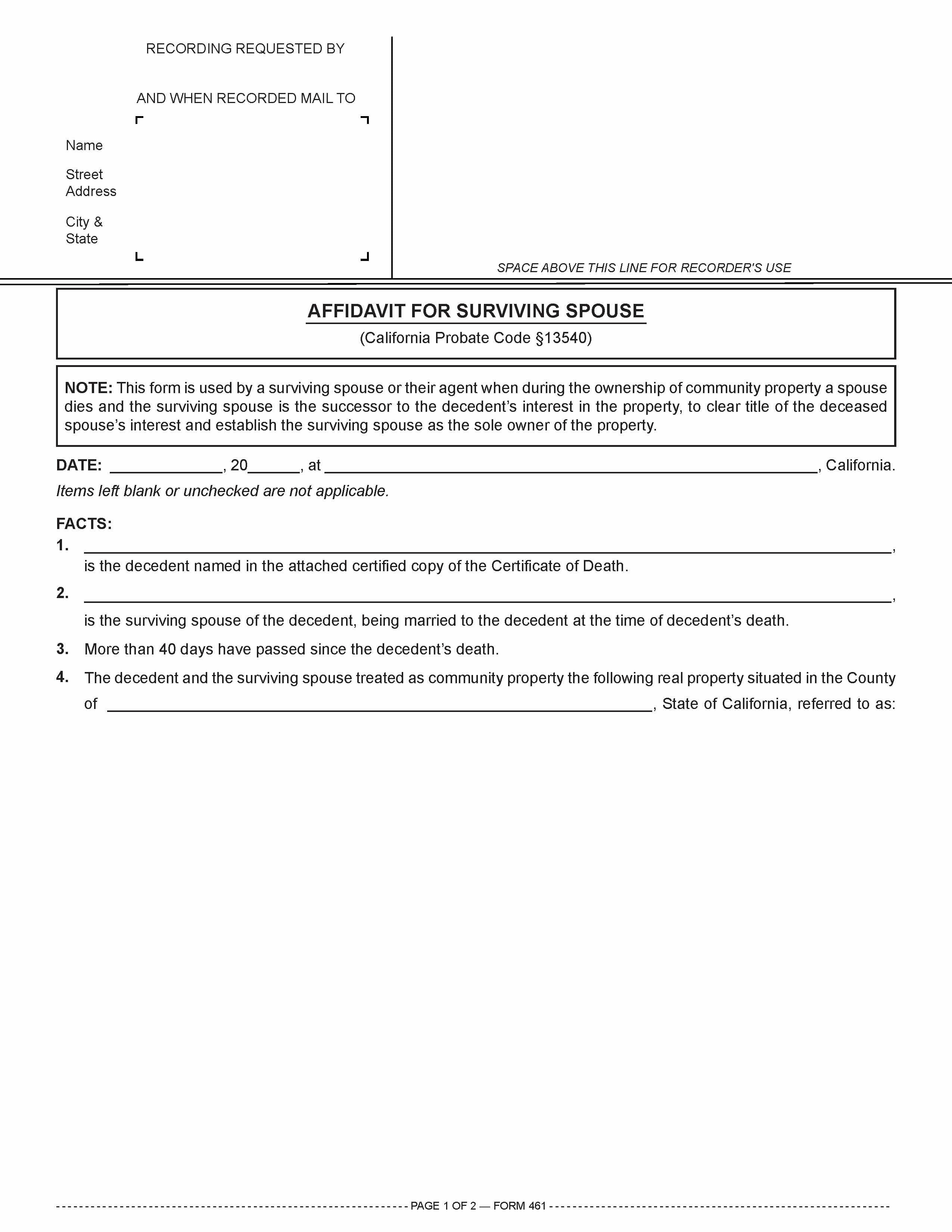

This form is used by a surviving spouse or their agent when during the ownership of community property a spouse dies and the surviving spouse is the successor to the decedent’s interest in the property, to clear title of the deceased spouse’s interest and establish the surviving spouse as the sole owner of the property.

A vivid vesting overview

Real estate is owned by a person or persons, who by definition are either an individual (or individuals) or an entity, such as a corporation, limited liability company (LLC) or partnership.

A vesting is a method of holding title to real estate.

Ownership by an individual or entity is classified as either a:

- sole ownership; or

- co-ownership.

Sole ownership is reflected by use of a vesting naming an individual or entity as the one person entitled to ownership of the entire property described in the conveyance transferring title to the individual or entity.

Co-ownerships exist for individuals in two fashions:

- as vested co-owners on title; or

- as co-owners of an entity, which is itself the vested owner holding title to the property.

