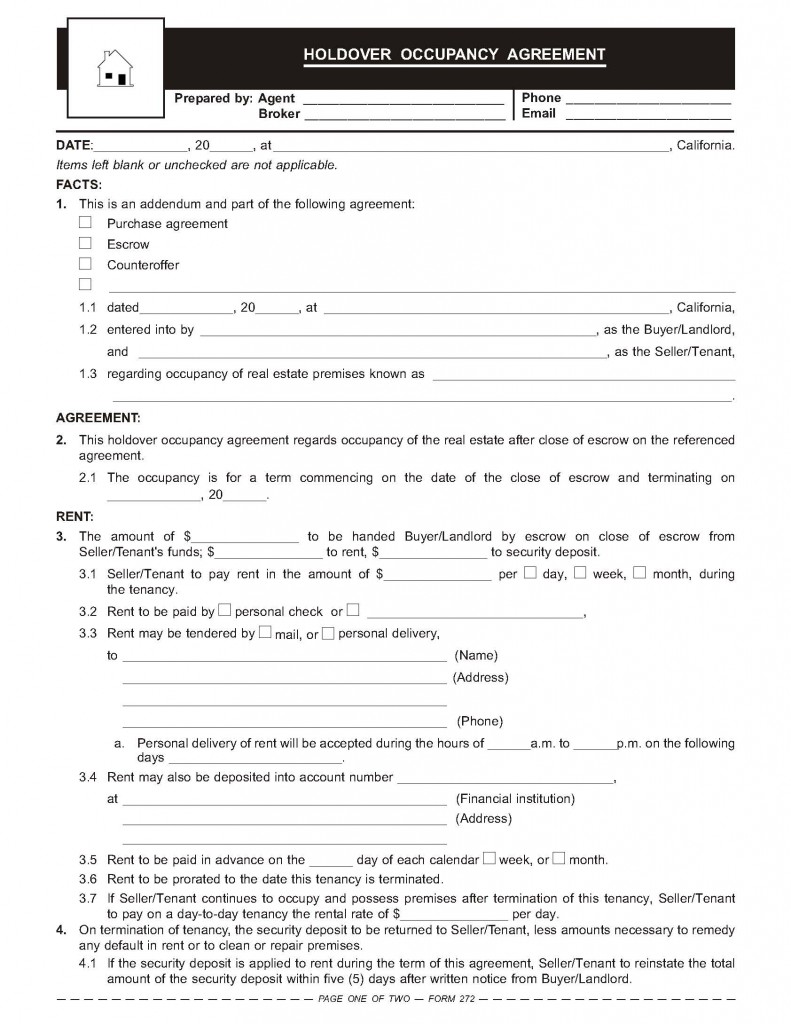

Form-of-the-Week: Holdover Occupancy Agreement – Form 272

The recent increase in home prices has left nearly a million California homeowners flush with new equity. With equity, previously underwater homeowners suddenly have the ability to sell and relocate into a home more suitable for their needs.

When relocating to a replacement residence, the seller and their agent face the logistical challenge of timing the closing of the sale of their current home with the closing of the purchase of their replacement home. While concurrent closings are preferred, they are not always possible.

The challenge for the seller’s agent is to help the seller avoid moving twice. The concurrent move from the seller’s current home to their new home will have less risk if an arrangement is negotiated with the buyer for the seller to remain in possession of the home sold under a holdover occupancy agreement. Here, the seller remains an occupant of their current home until they can take possession of their replacement home, normally on the close of the purchase escrow for that home.

Alternatively, arrangements are made under an interim occupancy agreement to prematurely take possession of the replacement property on the date the sales escrow closes, prior to closing the purchase escrow on the replacement home. [See first tuesday Form 271]

Here we review the more risk-free arrangement: the retaining of possession to the home sold under a holdover occupancy agreement. [See first tuesday Form 272]

Holdover tenancy to bridge the closing gap

When the seller’s closing date on the sale of their current home is to occur prior to the date scheduled for closing escrow on the purchase of their replacement residence, it is best if a short-term lease-back for the seller is negotiated, commonly called a holdover.

A lease-back arrangement permits the seller to remain in possession of the home they have sold for the time needed to close their purchase escrow and take occupancy of the replacement residence. Thus, the seller avoids a double move.

A holdover tenancy in this context occurs when the buyer consents to let the seller continue to occupy the property for a period of time after escrow closes and the buyer has acquired ownership. The agreed-to holdover tenancy transforms the buyer/seller relationship to that of landlord/tenant, even if they do not enter into a written occupancy agreement. A tenancy is formed if the seller merely retains possession after closing with the consent of the buyer. [Covina Manor Inc. v. Hatch (1955) 133 CA2d 790]

However, a holdover tenancy, without a properly provisioned written occupancy agreement, poses questions about the buyer’s ability to protect their interest in the newly acquired property. What if the seller-turned-tenant loses interest in maintaining the property, commits outright waste, defaults on rent payments or does not move out on the date orally agreed?

Written evidence of the terms of an occupancy is needed as minds and memories tend to fail or fade.

Getting rid of the seller after the holdover tenancy period expires is the buyer’s biggest risk, along with concerns over maintenance. Use of a formal holdover occupancy agreement greatly reduces these risks by putting the agreed-to terms in writing to evidence the terms agreed upon – in a word, memorialized. [See first tuesday Form 272]

Related article:

Brokerage Reminder: Buyer protection for a seller’s holdover tenancy

first tuesday’s Holdover Occupancy Agreement is used by a seller’s agent when negotiating a lease-back with the buyer of the property. Arrangements are made for the seller to remain in possession after the close of escrow until they are able to take possession of a replacement property they are acquiring. The written agreement spells out the terms and conditions for the lease-back between the seller and buyer, leaving nothing to chance.

The tricky part of the negotiations is setting the date for expiration of the tenancy, since the date scheduled for the close of any purchase escrow is a target date. Often the closing does not occur exactly on the day scheduled for closing.

So to buy time, the date for expiration of the holdover is best set beyond the scheduled closing date. This leaves sufficient time to overlap the date for closing escrow on the home to be acquired and occupied. For the seller, it is also better to pay a few days extra rent than move twice.

The Holdover Occupancy Agreement contains many provisions commonly found in lease agreements. These include rent and security amounts, as well as other rights and obligations established between a landlord and tenant. Although holdover occupancy agreements resemble other lease agreements, the special circumstances of the agreed-to seller holdover require some special provisions.

The Holdover Occupancy Agreement provides for:

- the commencement and termination dates of the holdover occupancy;

- the rent and deposit amounts to be handed to the buyer by escrow from the seller’s proceeds on closing;

- the rent amount during the tenancy;

- the daily rental rate if seller continues to occupy and possess the property after termination of the tenancy; and

- use and maintenance clauses pertaining to the seller’s obligations while occupying the property. [See first tuesday Form 272]

The Holdover Occupancy Agreement is best managed as an attached addendum and made part of the purchase agreement entered into by the seller and the buyer. But it may be agreed to later, prior to closing escrow.

Typically, the buyer is presented with the agreement in a counteroffer, with the seller negotiating for the continued occupancy. The agreement clarifies the buyer’s ownership rights and, more importantly, creates a landlord-tenant relationship for quick judicial resolution of any disputes over occupancy or monies owed.

What is the cost for this form? Joe

Joe Lake,

Thank you for your inquiry. All RPI Forms are free to the public. Simply click on the image of the form above to download, or go to our Forms Download page here.

Regards,

ft Editorial staff

I really like this Holdover Occupancy Agreement form; it’s far superior to the solutions for rent-backs in Winforms. This one is so specific, and ties all back to the Purchase Agreement if you desire to do that. The way it’s formatted is so self explanatory, I can see that it would cut down on a lot of the fear based questions that my Buyers would be posing. I like it.