Personal property included in the sale of real estate

Real estate and personal property exist in two independent ecosystems – one mobile, the other immobile (except maybe in our earthquake prone California). In combination, a real estate sale often includes the sale of personal property – furnishings and equipment – as part of the transaction.

First the basics. Property is anything which may be owned. In turn, ownership is the right to possess the property owned and use it to the exclusion of others.

The right to possess and use property includes the rights to:

- occupy;

- sell or dispose;

- encumber; or

- lease.

Property is divided by types into two primary categories:

- real estate, also called real property or realty; and

- personal property, also called personalty.

Real estate is characterized as immovable, whereas personal property is movable. [Calif. Civil Code §657]

Related video:

Real estate includes land and anything permanently affixed or appurtenant to it, such as buildings, trees or rivers, built-ins and rights in other real estate, but not trade fixtures. [CC §658]

Personal property is defined, by way of exclusion, as all property not classified as real estate. [See RPI e-book Legal Aspects of Real Estate, Chapter 3]

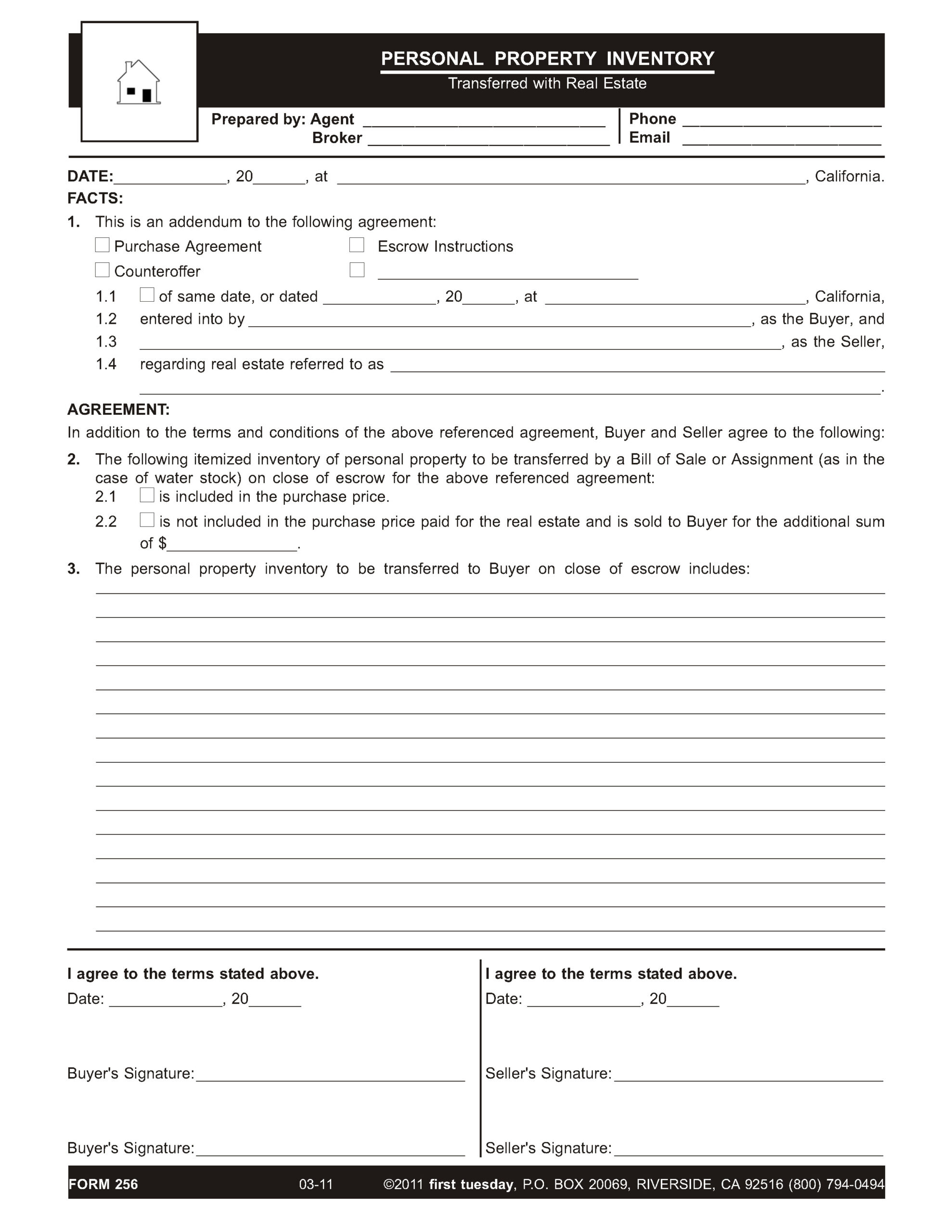

When arranging a sale of real estate which includes the transfer of personal property, an agent prepares a personal property inventory sheet describing the personal property to be transferred. The inventory sheet is attached to a purchase agreement or counteroffer as an addendum. [See RPI Form 256]

Analyzing the personal property inventory

An agent uses the Personal Property Inventory — Transferred with Real Estate published by Realty Publications, Inc. (RPI) when preparing a purchase agreement or counteroffer for a real estate transaction when the transfer of personal property is included. The form allows the agent to list the personal property to be included in the purchase price, or separately paid for as an additional sum. [See RPI Form 256]

The Personal Property Inventory — Transferred with Real Estate form contains:

- facts, such as the purchase agreement or counteroffer, date of the agreement, identify of the buyer and seller, and real estate involved [See RPI Form 256 §1];

- whether the personal property is included in the purchase price [See RPI Form 256 §2.1];

- when the personal property is not included in the purchase price, the additional price to be paid for the personal property [See RPI Form 256 §2.2];

- blank space to describe the personal property items to be transferred to the buyer [See RPI Form 256 §3]; and

- signatures of the buyer and seller. [See RPI Form 256]

Personal property in a carryback sale

Mortgages made by private lenders are usually secured by second mortgages on the real estate. Thus, junior lenders often want additional security to secure payment of the debt.

Additional security frequently takes the form of personal property, such as:

- furnishings;

- trade fixtures;

- business inventory;

- equipment;

- machines; or

- business revenue (accounts receivable).

Unlike the use of a single document to secure a debt by real estate – a security device called a trust deed – two documents are required to properly secure a debt with personal property:

- a security agreement which creates a lien on the personal property; and

- a UCC-1 Financing Statement which is recorded to give public notice of the lien. [See RPI Form 436-1 and 436-2]

To create a lien on personal property transferred in a sale or as additional security for lender financing real estate, a security agreement is entered into which grants the carryback seller or lender a security interest in personal property described in the agreement. Transactions which often include personal property transfers include second homes, apartments, motels/hotels, and business opportunity situations.

Further, and of great importance, to put the public on notice of the lien created by the security agreement, a UCC-1 Financing Statement (UCC-1) is prepared and filed. The filing is a recording of the UCC-1 with the California Secretary of State (SOS) or with the county recorder, depending on the type of personal property and its relationship to the real estate. This UCC-1 recording is called perfecting the lien. [Calif. Commercial Code §§9310; 9501]

Perfecting the lien establishes the mortgage holder’s interest and priority over all other later perfected security interests in the personal property by others after the UCC-1 is recorded.

Editor’s note — A carryback seller does not use a trust deed as a security device to create a lien on personal property. A recorded mortgage imposes a perfected lien on real estate, not personal property.

Related article:

Brokerage Reminder: The UCC-1 financing statement and securing debt with personal property

Documenting a perfected security interest in personal property

Three documents are required to properly structure a sale or loan transaction which includes personal property as additional security for a mortgage:

- a promissory note [See RPI Form 420];

- a security agreement [See RPI Form 436]; and

- a UCC-1 Financing Statement.

To close escrow on a sale involving personal property, a bill of sale is prepared and signed by the seller. A bill of sale transfers ownership of the personal property to the buyer, just as a grant deed conveys the ownership of real estate. [See RPI Form 408]

The promissory note evidences the buyer’s obligation to pay the debt created by a seller’s installment sale or a lender’s loan which is commonly called a mortgage.

The debt is evidenced by one note, not two, and secured by both the real estate using a trust deed and the personal property using a security agreement and a UCC-1. The sale is called a mixed collateral transaction.

Alternatively, a carryback seller and buyer might agree to allocate the carryback debt owed the seller between the real estate and the personal property – part of the debt secured by the real estate, the remainder by the personal property. Thus, two separate debts owed the seller comprise the amount of the unpaid portion of the price owed by the buyer.

When two separate debts are created and each is separately secured, both the trust deed and the security agreement may contain a cross-collateral provision stating a default on one of the debts constitutes a default on the other, called a dragnet clause. [Wong v. Beneficial Savings and Loan Association (1976) 56 CA3d 286]

Related Client Q&A:

Client Q&A: How do I use personal property to secure a debt?

The security agreement

A security agreement creates a lien on personal property. It, together with a recorded UCC-1 security device, are the personal property counterpart to a trust deed used as the security device to impose a mortgage lien recorded on title to real estate.

The security agreement contains the rights and obligations of the transaction participants regarding the secured personal property, including:

- protection against waste;

- remedies on default; and

- transfer-alienation provisions. [See RPI Form 436]

The security agreement, in contrast to the UCC-1, is retained by the mortgage holder and not recorded with any agency.

