Compiling mortgage data

The federal Home Mortgage Disclosure Act (HMDA) requires California Bureau of Real Estate (CalBRE)-licensed brokers who make consumer or business mortgages secured by residential real estate to annually disclose to the public their mortgage origination, application and purchase data. The federal government uses HMDA data to detect potential patterns of unlawful discrimination. [12 Code of Federal Regulations §§1003 et seq.]

State and federally regulated banks and brokers who make decisions on whether or not to make a mortgage secured by any residential real estate — whether consumer or business and regardless of the number of units — are required by HMDA to compile data on mortgages they originate.

In 2015, the Consumer Financial Protection Bureau amended HMDA regulations affecting CalBRE lenders in 2018. Here’s a quick rundown of how HMDA currently works, along with the changes to expect next year.

Editor’s note — HMDA applies to two types of lenders: depository lenders such as banks and credit unions, and nondepository lenders like mortgage bankers. This article focuses on the rules governing nondepository lenders.

Lender reporting thresholds

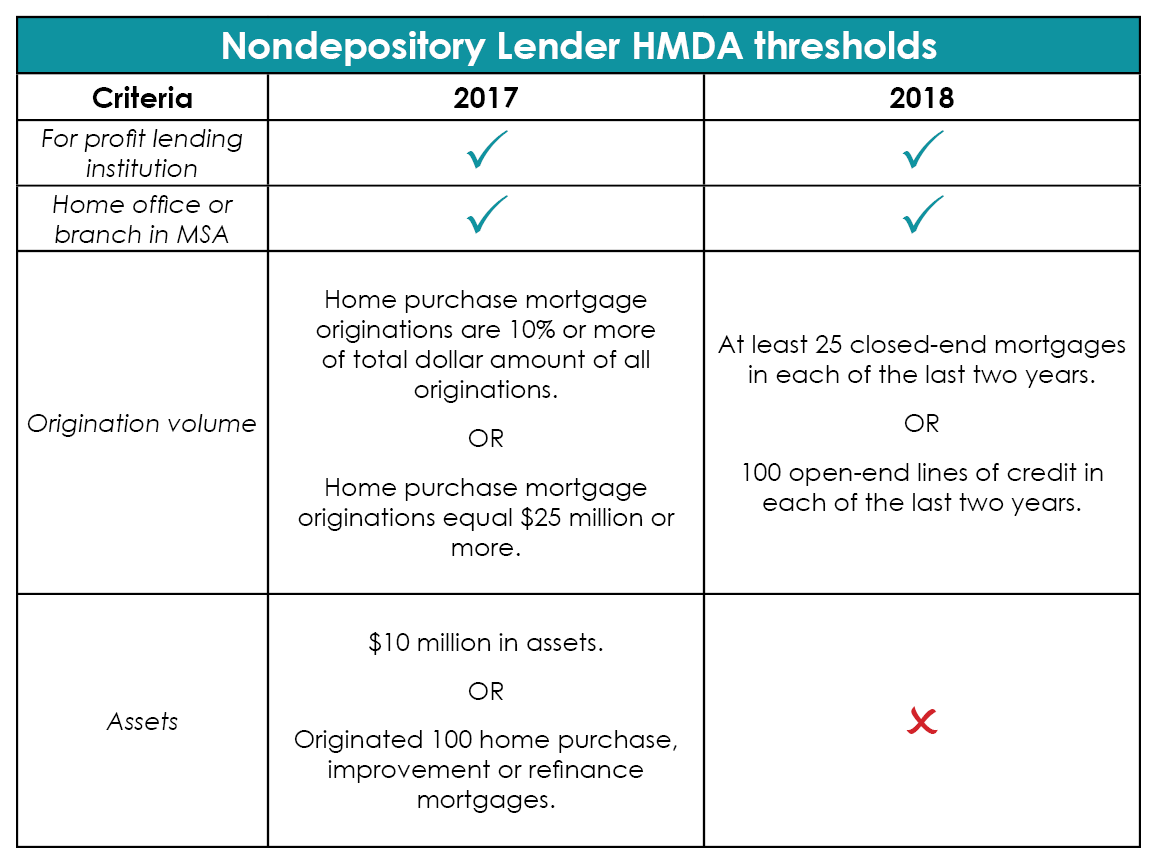

CalBRE-licensed brokers who make mortgages for the purchase or improvement of residential real estate need to collect HMDA mortgage data in the current calendar year if they meet the following thresholds:

[12 Code of Federal Regulations §1003.2]For more detail on the types of lenders which are covered by HMDA, see the CFPB’s HMDA institutional coverage cheat-sheets for 2017 and 2018.

Also beginning January 1, 2018, a mortgage banker will only report on closed-end mortgages if they meet the origination volume for closed-end mortgages. Likewise, they will only report on open-end lines of credit if they meet the origination volume for open-end lines of credit.

For example, consider a broker who meets all other HMDA thresholds for 2016 and 2017, and is required to report HMDA data in 2018. In each of 2016 and 2017, they originate over 100 closed-end mortgages, but less than ten open-end lines of credit. Thus, in 2018, they have to report HMDA data on closed-end mortgages, but do not have to report on open-end lines of credit. [12 CFR §1003.3(c)(11)-(12)]

Editor’s note — CalBRE-licensed broker-lenders who do not meet the federal HMDA reporting thresholds may be required to report similar data on California’s residential mortgage loan report.

Types of mortgages covered under HMDA

HMDA-covered brokers need to collect data on mortgage applications, originations and acquisitions of:

- home purchase mortgages, which are purchase-assist mortgages for residential real estate, regardless of occupancy or the number of units, including construction permanent loans;

- home improvements mortgages, which are mortgages used to fund the improvement of residential real estate, regardless of occupancy, the number of units or security; or

- refinances of existing mortgages secured by residential real estate, regardless of occupancy or the number of units. [12 CFR §1003.1(c), 12 CFR §1003.4(a)]

Loans which fund a primarily agricultural purpose are not reported, even if the loan is secured by a residential property. However, loans which fund both a consumer purpose and a business purpose are reported if they fall into one of the three categories above. [12 CFR §1003.3(c)(9)-(10)]

An example of a business mortgage which is subject to HMDA data collection is a home equity line of credit (HELOC) opened by a homeowner who uses the proceeds primarily to fund a new business, but secondarily to remodel their bathroom. Since the proceeds are used, even in small part, to improve the homeowner’s dwelling, this mortgage is considered a home improvement mortgage, subject to HMDA data collection.

For more detail on the types of mortgages which are covered by HMDA, see the CFPB’s HMDA transactional coverage cheat-sheet.

Data collected on HMDA

The data includes:

- the mortgage loan number;

- the date the mortgage application was received;

- the type and purpose of the mortgage;

- whether the application resulted in a preapproval, denial or origination;

- the property type of the property securing the mortgage;

- the owner-occupancy status of the real estate securing the mortgage;

- the mortgage amount;

- the action taken by the lender on the application;

- an identification of the MSA and census tract in which the property is located;

- the ethnicity, race and sex of the mortgage applicant;

- the gross annual income of the mortgage applicant;

- the type of investor that will purchase the mortgage;

- the spread between the annual percentage rate (APR) and the annual prime offer rate; and

- whether the mortgage is subject to the Home Ownership and Equity Protection Act (HOEPA). [12 CFR §1003.4(a)]

Additional HMDA data which will be collected in 2018 includes:

- the borrower or applicant’s age;

- the borrower or applicant’s credit score;

- automated underwriting information;

- a unique loan identifier;

- property value;

- the lending channel, e.g., retail or broker;

- points and fees paid;

- borrower-paid origination charges;

- discount points;

- lender credits;

- the term of any prepayment period;

- interest rate;

- the presence of terms resulting in potential negative amortization; and

- the mortgage term. [Future 12 CFR §1003.4]

Reporting and disclosure

By March 1 of each year, reporting brokers are required to transmit HMDA data to the CFPB on a form known as the Loan / Application Register (HMDA-LAR). Reporting broker-lenders are required to provide the HMDA-LAR (sans identifying information) or a summary disclosure statement to the public upon request. [12 CFR §1003.5(b)-(c)]

Beginning in 2018, HMDA data will be transmitted electronically. At that point, HMDA-covered broker-lenders no longer need to provide a disclosure statement or provide the HMDA-LAR to the public upon request. They may simply respond to a request by directing the inquirer to the CFPB website for HMDA data. [Future 12 CFR 1003.5(c)]

Great job over again! Thanks a lot.