Form-of-the-Week: Owner-Occupancy Rider – Form 202-3

Prevention of mortgage application fraud

California ranks among the states with the highest risk level for mortgage application fraud in the nation. Homebuyer occupancy misrepresentation is the most common form of mortgage application fraud in the state.

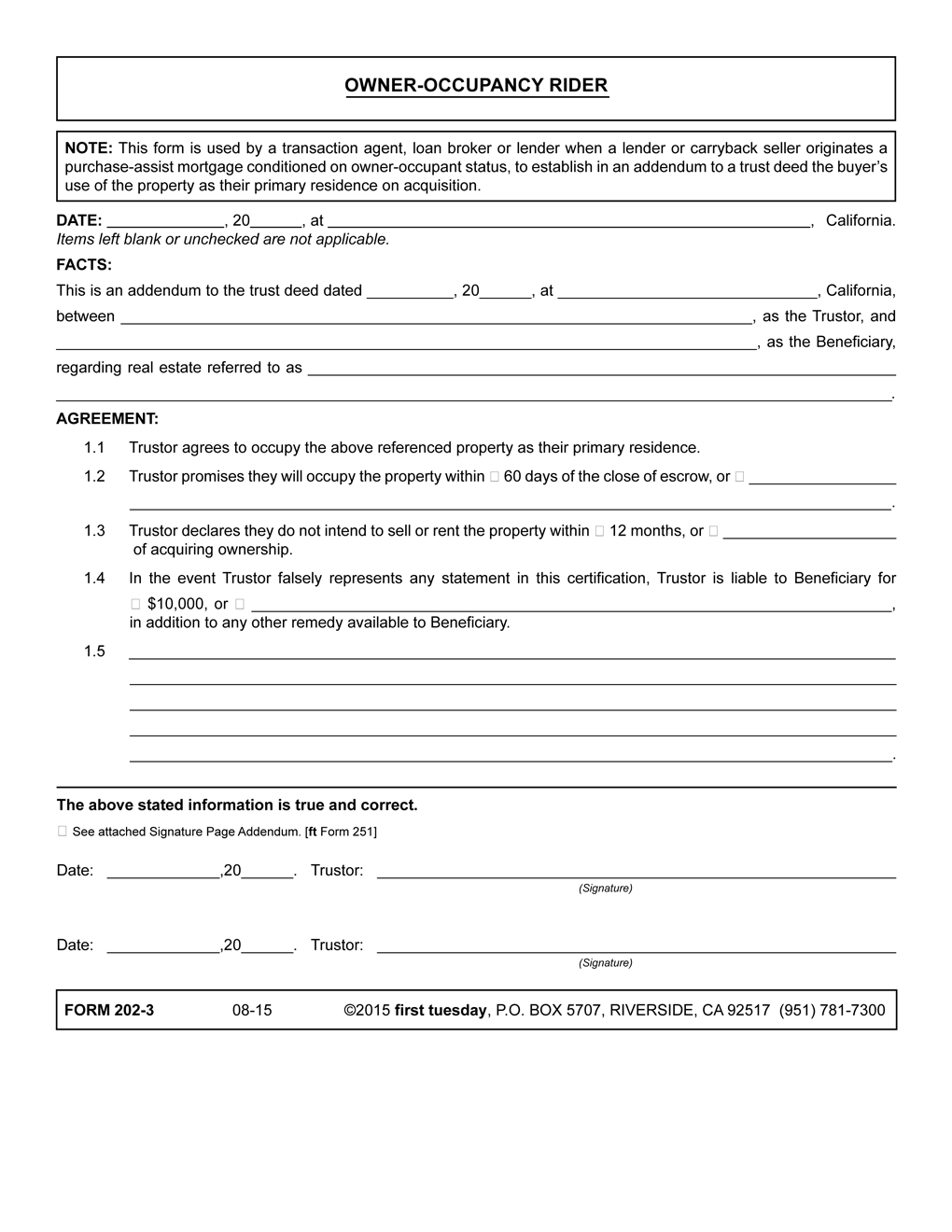

Occupancy misrepresentation occurs when the buyer of a property to be funded by a mortgage lies about whether the property they’re purchasing will be used as their primary residence. [See first tuesday Form 202-3]

Buyers of houses misrepresent their occupancy intentions with the goal of inducing the lender to originate a lower interest rate consumer-purpose mortgage with minimum down payment requirements available only to occupant buyers. Further, a carryback seller may also be looking for the security that an owner occupant has to offer versus an investor, who can more rationally walk away from their investment in times of recession and hardship.

On taking title, the deceptive buyer becomes an absentee owner. They rent out the property either as:

- a long-term income-producing investment property; or

- one to hold until it can be promptly flipped at a profit.

The current high demand for rental accommodation in California tempts more and more speculators and investors to commit what they incorrectly believe is merely a minor infraction.

However, when the speculator or investor gets caught, the mortgage holder may call the mortgage due, demanding immediate repayment of the balance. Further, borrowers caught committing mortgage fraud are flagged by name on Suspicious Activity Reports (SARs). SARs are filed with the Financial Crimes Enforcement Network (FinCEN), a database maintained by the federal government. As penance for their fraud, these alerts will prevent the listed speculators and investors from obtaining new mortgages or refinancing existing ones, regardless of their legitimacy.

The owner-occupancy rider

A transaction agent, loan broker or lender uses

first tuesday’s Owner-Occupancy Rider – Form 202-3 when a lender or

carryback seller originates a purchase-assist mortgage conditioned on

owner-occupant status. The rider is an addendum to the trust deed the buyer executes and becomes a condition of the lien on the property purchased as their primary residence. [

See first tuesday Form 202-3]

The Owner-Occupancy Rider serves as an extra layer of protection against mortgage fraud and provides lenders and carryback sellers with documentation that may be used to identify and prosecute such fraud. Thus, use of the form eliminates a buyer’s argument that they misunderstood the intent of the occupancy question that is often glossed over when filling out a mortgage application or signing settlement documents. [See first tuesday Form 202 and 202-3]

In addition, the Owner-Occupancy Rider holds real estate investors and speculators accountable for their decisions. Thus, it reduces the risk of default and foreclosure faced by mortgage lenders and carryback sellers and decreases the likelihood of acquiring a mortgage on a rental property with its risk of nonperformance.

Agreement as addenda

Under the Owner-Occupancy Rider Agreement, the buyer agrees:

- to occupy the property as their primary residence [See first tuesday Form 202-3 §1.1];

- to occupy the property within 60 days of the close of escrow, or within a time frame mutually agreed to between the participants [See first tuesday Form 202-3 §1.2];

- they do not intend to rent or sell the property within 12 months of acquiring the property, or within a time frame mutually agreed to between the participants [See first tuesday Form 202-3 §1.3]; and

- to be liable to the beneficiary (lender) for $10,000, or an amount mutually agreed to between the participants, in addition to any other remedy available to the beneficiary if they falsely represent any statement in the certification. [See first tuesday Form 202-3 §1.4]

The Owner-Occupancy Rider, when attached to a trust deed, incorporates the owner-occupancy requirement as additional terms to the trust deed. This offers any lender or carryback seller the security of knowing the buyer will occupy the property, thus reducing the risk of default. Also, the mortgage holder is permitted to call the principal due when the buyer misrepresents their intended use of the property. [See first tuesday Form 450]