Many elements influence and shape the future housing market. Of these factors, rising mortgage interest rates will have the greatest impact on home prices in 2017, concludes the Zillow Home Price Expectation Survey.

Following higher interest rates, 2017’s inventory shortage and changing demographics are two more significant factors which respondents say will influence home prices in 2017.

The survey results are based on replies from a relatively small pool of 100 U.S. real estate professionals, academics and economists. These respondents expect prices to continue to rise unabated in 2017. But the magnitude and trajectory of the rise will vary based on interest rate movement. The higher interest rates go, the greater the downward pressure on home prices.

The reason is simple — when interest rates increase, the amount of mortgage principal amounts homebuyers are able to qualify for falls. Initially, buyers will try to stretch their budgets to continue searching for homes in the same price range as before the rate shift. However, as a matter of financial certainty, the budget nearly always prevails. Sellers ultimately need to adjust their pricing expectations to conform to decreased homebuyer purchasing power. This reactive seller behavior is why we see a delay of around 9-12 months from the moment rates increase to prices adjusting downward accordingly.

Sellers complicate matters further in an era of rising interest rates. When rates continue to rise, buyers who purchased or refinanced within the past few years are hesitant to give up their low interest rate for a higher one. This is inevitable in light of the movement in interest rates in recent years. Therefore, more homeowners are incentivized to stay put — unless an external factor compels them to pull anchor, such as a new job elsewhere.

With fewer sellers, an inventory shortage is likely — a scary thought on top of 2017’s already slim inventory of starter homes.

Related article:

Agent advice

How do you use this information to your — and your clients’ — advantage?

Some buyer and seller clients may be on the fence following the rate hike at the end of 2016, which persists today. Let them know that rates are likely to hover around their current rate for much of 2017. There will be changes, but these changes will be modest in the immediate future. However, rates will continue to rise in the coming years. Those who wait to take out a mortgage will likely regret it.

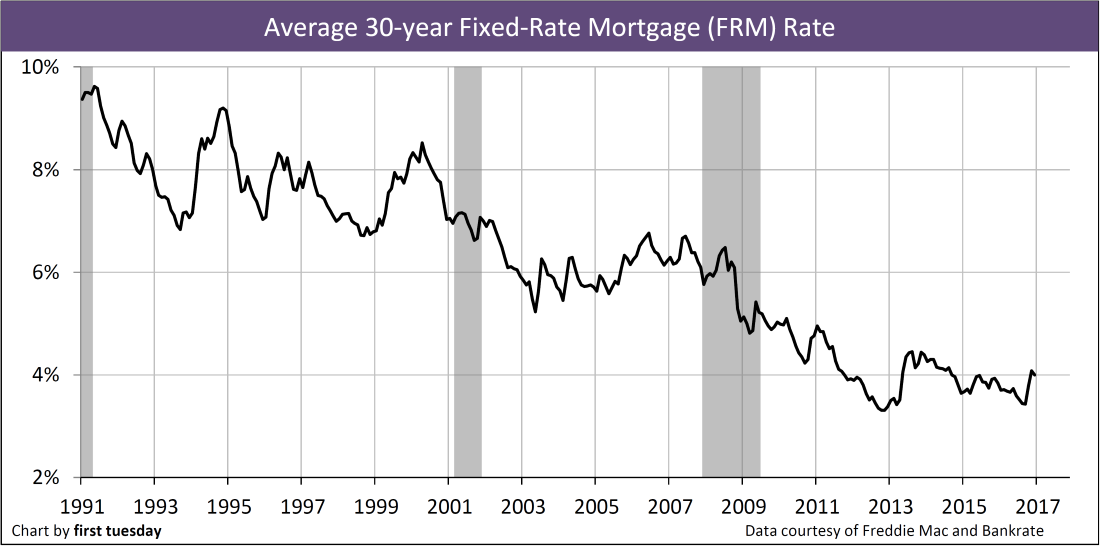

You can also offer your clients some historical perspective. True, rates have increased over half a percentage point from their recent low (which averaged around 3.4% in October 2016, and is now at just over 4.0% in March 2017). But when viewed alongside the rates in previous decades, today’s rates are very low, indeed. Not convinced? Take a look at the below chart:

Rates aren’t expected to return to the highs of the 1990s anytime soon. The Federal Reserve (the Fed) anticipates an increase of around two-and-a-half percentage points by 2019. For mortgage rates, that’s the same level as 2005-2007, when 30-year FRM rates averaged around 6%-6.5%.

One minor problem with this article. Two weeks ago the Fed rates its rates 1/4%. Over the last two weeks mortgage rates FELL 3/8%. Same thing happened when Fed first raised in DEC 2015. Where are the rising rates? Maybe rates will rise… or not.

Thank you for not hating on the Trump administration. That was refreshing.