Winter 2016 CalBRE Real Estate Bulletin

The Winter 2016-2017 California Bureau of Real Estate (CalBRE) Real Estate Bulletin features a lengthy discussion of the Real Estate Settlement Procedures Act (RESPA) and real estate referral fees, housekeeping for licensees and legislative updates.

Let’s get to it!

Reviewing RESPA

We encourage you to read CalBRE’s analysis of how state and federal laws control compensation in real estate transactions.

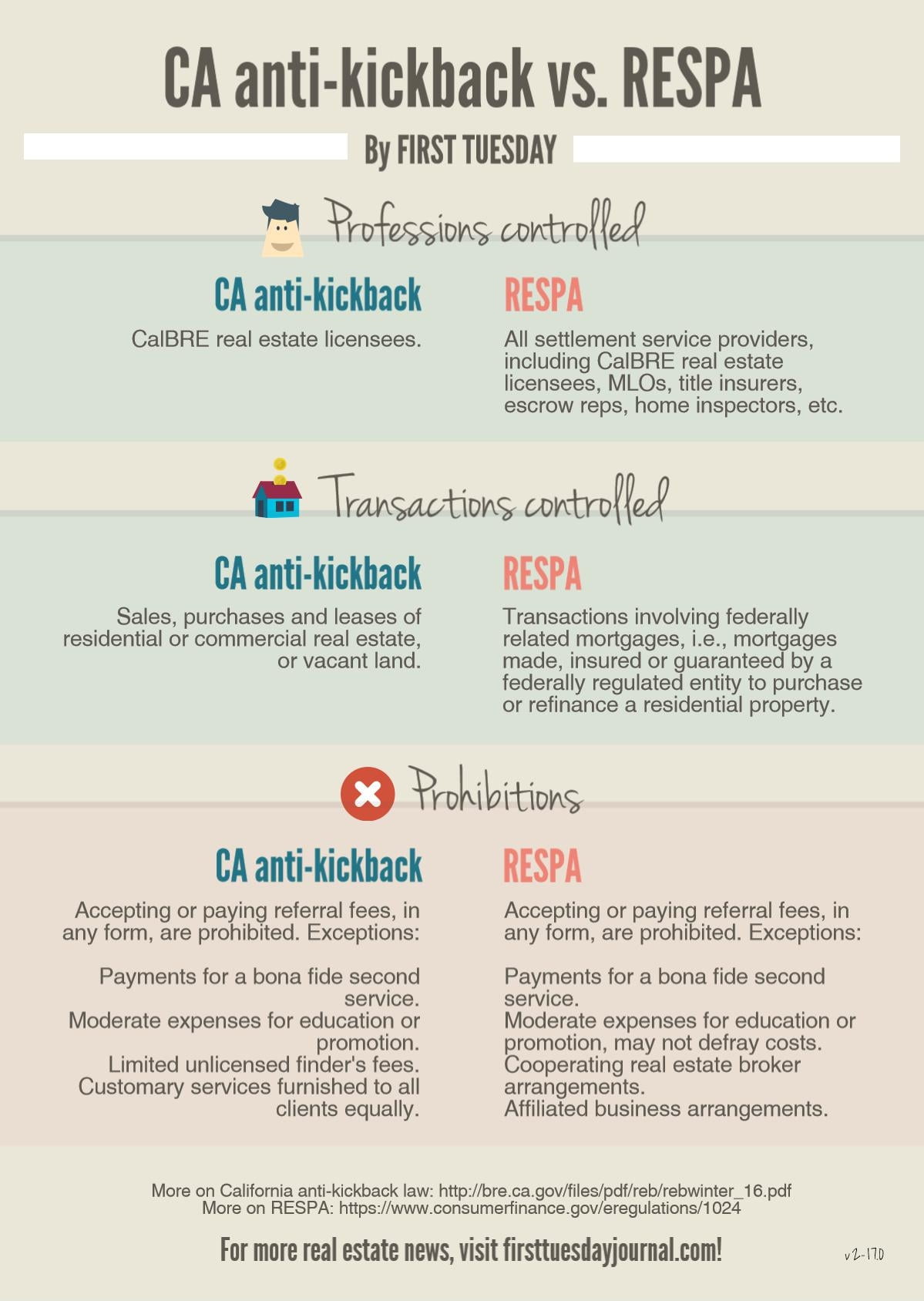

California’s anti-kickback laws apply to all CalBRE licensees engaged in real estate activities, e.g., the purchase, sale or lease of residential or commercial real estate or vacant land.

The state anti-kickback laws expose a CalBRE licensee to disciplinary action for accepting anything of value in exchange for referring business to other related businesses, like title insurance companies or home inspectors. [Calif. Business and Professions Code §10177.4]

Under state law, compensation paid for a bona fide second service is permissible. For instance, a broker who owns both an escrow company and a real estate brokerage may charge fees both for the listing and the escrow activity on the same transaction.

All compensation received by a real estate broker needs to be disclosed to the principals in the transaction. [Bus & P C §10176(g)]

Under the federal law, RESPA prohibits settlement service providers from giving or receiving kickbacks in connection with a federally related mortgage. Settlement service providers include anyone who engages in real estate brokers and agents, but also controls the fees of mortgage loan originators, title insurers, home inspectors, escrow representatives and any other individuals or companies that provide services in connection with a federally related mortgage.

Very generally, a federally related mortgage is a mortgage on residential real estate insured, guaranteed or made by a federally regulated bank or entity. [12 Code of Federal Regulations §§1024 et seq.; for a full discussion of what a federally related mortgage is, see here.]

Here’s a quick cheat-sheet we created to understand the difference in coverage between state anti-kickback laws and RESPA:

Under RESPA, a real estate broker who also owns an escrow company may refer a client to the escrow company only if they disclose their affiliation/interest in both companies to the principals on the affiliated business arrangement disclosure. [See RPI Form 251]

CalBRE then goes on to analyze the effects state and federal laws have on real estate broker compensation. Specific scenarios reviewed include:

- payment for promotional activities split between a broker and another service provider;

- unlicensed finder’s fees;

- referral fees from a real estate broker to a mortgage broker;

- cooperating broker referrals;

- affiliated business arrangements; and

- referral fees for commercial real estate transactions.

License maintenance

Is your real estate practice in order? All licensees are required to keep their business address, phone number and email address up-to-date with the CalBRE. [Bus & P C §10162]

If you’re an employing broker, you also need to retain a copy of each of your licensed employees’ license certificates.

Changes to contact and employment information can be completed through CalBRE’s eLicensing portal.

Finally, don’t forget to check your license expiration date. Your real estate license is good for four years from the last issue date, and you have to complete 45 hours of continuing education before you can renew.

(If you need help with your renewal requirements, check out our 45-hour education page – package #901 is our best-seller, in case you’re in the market!)

New laws for 2017

Finally, CalBRE briefly digested real estate related laws passed in the 2015-2016 California legislative session. In case you missed it, we put together a 2016 Legislative Review about a month ago – check out the downloadable PDF file here.

Here’s a link to the full Winter 2016 CalBRE Bulletin.

See you in spring!