A crisis squandered by an inactive government

Conventional wisdom holds that foreclosures are triggered when homeowners owe more on their mortgages than the fair market value (FMV) of their homes — in other words, when they are underwater. This is a financial condition called negative equity.

Updated December 8, 2025

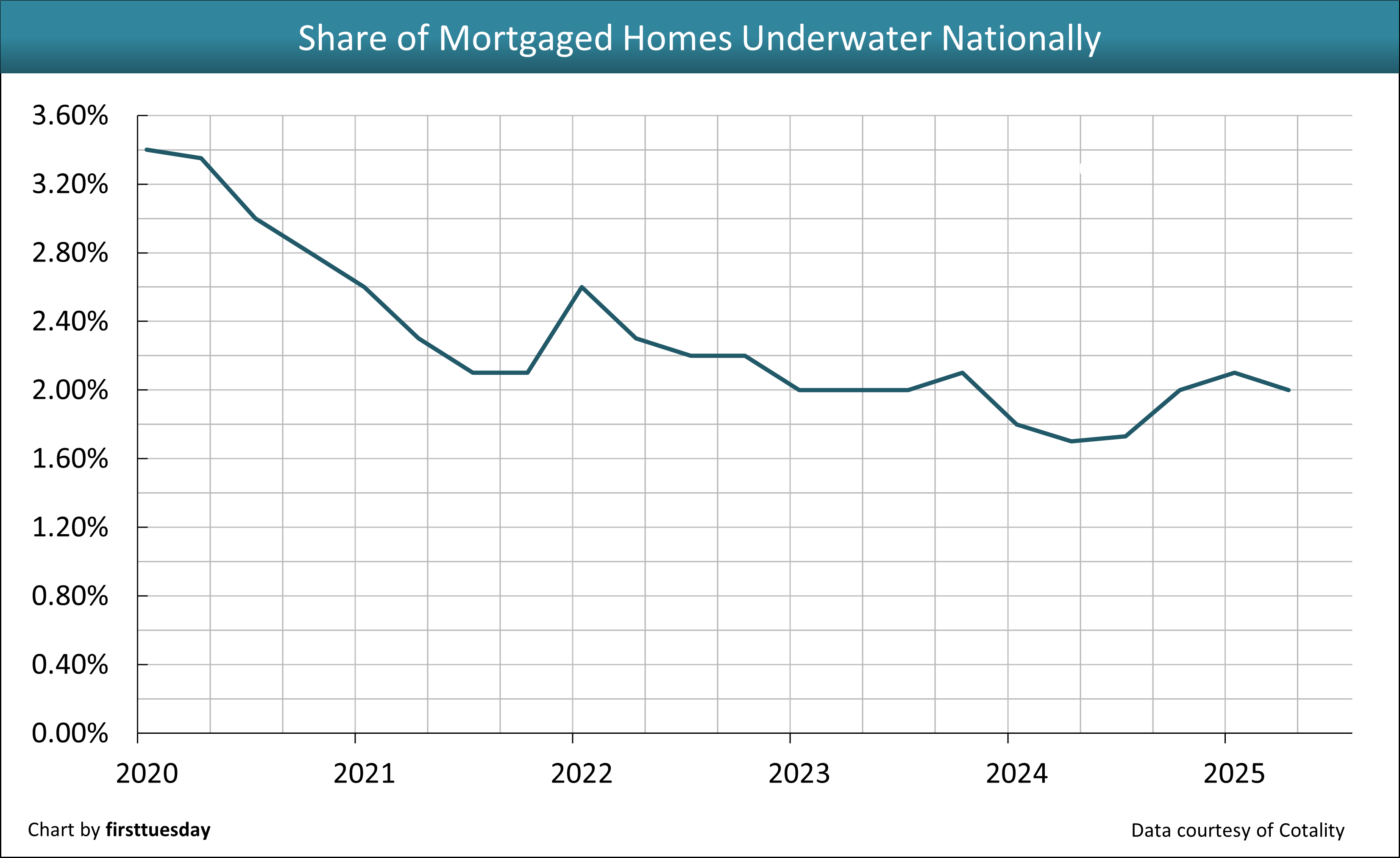

Chart 1

Chart update 12/12/25

| Q2 2025 | Q2 2024 | Annual Change | |

| Percentage of homes with negative equity nationwide | 2.00% | 1.70% | +15% |

Experienced by a debilitating one-third of California’s homeowner population in the years immediately following the Millennium Boom, negative equity is universally feared by homeowners, lenders and policymakers alike. Consistent with this wisdom, negative equity is often blamed as the primary cause for the rise in foreclosures that invariably accompanies a bust in real estate pricing which reoccurs cyclically.

In response to the huge increase in households with negative equity homeownership and the corresponding foreclosure frenzy in 2008-2011, the government unleashed a series of policies attempting to induce lenders to offer mortgage modification in lieu of foreclosure.

