Form-of-the-week: Condition of Property — Transfer Disclosure Statement (TDS) – Form 304

Mandated on one-to-four residential units

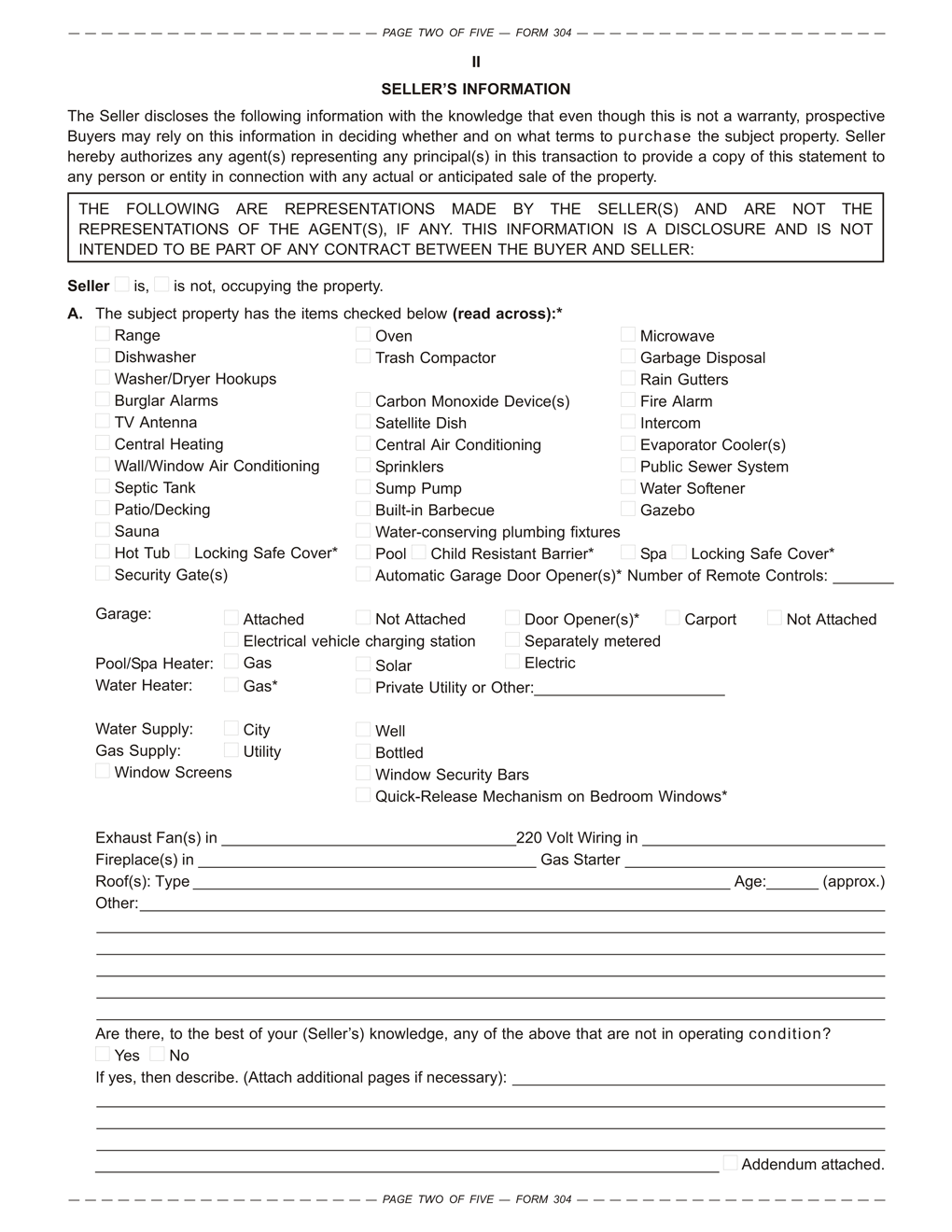

A seller of a one-to-four unit residential property completes and delivers to a prospective buyer a statutory form called a Transfer Disclosure Statement (TDS), more generically called a Condition of Property Disclosure Statement. [Calif. Civil Code §§1102(a), 1102.3; see first tuesday Form 304]

The seller’s use of the TDS form is mandated. The seller is required to prepare it making all entries with honesty and in good faith, whether or not a seller’s agent is retained to review its content. [CC §1102.7]

Editor’s note – A “condition of property” form does not exist for use in California which covers other than one-to-four unit residential property. However, first tuesday is in the process of producing a standardized condition of property disclosure form for the sale of other types of properties including commercial property later this year.

When preparing the TDS, the seller sets forth any property defects known or suspected to exist by the seller.

Any conditions known to the seller which might negatively affect the value and desirability of the property for a prospective buyer are to be disclosed in the TDS by the seller, even though the defect may not be a boilerplate item listed on the form. Disclosures to the buyer are not limited to conditions preprinted for comment on the form. [CC §1102.8]

Also, the buyer cannot waive the seller’s delivery of the statutorily-mandated TDS, even when it is not handed to the buyer before entering into a purchase agreement for the property. Any attempted waiver, such as the use of an “as-is” clause in the purchase agreement or counteroffer, is void as against public policy. The words “as is” are never to be used in the context of a real estate transaction. “As is” implies a failure to disclose something adverse about the property known to the seller or the seller’s agent, a prohibited activity. [CC §1102.1(a)]

A property is always sold “as disclosed” in the TDS.

Delivery of the disclosure statement

first tuesday’s Condition of Property – Form 304 is used by the seller and their agent when marketing a one-to-four unit residential property for sale. Its use complies with the content for mandated disclosures regarding physical and environmental conditions of the property. [

See first tuesday Form 304]

While the seller is required to prepare the TDS, the TDS is delivered to the prospective buyer by the agent who has direct contact with the buyer when the purchase agreement is handed over by the buyer. In the instance of a principal-to-principal transaction negotiated directly between the seller and buyer without the participation of a transaction agent (TA), the seller is obligated to deliver the TDS to the buyer. [CC §1102.12]

The failure of the seller or any of the agents involved to deliver the seller’s TDS to the buyer does not invalidate a closed sales transaction. However, the seller and the seller’s broker are both liable for the actual monetary losses incurred by the buyer due to an undisclosed defect known to them or unknown to them due to their negligence. [CC §1102.13]

Further, the time for delivery of the TDS to the potential buyer is mandated to occur before the seller accepts a purchase agreement offer submitted by a buyer — as soon as practicable (ASAP) after negotiations by the buyer begin.

If the TDS is delivered to the buyer after the seller enters into a purchase agreement, the delivery is untimely, a violation of TDS rules. Here, the buyer has several remedies, including:

- cancel the purchase agreement and any escrow on their discovery of undisclosed defects known to the seller or the seller’s agent and unknown and unobserved by the buyer or the buyer’s agent prior to acceptance [CC §1102.3];

- make a demand on the seller to correct the defects or reduce the price accordingly before escrow closes [See first tuesday Form 150 §11.2]; or

- close escrow and make a demand on the seller for the costs to cure the defects. [Jue Smiser (1994) 23 CA4th 312]

Mandatory inspection by the agents

A seller’s agent is obligated to personally carry out a competent

visual inspection when they list a one-to-four unit residential property for sale. [

See first tuesday Form 304]

Following their mandatory visual inspection, the seller’s agent reviews the TDS prepared by the seller, or prepares it themselves if the seller is exempt (as discussed below). In addition to observations, they may rely on specific items covered in a home inspector’s report they obtained on the property. [See first tuesday Form 130]

A buyer may only recover the cost to cure or loss of value resulting from an undisclosed and unknown defect that is observable by a reasonably competent broker during a visual on-site inspection. A seller’s agent conducting an inspection is expected to be as competent as the broker they represent.

A buyer of a one-to-four residential unit property has two years from the close of escrow to pursue the seller’s broker and agent to recover losses caused by the broker’s or agent’s negligent failure to disclose observable and known defects affecting the property’s physical condition and value. [CC §2079.4]

However, the buyer is unable to recover their losses from the seller’s broker if the seller’s broker or agent competently inspected the property and was unable to reasonably observe the defect and did not actually know it existed. [CC §1102.4(a)]

Exempt sellers, their agents and targeted properties

Unless a seller is

exempt, sellers of one-to-four unit residential real estate are required to fill out and furnish buyers with a statutory TDS prior to entering into a purchase agreement. [CC §1102]

Some special-situation sellers are exempt from using the TDS when disclosing what they know about the property being sold. However, the seller’s broker and their agents are never exempt from:

- conducting a visual inspection of a one-to-four unit residential property, sold or acquired when acting on behalf of any seller [CC §2079]; and

- disclosing their observations and knowledge about the property on a TDS form or other separate document. [CC §1102.1]

Transactions which exempt the seller (but never the seller’s agent) from preparing and delivering the statutory TDS to a buyer include transfers:

- by court order, such as probate, eminent domain or bankruptcy;

- by judicial foreclosure or trustee’s sale;

- on a lender’s resale of real estate owned (REO) property they acquired by foreclosure or on a deed-in-lieu of foreclosure;

- from co-owner to co-owner;

- from spouse to spouse, including property settlements resulting from a dissolution of marriage;

- by reversion of unclaimed property to the state; and

- from or to any government agency. [CC §1102.2]

The seller’s agent is never exempt from preparing and delivering a TDS to a buyer, though the seller may be exempt from using the boilerplate TDS form to disclose what they know.

Regarding “as is” sales: I am curious to see comments on how the requirements for TDS is handled by real estate auctioneers…other than a foreclosure auction. Are the required disclosures given out before auction day and prospects required to acknowledge their receipt prior to bidding? Are they given to the winning bidder subsequent to the bidding? Auctioneers have long claimed to sell “as is, where is”. But, how does this actually work with the disclosure requirements?