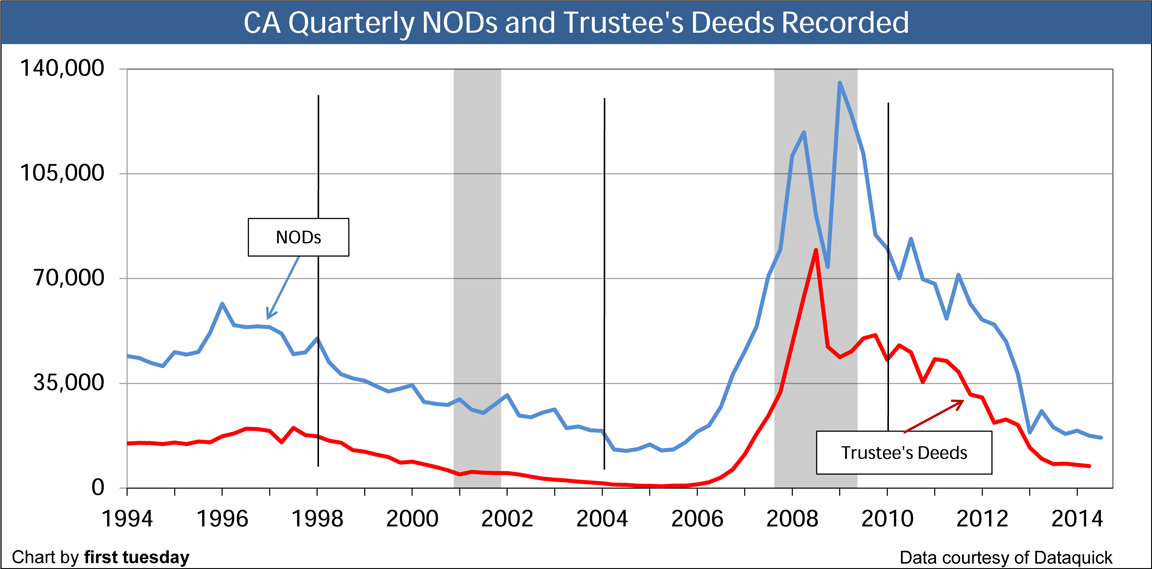

Just over 17,500 notices of default (NODs) were recorded in California in the second quarter (Q2) of 2014, down 9% from the prior quarter and down from 32% the same time last year.

Roughly 7,400 trustee’s deeds were recorded in Q2 2014, signifying foreclosure sales. This is down by 25% from one year ago when 9,800 trustee’s deeds were recorded.

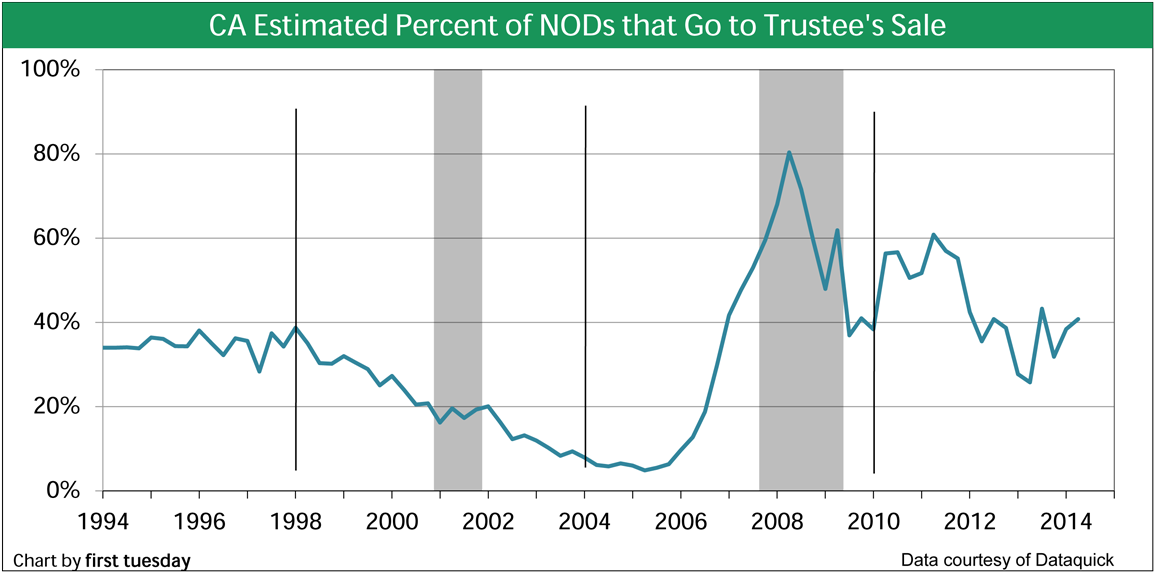

However, the percentage of NODs resulting in foreclosure rose to 41%. This is up from 26% one year earlier.

Among California’s largest counties, the greatest one-year drops in foreclosure sales took place in San Francisco (-58%), Riverside (-30%) and Orange (-36%) counties.

Looking forward, the number of trustee’s deeds has likely bottomed in mid- 2014, due to the flattening trend in NODs. Expect a slight increase in NODs, followed by a parallel increase in foreclosure sales in 2015, the result of declining prices from lost sales volume.

Chart 1

Chart update 08/15/14

| Q2 2014 | Q1 2014 | Q2 2013 |

NODs recorded | 17,524 | 19,215 | 25,747 |

Trustee’s deeds (foreclosures) | 7,392 | 7,799 | 9,840 |

Chart 2

Chart update 08/15/14

| Q2 2014 | Q1 2014 | Q2 2013 |

| % NODs going to foreclosure | 41% | 38% | 26% |

Foreclosures are an indicator of continued market distress. These charts track the number of NODs, which predict foreclosure sales occurring roughly nine months forward

The foreclosure process begins

Recording an NOD is the lender’s first step in the foreclosure process, following a minimum 90-day delinquency. The recorded trustee’s deed is the final step when the delinquency has not been paid current or the loan paid off.

If the lender acquires title after the foreclosure sale, the property is relisted as real estate owned property (REO). If a third-party purchaser acquires the property at the foreclosure sale, no special notation takes place when the property is relisted.

NODs are a good indicator of the financial condition of state, regional or local housing markets. As such, recent data on NODs and foreclosure sales forecasts the future volume of foreclosures and REO inventory.

In a normal housing market, the entire foreclosure process takes place over four to five months following a recorded NOD. In the current market, it takes an average of nine months to complete the foreclosure process from NOD to trustee’s foreclosure sale.Why so long? Negotiations for loan modifications and short sales, and lender backlogs are to blame. Still, good news going forward: the foreclosure process is trending shorter year over year.

Today’s NODs indicate the amount of foreclosure activity nine months forward.

The quantity of NODs has generally declined since 2009. The percentage of NODs that end in foreclosure has also decreased. This decrease is due primarily to increased short sale and loan modification activity.

Time keeps on ticking

Short sales remain somewhat common in 2014, totaling 9% of all California resale activity in Q1 2014.

The lender that does not foreclose promptly when faced with a 90-day delinquency will lose money each day the trustee’s sale is delayed. In turn, that delay will lengthen the real estate market’s recovery period.

Another aspect to be observed: foreclosures tend to tick upward toward the end of a recovery. Underwater homeowners eventually turn to strategic default if they see no debt relief from price increases.

NODs become REOs

Only when NODs become REOs or flips do they impact prices. Large amounts of REOs destabilize home sales volume and pricing, dragging prices down. The abnormality in 2013 was due to the high speculator presence. Speculators have caused prices to inflate drastically, in turn helping REO resales decline to about 7% of all home sales. Don’t expect REO resales to remain this low in 2014, as speculators have begun to exit the market, taking high prices with them.

Once REOs decline and remain at a normal 7% of sales volume, stability will return to real estate pricing. However, it all starts with fewer NODs and foreclosure sales. California’s NOD and foreclosure levels are slowly decreasing. NODs will likely return to normal levels once the Fed raises interest rates around 2015.

Related article: