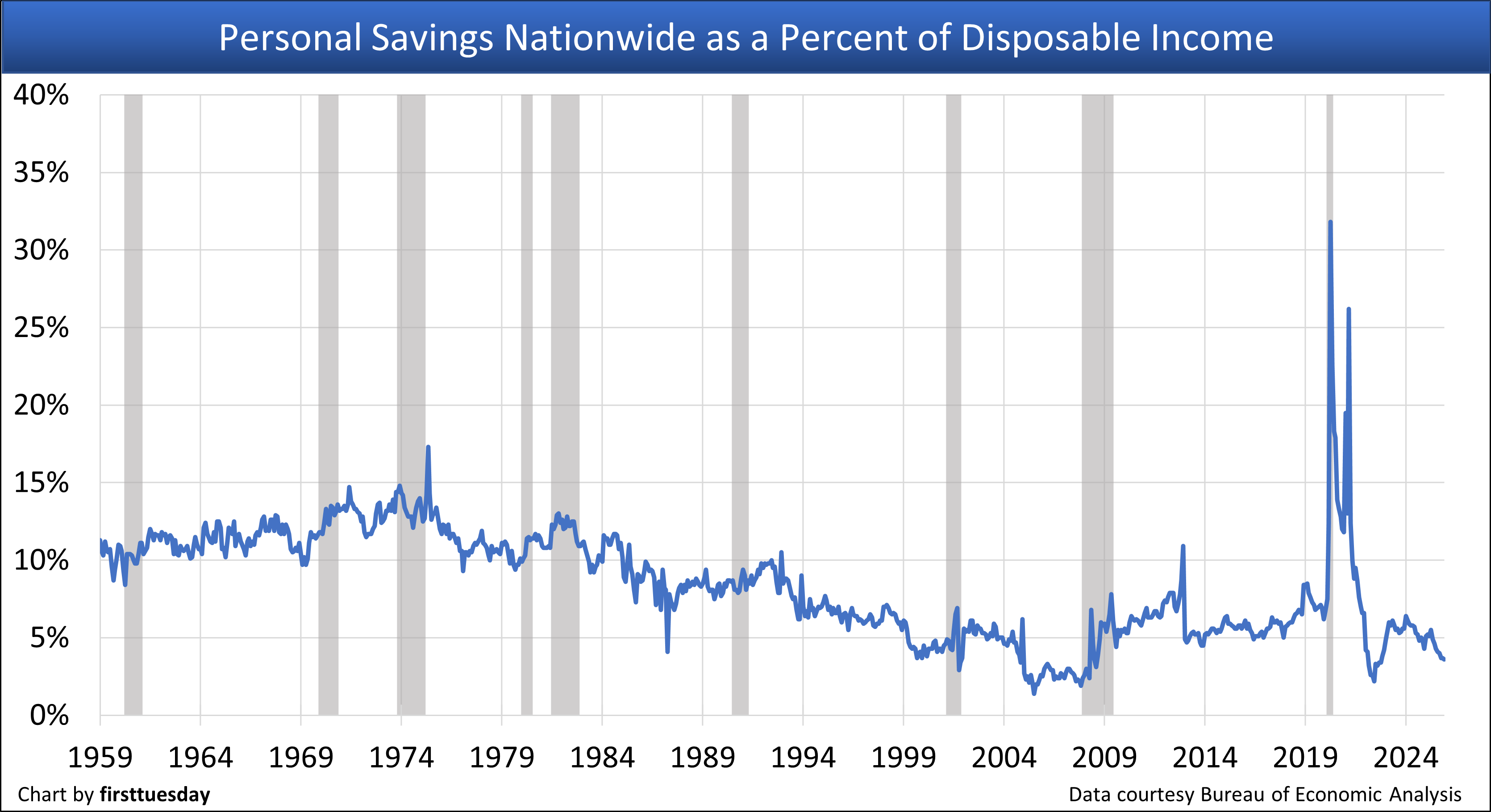

Why this matters: Personal savings nationwide diminished over the past few decades, only increasing during recessionary periods as consumer confidence falls. The lack of consistency in family savings plans leaves the typical household ill-equipped for emergencies when a recession sets in, much less a down payment to buy a home.

For brokers and agents in home sales to maintain fees during recessions they first develop clientele among tenants. Clientele bonding is achieved by group meets or individual coaching on the tenant’s need for routine savings as the prerequisite for ownership.

