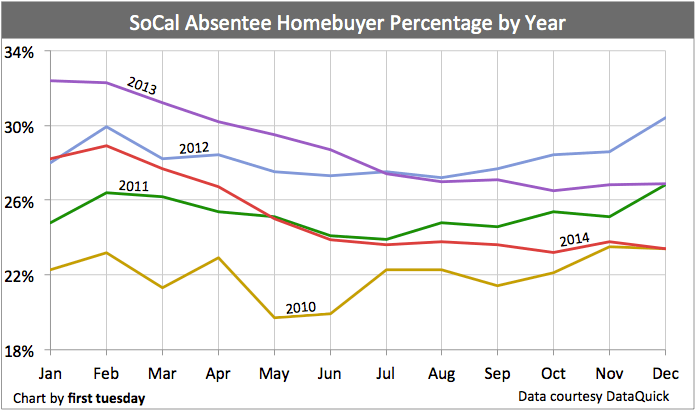

It’s official: speculators made their exit in 2014 and their ranks continue to decrease as we start the new year. While still above average at the start of 2014 (the red line in the chart), the share of absentee homebuyers (mostly speculators) in Southern California’s resale market dropped quickly.

All in all, the average percentage of speculators was level with 2011, at one in four home sales purchased by speculators and investors. In 2015, speculator participation will repeat the path of their run in the market during 2010 (the gold line in the chart), a downward move until they reenter the market going into 2016.

Annual average absentee homebuyer percentage

| 2010 | 22% |

| 2011 | 25.2% |

| 2012 | 28.3% |

| 2013 | 28.8% |

| 2014 | 25.2% |

Believe it or not, fewer speculators is good news for the long-term health of California’s housing market. That’s because a higher than average share of speculators throws home sales volume and prices out of balance. This was demonstrated in the 2013-2014 surprising leap in home prices through languishing and slipping home sales volume during that same period.

Essentially, prices were being propped up by speculator cash while lacking the support of end users of real estate (buyer-occupants and long-term buy-to-let investors).

Thus, as the housing market continues to lose its speculator support, expect home prices to fall quickly in 2015, bottoming around mid-2016.

Why is this good news? Pricing finally falling within reach of incomes means a return to normalcy — and eventual stability. Home sales volume will begin to recover throughout 2016 and rise to a peak in 2019-2020 when The Great Convergence of first-time homebuyers and sell-and-buy Baby Boomers hit the market.

Speculators are leaving higher priced markets and fleeing to lower priced areas. In some areas, investors still can purchase rental properties at a price that will allow an excellent annual return on investment. My real estate contact in Jacksonville FL tells me that investors are coming from Southern California (my area) to her area in search of acceptable returns. However, I think these buyers are investors rather than speculators, so I think this article is mostly right. I do, however, disagree on one point: I don’t think prices will fall noticeably because of this, but I do think they will remain relatively flat for some time.

You are wrong!!!

It is a fact that literally hundreds of wealthy peculators and Investors are still buying up low end houses to use as rentals as fast as they can.

Those folks have unlimited capital and the price of low end homes is still attractive because it is still below the historic high and after all it is also a fact that the number of renters is increasing which is forcing rents ( and returns on home investments) up, up up like crazy!!!

The bottom line is at this time it still a super great real estate investment to buy low end homes as rentals! ( and they will appreciate like crazy over the next 10 years–i.e: double in value which with leverage will yield 10% profit minimum per year–inn addition to the cash flow from rents. )