If negative equity is the problem, mortgage modifications, most effectively in the form of reduced mortgage debt (also known as a cramdown), are the preferred solution. But the government in 2005 put an end to mortgage cramdowns for families who owned the home they lived in. Yet government efforts to generate mortgage modifications were largely unsuccessful as the only viable alternative to cramdowns, default and lender foreclosure.

The lending industry historically disregards government incentives to modify mortgages. However, lenders are less able to ignore the lawsuits of state attorneys general, which do induce action. Without modifications, marginally insolvent homeowners with negative equity default and go into foreclosure, a drag on the state’s economy. Just in California, some 1.1 million households lost their homes in the 2008 Great Recession period through 2012.

When lenders do choose to modify a mortgage, they leave the mortgage balance intact, limiting the modification to a mere reduction of the dollar amount of scheduled payments or their deferral in exchange for an elongated term.

That lender perspective is best encapsulated in a 2008 study from the Federal Reserve Bank of Boston (FRBB).

Contrary to popular belief, the FRBB study found negative equity on its own is rarely sufficient to induce foreclosure. By examining historic foreclosure rates in Massachusetts over a 20-year period, the report’s authors discovered that over 90% of homeowners with negative equity continued to pay their mortgages.

What then would compel a negative equity owner to strategically default?

A 2016 paper by the FRBB identified the main culprit for strategic default — job loss or other financial shock. Negative equity status was revealed to rarely play a primary role. This fact is not lost on mortgage lenders.

Further, the 2016 report demonstrates that strategic default almost always remains a seldom-used option for homeowners. The homeowner is faced with many economic disincentives that accompany the foreclosure process. These drive negative equity owners to hold on to their homes, in spite of the long-term personal and financial costs imposed by ownership. As a result, they become prisoners in their own homes, policed by lenders seeking to keep their mortgages performing.

Negative equity — plus a shock — spells default

Even when the outstanding mortgage balance exceeds the home’s market value, it is almost always a more fiscally sound decision for homeowners to continue making payments on their mortgages when they are able, according to the FRBB report.

This is due to:

- the costs of relocating;

- the damage done to credit; and

- the emotional distress associated with failing to keep their home.

Combined, these factors keep homeowners in their residences — imprisoned — unless some additional external factor tips the scale of their judgment.

If the preponderance of underwater homeowners are not in fact at risk of default due to inability to pay, then mortgage modifications that reduce the mortgage balance or interest rate are an unnecessary loss for lenders.

Why would lenders effectively offer discounts to owners who would never have defaulted in the first place?

This logic also applies to the approval of a short sale.

Short sale approval involves a discount given to owners who must first default and force adverse credit reporting and notices of foreclosure when they actively seek a way out from under what has become an onerous mortgage debt. Here, the owner forces the issue by selling at current prices, contingent on the lender discounting for a final payoff in what becomes a full satisfaction of the total mortgage debt.

The sole relief is the availability of forbearance agreements which temporarily reduce or defer monthly mortgage payments but do not alter the original terms of the mortgage. These are far more frequently considered by lenders. Unlike other measures, forbearance agreements are economically beneficial only to homeowners at serious risk of foreclosure. Lenders who use forbearance agreements can thus direct their resources where they will be most effective — foreclosing on the insolvent homeowners.

During 2020-2021, heightened numbers of homeowners entered forbearance programs under the Coronavirus Aid, Relief and Economic Security (CARES) Act — it was a time consisting of record-low foreclosures, despite high levels of job loss and mortgage defaults.

The share of mortgages in forbearance peaked at 8.5% in May 2020 when 3.35% of mortgaged homes nationally were underwater. This steadily declined as homeowners regained jobs lost during the 2020 recession. Homeowners were further buoyed by multiple rounds of government-sponsored stimulus, in the form of direct checks to taxpayers and extra cash to businesses willing to hire during the recession.

Without the need to sell, homeowners who would have completed a forced sale instead kept their home off the market, shielded by forbearance while their incomes returned. This contributed to record-low levels of for-sale inventory during 2021 which rippled through California into a near 33% increase in home prices within 12 months.

Looking back at the short 2020 recession, government forbearance programs and stimulus payments were the cure to keep homeowners housed while employment numbers caught up. Without a return of government-backed housing relief, the only cure available to a mortgaged homeowner who slips underwater is strategic default. Cramdown provisions for the bankruptcy code to permit homeowners to reduce the mortgage debt to the market value of the property, as permitted before 2005, was unacceptable for policy makers.

