Stock prices continued to rebound in the second quarter (Q2) of 2023 — nearing a return to the record heights achieved at the end of 2021. The price-to-earnings (P/E) ratio also rose slightly to 20.5 in Q2 2023, well below the recent high of 34.2 reached in 2020, but still above the historically applicable benchmark of 15.5.

The stock market’s P/E ratio is the reciprocal of the capitalization (cap) rate – how buyers of real estate price their investments. The most recent P/E ratio of 20.5 is equivalent to a cap rate of 4.9% – not great, but an improvement over 2020 when the cap rate equivalent was just 2.5%. Savvy investors tend to demand higher cap rates to stay ahead of rising interest rates.

Following 2022’s plunge in stock prices, the stock market officially gained bull market status in Q2 2023, having climbed over 20% from the Q3 2022 bottom. However, the stock market has long been detached from reality, continuously hitting new heights despite 2020’s job losses and the unsustainable impact of stimulus payments (now fully depleted from the wallets of both consumers and businesses). Watch for more volatility heading into 2024 as stock market investors continue to react to Federal Reserve actions on interest rates and the oncoming economic recession.

For real estate, this means we are in a hold phase as savvy investors look ahead to the next buyer’s market when property prices will hit a bottom. Property prices are expected to decline in 2024, hitting bottom around 2025, at which point the next buy phase will begin.

Updated September 7, 2023. Original copy released October 2009.

Chart update 09/07/23

Chart update 09/07/23

Chart update 09/07/23

| Q2 2023 | Q1 2023 | Q2 2022 | |

| Price Index | 4,450 | 4,109 | 3,785 |

| P/E Ratio | 20.5 | 18.8 | 18.4 |

Track the current stock pricing and earnings on the S&P 500 stock pricing index, and make connections between the world of the stock market and the world of real estate.

firsttuesday Analysis

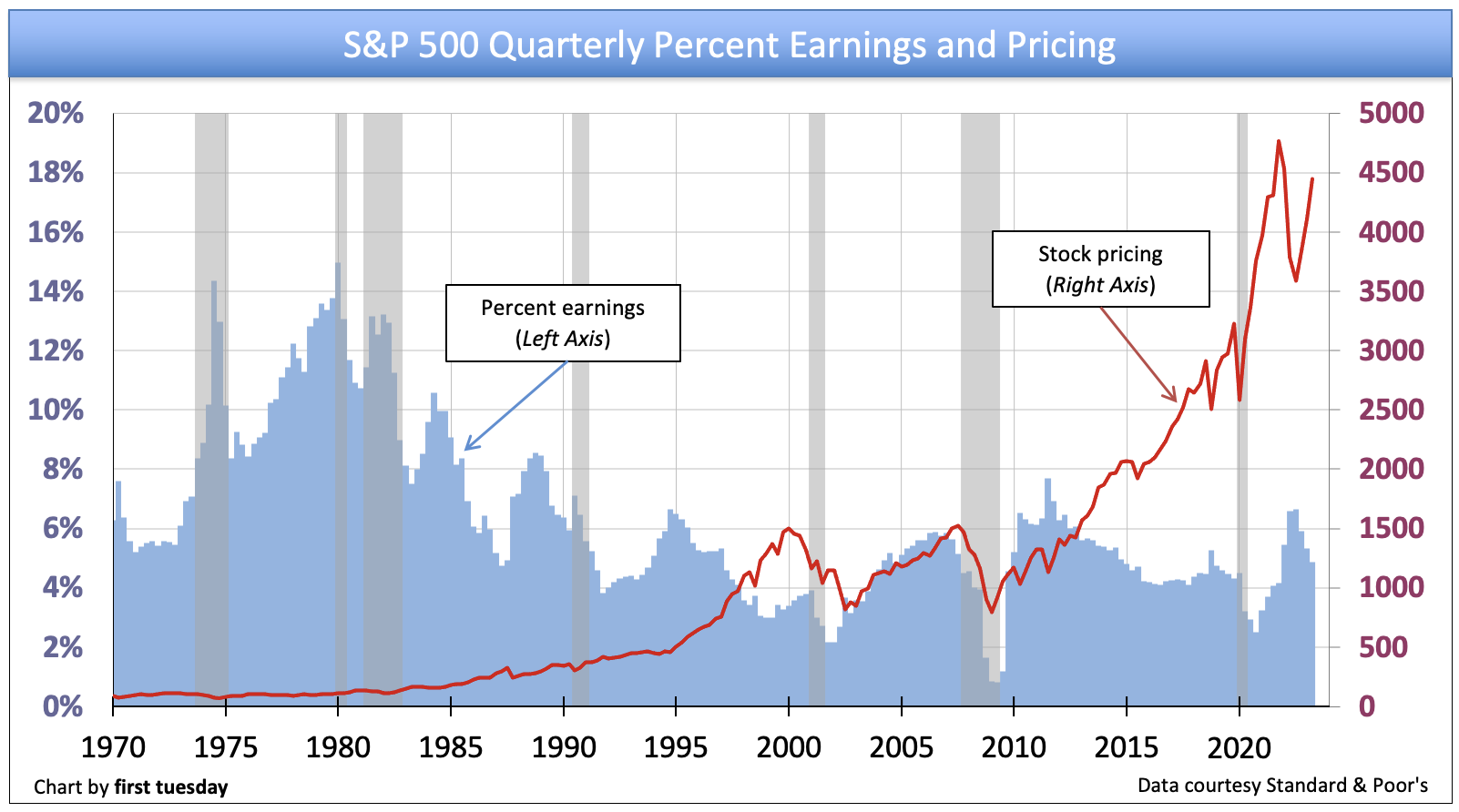

The red line of the first chart above tracks pricing of the 500 stocks listed in the Standard and Poor’s (S&P) 500 index. The dark blue line in the second chart above tracks the price-to-earnings ratio for those S&P 500 companies, called the net income multiplier (NIM) in real estate transactions. The light blue shading in the top chart track earnings as a percent of total price, a figure analogous to the rate of capitalization, or cap rate, by real estate investors.

The dramatic rise in stock pricing beginning in the mid-1990s was accompanied by a huge increase in the amount of funds entering the stock market, as the aging Baby Boomer generation began to earn more and invest more heavily in stocks. In 2008, the Boomers started to retire. Now, to maintain the lifestyle they have become accustomed to, the Boomers in retirement will draw down their savings and use their accumulated wealth to consume goods and services.

Related article:

This behavior of dis-saving — cashing in savings — is already beginning to cause a decline in the price of stocks, although the effect has gone unnoticed due to the stock market crash of 2008. No force exists in the current market to offset Boomer influence on stock pricing, and the Boomers themselves will not be in a position to reinvest the money they withdraw back into the market.

While stock ownership is a luxury, shelter is a necessity. As Boomers retire and sell their homes over the upcoming 10-20 years, their home sales will be offset almost completely by home purchases they will make. The Boomers grew up with the American dream of personal ownership of a single-family residence (SFR), and they will continue their inveterate habit of homeownership as they relocate in the future.

Related article:

The P/E Ratio

The price-to-earnings (P/E) ratio is a simple abstraction, a multiplier used to compare the price of a stock with the earnings of the company. In the market crash of 2008, stock prices dropped dramatically from their former heights, but as the P/E ratio demonstrates, the earnings reported by the companies that underlie those stocks dropped much further.

From the end of World War II to the late 1990s, the P/E ratio of the S&P 500 hovered between 10 and 20. This range delivers, respectively, from 10% to 5% corporate earnings on the price paid for the stock.

Around 1997, however, the P/E ratio reached unusually elevated numbers, which remained elevated until 2002. Part of the accelerated rate was due to a surge of Boomer earnings and investments driving up the overall price of stocks (just as home prices were boosted by the surge of Boomers in the 1980s).

Nonetheless, after the stock market crash which ended in 2002, the P/E ratio remained near 20 (see darkened bar on chart) until the financial crisis reached its apex in the last quarter of 2008, when the P/E ratio abruptly jumped from 25 to 60 as stock prices failed to adjust to the drop in earnings. In 2009, earnings fell further and stock prices continued to rise (as risk takers returned, bringing more money into the market to vie for the same number of stocks), until the P/E ratio peaked at a multiplier of 122 in the second quarter of 2009, with annual earnings of only 0.82%.

Stock prices set adrift

These numbers were fueled by irrational optimism among investors, not by legitimate pricing expectations about the future income of these companies. After dramatic stock price drops in the third and fourth quarters of 2009, the P/E ratio at the end of 2009 was approximately 23: more realistic but still too high for long-term stability.

By mid-2010, the ratio had fallen to 16, right in line with its historic link to earnings. A year later, the P/E ratio had dropped below this average, and was hovering between 11 and 15, thanks to tepid earnings and a continuing lack of confidence about growth in the economy.

This return to market norms in 2009 and early 2010 came about due to a combination of gradually rising stock prices and dramatically rising earnings. Provided the market continues to gradually right itself, investors will soon become more tolerant of risk, and the economy as a whole will benefit.

Beginning in 2013 and continuing through 2019, stock prices quickly exceeded reasonable heights, a growth rate which will prove unsustainable in the months to come. Now that stocks have dipped significantly, investors will adjust to the coming reality of the rise in interest rates over the next two-three decades as U. S. GDP increases. Investments will reflect this realization, keeping the P/E ratio between 10 and 20, and the percent earnings between 10% and 5%. Thus, a measure of stability will return to the stock market.

Related article:

Real Estate Applications

The real estate and stock markets are not the same, of course, but thoughtful investors will pay attention to their relationship. There are some notable distinctions to be made between the two.

Real estate investors will never be satisfied with the 5% returns offered by stocks when the P/E multiplier is closer to 20. Property owners certainly do not buy real estate based on a 5% cap rate – a net income multiplier of 20 – the current P/E ratio buyers of stocks are settling for. Further, problems that plague stocks, like spurts of inflation and short-term interest rates, are far less likely to affect properly mortgaged real estate.

Real estate investment pricing, in turn, is driven by the components making up the cap rate investors use to set real estate prices. 2.5% to 3.2% of the return from an investment in real estate must provide for the annual recovery, over 30 to 40 years, of capital allocated to improvements on the property due to their inevitable physical deterioration (called depreciation).

Capital recovery problems are inapplicable to investments in companies listed on the stock market. They sell products which can be changed to suit the current needs and location of the population – unless, of course, they are real estate investment trusts (REITs).

Related article:

https://journal.firsttuesday.us/reit-investment-playing-the-real-estate-game-from-the-sidelines/3809/

The cap rate and converse P/E ratio

In the stock market, the price paid by buyers is expressed in terms of its relationship to the company’s earnings, as a P/E ratio. Conversely, real estate prices are offered (and paid) based on the rate of return sought by the buyer, called a cap rate. It is only then that a NIM—the real estate equivalent to a P/E ratio — is determinable.

The NIM is easily produced: it is simply the reciprocal of the cap rate. For example, earnings of 5% (a 5% cap rate) will indicate a P/E ratio – NIM – of 20. Remember: real estate buyers evaluate the property’s return on their investment by use of the cap rate; stock market investors determine their success by the ratio of earnings to quoted price.

More importantly, stocks represent stored wealth, especially the accumulated wealth of senior citizens. These seniors will soon begin to pull cash out from this store of wealth as they retire. Current trends in the stock market and future interest rates expectations are not likely to inspire a great deal of investment momentum activity in the near future, even from the most optimistic.

I have been using the chart that compares the S&P index to the earnings. I cannot understand it since the P?E has been reasonably stable. One part is an absolute number, the other a percentage. Is it compatible?

This is a great article. Very well thought out. I was doing the same calculation just today and ran across this piece. The message I struggle with are the replacement costs and the leading indicators.

The real estate market and the stock market are distant in-law cousins. Real estate markets generally speaking are divided in Housing and Investment.

-Housing market values are driven by personal values (likes, dislikes, color, neighborhood, etc, etc) and values have very little to do with return. Simply, housing is shelter and should never be viewed as an investment. In fact, on many occasions buyers are willing to pay more to satisfy their personal desires.

-Investment – Real estate has become an Asset Class that investors compare to Bonds because they have similar elements when evaluating and choosing it as an investment, in addition, it offers the investor a hedge against inflation. Capitalization rates are directly derived from Bond market rates. Incidentally, as rates go up Capitalization rates will go up and consequently values of properties will go down.

Very informative Didn’t understand anything

There might be a correlation between P/E and the CAP rate.

Very Infomative. I would like more information on this topic. I am not interested in an ongoing financial obligation.