Get your buyer the best financial advantage; submit multiple loan applications and compare

Submitting a loan application to a lender is the catalyst which sets the machinery of the mortgage industry in motion. All too often, a homebuyer needing purchase-assist funding is left to grapple single-handedly with lenders to look out for his own financial interests with no protective assistance. The game under RESPA is well known to be rigged to favor the lender. Thus, it becomes the duty of the “gatekeeper” who brought the homebuyer into the marketplace, the homebuyer’s selling agent, called a transaction agent (TA) by the lenders, to diligently ensure the homebuyer gets the best financial advantage available to him for the class of loan the homebuyer seeks.

The TA needs to make sure the homebuyer receives all the correct documentation from the lender and within the time periods prescribed by law. All lenders are quick to proclaim they fully comply automatically with the law, as though all lenders are they same. However, lenders are not all the same and neither are their charges and rates. This variance is necessary to maintain a competitive world. Without the clear disclosures and questions asked about the estimates received from lenders, there is an asymmetry of information – the lender possesses a large volume of data about the homebuyer, but the homebuyer has no sufficient details of loan terms and what the lender is really going to do until the time of closing.

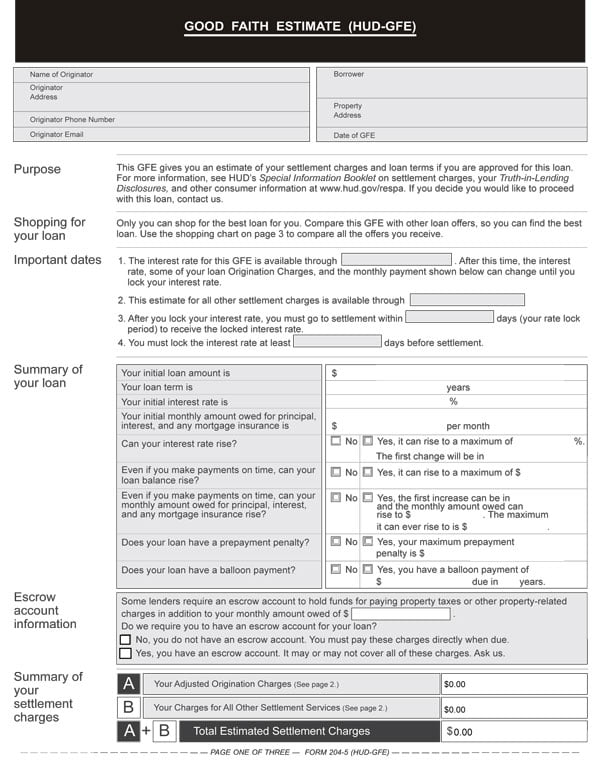

Under the Real Estate Settlement Procedures Act (RESPA), any lender making any consumer purpose loan secured by a one-to-four unit residential property must deliver a Good Faith Estimate (GFE) to the homebuyer within three days of the homebuyer’s submission of a loan application. The GFE itemizes the settlement charges and states the amounts the homebuyer will pay for each – within ten percentage points. These settlement charges include loan origination fees, credit report fees, insurance costs, and prepaid interest the lender intends to charge or be reimbursed for originating the loan.

The TA needs to consider encouraging his homebuyer to submit loan applications to at least two different lenders, then analyze the GFEs issued by both. The homebuyer should resist paying any appraisal fees or other fees until the GFE has been received. Only then is the lender on the record about what they will commit to in writing – and even that can be changed with the issuance of a new GFE. RESPA intends the GFE to be used to compare loan costs of the same type of loan offered by different lenders under multiple loan applications. Lenders resist any attempt at competitive bidding, but the receipt of multiple GFEs quickly distinguishes the good loan terms from the bad. This is the root of lenders’ motivation to demand fees upfront before the GFE is delivered.

When a loan contingency exists in a sales transaction, which is usually the case, the homebuyer typically needs the assistance of his TA to negotiate with the lender and ensure the homebuyer ends up with the most competitive loan rates and terms available. To best achieve this objective, the homebuyer submits separate loan applications to multiple lenders, with a minimum of two. Again, the homebuyer should not pay any deposit for credit reports, appraisal fees, etc, until that GFE is received. The GFE is the document that helps the homebuyer determine whether he wants to proceeds with the lender and incur the expense of the reports and fees. This is no different than getting a bid on the purchase price of the same automobile from two car dealers, except with a home purchase, substantially more money is involved and thus greater protection is needed.

If the estimate of costs and rates worked up by the loan representative prior to submission of the loan application are different from those furnished in the GFE and accompanying Truth-in-Lending (TILA) annual percentage rate (APR) disclosures, the lender’s true colors are instantly exposed. The buyer, with the guidance of the TA, can determine whether the loan representative gave them straight forward and honest information, or if the initial interview with the loan representative was a fabrication to entice the buyer to apply for a loan. [See first tuesday Form 221]

To compound this rigged game, lenders often change their rates and charges disclosed in the GFE immediately before closing. When they do so, they hand the homebuyer a second “refreshed” GFE and TILA (APR) disclosure – as is allowed by RESPA – and thus suddenly modify (more specifically, increase) the charges, interest rate and loan terms. This bait-and-switch is played on the homebuyer just three business days before closing.

If no backup application has been placed with another lender, the homebuyer has no last minute alternative available to protect himself against the lender going in for those extra profits at the last possible opportunity, nefariously gaming the system. However, when loan applications are at work with two or more lenders, the buyer is able to choose the lender who offers the superior set of loan costs, interest rate and repayment schedule at time of closing.

Although the second application may double the homebuyer’s application costs if the lenders refuse to wait for the deposit of the costs before they deliver the GFE – part of the gaming of the RESPA rules – these costs are de minimis in comparison to the total dollar amounts involved in the transaction. The TA should not let the homebuyer be dissuaded on these grounds. The extra cost for the second or third loan application is to be considered the premium paid for protection under RESPA. The homebuyer needs at least two GFEs before any comparison can be made, which is the specific intent of the GFE.

Multiple government agencies, both federal and state, promote the practice of submitting multiple applications. To assist the buyer with the task of comparing the products of two or more lenders after multiple applications have been submitted, page three of the GFE contains four columns to compare up to four loans offered by different lenders.

Also, government agencies and enterprises such as the California Department of Corporations, Freddie Mac, Fannie Mae, the Federal Reserve, and the Federal Trade Commission publish Mortgage Shopping Worksheets. These worksheets, designed to be completed by the buyer with the assistance of the TA, contain two columnar itemizations of all the variables commonly occurring at the time of origination and over the life of a loan – for the sole purpose of comparing competitive offers from different lenders.

After submitting loan applications to two lenders and receiving the corresponding GFEs, the buyer will possess all the information needed to fill in both columns, one for each lender. Once complete, the buyer and TA can clearly compare the terms offered by the competing lenders, then proceed to close with the lender making the more advantageous offer.

Understanding the updated GFE and HUD-1

The homebuyer financing his home purchase is going to ask his TA to help navigate, or at least explain, the intricacies of both the GFE and Settlement Statement (HUD-1). Hundreds of thousands of the homebuyer’s dollars, spent today and tomorrow, are at stake. Thus, the TA familiar with the revised GFE and HUD-1 is able to intelligently point the homebuyer to the best financial arrangements and answer any questions about the lender and the process posed by the homebuyer he represents. This action is what generates the referrals agents live by.

While the GFE is given at the beginning of a transaction, the HUD-1 is provided at the end. At least one day prior to settlement, the lender must give the homebuyer the HUD-1 Settlement Statement which states the actual settlement costs imposed on the homebuyer. It must conform to the GFE(s) originally received. [See first tuesday Form 402]

After the transaction has closed, the TA should assist the homebuyer conduct a line-by-line comparison between the estimated costs disclosed in the GFE and actual costs revealed in the escrow closing statement, also prepared on the HUD-1.

The Department of Housing and Urban Development (HUD) updated the nationally used GFE and HUD-1 in 2010. However, the laws and professional practice protecting homebuyers in California are more stringent than those imposed by Congress for the nation. Prior to the HUD updates, California MLBs who arranged traditional consumer loans secured by one-to-four unit residential property used DRE 883, the Mortgage Loan Disclosure Statement/Good Faith Estimate as mandated by the Department of Real Estate (DRE). Further, MLBs who arranged nontraditional mortgages (ARMs) used DRE 885. Both DRE 883 and DRE 885 contain two components, a California mortgage loan disclosure statement and a modified version of the GFE published by HUD. Because of its California-specific nature, DRE 883 and DRE 885 controlled over the GFE published by HUD for MLBs in California.

However, after the HUD update of both the GFE and HUD-1, the internal numbering scheme of DRE 833 and DRE 885 no longer align with the internal numbering scheme of the revised HUD-1, preventing the homebuyer from being able to intuitively compare both documents.

Thus, the DRE discontinued the use of the DRE 833 in California until they can integrate it with the revised HUD-GFE and get it approved by HUD, which could potentially take years. In the meantime, the DRE requires MLBs who arrange traditional consumer loans secured by one-to-four unit residential property to submit two disclosures to homebuyers: DRE 882 (the mortgage loan disclosure statement portion of DRE 883) and the new HUD-GFE. MLBs who arrange nontraditional mortgages will still use DRE 885 but must also submit the new HUD-GFE, as the GFE within DRE 885 is obsolete.

For the professional use of our students, first tuesday has redrafted this entire series of forms to comply with the HUD updates and California law.

- Mortgage Loan Disclosure Statement (DRE 882) – This form is given to homebuyers who take out traditional loans. [See first tuesday Form 204] The homebuyer must also receive the HUD-GFE in conjunction with the mortgage loan disclosure. [See first tuesday Form 204-5]

- Mortgage Loan Disclosure Statement/Good Faith Estimate (DRE 885) – This form is given to homebuyers who take out nontraditional loans. [See first tuesday Form 204-2] The homebuyer must also receive the HUD-GFE in conjunction with the mortgage loan disclosure. [See first tuesday Form 204-5]

- Good Faith Estimate (HUD-GFE) – This form is given to homebuyers in conjunction with either 204 or 204-2. [See first tuesday Form 204-5]

All first tuesday forms have been enhanced to allow digital entry and saving. Click on the links above to access the enhanced form.

Hello Connor, the only issue I see here is that in order to compare loans from different lenders you would have to subject your Buyer to have their credit report run as many times. No lender will hand you a GFE unless they take down an application with the necessary financial information and run a credit report.

But certainly when Buyer gets the GFE it should be read thoroughly and Buyers should ask questions from the loan officer if any discrepancies.