The complete marketing package mitigates risks

The contents of a complete property marketing package constitutes the evidence a sellers agent needs to demonstrate they have complied with their general duty to fully inform prospective buyers what it is that the agent offers for sale.

Simply: full disclosure. But first, the agent needs to discover what needs to be disclosed.

When employed as a sellers agent, the agent owes a special fiduciary duty to the seller to use diligence to properly market their listed property, locate a buyer who enters into a purchase agreement with the seller, and close escrow on a sale. Post-closing buyer surprises, or worse, are risks mitigated by proper seller representation.

The primary objective of the sellers agent: solicit and locate prospective buyers to acquire the property on the listed terms and property conditions disclosed at the earliest practical moment, but always before accepting an offer.

Between the seller and the buyer, the symmetry of property information is the ultimate goal of the sellers agent in a real estate sales transaction, always. Thus, what the seller knows about the property, the buyer also needs to know when negotiations begin, up front and well before a purchase agreement is entered into by the seller.

Negotiations by a prospective buyer start on their inquiry, or their agent’s, seeking additional property information. Negotiations end when bargaining results in a purchase agreement signed by the buyer and the seller.

At the moment a prospective buyer voices an earnest interest by inquiring about the property, the sellers agent owes that buyer and their agent a general duty to voluntarily provide critical information about the nature of the listed property. The property disclosures include all conditions which might adversely affect its value as viewed by an informed and prudent buyer. This critical information as negatively affecting a property’s value are called material facts.

The objective of these upfront (and early) disclosures by the seller and their agent of known conditions is to put the buyer in the shoes of the seller. For this equal footing, the buyer is provided sufficient information about the property to make them aware — put them on notice — of conditions affecting its value and their use of the property. Otherwise, they are not able to set a price based on “what is” the listed property, just on what they learned about the property by the time they enter into a contract with the seller.

To accommodate the sellers agent delivery of property information to a prospective buyer, the sellers agent conducts their own property inspection at the listing stage. They also require the seller to fill out a Transfer Disclosure Statement (TDS) which the agent reviews for error’s known to the agent due to their inspection or an HIR. Further, the agent gathers other pertinent information about the current operations of the property, and organizes all these disclosures for inclusion in their marketing package.

Related Client Q&A:

Contents of a marketing package, stem to stern

An agent soliciting employment with an owner who wants to sell a property uses a listing agreement form as a disclosure checklist. Thus, they review with the owner those property reports the owner needs to authorize the agent to acquire. The reports are included in the marketing package delivered to buyers who express an interest in buying the property. [See RPI Form 102 §7]

The third-party reports to be gathered for inclusion in the agent’s marketing package, agreed to by the owner, include:

- a Natural Hazard Disclosure (NHD) Statement, provided by an NHD expert [See RPI Form 314];

- a structural pest control (SPC) report and any clearance;

- a home inspection report (HIR) to accompany mandated TDS seller property disclosures;

- an occupancy (transfer) certificate, as locally required on sales; and

- a septic tank report.

Along with third-party reports, the agent’s marketing package needs to include various property disclosures the seller or the agent will prepare, such as:

- a Transfer Disclosure Statement (TDS), the disclosure of the physical condition of the property [See RPI Form 304];

- an NHD Statement, unless obtained from an NHD expert [See RPI Form 314];

- a Lead-Based Paint (LBP) Disclosure, required on all pre-1978 residential construction [See RPI Form 313];

- Federal Residency Declarations confirming the seller’s legal status for tax purposes regarding buyer withholding requirements when closing escrow [See RPI Form 301];

- a Residential Earthquake Hazards Report, disclosing structural weaknesses for properties built prior to 1960 [See RPI Form 315];

- the multiple listing service (MLS) printout and property profile;

- a Seller’s Neighborhood Security Disclosure, relating to security conditions in and around the property [See RPI Form 321];

- common interest development (CID) documents, when applicable;

- a local ordinance compliance report, disclosing the property’s compliance with city and county ordinances [See RPI Form 307];

- an Annual Property Operating Data Sheet (APOD), disclosing the costs of operating the property, as well as rental income figures when tenant occupied [See RPI Form 352, 562 or 318]; and

- a rental income spreadsheet, setting out the rent roll for tenant-occupied property. [See RPI Form 352-1]

Related article:

Income-producing property package

The contents of a marketing package for income-producing property is more extensive than property to be solely buyer occupied. Financial information presented in a marketing package for income-producing property include:

- an Annual Property Operating Data Sheet (APOD), disclosing rental income and the costs of operating the property [See RPI Form 352];

- a rental income spreadsheet [See RPI Form 352-1];

- a two-year occupancy history of each unit;

- information regarding security arrangements and criminal activity on or around the property during the past year [See RPI Form 321];

- information regarding maintenance procedures and the repair services used [See RPI Form 324];

- a copy of schedule “B” (CC&R exclusions) to the owner’s policy of title insurance;

- the lender’s name and the principal balance, payments, interest rates and due date on each existing mortgage; and

- any available information relating to the integrity of the property’s condition and the nature of the property’s location which may adversely affect the property’s value. [See RPI e-book Real Estate Practice, Chapter 52]

Related article:

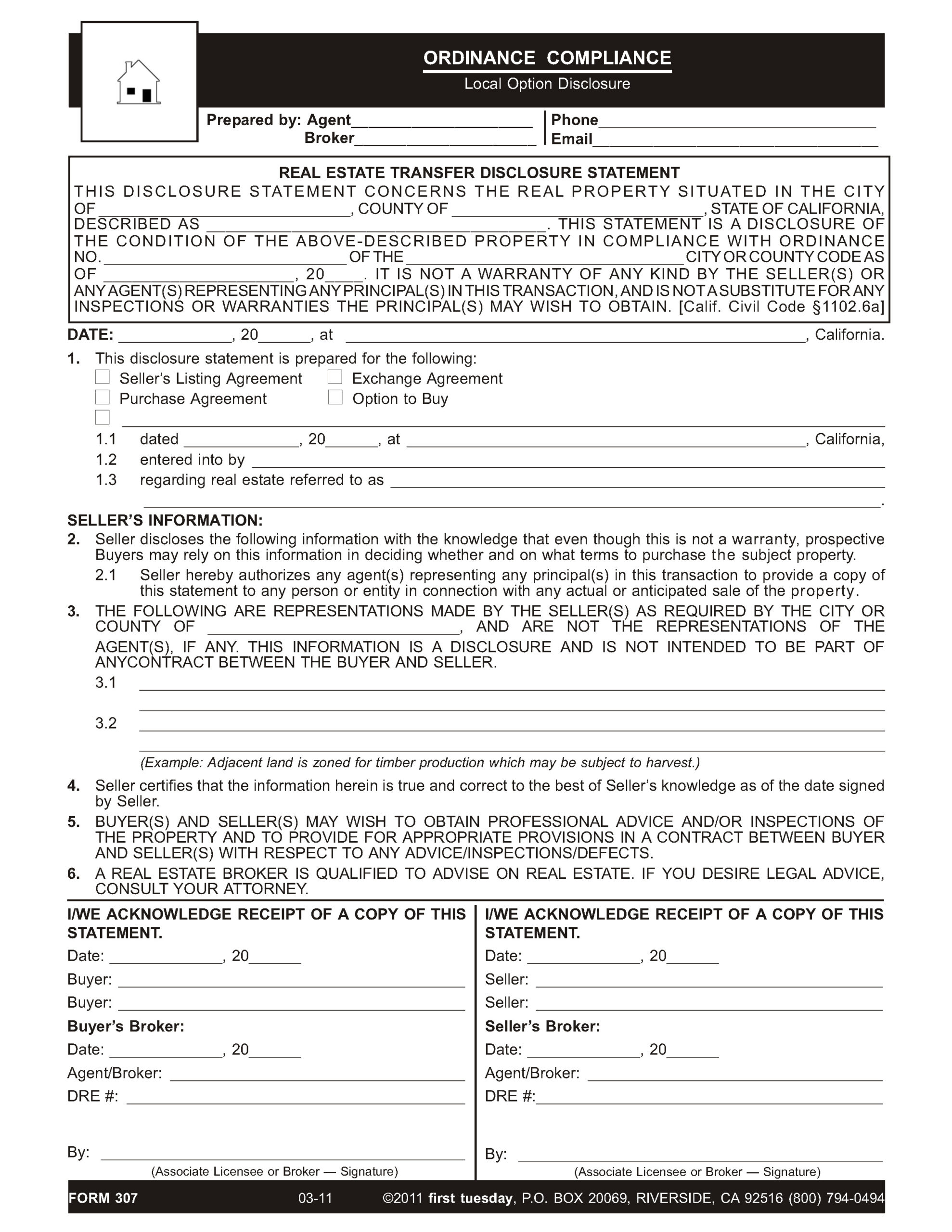

Ordinance compliance

An ordinance compliance report is used as part of the Transfer Disclosure Statement (TDS) to comply with city or county ordinance disclosure requirements. [Calif. Civil Code §1102.6a; See RPI Form 307]

A sellers agent uses the Ordinance Compliance — Local Option Disclosure published by Realty Publications, Inc. (RPI) when preparing a marketing package for the sale, lease, exchange or option of a one-to-four unit residential property. The form allows the sellers agent to disclose the property’s compliance with city or county ordinances in a written document handed to prospective buyers and tenants. [See RPI Form 307]

The Ordinance Compliance — Local Option Disclosure contains:

- the date, transaction type and referenced real estate [See RPI Form 307 §1];

- the seller’s authorization to provide the disclosure [See RPI Form 307 §2];

- the city or county and the ordinance requiring compliance [See RPI Form 307 §3];

- the seller’s certification that the information is true and correct [See RPI Form 307 §4]; and

- signatures of the seller, sellers broker, buyer, and buyers broker. [See RPI Form 307]

Related article:

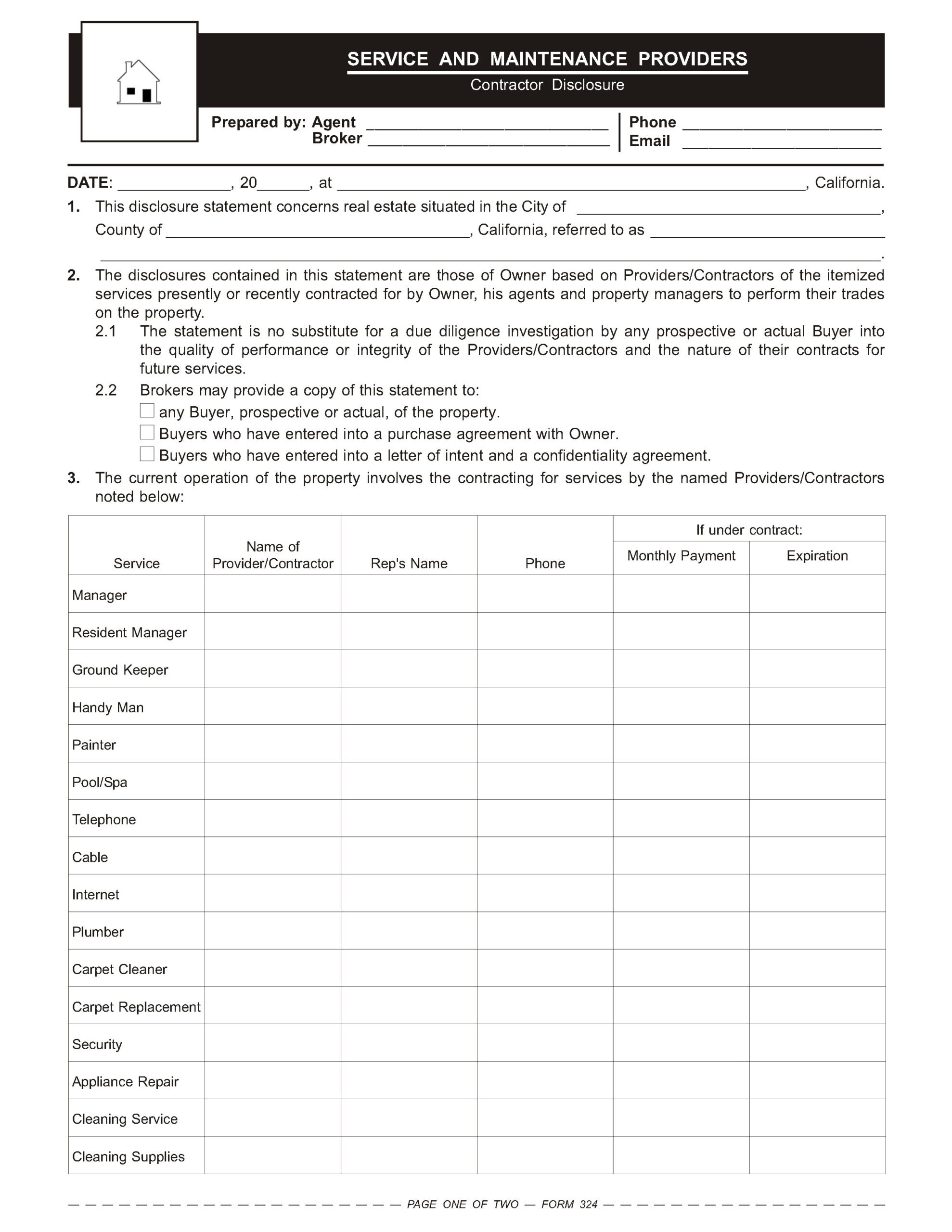

Service and maintenance providers

A sellers agent uses the Service and Maintenance Providers — Contractor Disclosure published by RPI when preparing a marketing package to disclose information about service and maintenance providers currently used on a property listed for sale. On commencement of negotiations with a prospective buyer, the form allows the sellers agent to disclose the identity of service and maintenance contractors the seller uses to stage a seamless transfer of ownership operations. [See RPI Form 324]

The Service and Maintenance Providers — Contractor Disclosure contains an itemized list of service providers the owner uses. For providers under contract, the monthly payment amount and expiration of each service agreement. The services listed include:

- a manager;

- a resident manager;

- a groundkeeper;

- a handyman;

- a painter;

- pool/spa;

- telephone;

- cable;

- internet;

- plumber;

- carpet cleaner;

- carpet replacement;

- security;

- appliance repair;

- cleaning service;

- cleaning supplies;

- cabinet/countertops;

- drapery cleaners;

- apartment rental ads;

- apartment owner’s association;

- hardware supplies;

- glazing/screens;

- roofers;

- insurance;

- electricity;

- gas;

- trash pickup;

- pest control;

- water; and

- locksmith. [See RPI Form 324]

Related video:

Want to learn more about receiving and splitting broker fees? Click the image below to download the RPI book cited in this article.