To create an enforceable security interest in personal property, the security agreement needs to:

- identify the debt or other obligation for which the personal property is security, typically evidenced by a mortgage;

- describe the personal property which functions as the security; and

- grant a security interest in the personal property from the buyer or borrower to the mortgage holder. [Needle Lasco Industries, Inc. (1970) 10 CA3d 1105]

An enforceable security interest or lien attaches to personal property when:

- the borrower or buyer signs and delivers a security agreement containing a description of the personal property;

- the borrower or buyer has ownership rights in the personal property, as on a bill of sale; and

- value is given in exchange for the security interest, such as an installment sale of property by a seller or a loan made by the lender. [Com C §9203(b)(3)]

When the personal property consists of standing timber or unharvested crops which the buyer intends to remove, the security agreement needs to also include a description of the real estate on which the personal property is located. [Com C §9203(b)]

Related article:

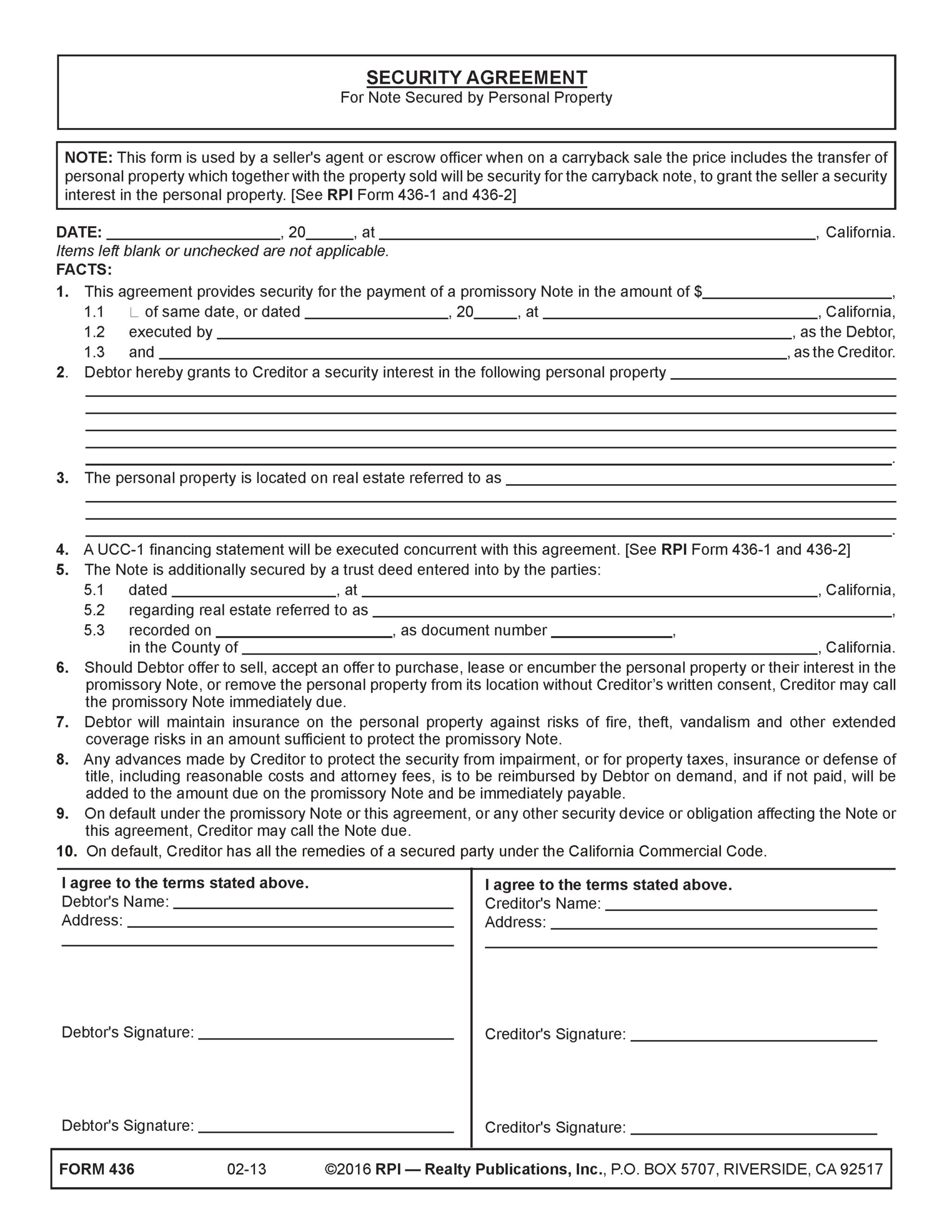

Analyzing the security agreement

A seller’s agent or escrow officer uses the Security Agreement — For Note Secured by Personal Property published by RPI when on a seller carryback sale the price includes the transfer of personal property which together with the property sold will be security for the carryback note. The form allows the agent or escrow officer to grant the seller a security interest in the personal property. [See RPI Form 436]

The Security Agreement — For Note Secured by Personal Property contains:

- the promissory note information the personal property provides security for [See RPI Form 436 §1];

- the personal property offered as security [See RPI Form 436 §2];

- the real estate the personal property is located on [See RPI Form 436 §3];

- the trust deed further securing the promissory note [See RPI Form 436 §5]; and

- signatures of the debtor and creditor. [See RPI Form 436]

Related article:

Form-of-the-Week: Abandonment and Right to Reclaim Personal Property — Forms 581, 583 and 584

Want to learn more about receiving and splitting broker fees? Click the image below to download the RPI book cited in this article.