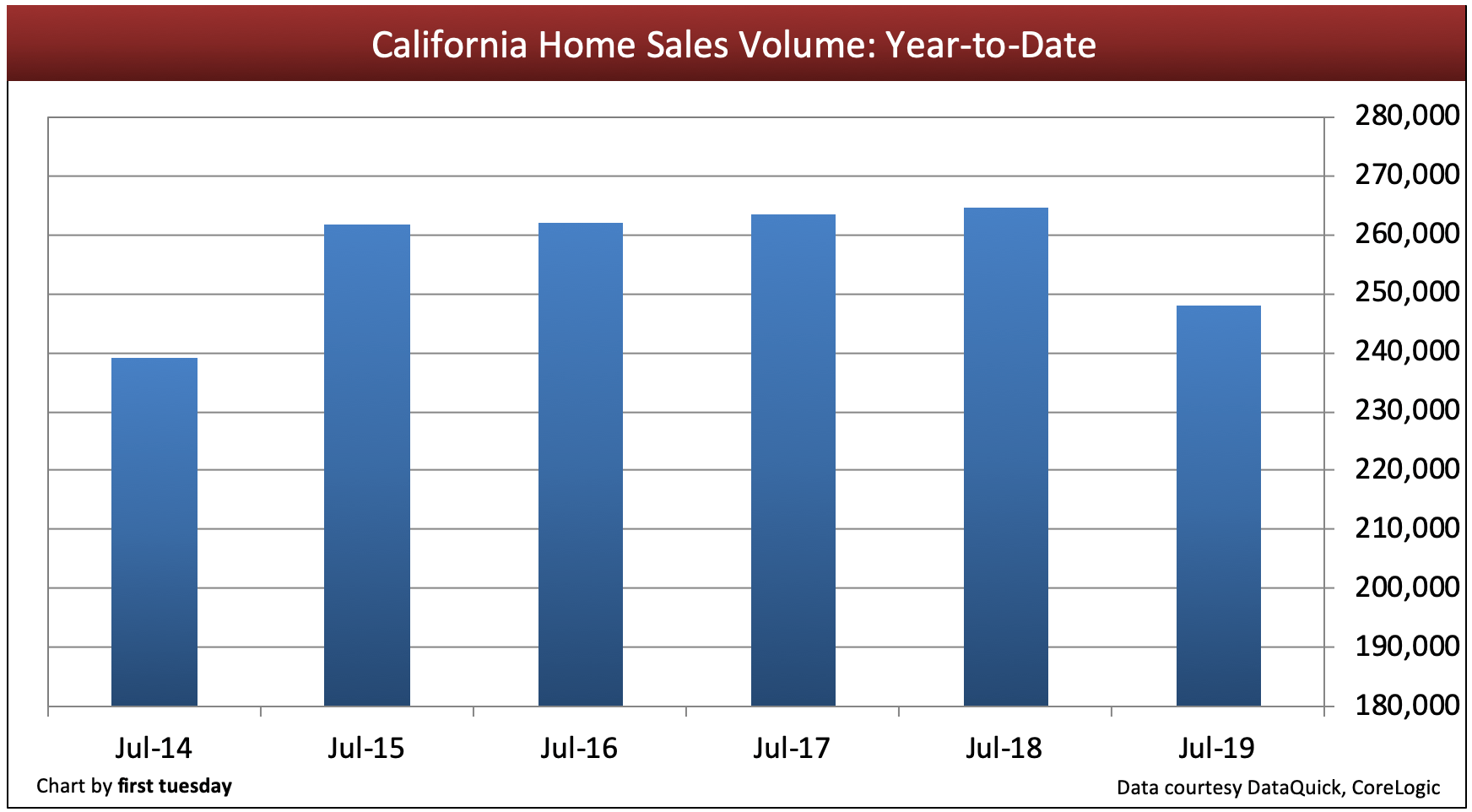

Home sales volume in 2019 is “relatively weak,” according to a report by California’s Legislative Analyst’s Office (LAO).

However, the LAO stresses that, while weak, the decline in sales has not fallen below the level typically seen immediately preceding a recession. For example, in July 2019 year-to-date (YTD) sales volume was 6% below a year earlier. Compare this with the months shortly before the 2008 recession, when sales volume showed a 20%-40% annual decrease.

But some perspective is helpful, as home sales volume never truly recovered from the Great Recession. Compare 2018’s 442,000 total homes sales volume with the 753,900 peak sales volume experienced in 2005. The sales volume levels experienced each year since 2008 have remained well below the numbers experienced during the Millennium Boom, closer to the sales volume of the mid-1990s.

Since home sales volume hasn’t ballooned like, say, home prices have in the past decade, the drop in sales does not need to be steep as in past housing cycles to still ring warning bells for forecasters.

Home sales to continue down into the next recession

California’s admittedly weak sales volume is just one signal of many that point to the next economic recession.

Rapidly rising prices and interest rates in 2018, along with uncertainty brought on by shifting economic policies, have discouraged potential homebuyers. Granted, the drop in average fixed rate mortgage (FRM) rates in 2019 has briefly restored buyer purchasing power, accounting for a brief uptick in sales volume in the single month of July 2019. But overall economic conditions continue to point toward a coming recession.

In particular, the yield spread — the time-tested indicator of recessions — went negative in June 2019 and continues to decline. This forecasts a recession to arrive within 12 months, expected in mid-2020.

Declining construction numbers also point to the increasing likelihood of a recession in 2020. A recent St. Louis Federal Reserve study notes 2018-2019’s residential construction decline is in line with historical construction trends that precede recessions.

Home sales will continue their year-over-year decrease through the rest of 2019, slowing the flow of agent fees. Sales volume won’t rise significantly until homebuyers sense the recession is over, likely in 2020-2021. Once it’s clear that home prices have hit their bottom, homebuyers will return in greater numbers, pushing sales volume to its next peak.

Real estate professionals can survive the next couple of down years and make up for reduced sales by expanding their practice. Titles they can add to their portfolio include:

- property manager;

- foreclosure and short sale expert;

- notary public;

- mortgage loan officer; and

- broker.

Related article: