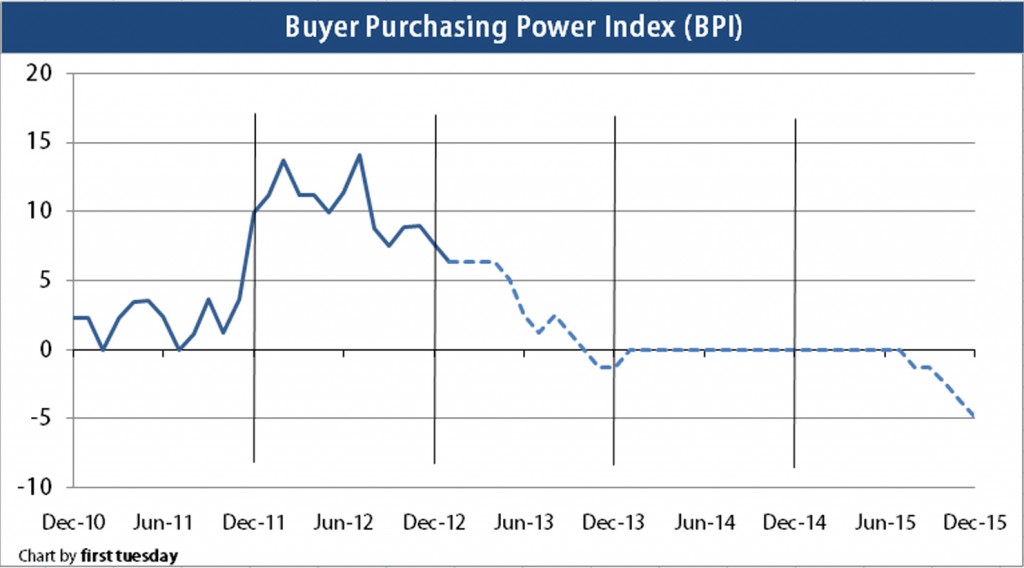

The buyer purchasing power index (BPI) decreased to 6.36 in January 2013. While 6.36 is a high score, it is down slightly from the prior month when the BPI was 7.7. This month’s BPI represents a 6.36% increase in mortgage funds available to today’s buyers over one year earlier. All figures remain positive for short-term upward home price movement.

first tuesday forecasts the BPI will drop to zero by mid-2013 and remain there throughout 2014. The BPI will go negative in 2015 when long-term rates rise due to an improving economy. Sellers will then experience downward pressure on prices, as buyers are able to borrow less with the same income.

| January 2013 | December 2012 | January 2012 | |

| Buyer purchasing power index (BPI) | 6.36 | 7.7 | 11.23 |

The BPI is calculated using the average 30-year fixed rate mortgage (FRM) rate from Freddie Mac (Western region) and the median income in California.

A positive index number means buyers can borrow more money this year than one year earlier.

A negative index figure translates to a reduced amount of mortgage funds available.

An index of zero means there was no year-over-year change in the amount a buyer can borrow. At a BPI of zero, prices cannot rise unless buyers resort to ARM financing techniques.

As BPI rises, a buyer can borrow more money and purchase a more expensive home, but still make the same monthly payment they would have made one year earlier when mortgage money was more expensive.

—

first tuesday journal online is a real estate news source. It provides analyses and forecasts for the California real estate market, and has done so since 1978.