Control of your IRA investments

An individual retirement account (IRA) owner with a few hundred thousand dollars or more in the account may direct, manage and control the investment of funds to buy and own real estate.

To invest IRA funds in income property, the IRA owner establishes and transfers their accumulated IRA funds to a separate self-directed IRA (SDIRA). [See RPI e-book Forming Real Estate Syndicates, Chapter 15]

Holding a real estate investment in an SDIRA is unlike using an IRA to invest in a real estate investment trust (REIT). In a REIT, the IRA participation is akin to holding stock in a corporation with others managing your investment.

An SDIRA, on the other hand, gives the IRA owner direct and continuing control over the management of IRA funds. It also gives the owner control over the selection and operation of the real estate acquired with those funds.

Thus, an SDIRA permits the flexibility of asset diversification outside ownership of the traditional Wall Street panoply of stocks and mutual funds. SDIRAs further allow their owners to delve into real estate, property tax liens and trust deed notes selected by the IRA owner and purchased with SDIRA funds.

Brokers advising clients need to be aware of the SDIRA as the vehicle that permits use of funds that otherwise do not get into real estate investments.

Before establishing an SDIRA to fund an investment in real estate, the owner’s IRA needs to have accumulated sufficient funds to purchase and carry ownership of property selected for acquisition.

The SDIRA LLC as the vesting vehicle

When investing in real estate, a prudent buyer practices asset preservation as part of diligent management of ownership. As a shield against remote liabilities, title to the real estate is vested in the name of a limited liability company (LLC)

To this end, establishing an SDIRA LLC provides protection for the LLC assets from claims other than arising out of ownership of the property. The SDIRA LLC entity shields the owner’s other IRA funds and personal assets held in other vestings from a loss resulting from the ownership of the property vested in the SDIRA LLC, and vice versa.

The primary IRA benefit of forming an SDIRA LLC is the IRA owner gains “checkbook control” — in addition to investment selection and acquisition control. Checkbook control gives the owner, who is named as the managing member of the SDIRA LLC, direct checkbook access to the IRA funds.

Thus, purchasing a property using an SDIRA LLC allows the owner to simply write a check to close acquisitions by drawing funds directly from the SDIRA LLC bank account opened to hold the IRA funds.

On acquisition, title to the property is vested in the name of the LLC. The same owner access to IRA funds applies for the payment of property operating expenses, including:

- maintenance;

- repairs;

- renovations;

- property taxes; and

- insurance premiums.

Critically, an IRA is a tax-exempt arrangement while an LLC is not taxed. Thus, all income and profits of the SDIRA LLC from ownership of property, such as rental operations and resale, are received tax free by the IRA.

Until withdrawn from the SDIRA LLC by the owner, any earnings from net operating income (NOI) or profits on sale of the property received by the SDIRA are not taxed. [26 United States Code §408]

Related article:

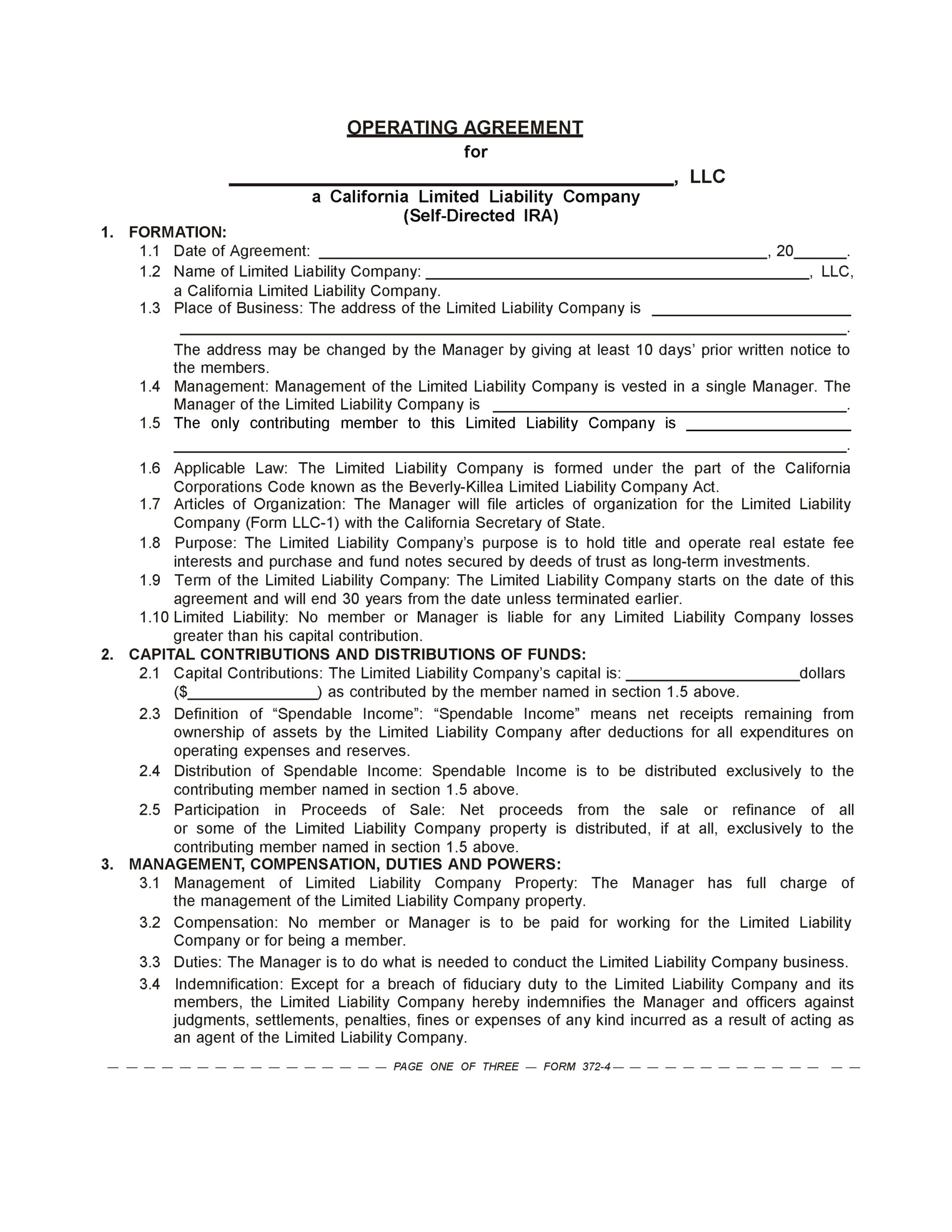

Analyzing the LLC Operating Agreement for Self-Directed IRA

An investor or their agent uses the LLC Operating Agreement — Self-Directed IRA published by Realty Publications, Inc. (RPI) when forming an LLC solely for the purpose of funding it to purchase real estate as an SDIRA owned by the investor. The form establishes the LLC operating terms, the rights and duties of the investor, and the SDIRA acceptable to an IRA administrator. [See RPI Form 372-3]

An editable Word document is also available to tailor the IRA investor’s particular needs for the investment. [See RPI Form 372-4]

The LLC Operating Agreement — Self-Directed IRA includes:

- LLC formation details [See RPI Form 372-3 §1];

- Capital contributions and distributions of funds [See RPI Form 372-3 §2];

- Management compensation, duties and powers [See RPI Form 372-3 §3];

- Accounts and accounting [See RPI Form 372-3 §4];

- Dissolution of LLC and distribution of capital [See RPI Form 372-3 §5];

- Limitations on members’ authority [See RPI Form 372-3 §6];

- Designation for a special advisor to the LLC [See RPI Form 372-3 §7];

- Miscellaneous provisions [See RPI Form 372-3 §8]; and

- Blank space to enter additional provisions and details. [See RPI Form 372-3 §9]

Related article:

The SDIRA LLC Operating Agreement – boilerplate for your client’s investment control

The single member LLC

A single member LLC (SMLLC) is a California authorized business entity with one owner or member. It has the limited liability protection of a corporation. In this manner, the LLC owner is not liable for any debts or liabilities the business incurs.

To form an SMLLC in California, the owner files the Articles of Organization (Form LLC—1) with the California Secretary of State (SOS).

After that, the LLC owner prepares an Operating Agreement which details how the owner plans to run the business of the LLC and sets the operating terms and the rights and duties of the owner. The owner needs to fill out the Operating Agreement and keep on file, though does not file it with the California SOS. [See RPI Form 372-5]

Taxwise, most SMLLCs elect to be pass-through entities so only the owner reports the income and pays taxes via the owner’s personal income tax return at Schedule C (Form 1040).

Related article:

Form-of-the-Week: LLC Investment Circular and Operating Agreement — Forms 371 and 372

Analyzing the LLC Operating Agreement for Single Member

An investor uses the LLC Operating Agreement — Single Member published by RPI — when forming a single manager/member LLC for an investment in income producing property. The form sets the LLC operating terms and the rights and duties of the manager/member. [See RPI Form 372-5]

The LLC Operating Agreement — Single Member contains:

- LLC formation details [See RPI Form 372-5 §1];

- Capital contributions and distributions of funds [See RPI Form 372-5 §2];

- Management, compensation, duties and powers [See RPI Form 372-5 §3];

- Accounts and accounting [See RPI Form 372-5 §4];

- Dissolution of LLC and distribution of capital [See RPI Form 372-5 §5]; and

- Miscellaneous provisions. [See RPI Form 372-5 §6]

Want to learn more about investing with an LLC? Click the image below to download the RPI book cited in this article.