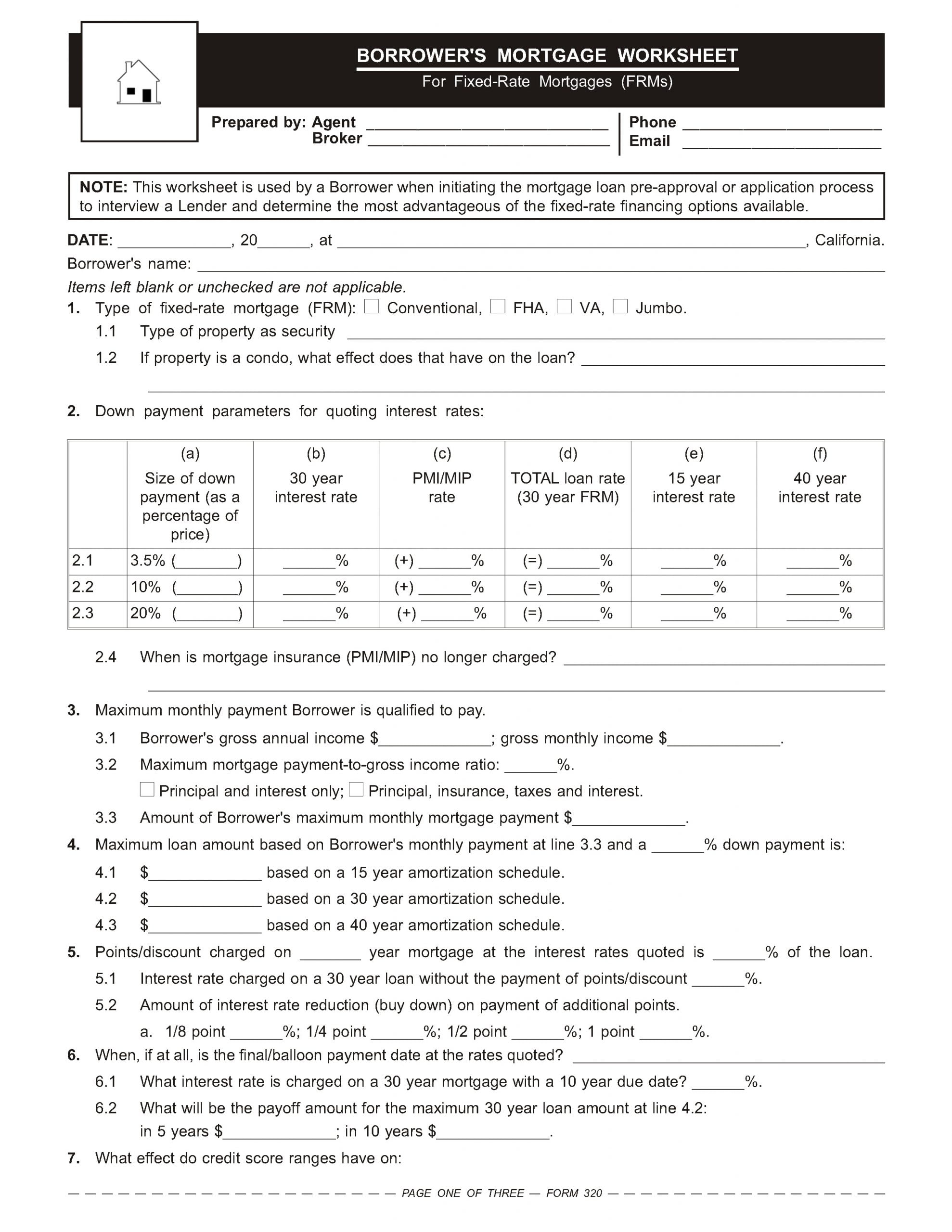

This worksheet is used by a Borrower when initiating the mortgage loan pre-approval or application process to interview a Lender and determine the most advantageous of the fixed-rate financing options available.

Walking the buyer through mortgage financing

The ability of a buyer or an owner to obtain financing is an integral component of most real estate transactions.

The buyer’s agent, referred to by lenders as the transaction agent (TA) in the context of financing, owes their buyer the duty to ensure they negotiate the best financial advantage available among multiple mortgage lenders.

The duties imposed by agency law on the TA include:

- helping the buyer locate the most advantageous mortgage terms;

- oversight of the mortgage application submission; and

- policing the lender’s mortgage packing process and funding conditions.

Recall that a lender’s objectives and goals are diametrically opposed to those of the buyer. The lender is selling a product to potential buyers. Consequently, homebuyers have the liberty to accept — or reject — a lender’s offer.

The buyer’s agent owes a fiduciary duty to their buyer to help them acquire the information needed to make an educated choice regarding their finances. Without mortgage information, a homebuyer cannot make a well-informed decision as to which mortgage offers the most advantageous terms.

Thus, the buyer’s agent is obligated to shepherd their homebuyers through the asymmetry of information created by the buyer’s inexperience and the lender’s silence about the mortgage process and available mortgage options. Agents, well-versed in real estate fundamentals and lender conduct, are the only ones available to walk their homebuyers through the mortgage market.

Interest rate variations

A promissory note is a document given as evidence of a debt owed by one person to another. It is given in exchange for property as a promise to pay. The signed promissory note is not the debt itself, but evidence the debt exists.

Promissory notes are partly distinguished based on interest rate calculations, such as:

- fixed interest rate notes, commonly called fixed rate mortgages (FRMs); and

- variable interest rate notes, commonly called adjustable rate mortgages (ARMs).

The most common type of home financing in the U.S. is the 30-year FRM. Under this arrangement, the interest rate and scheduled payments remain fixed for the life of the mortgage, giving certainty to future payment obligations. [See current market rates]

The ARM, as opposed to an FRM, calls for periodic adjustments to the interest rate after an initial teaser period. Thus, the amount of scheduled payments fluctuates from time to time and may rise significantly. The ARM provides the lender with periodic increases in its yield on the principal balance during periods of rising and high short-term interest rates.

Whether the buyer chooses an FRM or an ARM, they always have the option to shop around for the most advantageous financing options available to them.

A buyer who is shopping for a FRM, with help from the TA, uses the Borrower’s Mortgage Worksheet — For FRMs to determine their best FRM term. [See RPI Form 320]

Likewise, a buyer who is shopping for an ARM, along with their agent, uses the ARM Disclosure Worksheet to determine their best ARM term available across mortgage lenders. [See RPI Form 320-1]

Borrower’s mortgage worksheet for FRMs

A buyer, owner or their TA uses the Borrower’s Mortgage Worksheet for FRMs published by RPI when initiating the mortgage loan pre-approval or application process. The form allows the borrower to interview a lender and determine the most advantageous of the fixed-rate financing options available. [See RPI Form 320]

The Borrower’s Mortgage Worksheet for FRMs includes all the information and terms on a fixed-rate mortgage, including:

- the type of FRM (Conventional, FHA, VA, Jumbo) [See RPI Form 320 §1];

- the type of property [See RPI Form 320 §1.1];

- down payment parameters [See RPI Form 320 §2];

- the borrower’s maximum monthly payment abilities [See RPI Form 320 §3];

- the maximum loan amount for each amortization term (15-year, 30-year or 40-year) [See RPI Form 320 §4];

- points and discounts available [See RPI Form 320 §5];

- the final/balloon payment terms [See RPI Form 320 §6];

- the effect of credit scores on different aspects of the mortgage [See RPI Form 320 §7];

- the effect of a co-signer on the mortgage [See RPI Form 320 §8];

- whether the mortgage has a prepayment penalty provision or not, for which period it applies and how much the penalty is [See RPI Form 320 §9];

- the loan assumability terms by the buyer on resale of the property [See RPI Form 320 §10];

- the lender’s pre-approval letter information and when the borrower will receive it [See RPI Form 320 §11];

- charges to be disclosed in a Good Faith Estimate (GFE) [See RPI Form 204-5; See RPI Form 320 §13];

- seller contribution restrictions [See RPI Form 320 §14];

- loan documents to be signed at the time of closing [See RPI Form 320 §15];

- web addresses where loan information is obtained [See RPI Form 320 §16];

- unemployment insurance information [See RPI Form 320 §17]; and

- lender recommendations. [See RPI Form 320 §18]

Once complete, the buyer or owner and their agent have all the information needed to determine whether the borrower wants to close on the mortgage on the terms offered.

Form navigation page created 09-2022. Updated 01-2026.

Form last revised 2011.

So nice. Thank you for sharing.