The second part of this series covers the remaining economic concepts used in the appraisal of real estate. Click here for Part I.

Advanced economic theory in appraisals

Numerous economic principles are employed in the appraisal of real estate. The economic principles of appraisal covered in Part II of this series includes the principles of:

- consistent-use;

- balance;

- contribution;

- substitution;

- anticipation; and

- competition.

The consistent-use principle: Once improvements on a property have been built, the consistent-use principle comes into play. Land and improvements are to be valued on the same basis. When the highest and best use of land as vacant is established, the principle of consistent use holds the improvement is to be valued on that same basis.

Similarly, consider an appraiser valuing a single family residence (SFR) built on land which could also be developed to support a multi-unit income property. Here, the appraiser is not to combine the value of the single family residence and the value of the land if it were used to for a multi-unit property – again, the appraiser values the land and the structure on the same basis.

The principle of balance: The principle of balance holds a property’s maximum value is realized and sustained when each of the four elements of the factors of production are in economic balance. Thus, the value of a property depends on the balance of:

- land;

- labor;

- capital; and

- entrepreneurship.

The principle of contribution: The principle of contribution relates to how the value of an added improvement affects the value of the underlying property.

Under this principle, the value of one component (an improvement) is measured in terms of its contribution to the value of the whole property, rather than its individual cost taken by itself. A related principle is that of an increasing or decreasing return. When a contribution exceeds the cost, this creates an increasing return, and vice versa.

Consider a swimming pool added to a property otherwise valued at $500,000. The swimming pool costs $25,000 to install. The property’s fair market value increases $518,000 due to the additions which are added. This is an example of a decreasing return since the fair market value of the property increased, but less than the cost to install the pool.

The principle of substitution: Under this principle, a buyer will not pay more for a property if it will cost less to buy a similar property of equal desirability. The principle of substitution is a truism of the real estate industry, both in the context of sales and appraisals.

The principle of substitution is the most basic principle of appraisal as it is used in each of the three approaches to value.

The principle of anticipation: The principle of anticipation concerns how a property will benefit the owner over time and into the future. Essentially, it represents the present worth of the rights to all prospective future benefits, both tangible and intangible. In this context, the owner is anticipating the future benefits they will derive from the property.

The principle of anticipation is most commonly used in commercial and income properties.

The principle of competition: The principle of competition holds excessive profits in any line of business will trigger excessive competition – and this excessive competition will, in turn, destroy profits.

Consider a store that opens in a stable area. The store does extremely well and provides a significant return on the investment. Two entrepreneurs separately, and independently, observe the success of the business and open two similar stores in the same neighborhood simultaneously. As a result, the revenue and profits of the original store drops – as does its value. Further, the two new stores don’t perform as well as anticipated.

The other economic principles used in the appraisal of real estate covered in Part I of this series include the principles of:

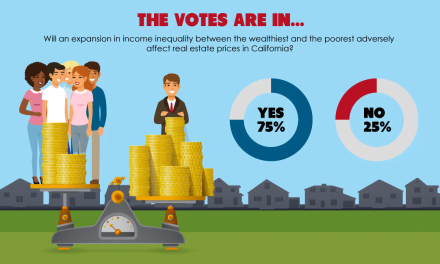

- supply and demand;

- change;

- conformity; and

- highest and best use.

Related article: