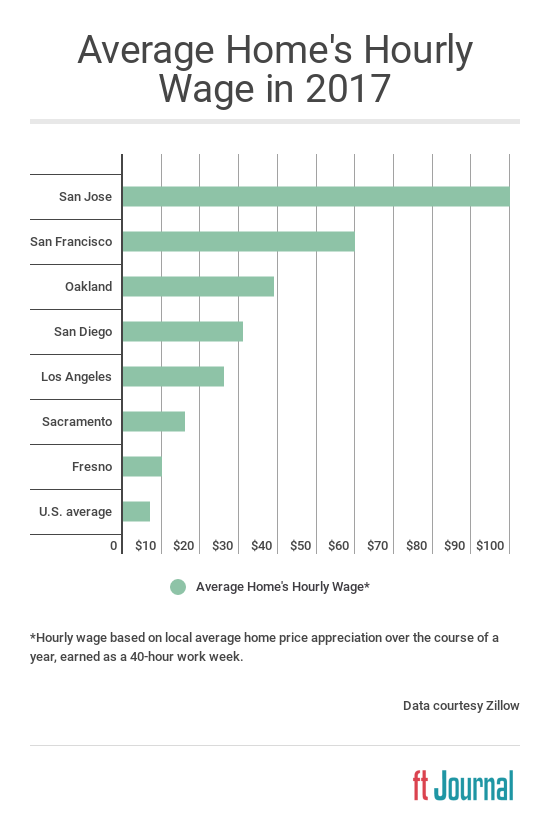

Here’s a new way to think about home price appreciation:

If the average U.S. home worked a 40-hour work week (because, why not?), in 2017 it would have earned $7.09 an hour based on home price appreciation alone. This translates to an average home value increase of $14,800 over the course of a year, according to Zillow.

For those who cash out on their home’s increased value, that’s not a bad side gig, right?

Further, keep in mind that’s just the national average — when you look at California, homes are paying out a much higher “hourly wage.”

Take San Jose, where the average home value increased an astounding $200,000 over the course of 2017. That translates to an hourly wage of $100 an hour.

Though an “average” home price is just a crude mathematical yardstick — not a literal property — this juicy “hourly wage” rubric can be particularly compelling for those on the fence of purchasing.

Should we all be flipping homes?

These impressive dollar amounts may tempt you to neglect your buyer and seller clients and get into the flipping business instead.

However, these “hourly wages” come with a huge caveat — a homeowner needs to sell their home before they can cash out. Further, when it comes time to sell, sellers don’t receive the full amount their homes have appreciated. Their bottom line is diminished by:

- agent fees;

- the costs of fixing up their home to sell;

- moving costs, if they live in the home;

- buyer concessions;

- transfer taxes; and

- capital gains taxes (except when they are selling a home which has been their primary residence for at least two of the past five years).

Further, these dollar amounts are not guaranteed. Buying a home for investment purposes is inherently risky — just ask anyone who purchased in the years leading up to the 2008 recession.

The safest way to make a home purchase is to plan on owning it long-term. This is true whether you plan on purchasing a home to live in, or to rent out as a long-term investment.

This is especially true as we are quickly approaching an inevitable slowdown in home prices as the next economic recession looms. Home sales volume has already flattened and interest rates continue to rise in 2018. These signs point to slowing home price increases in 2018, potentially flattening by 2019.

You can inform your buyers of the “hourly wage” calculation, but make sure they’re aware of the broader truth: given time, home values keep up with and often exceed inflation, making a long-term home purchase a wise financial investment. This is true no matter when you purchase during the home price cycle.

On the other hand, flipping homes is a risky investment choice, one that pays off while the market is hot, but ends in foreclosure and financial ruin when the inevitable downturn occurs.

Related article: