The Lull Before The Storm: 16 factors set to rise with interest rates

From the 1980s until 2012, interest rates steadily declined. This falling interest rate environment is all most adults have known. Now, as we enter the next two-to-three decades of rising rates, we need to examine the many ways higher interest rates will impact real estate. The following factors will be stretched and shaped by rising interest rates in the coming years.

1. Personal savings

Consumers will become disinterested in taking on debt as interest rates rise, causing a reduction in debt and increased savings.

2. Private student loan payments

Young adults who took out private student loan payments with adjustable rates will see their payments rise, stifling their ability to participate in the economy.

%

College graduates who have taken out student loans.

3. Business operating expenses

Business owners who finance or rent their equipment, inventory or buildings will see costs rise alongside interest rates.

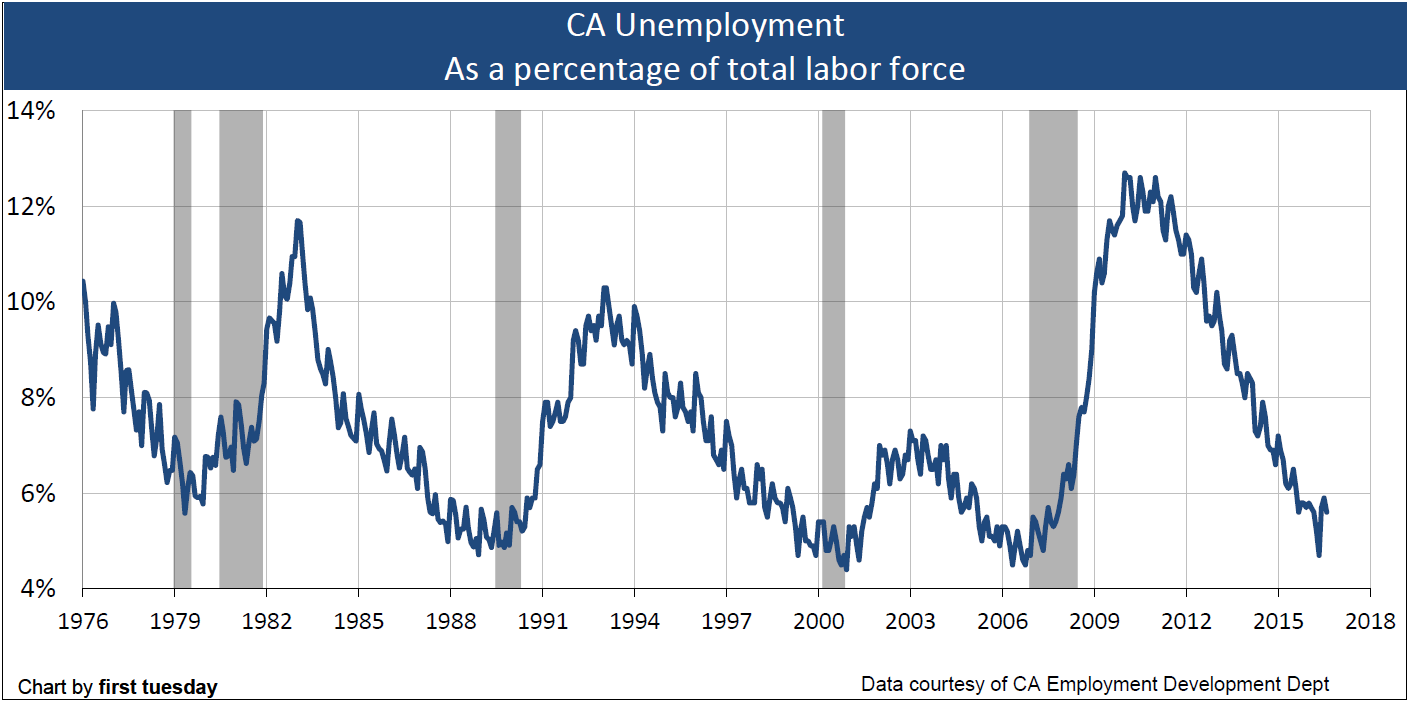

4. Unemployment

As interest rates inch higher, the economy will slow, leading to slower job growth and a higher unemployment rate.

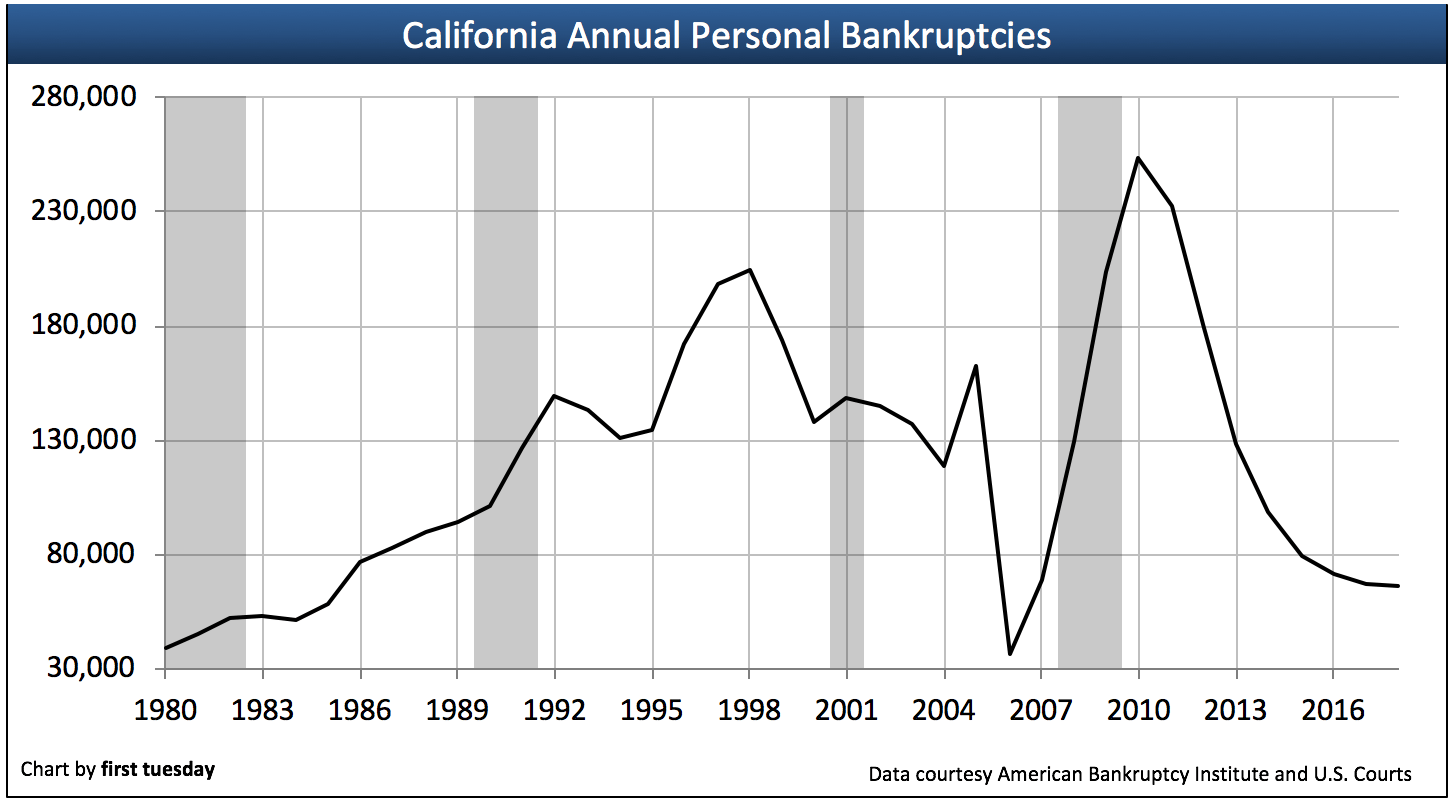

5. Bankruptcies

Personal and business bankruptcies will rise along with interest rates due to higher unemployment and the inability to pay back debts at higher rates.

6. Bank stocks

Banks will see increased profits from higher interest rates.

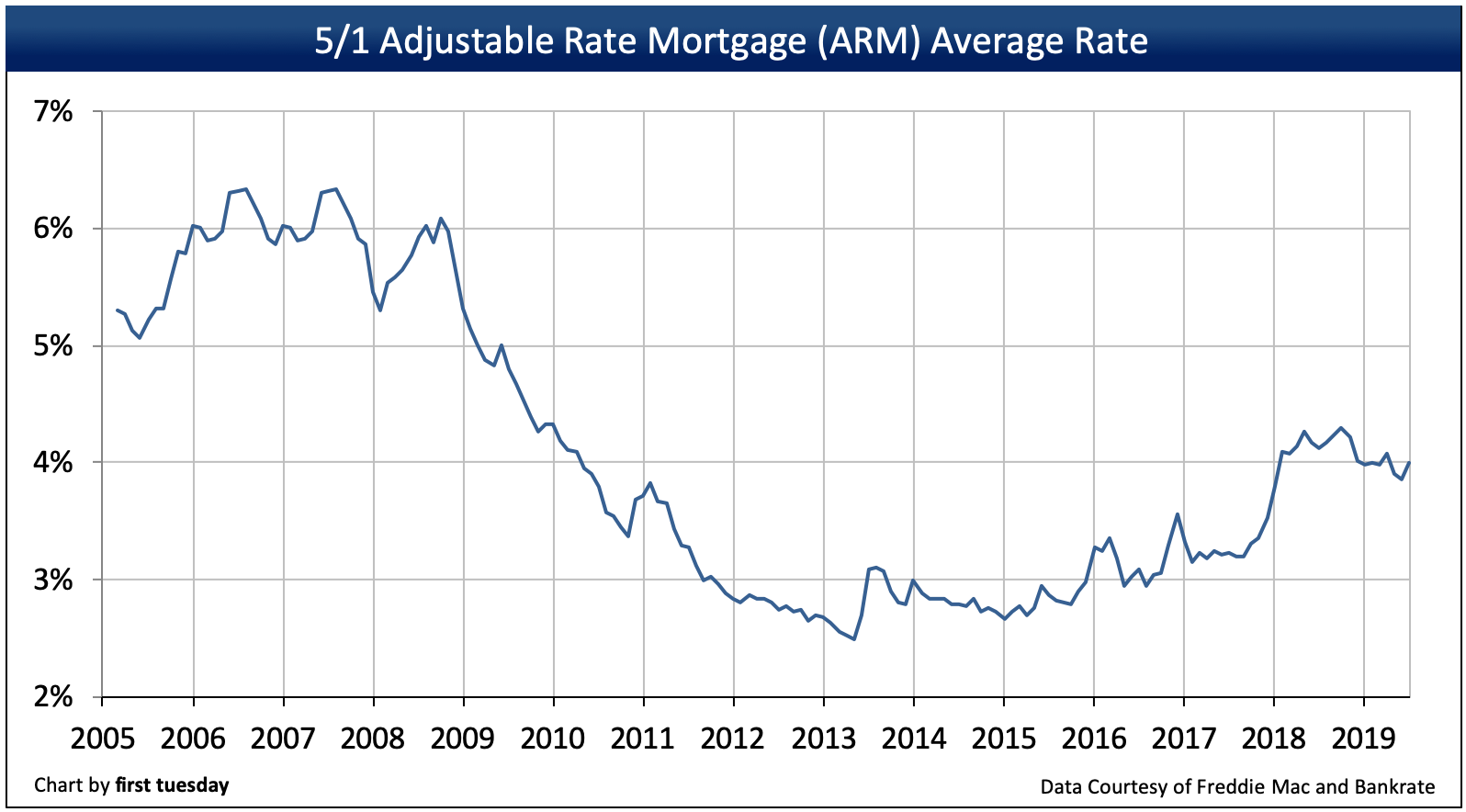

7. Adjustable rate mortgage (ARM) rates

Homeowners with ARMs will need to make higher payments as their interest rates reset. Refinancing will be unfeasible due to higher interest rates and those who cannot pay will need to sell or walk away.

8. REOs

REOs in the hands of lenders increase.

9. Foreclosures

Lenders will foreclose more often as more homeowners overextend themselves — particularly ARM holders.

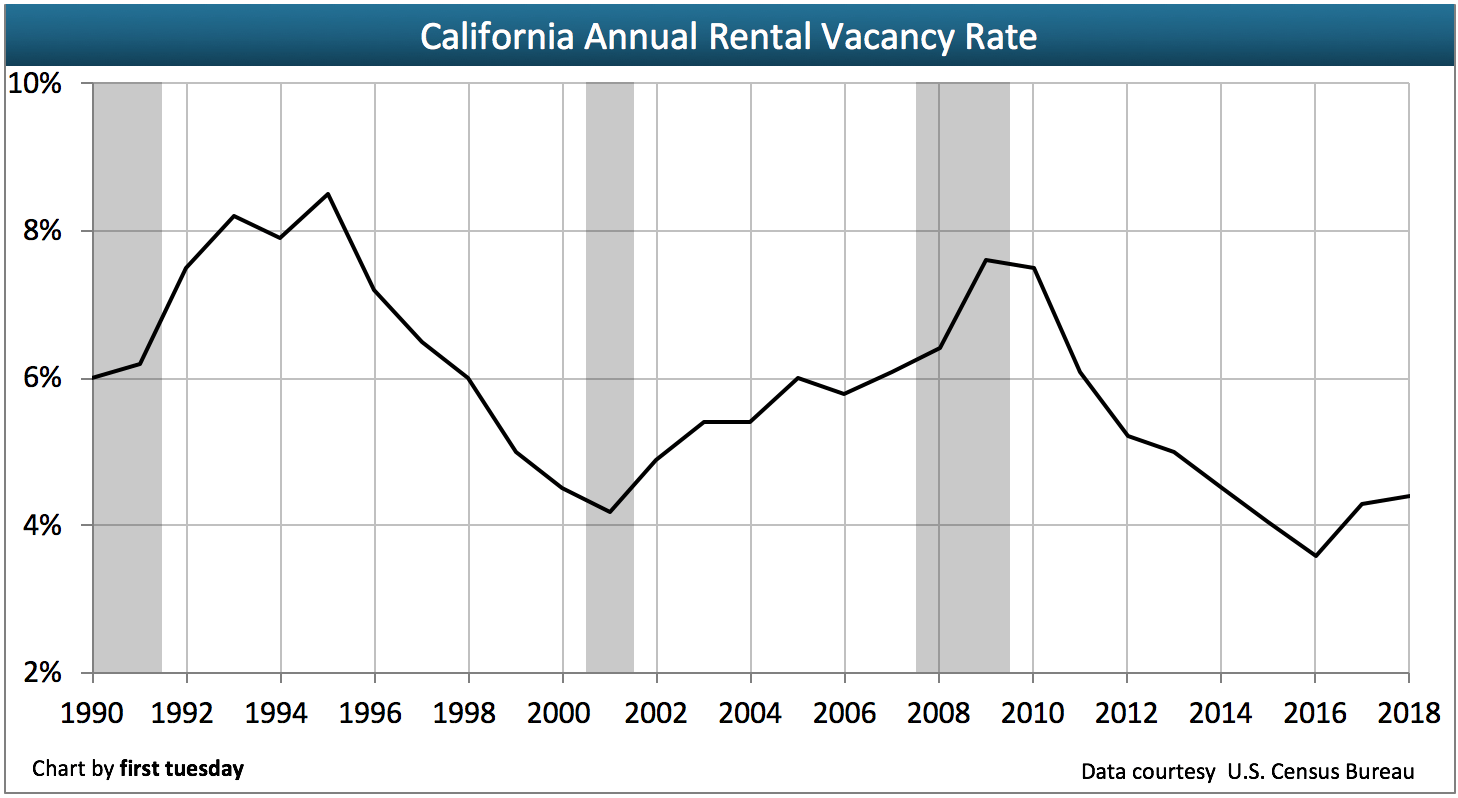

10. Vacancies

More vacant properties will appear as lenders work through their rising REO inventory of homes. More commercial properties will sit vacant due to business failures.

11. Demand for property managers

More renters will arrive on the scene as homeownership becomes more difficult to attain at higher rates.

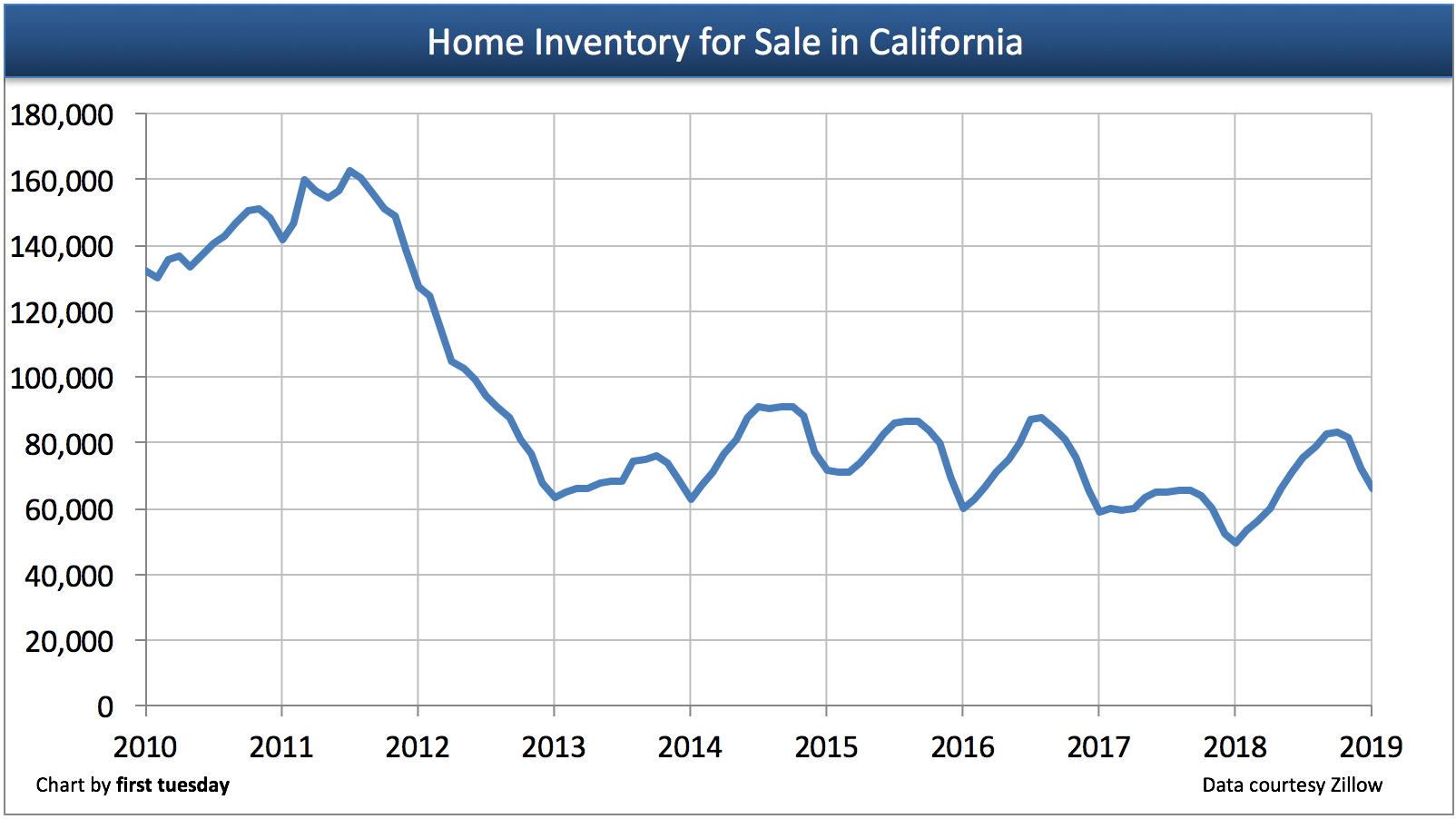

12. For-sale inventory

Homes will sit longer on the market as homebuyers contend with higher interest rates and reduced purchasing power.

13. Expired listings

The share of home listings that expire will rise as homes sit on the market longer.

14. Inactive licensees

The number of inactive licensees will rise as underemployed agents and brokers need to look elsewhere to make the same living they were used to before interest rates rose.

15. Litigation

While interest rates slow prices and home sales, money will be lost on either side, resulting in buyers and sellers more likely to pursue litigation.

16. Relocations out of state

More homeowners and renters unable to keep up with the high cost of living in California, made worse by rising interest rates, will leave for other, less expensive states.