Related article:

California’s for sale inventory: a symptom of seller reluctance in 2023

Negative equity in the years ahead

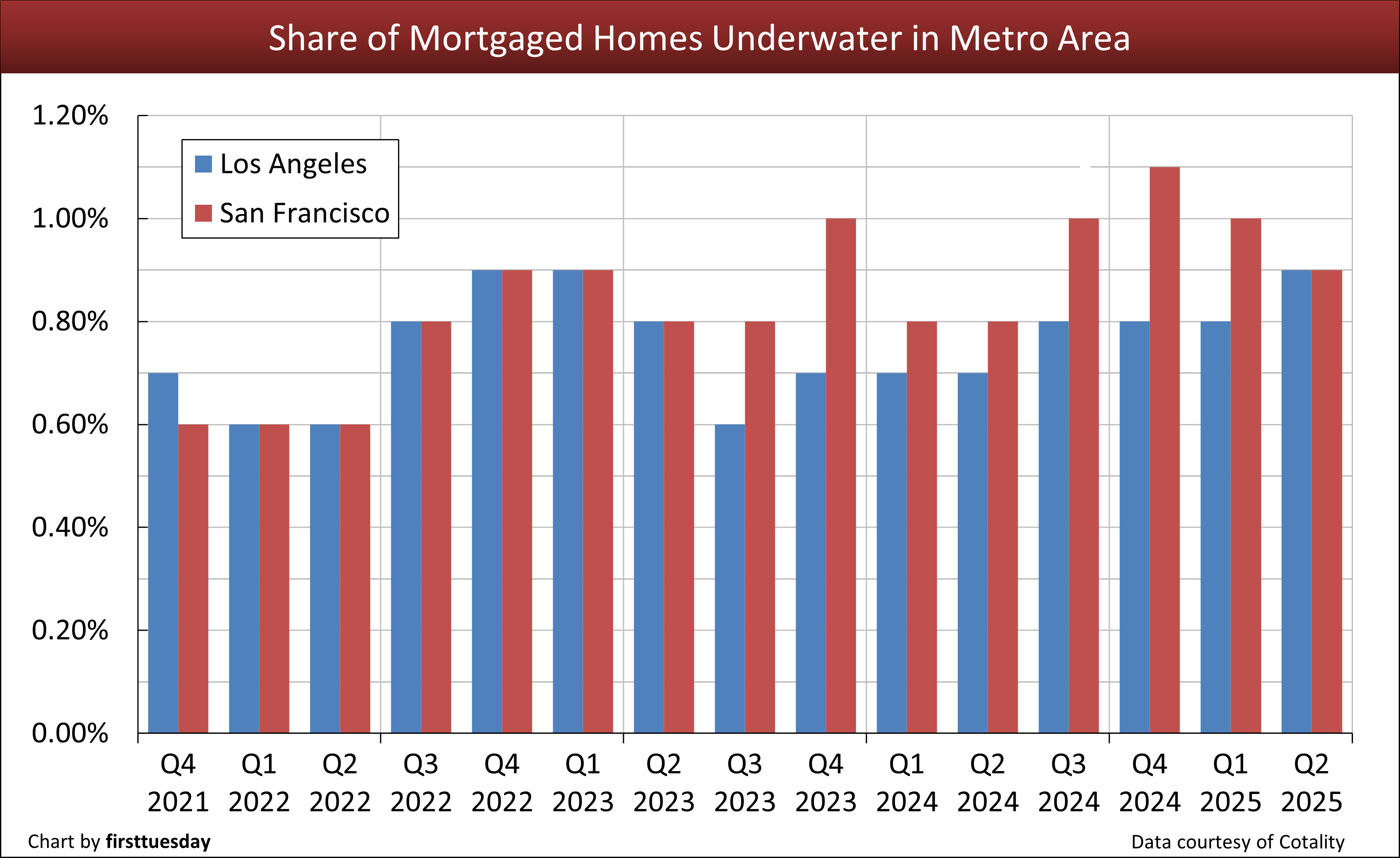

Chart 2

Chart update 12/12/25

| Q2 2025 | Q2 2024 | Annual Change | |

| Percentage of Los Angeles homes with negative equity | 0.9% | 0.7% | +22% |

| Percentage of San Francisco homes with negative equity | 0.9% | 0.8% | +11% |

The share of mortgaged homes with negative equity in California’s influential metro areas increased slightly in the years since recovering from the pandemic economy and are far below the national average. However, watch for this number to rise through 2026, as the price decline resumes following 2022’s price peak which continues to decline throughout the state. For perspective, a whopping 37% of mortgaged California homeowners were underwater at the height of the foreclosure crisis, in the first quarter of 2010, two full years into the Great Recession.

As home prices continue to contract over the next two-to-three years, watch for the share of underwater homes to rise rapidly, plunging anyone who purchased after 2021 with a minimal down payment and high mortgage rate deep underwater.

Real estate professionals can get ahead of rising owner need to sell by learning to assist underwater homeowners. Gathering options for homeowners facing negative equity on top of an inability to pay or a need to move will prepare agents to work with a larger share of clients in the down years ahead.

Stay on top of the latest market developments with firsttuesday.

Related video: