| |

Click chart for article Click chart for article | Home Sales Volume and Price Peaks: Homes sold in California, per month, from September 2003-present, with accompanying analysis and predictions. |

| |

Click chart for article Click chart for article | Tracking the Market: The value of stocks in the market, represented by the S&P 500 index, is contrasted with the price/earnings (PE) ratio, along with first tuesday insight and forecasting. |

| |

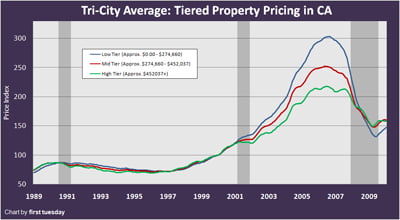

Click above for additional charts and article Click above for additional charts and article | CA Home Values 1989-Present: Tiered pricing from the Case-Shiller index, comparing the prices of all homes in San Diego, Los Angeles, and San Francisco over the past twenty years. |

| |

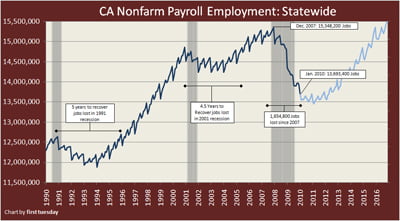

Click above for additional charts and article Click above for additional charts and article | Jobs Move Real Estate: The past and future of jobs in California: current, detailed employment numbers for the state and its biggest counties. |

| |

Click chart for article Click chart for article | CA Unemployment 1976-Present: The dark side of Jobs Move Real Estate: the unemployed percentage of the labor force, with analysis of the vital role jobs play in the market at large. |

| |

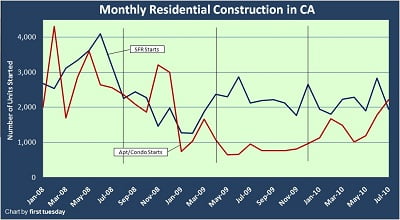

Click chart for article Click chart for article | Monthly Residential Construction: New homes constructed in California on a monthly basis, displaying trends in the construction of new single-family residences (SFRs) and Apartments/Condos. |

|

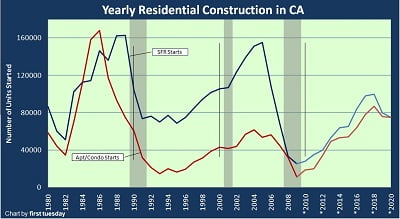

Click chart for article Click chart for article | Annual Residential Construction: New homes constructed in California on a yearly basis, displaying trends in the construction of new single-family residences (SFRs) and Apartments/Condos. |

| |

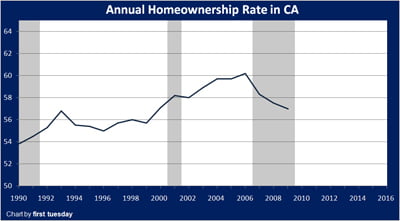

Click chart for article | Homeownership Statewide The rate of single-family homeownership in California since 1990. |

| |

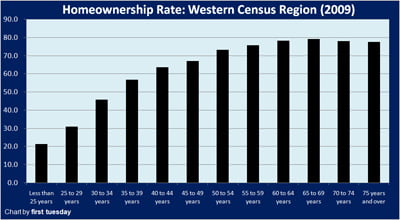

Click chart for article | Homeownership by Age in the Western Census Region: 2009’s rate of single-family homeownership in the western region, broken down by age group. |

| |

Click chart for article | Rental Vacancies Statewide: The rental vacancy rate in California from 1990-present, courtesy of the United States Census Bureau. |

| |

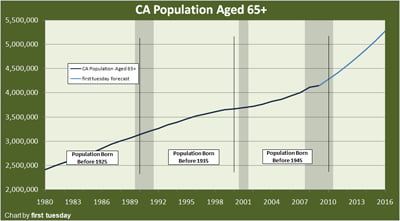

Click chart for article | State population over 65: The total California population of “Senior Citizens,” citizens aged 65 and over, from 1980-present, with first tuesday projections based on the current population of Baby Boomers. |

| |

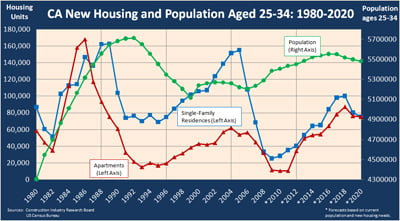

Click chart for article Click chart for article | First Time Homebuyers and New Housing: The annual number of 1st time homebuyers, aged 25-34, with the construction of single- and multi-family residences from 1980, with first tuesday forecasts. |

| |

Click chart for article Click chart for article | ARM Ratio in the Market: The ratio of adjustable rate mortgages (ARMs) to all loans originated in the United States. |

| |

Click chart for article Click chart for article | Personal Bankruptcy in CA: California’s annual number of personal bankruptcies filed, and a brief explanation of bankruptcy’s often-overlooked tie to homeownership. |

| |

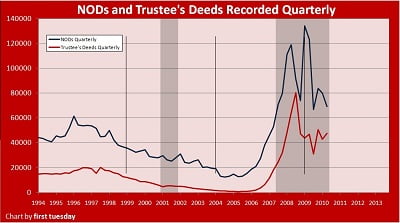

Click above for additional charts and article Click above for additional charts and article | NODs and Trustee’s Deeds: Notices of Default (NODs) issued quarterly, from 1994-present, giving an in-depth look at foreclosures past and future. |

| |

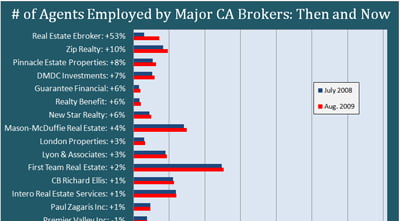

Click chart for article Click chart for article | How CA’s Mighty Have Fared, One Year On: The number of agents employed by California’s 30 largest brokers in July 2008 and August 2009. |

| |

Click chart for article Click chart for article | Trends in Homebuyer Sentiment: Homebuyer opinion on the housing market and personal financial conditions |

| |

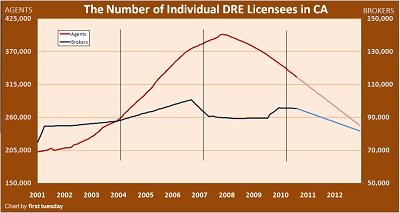

Click chart for article Click chart for article | Broker and Agent Population: The total number of DRE-licensed brokers and sales agents in California from 2001-2009. |

| |

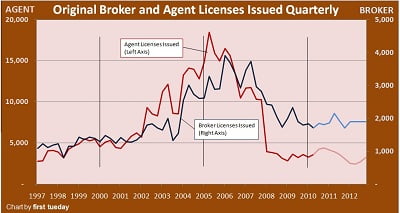

Click chart for article Click chart for article | Broker and Agent Licensing: The number of sales agent and and broker licenses issued by the California Department of Real Estate from 1997-present. |

| |

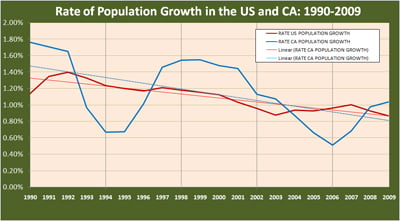

Click chart for article Click chart for article | Rate of Population Growth: The rate of population growth for California since 1990, compared with growth rates for the entire nation. |

| |

Click chart for article Click chart for article | REIT Values and Returns: Historical Values and Returns from all US Real Estate Investment Trusts (REITs). |

| |

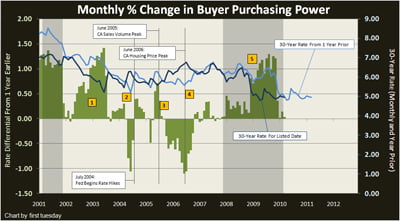

Click chart for article Click chart for article | Buyer Purchasing Power: The buyer’s ability to purchase a home, as influenced by the annual change in federal rates. |

| |

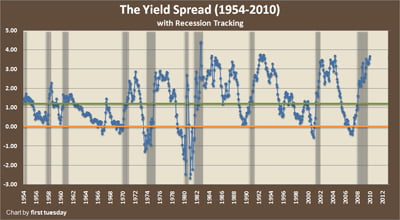

Click chart for article Click chart for article | The Yield Spread: An essential tool used to predict economic conditions affecting the real estate market. |

| |

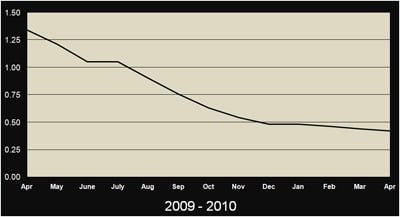

Click chart for article Click chart for article | 91-Day Treasury Bill —Average Auction Rate: Used to determine the minimum interest rate the seller must impute in a delayed §1031 transaction. |

| |

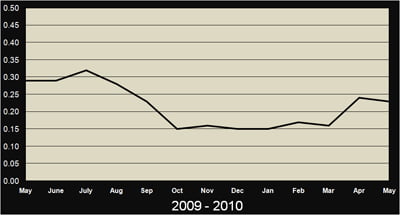

Click chart for article Click chart for article | 3-Month Treasury Bill: The base price of borrowing money in the short-term, used to determine the yield spread. |

| |

Click chart for article Click chart for article | 10-Year T-Bonds —Average Market Yield: Indicates the direction of future FHLMC rates. |

| |

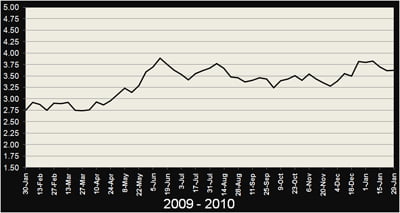

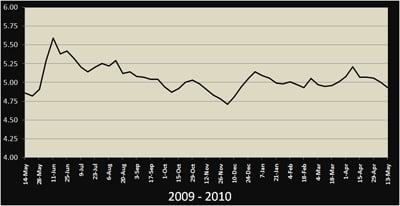

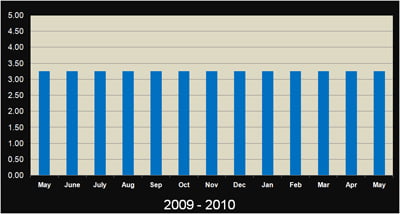

Click chart for article | Average 30-Year Conventional Commitment Rate: The 30-year rate at which a lender commits to lend mortgage money in the United States-West as reported by FHLMC. |

| |

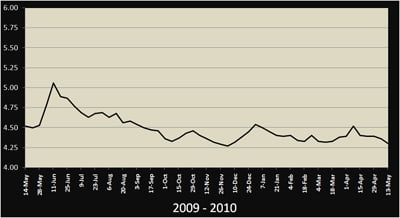

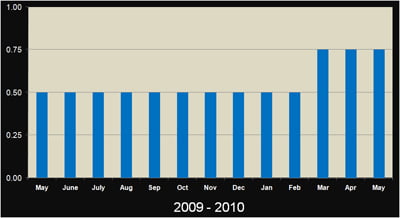

Click chart for article | Average 15-Year Conventional Commitment Rate: The 15-year rate at which a lender commits to lend mortgage money in the United States-West as reported by FHLMC. |

| |

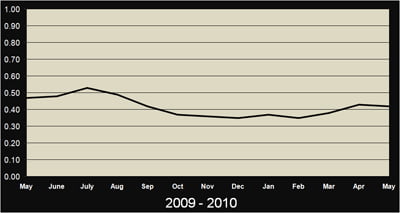

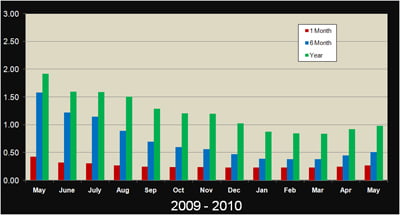

Click chart for article Click chart for article | 6-Month Treasury Bill — Average Auction Rate: The ARM interest rate equals the 6-month T-Bill rate (at time of adjustment or an average of several prior rates), plus the lender’s profit margin. |

| |

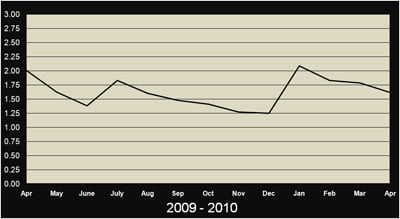

Click chart for article Click chart for article | Treasury Securities Avg. Yield — 1-Year Constant Maturity: The ARM interest rate equals T-Bill yield, plus the lender’s profit margin. The index is an average of T-Bill yields with maturities adjusted to one year. |

| |

Click chart for article | 12-Month Treasury Average: The ARM interest rate equals T-Bill average yield plus the lender’s profit margin. The index is an average of the one-year T-Bill rates for the past 12 months. |

| |

Click chart for article | Cost-of-Funds Index (11th FHLBB District): The ARM interest rate equals the Cost-of-Funds, plus the lender’s profit margin. The current index reflects the cost of funds two months’ prior in the Unites States-West. |

| |

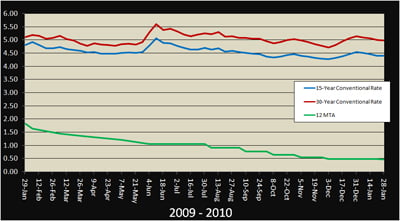

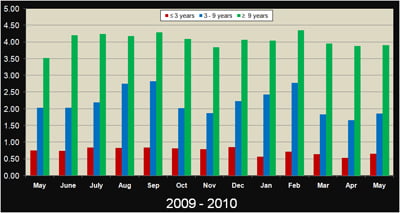

Click chart for article Click chart for article | Combined average rates and 12 month treasury average: The average 15- and 30-year conventional commitment rates as reported by the FHLMC, superimposed with the 12 month treasury average. |

| |

Click chart for article | London Inter-Bank Offered Rate: The ARM interest rate equals the LIBOR rate plus the lender’s profit margin. The rate is set by the banks in London, England. |

| |

Click chart for article | Prime Rate: The prime rate is used by banks to price short-term business loans and set ARMs. |

| |

Click chart for article | Discount Rate — Federal Reserve Bank of San Francisco: Usury law limits the annual interest yield on nonexempt loans to 10%, or the discount rate plus 5%, whichever is greater. |

| |

Click chart for article | Applicable Federal Rates: Determines minimum interest yield reportable on carryback financing. The AFR category is determined by the carryback due date. |