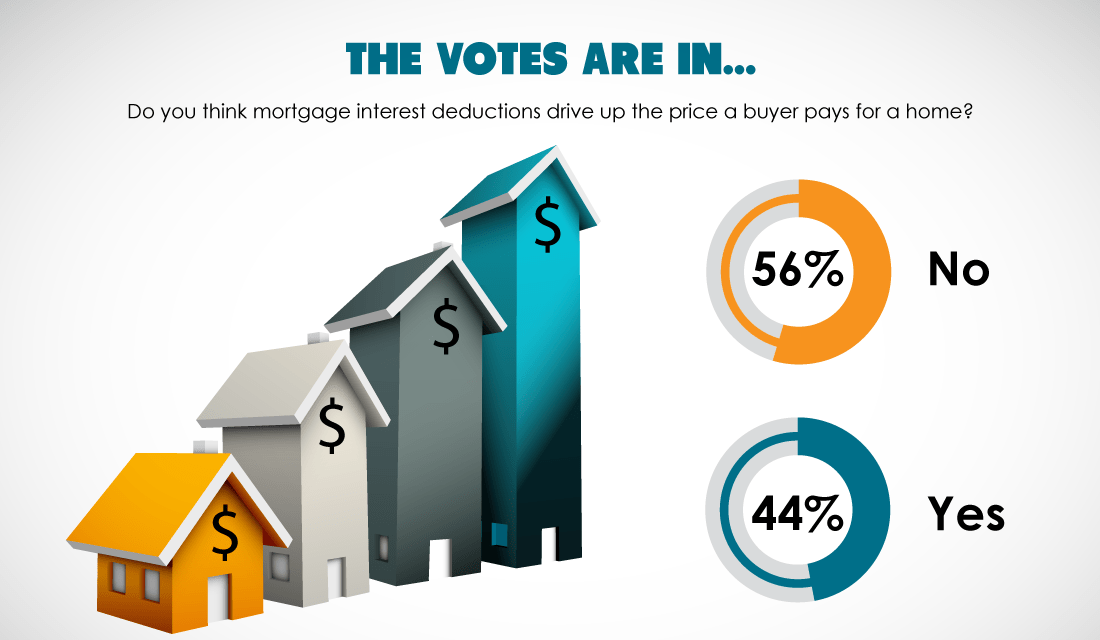

Most of our readers aren’t sold on the inflationary effects the mortgage interest tax deduction (MID) has on home prices, according to a recent poll. More than half of voters — 56% — said the MID does not drive up homes prices, while the remaining 46% believe it does.

Yet, in a separate poll, a majority 87% of voters also agreed MID elimination will cause home prices to decrease (though readers were undecided on how long this would last). These conflicting poll results suggest some reader uncertainty about the pricing effects of the MID.

So, what’s the deal with MID and home prices?

How the MID affects pricing

The MID was created to promote homeownership by subsidizing low- to middle-income homeowners through an itemized tax deduction of qualified interest paid on a mortgage. [Internal Revenue Code §163(h)]

Proponents claim the MID is a critical tax law that ensures the affordability of homes and increases homeownership. However, despite its positive reputation, the MID has been known to:

- disproportionately benefit high-income homeowners; and

- artificially inflate home prices.

As the MID acts as a tax savings for the wealthy, it simultaneously baits homeowners to overextend their finances to replace the lost revenue — with the promise of recouping their losses through a tax deduction. The MID thus causes home prices to rise, increasing profits for builders, subsidizing lender profits through larger mortgage amounts and driving up broker fees on excessive pricing.

Any “savings” promised to the buyer through a later tax deduction are actually spent up front in the purchase price.

The government essentially reimburses the homeowner over the first ten years of their mortgage by allowing tax deductions for interest, mortgage insurance and property tax and tax-free profit on the later sale — but only if the buyer has the income and financial wherewithal to itemize. Those homeowners who do not itemize essentially make a donation to the builders, lenders, brokers and high-income homeowners who do claim the deduction.

Thus, rather than functioning as a tax subsidy for the average homeowner — as intended — the MID redistributes personal wealth via mortgaged homeownership.

So, despite ample support for the MID from real estate professionals, it’s clear it disadvantages the average homebuyer.

A more practical solution is to reform the MID to redirect benefits from wealthy beneficiaries to mid- and low-income homebuyers, the intended recipients. And reform may not be too far off: the MID recently took a hit from tax code changes that reduced the maximum amount of deductible mortgage interest — perhaps finally signaling the beginning of the MID’s very slow departure.

Related article:

Total B.S. I been in real estate 35 years with REAL average workers –u know the ones that make a real average living that takes 2 incomes to buy a house and they all Love the MID to lower their tax bill uncle sucks and waists They all love giving less to the FED and State especially in overpriced CALIF. The !% ers don’t need. Its caped for them anyway