First, your rainy day fund — counseling buyers

The rate of savings is the amount of disposable income a person sets aside annually. Saving is the step taken to increase cash reserves for big purchases like the down payment made to acquire a property. Stockpiled funds are not just cash waiting to be spent.

Savings is a way to transform personal income into greater wealth. A meaningful down payment of, say, 20% plus preserves significant sums of money for the buyer at the time of purchase and over the life of their mortgage.

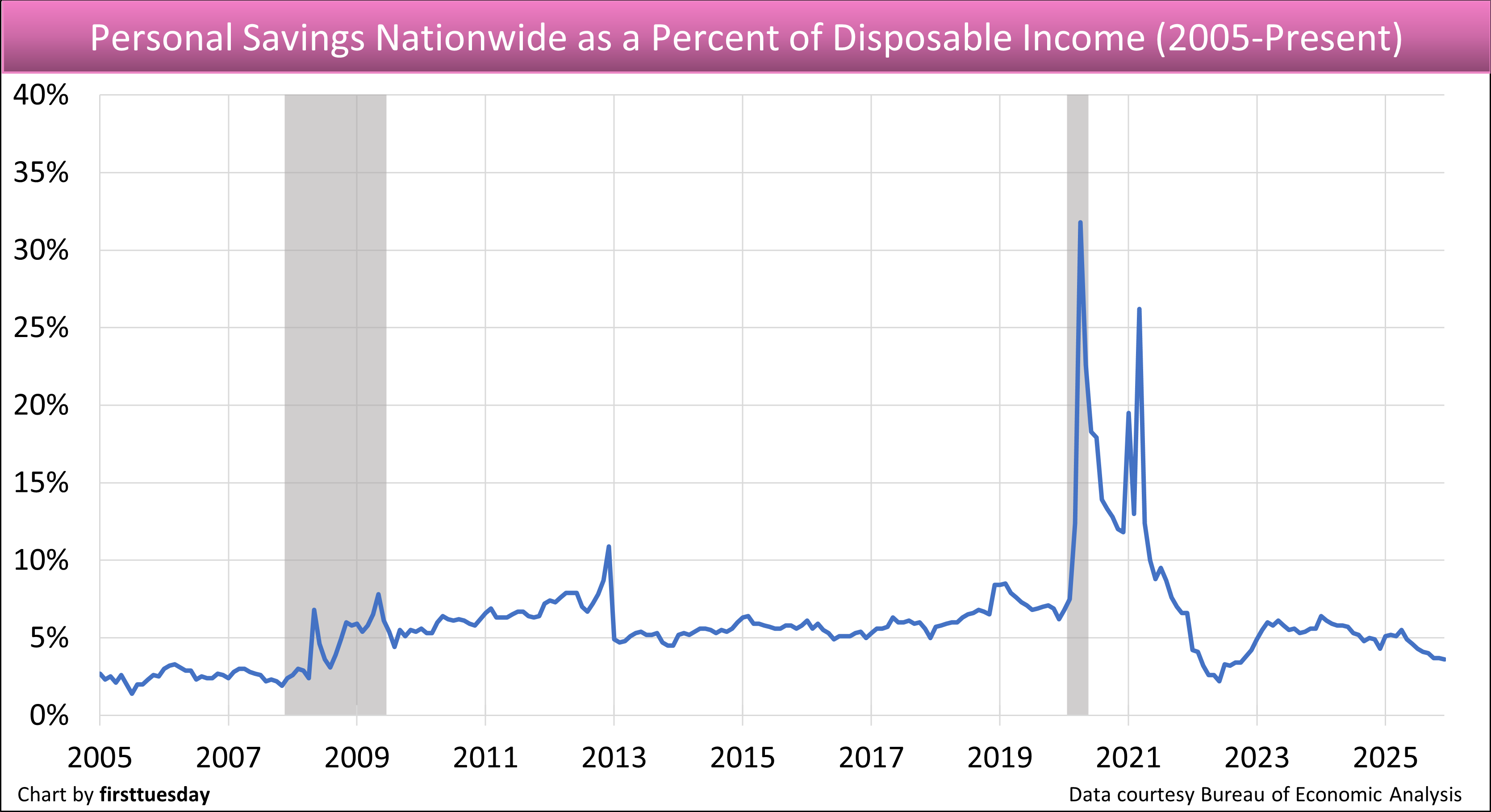

The national personal savings rate, as a percentage of disposable income is now inching downward towards 2022’s decade-low 2% rate, at 3.6% in December 2025. An 8% to 10% portion of monthly income set aside as savings makes jobholders more economically viable in the future.