Co-owners vest title in their individual names under one of only four types of ownership available for property located in California:

- as joint tenants;

- as tenants in partnership;

- as tenants in common; and

- as community property, with or without the right of survivorship. [Calif. Civil Code §682]

Types of ownership

When the type of vesting is not stated upon two or more persons taking title to real estate, the co-owners are presumed to be tenants in common, a sort of default vesting attributed to their ownership.

However, when the co-owners are husband and wife and title is not vested as a tenancy in common, the property is presumed to be community property.

A tenancy in partnership exists for ownership purposes when a California partnership has been formed for operating purposes, such as holding and operating income-producing property.

Although most joint tenancies are created between a husband and wife, a joint tenancy may be created between persons other than a married couple, such as between other family members. Conversely, community property vestings are only available to married couples or registered domestic partners. [Calif. Family Code §297.5]

Also, the number of joint tenants holding title is not limited to two, as is the case for a married couple’s ownership of community property. Any number of co-owners can, under one deed, take title to real estate as joint tenants so long as they share equally in ownership.

The joint tenancy vesting has been and is an estate planning tool used for the orderly transfer of ownership between family members on death. The vesting is rarely used in a business environment, except for community-owned enterprises or investments.

The creation of a joint tenancy requires the conveyance of four unities:

- unity of title, meaning the joint tenants take title to the real estate through the same instrument, such as a single grant deed or court order;

- unity of time, meaning the joint tenants receive their interest in title at the same time;

- unity of interest, meaning the joint tenants own equal shares in the ownership of the property; and

- unity of possession, meaning each joint tenant has the right to possess the entire property.

The sole advantage of a joint tenancy vesting for co-owners is the extinguishment of a co-owner’s entire co-ownership interest in the property on their death. On death, the surviving joint tenant absorbs the interest of the deceased co-owner. Thus, the ownership interest previously held by the deceased co-owner avoids probate procedures since no interest remains to be transferred.

The same results occur on death when a married couple or registered domestic partnership uses the community property with right of survivorship vesting to hold title to real estate or personal property.

Termination of interest on death

When the co-ownership of property is vested as joint tenants or community property with right of survivorship, the death of a co-owner automatically extinguishes the deceased co-owner’s interest in the real estate. Thus, the surviving co-owner(s) become the sole owner(s) of the property.

However, title to the deceased co-owner’s interest in the property needs to be cleared away before the surviving co-owner will be able to properly sell, lease or encumber the property as the sole owner.

The new ownership interest of a surviving joint tenant, clear of the deceased’s interest, is documented by simply recording an affidavit, signed by anyone, declaring the death of a joint tenant who was a co-owner, attaching a death certificate and describing the real estate. [See RPI Form 460]

Likewise, the half interest in community property held by the deceased spouse at the time of death vested as community property with right of survivorship is extinguished by the same affidavit procedure used to eliminate the interest of a deceased joint tenant — except that the surviving spouse (or the surviving spouse’s representative) is the only one authorized to make the declaration. [See RPI Form 461]

Once the affidavit is notarized, recorded and indexed, anyone conducting a title search on the property will have notice of the joint tenant’s death since the deceased joint tenant is indexed as a grantor. Thus, the surviving joint tenant becomes sole owner of the property due to the right of survivorship.

On a simple community property vesting, when no one contests the surviving spouse’s right to become the sole owner of the deceased spouse’s interest in the property, the surviving spouse needs to wait 40 days following the death before the property may be sold, leased or encumbered.

After 40 days, an affidavit by the surviving spouse is recorded to clear title by declaring the death and attaching a death certificate. [See RPI Form 461]

Community property affidavit

A surviving spouse or their agent uses the Affidavit for Surviving Spouse published by RPI when during the ownership of community property, a spouse dies and the surviving spouse is the successor to the decedent’s interest in the property. The affidavit allows the surviving spouse to clear title of the deceased spouse’s interest and establish the surviving spouse as the sole owner of the property. [See RPI Form 461]

The Affidavit for Surviving Spouse includes:

- the date;

- the address;

- the name of the deceased spouse;

- a copy of the deceased spouse’s death certificate;

- the name of the surviving spouse;

- a description of the real estate affected by the spouse’s death; and

- the signature of the surviving spouse or their representative. [See RPI Form 461]

Form navigation page published 12-2022. Updated 01-2026.

Form updated 2015.

Form-of-the-Week: Affidavit of death of joint tenant and surviving spouse — Forms 460 and 461

Form-of-the-Week: Transfer on Death Deeds — Revocable Transfer and Revocation — Forms 411 and 411-1

Article: Vesting the ownership

Brokerage Reminder: How vested are you?

Recent Case Decision: Is a will distributing a fractional ownership interest in property vested as joint tenants undermined when the deceased did not sever the joint tenancy co-ownership?

Recent Case Decision: Does the acquisition date determine whether properties held in joint tenancy by a married couple constitute community property?