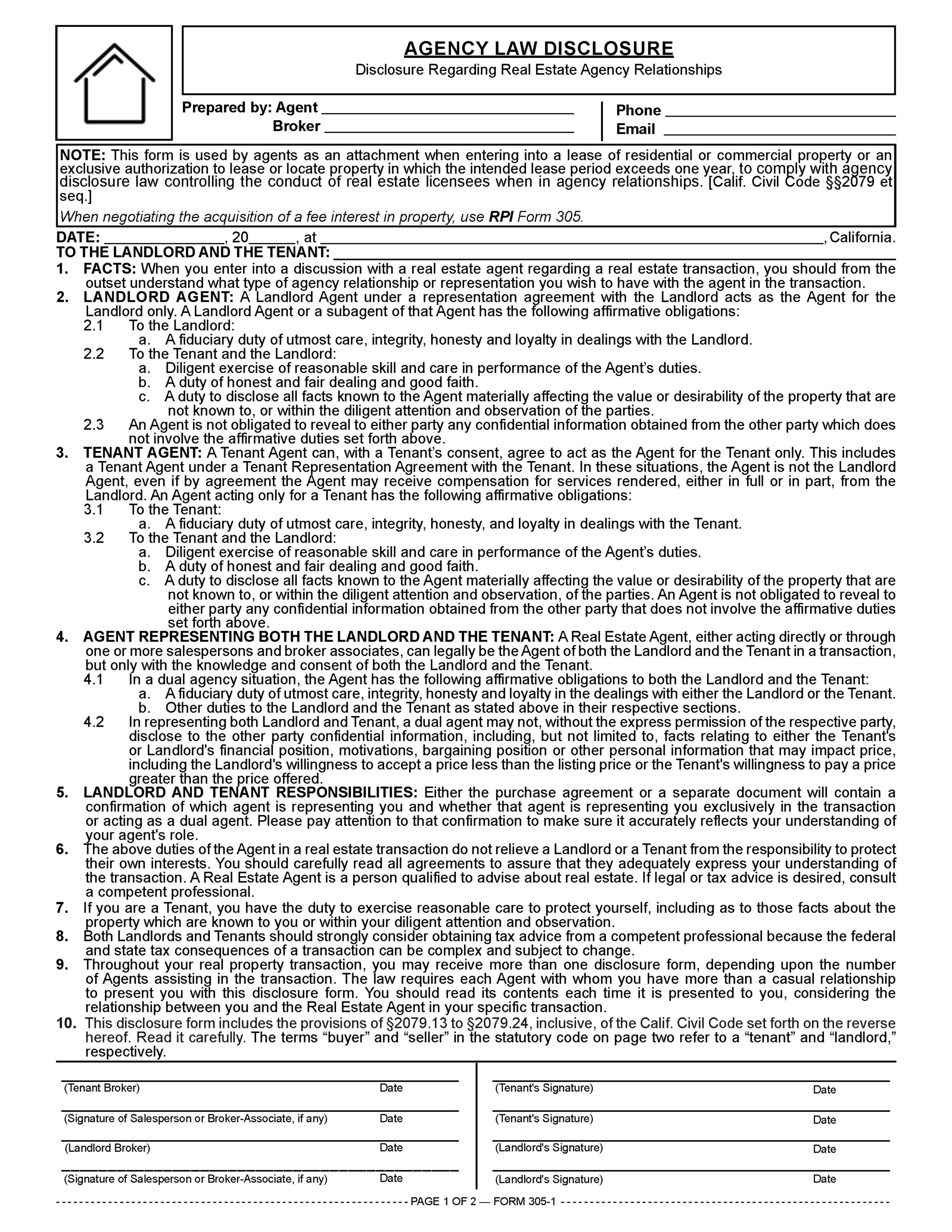

This form is used by agents as an attachment when entering into a lease of residential or commercial property or an exclusive authorization to lease or locate property in which the intended lease period exceeds one year, to comply with agency disclosure law controlling the conduct of real estate licensees when in agency relationships. [Calif. Civil Code §§2079 et seq.]

Legislated order quells willfully cultured chaos

The Agency Law Disclosure is handed to all participants when listing, selling, buying or leasing for a term greater than one year:

- property containing one-to-four residential units;

- mobilehomes; and

- commercial property. [Calif. Civil Code §§2079.13(j), 2079.14]

Editor’s note — Among all types of real estate, only multi-family apartment sales of five or more units remain outside the agency disclosure law, but not so for residential property leases over one year.

At its core, the Agency Law Disclosure is a restatement of conduct as voiced by codes and case law. The disclosure categorizes and defines agency relationships for licensees acting on behalf of another person in all real estate sales transactions and leases exceeding a one year term. [See RPI Form 305, 305-1 and 550-2]

To cover the distinctions in nomenclature between sales and leasing transactions, Realty Publications, Inc. (RPI) publishes two different versions of the agency disclosure form to enhance comprehension.

Each version contains language engineered to best identify the participants involved in the two sets of transactions:

- the sale or exchangeof any real estate [See RPI Form 305]; or

- the lease for a period exceeding one year [See RPI Form 305-1 and 550-2]

Editor’s note —Two identical versions of the agency disclosure exist for leasing to place the form in both the “disclosure” and “property management” series of RPI forms. Either may be used when negotiating a listing, offer/letter of intent (LOI) or agreement for the lease of real estate for a period greater than one year. [See RPI Form 305-1 and 550-2]

The objective for the mandatory inclusion of the real estate agency disclosure law in transaction documents is for agents to actually inform the public (and licensees so they are able to answer agency questions) about the duties a licensee owes to members of the public, be they an owner, buyer or tenant.

The law was put in place to eliminate omissions about the agency duties of agents, and misconceptions or ignorance about a licensee’s duty by members of the public, also known as principals.

Further, the agency disclosure law created not just one, but two separate sets of agency-related disclosures to be made by agents in real estate sales and leasing transactions:

- an Agency Law Disclosure form discussed above — to be attached to employment agreements (listings) and lease agreements for a term greater than one year, to set out the “rules of agency” advising on the conduct expected of real estate licensees when dealing with the public in their capacity as a licensee [See RPIForm 305, 305-1 and 550-2]; and

- an agency confirmation provision— contained in purchase agreements, LOIs and any documents used to negotiate the lease of real estate with a term exceeding one year, to declare the agency relationships acted upon by each participant’s agent in the transaction. [See RPI Form 550]

Uniform jargon and the agency law

The Agency Law Disclosure is used by brokers and their agents, to both educate themselves and familiarize participants in real estate transactions with:

- the uniform jargonused in real estate transactions; and

- the various agency roleslicensees undertake on behalf of the landlords and tenants they represent in leasing transactions.

The rules of agency in California are presented in the two-page disclosure form. The exact wording of its content is dictated by statute and thus is nearly identical across all form publishers.

Editor’s note — The statutory language is phrased explicitly in the context of real estate sales, not leases, a conceptual deficiency suggesting the statute should have provided a code section and form for both a sale and a lease transaction.

While most publishers have only a one-size-fits-all Agency Law Disclosure, RPI provides a variation referencing landlord and tenant on the first page of the form as the transaction participants, instead of inarticulately referencing them as the “seller and buyer.” [See RPI Form 305-1 and 550-2]

The entries made by the agent using the form identify the document it accompanies, the participants involved and the signatures obtained. [CC §2079.16; see RPI Form 305, 305-1 and 550-2]

The second page of the Agency Law Disclosure defines words and explains phrases commonly used as descriptive jargon within the real estate industry and is an exact reproduction of the controlling code. Though the code is worded in the context of an agent representing a buyer or seller, the same rules of conduct and disclosure apply for an agent of a tenant or landlord, respectively. Here, the tenant is cast as the buyer while the landlord is cast as the seller, requiring the reader to translate to apply the rules to leasing situations.

Industry jargon is commonly used to express:

- the agency relationships of brokers to the participants in a transaction;

- broker-to-broker relationships; and

- the employment relationship between brokers and their agents.

The Agency Law Disclosure does not mention, much less define, the broker’s role as an exclusive agent for either the tenant or landlord. Yet the separate agency confirmation provision, included in the lease of more than one year on all properties, calls for the broker to determine their agency status and timely disclose it to all participants. [See RPI Form 550]

The mandated provision permits the broker to characterize their conduct with the participants as the agent of the “landlord exclusively” or the “tenant exclusively.” [See RPI Form 550]

These exclusive characterizations of agency conduct have no relationship to employment created under exclusive authorizations to lease property or locate space. [See RPI Form 110 and 111]

The landlord’s agent under an authorization to lease understands the prospective tenant may turn out to be one of their tenant clients. This representation of opposing participants makes the broker a “non-exclusive” dual agent, totally unrelated to any exclusive employment of the broker on a listing by either the tenant or landlord.

The participants, their brokers and the duties owed to all

The Agency Law Disclosure states the principles of law governing the conduct of brokers who are acting as agents solely for a tenant or landlord. [See RPI Form 305-1 and 550-2]

Here, broker obligations owed to the participants in a real estate transaction are divided into two categories:

- the special or primary agency duties of an agent owed by a broker and their agents to their principal, stated as fiduciary duties; and

- the general duties owed by each broker to all participants in the transaction, requiring them act honestly and avoid deceitful conduct, known as general duties.

Failure to disclose has adverse fee consequences

Failure of the landlord’s or tenant’s agent to hand their client the Agency Law Disclosure form prior to entering into an exclusive authorization to lease or locate space is a violation of real estate law which carries penalties.

As a consequence of this up-front failure, the broker stands to lose their fee when challenged by the landlord or tenant prior to payment of the fee.

Thus, procedurally, the Agency Law Disclosure form is treated as a preliminary and compulsory listing associated event. When not made part of the authorization to lease or locate space by attachment, the broker cannot reasonably expect to enforce collection of their fee when the property is leased — even after the brokerage fee has been further agreed to with the tardy delivery of the agency disclosures at the time of preparing and entering into lease agreements. [Huijers v. DeMarrais (1992) 11 CA4th 676]

For commercial agents, this fatal defect in the initial handling of the fee agreement adversely affects the collection of fees on extensions, renewals and later sales of the property to the tenant which are otherwise earned. [See RPI Form 552]

Further, when the landlord’s broker or their agent fails to hand the landlord an Agency Law Disclosure form when entering into an exclusive authorization to lease, the agency may be cancelled by the landlord at any time. Payment of the fee may be avoided by the landlord even when it has been earned.

For the tenant’s broker to protect themselves against loss of their fee due to the failure of the landlord’s broker to provide the Agency Law Disclosure form to the landlord, the tenant’s broker needs to perfect their right to collect their portion of any fee to be paid by the landlord.

Here, the share of fees earned by the tenant’s broker and payable by the landlord needs to be agreed to by the landlord directly with the tenant’s broker. This fee arrangement is stated in a boilerplate provision in each lease agreement used by the tenant’s agent. [See RPI Form 550 and 552]

Further, the landlord’s payment of a fee earned by the tenant’s broker is not enforceable without an Agency Law Disclosure form attached to the initial written negotiations — an LOI or offer to lease — prepared by the tenant’s broker and signed by the tenant prior to submission to the landlord or the landlord’s agent.

Click any image below to view the video.

Form updated 2025 to conform with language changes for best broker practices.

Form navigation page published 07-2017. Updated 01-2026.