Savings include sufficient reserves to meet emergency expenditures and cash built up to mitigate financial stress. Through savings, households improve the their standard of living and opt out of renting to buy a home with more than 20% down. These are solvency issues which perplex the typical job holder and a buyer agent addresses them with potential first-time home buyers to establish trust and bond for future transactions.

Looking at the national disposable income, setting aside 3.6% only amounts to an average of $2,437 saved annually. This is nowhere near enough to create an emergency fund. Individuals need to set aside three months of income to cover emergencies such as sudden job loss, medical needs or vehicle breakdown.

In 2022, the savings rate plummeted by necessity, as households struggled to make ends meet under pandemic generated pressure of the highest consumer price inflation since 1980.

In retrospect, savings bottomed near 2% in 2005 when consumer confidence was high on Millennium Boom fumes but moved up to an inadequate 5% savings figure by the end of the 2008 recession.

Here in California, the room for saving is even narrower due to our higher cost of living incurred in the decade following the 2008 recession. While the California savings rate today is not separately available, it is lower than the national average. This disparity further chips away at the ability to accumulate adequate savings to cover emergencies, let alone gather enough for a down payment on a home.

Savings decline with job abundance — caution unwinds

Looking ahead through 2026, Californians plan to rein in spending as consumer confidence drops in anticipation of fewer jobs, an issue of a chaotic business environment. Further, the current international trade and migration disruptions are likely to bring on widespread job losses, aggravated by consumer price inflation as all asset classes are set to lose value in 2026, T-Notes excepted.

Worse, federal stimulus payments to buoy personal income and business operations in the coming recession are not likely to take place as they did in 2020. Stimulus needs raised income tax rates for high-end income brackets so as not to interfere with consumer spending and employment.

Watch for job losses purportedly triggered by overeager businesses adopting AI but more likely due to economic uncertainty over fast shifting tariffs. Tariffs are inflationary as they are passed on to consumers through price adjustments to pay the tariff taxes. Tariffs temporarily kill all economies producing and buying things until their cost works its way through the pricing of consumer goods, presently far from a done deal.

However, the personalized trade wars now fought interfere with the ability to figure out just when the coming economy-wide recession will likely be declared as official, much less a recovery. But an increase in savings by job holders does result from general uncertainty about the economy.

Updated September 24, 2025.

Chart update 2/25/26

| 2025 | 2024 | 2023 | |

| Annual average personal savings rate | 4.5% | 5.4% | 5.6% |

Chart update 3/4/26

| Q4 2025 | Q3 2025 | Q4 2024 | |

| Personal Savings Rate | 3.7% | 4.1% | 4.7% |

Data courtesy of United States Department of Commerce: Bureau of Economic Analysis

Gray bars indicate periods of recession.

*Data averaged through December 2025.

As mortgage rates trend higher in the long term, a cyclical process beginning in 2013, real estate demand is driven by how much money potential buyers have accumulated — saved. What does this mean for future home sales?

A trend in saving as econ-advice for first-time buyers

The 20% down payment, or more, is the loss-mitigating gold standard of residential mortgage originations. During the fevered years of the Millennium Boom, the standard became a quaint novelty, furthered by the present deregulation of the Wall Street mortgage bankers and the socializing of home mortgage losses to the Treasury. Before the mortgage crises of 2008 recession buyers (and lenders) got used to the easy days of purchasing a home with 0% down, and closing costs were either seller-paid or mortgage-lender financed as piggy-back second mortgages.

Unsurprisingly, this was reflected in the personal savings rates of the millennium period. However, from 1952 to 1990, personal savings as a percentage of disposable income was around 8-10%, according to the Federal Bureau of Economic Analysis (BEA). During the Millennium Boom, savings dropped to nearly 0%, a 50-year low.

However, the 2008 Great Recession ushered reality back through the front door. The 1,100,000 California homeowners who suffered the trauma of the Great Recession housing crash through foreclosure or short sales and then forced to rent fast found wisdom in stockpiling cash. The personal savings rate leaped up to 6% within a year.

The personal savings rate in Q4 2025 was at 3.6%, nearing the 2022 low, and down from the same quarter a year earlier in 2024.

As we head through the current undeclared recessionary period, expect to see an emergence of greater reliance on savings, with households saving when possible, to cushion themselves from the expected economic turbulence of a recession. When consumer confidence is relatively low, personal savings rises. A financial “comfort zone” is accommodated either way, until it isn’t.

Related article: