Riverside is the fourth most populous county in California, with nearly 2.5 million residents. Much of the region’s population growth took place during the Millennium Boom years when construction, jobs and new home sales skyrocketed.

But the 2008 recession left the region with deep losses in home sales volume, construction starts and employment. Riverside’s economy remained in a state of prolonged recovery for a full decade, slowly gaining momentum as lost jobs were painstakingly regained. Employment finally exceeded the number of jobs held prior to the Great Recession at the end of 2014, though it barely caught up with post-2007 population gain before the 2020 recession hit and more jobs were lost.

The good news is Riverside’s economy caught up with 2020 job losses much more quickly, with jobs exceeding the pre-2020 peak in the first half of 2022. But the recovery pace has crashed, with jobs growing an anemic 1.7% over the past year as of mid-2023.

Local sales agents can expect Riverside’s low inventory to rise heading into 2024 as the housing market continues to cool rapidly. Historically low interest rates and a shortage of sellers willing to list inflated home prices in 2021. But with 2022’s interest rate hike and sticky seller pricing, homebuyers’ options have quickly disappeared, causing home prices to fall (absent a transitory seasonal uptick in Spring 2023).

As we head deeper into the 2023 recession, expect home sales to slide through 2024, with home prices declining in the second half of 2023 through 2025. Home sales volume will pick up with the return of real estate speculators around 2025, a full recovery apparent with the return of end user buyers beginning in 2027.

View the Riverside regional charts below for details on current activity and forecasts for its local housing market.

Updated August 9, 2023. Original copy posted March 2013.

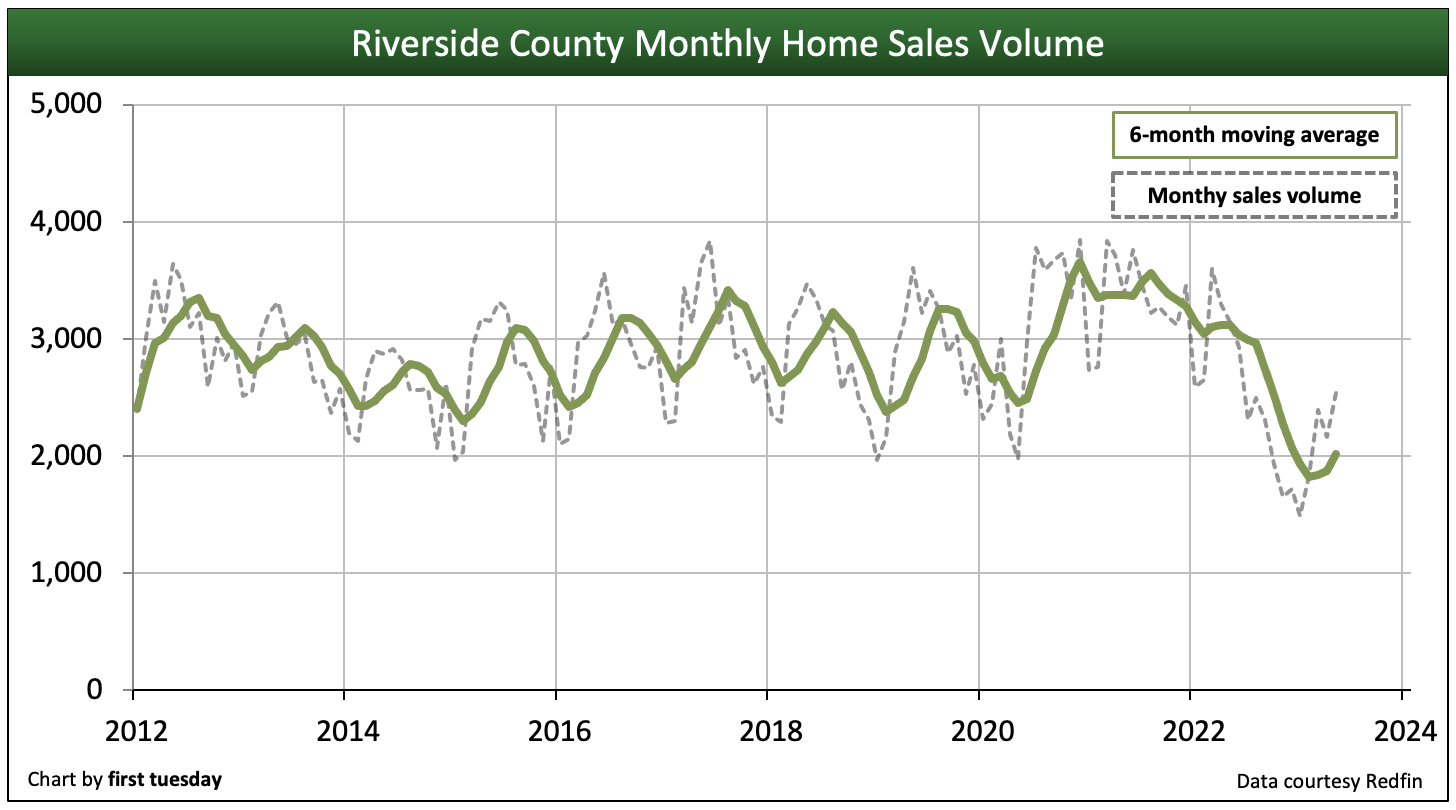

Home sales volume falls back

Chart update 08/09/23

| 2022 | 2021 | 2005: Peak Year | |

| Riverside County home sales volume | 30,600 | 39,900 | 68,100 |

*first tuesday’s projection is based on monthly sales volume trends, as experienced so far this year.

Home sales volume in Riverside County remained mostly level in the years of 2011-2010. Starting in 2020, sales volume took on a more volatile path, matching much of the rest of the state in terms of Pandemic Economics. After peaking in 2021, 2022 home sales volume slid 23% below 2021. Further, 2022 sales volume tumbled 12% below 2019, the last “normal” year for California’s housing market.

More recently, home sales volume year-to-date is a whopping 32% below a year earlier as of May 2023. Worse, compared to 2019, sales volume is 37% lower in Riverside.

As the housing market continues to plunge, some are pointing to the minor Spring 2023 price bump as evidence of a recession-proof market. But this recent bump was motivated by seasonal influences only. However, watch for prices to fall back heading into 2024 following spring’s seasonal bounce. Home prices will later slump below 2019 pre-recession levels in 2024, not expected to find a bottom until 2025.

Home sales volume in Riverside will begin to stabilize from the 2023 recession around 2026, at which point ender users will return to drive up sales volume and prices. In the meantime, real estate agents who need to switch their services to make a living in this buyer’s market will turn their focus to the types of buyers willing and able to purchase during a recession – namely, investors and purchasers of distressed properties.

Inventory climbs out of the hole

Chart update 09/14/23

| May 2023 | May 2022 | Annual change | |

| Riverside County for-sale inventory | 11,000 | 13,000 | -15% |

Multiple listing service (MLS) inventory has risen from the historic low reached at the end of 2021. After two years of steep decline, for-sale inventory in Riverside averaged a significant 42% above a year earlier at the end of 2022 as buyers quickly lost interested in the spiraling housing market. But by mid-2023, inventory had reversed direction, now 15% below a year earlier in Riverside.

The reason behind the inventory drop? Unlike the pandemic-era demand spike which pushed inventory into the basement, today’s low inventory numbers are most often due to reluctant sellers – not overactive buyers. As evidence, the number of new listings continues to dwindle, alongside home sales volume.

The winter months typically see the lowest inventory of homes for sale, peaking around mid-year.

Looking forward, expect inventory to climb in 2024. The significant interest rate increases of 2022 have slashed buyer purchasing power, making it nigh on impossible for mortgaged homebuyers to compete. Along with high inflation, the signs are pointing to a rapidly approaching downturn in the housing market — of which homebuyers and sellers are well aware. The seller’s market of the past decade has fully tipped into a buyer’s market, with prices now plunging as we head into 2023, as homebuyers increasingly take a wait-and-see approach to buying.

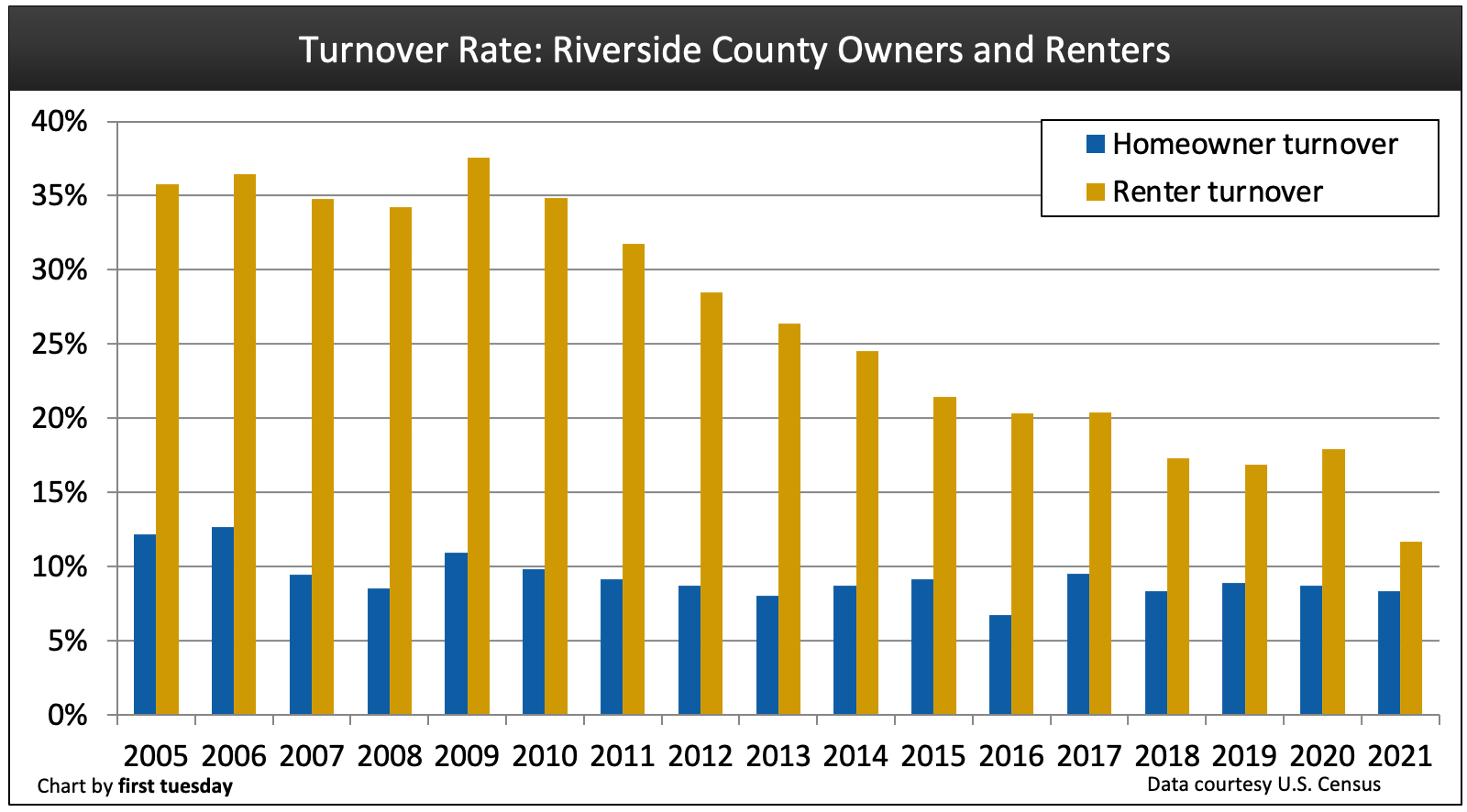

Turnover falls

Chart update 11/08/22

| 2022 | 2021 | 2020 | |

| Riverside County homeowner turnover rate | 8.3% | 8.7% | 8.9% |

Riverside County renter turnover rate | 11.7% | 17.9% | 16.9% |

Without homeowner or renter turnover, homes do not sell. In Riverside, the number of homeowners and renters moving in recent years peaked in 2009 due to the tax stimulus and high level of foreclosures, which temporarily lifted sales volume as tenants became homeowners. In a reversal, turnover has swiftly declined since then as potential end users have chosen more often to remain where they are.

The renter annual turnover rate has fallen dramatically, from above 26% in 2013 to just 11.7% in 2021 (the most recently reported Census year). On the other hand, the homeowner turnover rate fell back just slightly to 8.3% in 2021. Homeowner turnover is still below the level needed for a full recovery in home sales volume.

When slow job growth and wages stagnate, residents lack the confidence (and more importantly, often the financial ability) to move. When significant job losses occur, such as during the 2020 recession, turnover plummets. This dip was further complicated by the eviction and foreclosure moratoriums which encouraged residents to remain in place during the pandemic.

The turnover rate will rise when employment begins to recover consistently and wages improve sufficiently, as these increases boost confidence in the economy and reduce fears of carrying mortgage debt.

After this dip in economic activity, members of Gen Y who have remained employed will be more eager to rush from their apartments to buy and Baby Boomers will begin to retire in larger numbers, generally buying smaller, more convenient replacement homes after they sell. Immigrants will also play a significant role in boosting Riverside County’s suburban resale housing demand. Apartment vacancies will rise as they did in the early 1990s when the boomers took to buying homes.

Homeownership rate bounces back

Chart update 08/09/23

| Q1 2023 | Q4 2022 | Q1 2022 | |

| Riverside County homeownership | 70.5% | 63.9% | 68.8% |

Riverside County’s homeownership rate fell steeply during the last recession but has since achieved the rare status of clawing its way back to Millennium Boom levels. Riverside’s rate of homeownership hovered around 68% from 2000 through the end of the Millennium Boom. As of Q1 2023, the homeownership rate is a record 70.5%, up from nearly 69% a year earlier. This is significantly higher than the state average, which is 55.3% in Q1 2023.

By the end of 2014, the jobs lost in the Great Recession of 2008 were finally recovered, several months following the statewide jobs recovery. But with the intervening eight years of population increase, the ultimate jobs recovery with the strong wage rises needed to support high sales volume and in turn price increases didn’t occur until later in 2019, just in time for the economy to head into its next slump in 20202.

As we continue through the 2023 recession, homeowners behind on their payments are headed toward a forced sale when negative equity piles on with declining home prices. Thus, expect the homeownership rate too gradually fall back below pre-recession levels in 2024-2025, to rise again in the following recovery.

Related article:

The Fed bumps up rates again — the undeclared recession is here

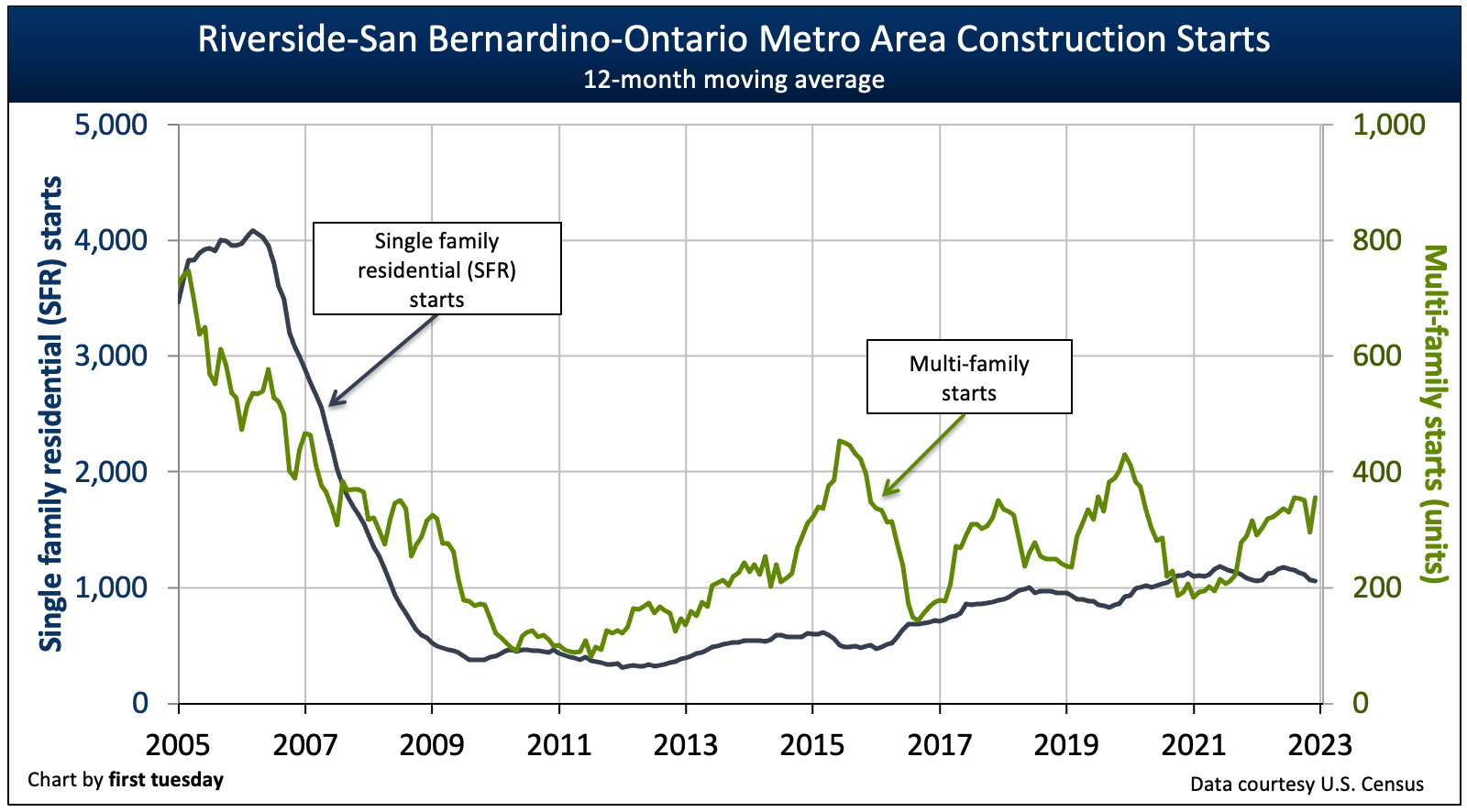

Residential construction mixed

Chart update 02/14/23

| 2022 | 2021 | 2020 | |

| Riverside County single family residential (SFR) starts | 11,800 | 11,700 | 12,300 |

Riverside County multi-family starts | 3,800 | 2,100 | 3,600 |

Residential construction starts are recovering marginally in the Riverside Metropolitan area. During the current housing cycle, multi-family starts recently peaked in 2015. Since then, multi-family starts have fluctuated each year, declining significantly in 2020, bouncing back gradually in 2020-2021.

Here, the focus on multi-family construction is far less pronounced than in regions closer to the coast, as the lower cost of land keeps SFRs within reach of more households. Meanwhile, single family residential (SFR) starts are rising gradually.

Construction increased dramatically during the Millennium Boom as the population moved from the urban centers of Los Angeles, Orange and San Diego Counties into the bedroom communities of Riverside County. Builders kept pace with buyer demand for new housing. Eventually, their starts overran the 2006-2007 decline in buyer demand. The excess starts resulted almost exclusively from distortions in mortgage and construction financing with personal guarantee arrangements.

When the housing bubble burst in 2006, the sale and thus the construction of SFRs and multi-family housing plummeted. Small builders went bust in droves. Today, the general trend for SFR starts in Riverside County is displaying signs of stability with no signs of reaching 2004 and 2005 numbers in the foreseeable future.

The next peak in SFR construction starts will likely begin around 2025, spurred by legislative efforts to increase California’s housing stock. Even then, SFR construction starts are very unlikely to return to the mortgage-driven numbers seen during the bacchanalia of the Millennium Boom.

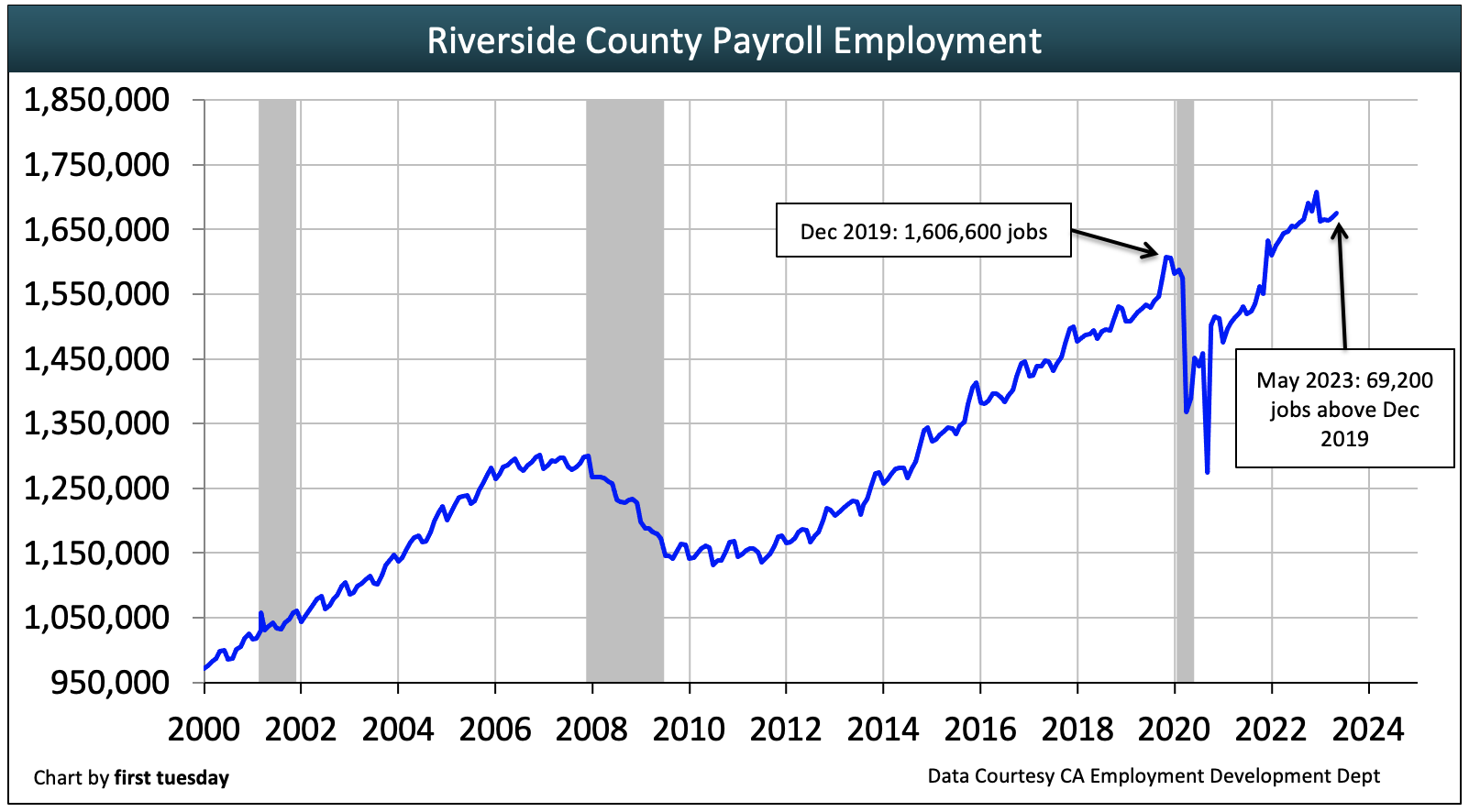

Jobs surpass pre-recession peak

Chart update 08/09/23

| May 2023 | May 2022 | annual change | |

| Riverside County jobs | 1,675,800 | 1,647,800 | +1.7% |

Before end users can provide sufficient support for the housing market, they need to acquire sustainable income — i.e., jobs with wages exceeding the rate of consumer inflation.

The number of individuals employed in Riverside County finally surpassed its December 2007 peak at the end of 2014, barely catching up when counting population gain at the end of 2019. But the recovery from the 2020 recession was much swifter, with Riverside one of California’s first major metros to achieve a jobs recovery. As of May 2023, just 69,2000 more individuals are employed in Riverside compared to the December 2019 pre-recession peak. The recovery pace has rapidly dwindled, with the number of jobs held today in Riverside just 1.7% above a year earlier.

However, watch for the chart above to waver in the coming months as the economy heads deeper into 2022’s undeclared recession. It will take another one-to-two years before a more consistent jobs recovery begins to adequately support further home price increases.

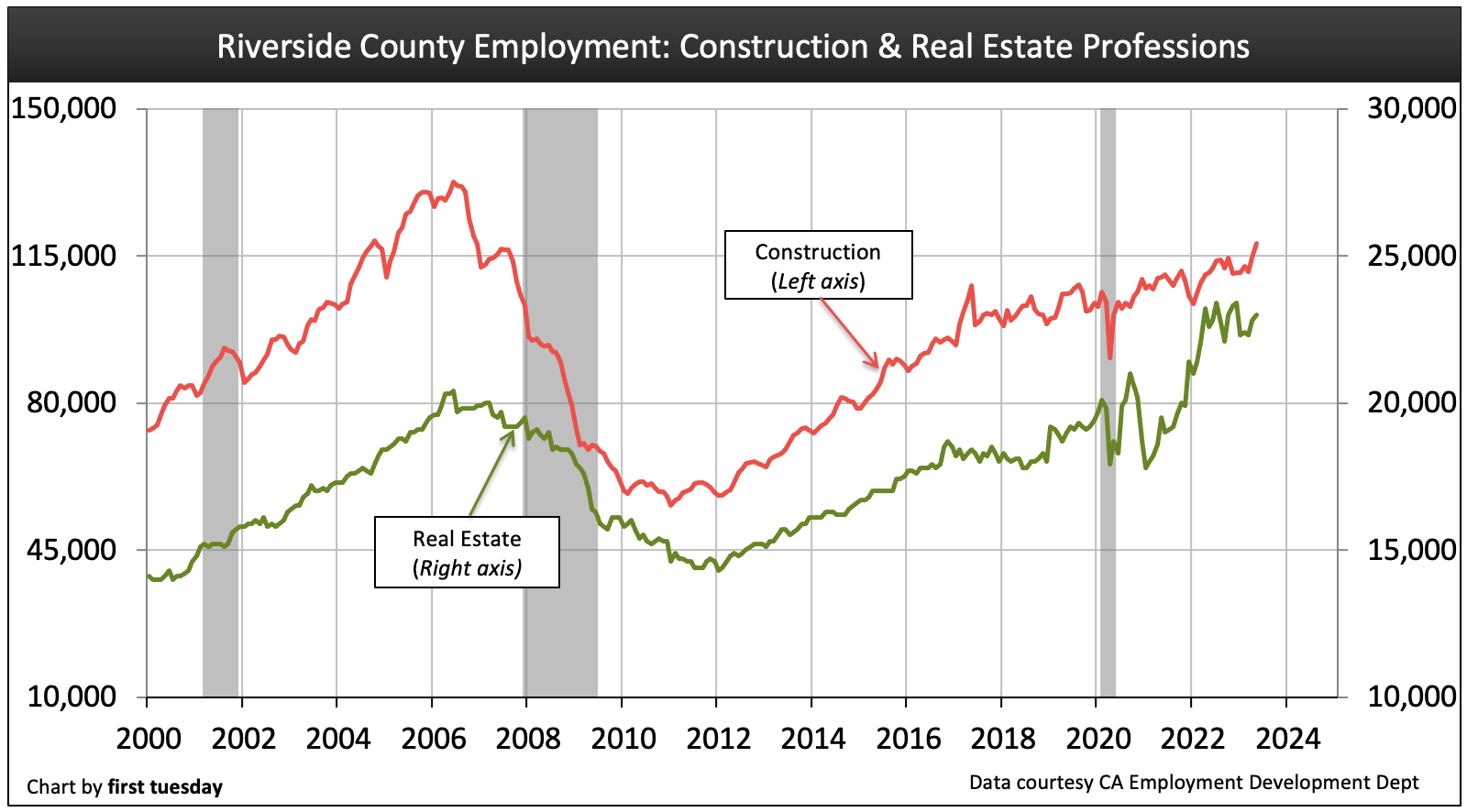

Real estate, construction slowly add workers

Chart update 08/09/23

| May 2023 | May 2022 | annual change | |

| Real estate | 23,000 | 22,600 | +1.8% |

| Construction | 111,000 | 117,900 | -5.9% |

While many of Riverside’s top employing industries have yet to recover from the 2020 recession, the 2020 recession has thus far been less hard on the real estate industry in Riverside, especially compared to other parts of Southern California.

The number of employed in the construction industry is down 5.9% over the past year in Riverside. At the same time, the number of individuals employed in the real estate industry was up a slight 1.8% from the previous year.

Expect the number of real estate professionals employed to see a decline in the coming years, the result of less stable sales volume and prices in 2023-2025. Construction workers will be somewhat shielded from today’s recessionary impacts, as, unlike during the lead-up to the 2008 recession, overbuilding has not been a problem in recent years. In fact, Riverside is in need of much more residential construction to keep up with demand from its rising population. State-initiated legislation will likely continue to propel construction even during the lean years ahead.

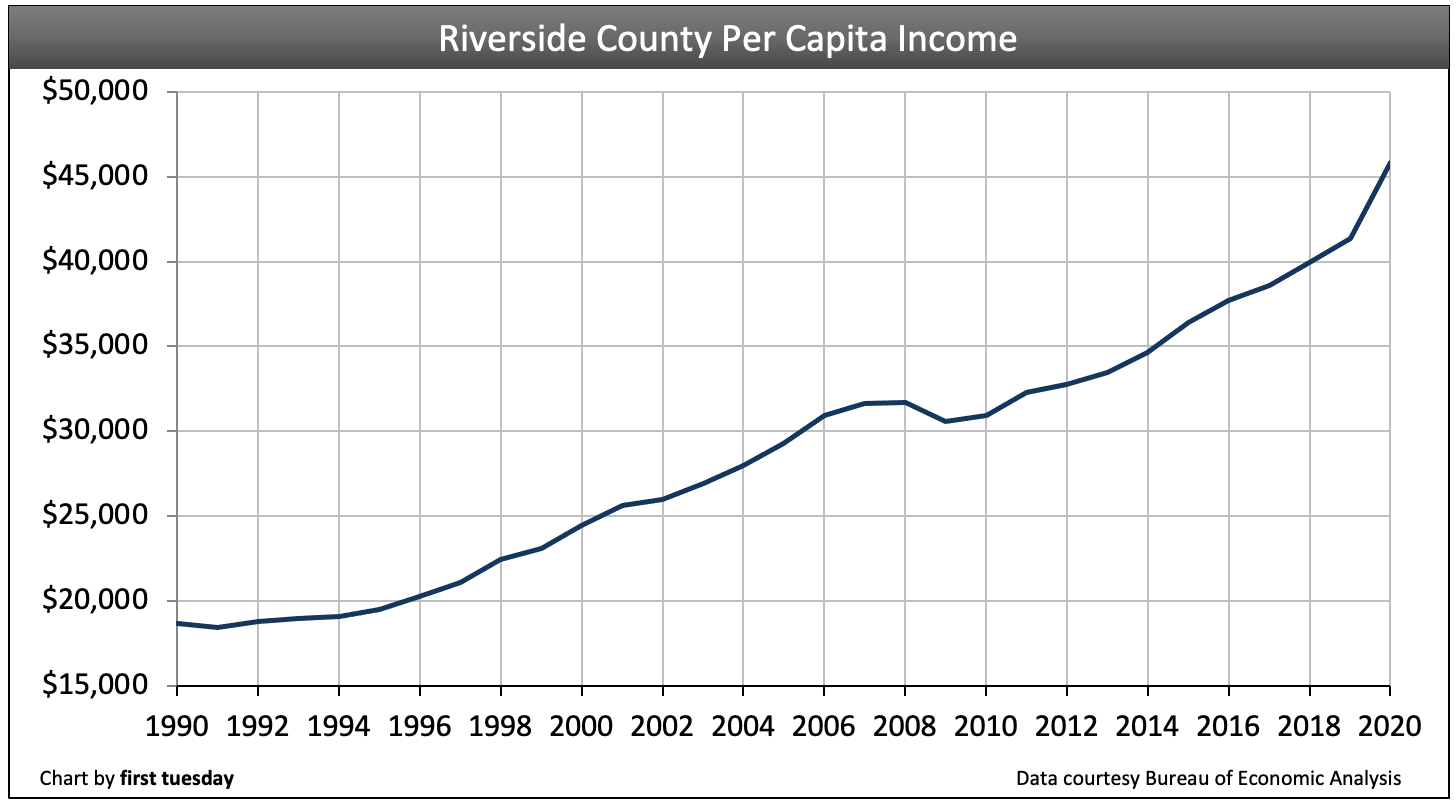

Per capita income recovers

Chart update 05/09/22

Chart update 05/09/22

| 2020 | 2019 | Annual change | |

| Riverside County per capita income | $45,800 | $41,400 | +10.6% |

| California per capita income | $70,700 | $65,300 | +8.3% |

Per capita income in Riverside is one of the lowest in the state. Low per capita income holds down rents and thus new multi-family starts. Annual income rose beyond 2008 peak year amounts in 2013 — and that’s before accounting for the purchasing power reduction brought on by interim inflation.

The average employed individual in Riverside earns just $45,800, according to the most recent Census reported year of 2020. The statewide average income is much higher than Riverside’s. But, the annual income rise in Riverside was a significant 10.6% compared to the state average of 8.3% in 2020. However, the average resident of Riverside spends less of their income on housing expenses than those living in urban coastal cities. In fact, some of this steep income rise may be attributed to high income-earners moving to the bedroom community of Riverside in search of cheaper housing.

Jobs and the pay received by locals is why homebuyer occupants ultimately determine selling prices. Buyers can only pay as much for a home (or rent) as their savings, income and credit score qualify them to pay — nothing more, no matter the price demanded by sellers. This amount is influenced by interest rates, which provided buyers a boost in 2020-2021. But as interest rates are on the rise for the foreseeable future, expect prices to feel downward pressure.

Expect per capita income to increase concurrently with increases in job numbers and the competition that brings employer demand for more employees.

The truth is that what reigns nowadays here in California more than any other State is a disease called GREED! but that’s not all, there’s also a problem with the Morality of the people, it’s been decaying since many many years ago, thx to people that exaggerated their desires for pleasure and lust they also expose their wrath when envy invades their haughty way of slothy and gluttonous living.

greed is what ‘the church’ admonishes us about (while collecting its riches from us). The ‘disease’, the social structure, is capitalism. This is how capitalism works. It takes our minds, our lives, all our life is consumed with fitting into the for-profit schema. Church aids the state – as you know.

its not capitalism nor greed that caused these problems, its the opposite, the welfare state. government wanted everyone to own homes and some people aren’t responsible enough to own homes causing this vicious cycle of booms and busts. u either use it to ur advantage or u listen to daddy government and accept a expensive handout. learn supply and demand along with fluctuating interest rates.

Maybe I live in a different riverside then the posters above. When I was in college working part time at T-Mobile, I was making close to 50k… Now that I have graduated I work in newport beach which is a 45 minute drive from riverside through till roads …. I had the option to buy a condo in OC for 400k or buy a big house with RV parking for 380k… So guess what I ended up buying in riverside. Most of my co workers are moving into riverside for same reason. That’s why the home prices are going up. Home prices are not made for entry level workers or single individuals…it is fairly easy to make 50 to 60k with few years of experience….combine that with your spouse 60k you can easily afford up to 480k since the interest rates are so low…. So to prospective buyers out there, don’t pay much attention to naysayers …..

to Jay and everyone: this is rent – owned by our Owners – controlling our lives. The need to make profit. For one thing if we don’t have ‘enough’ we’ll be out on the streets with the other dis-housed people – especially in our old age. Try paying rent on social security.

What the Author of this article has not included is the TOTAL PICTURE of what is on the HORIZON. For example it was disclosed that California will once again SHUT DOWN OIL in the SANTA BARBARA CHANNEL where currently receive 33% of all of California’s oil, plus the fact that Congress just approved the ability of Oil Companies exporting oil for the first time in FOUR DECADES. That and the mere fact that the current occupant of Sacramento as the Governor,(Jerry Brown), will not change the fact that California charges the most for gas in the U.S. and even though he favors FRACKING for OIL (on his 2,500 acre ranch only) and the fact that California will be increasing minimum wage and the fact that California will be increasing the price of gas next year to $4.50 a gallon for Regular and the fact that Obamacare will be causing the unemployment rate to increase as well and the fact that interest rates will be increasing next year for real estate loans, I do not see how the economy will be improving for at least the next 3 plus years at the earliest.

I agree whole heartedly with your assessment. Until income increases, there will be NO real recovery. Furthermore nobody’s addressing the back door property tax increases that are being called ” special assessments ” (an end around to prop 13).

My wife and I have recently been window shopping at all the new construction homes for sale, and noticed that with the property tax and special assessment fees that a buyer could pay in ezcess of 2% in taxes. If you factor in HOA’s your looking at upwards of 1000.00 a month above the mortgage. Then factor in the 50k plus premium the builders are placing on new construction, I’m not sure how a person with an average salary of 36k in this county can afford it. So what I see is lower down payment programs, lower FICO rate qualifications. .. in short we’re opening up ourselves to another bust. Albeit not as large as 05-06, but most definitely sure to happen.

The officials in this state have put so much downward pressure on the middle class with high utility costs, fuel costs, “special assessments “… they can’t afford to live here, let alone retire here. The mega rich can endure this , the poor can’t even contribute to the tax base , so you will see a collapse in our local economy. Already I’ve seen a drop in resale prices of 10k-20k just in the past month. The other major factor to consider is job growth and traffic congestion. Jobs being created in the IE for the most part are not high wage jobs. The high wages jobs are primarily in OC, SD & LA and as we all well all know, those commute times have increased substantially in the past few years.

To all you Gen Y’ers & Boomers out there, my advice is plan on getting the heck out of this place within the next 10 years. There are much more beautiful and better places to retire then California. Ask yourself what kind of quality of life will you have. Good luck and GOD Bless.

Well said!

The job growth in the IE is due to minimum wage job increase. Why would you need to write an article stating the obvious – that home sale volume is directly tied to job growth, and job growth with real income growth, not minimum wage income. It was the NINJA subprime lenders that created the home boom/bust. The INSTITUIONAL cash buyers like Blackstone, wealthy Arabs and Chinese that were able to buy the distressed properties and REOs and they purchased them in bulk in the IE around 2010 thru 2012, Now they have put them on the market at double (or more) the purchase price. But wage growth is not able to support these listing prices. This is a sellers market for all tiers the problem is the low tier group dont have the wage growth to buy in the IE. The game is rigged I’m afraid….get out of CA as quick as you can!

I believe that sam’s comment is clarifying whats really going on in short. And the authors, who spent so much time writing this article, fail to take a moment to speak to his comment; which would help readers.

The article says Riverside County per capita income $33,278 per yr. According to Zillow’s qualifying calculator this income would only qualify a buyer for $107,000 house that is with a $20,000 dn payment. And your debt level can only be $250.00 a month.

At an annual income of $33,278 divided by 40 hrs a wk x 52=, 1,920 hrs per yr. Equaling $17.34 per hr for one person. Or divided by 2 = $8.66 per hr for two. This looks a little like minimum wage to me.

So it would take two minimum wagers to qualify for a $107,000 house. But there are no $107k houses. One can use these numbers and juggle them around anyway they want. You could double the income from $17.34 per hr to $34.68 per hr or $66,556 a yr and you still could only afford a $214,000 house. But houses are ranging around $250,000 house your income would have to be $60,000. It begs the question(s). Who’s buying these houses? Two nurses living together or who. How can these price arranges be?

What we have is a squeeze play. Interest rates will have to remain low in order to sell houses that are already to high. There aren’t enough high productivity jobs to support the high price homes. This is a consequence of sending productive jobs to China and Mexico, etc.,and the allowing of illegal aliens/Mexicans and their Babies to do the massive numbers of minimum wage jobs created by corporations, once they found out they could control the government, which allows the illegal aliens into our country.

one of the things that has been done is that the money in our country is no longer circulated in our country.

What we are experiancing

To summarize prices are over priced. Who can afford them? Are interest rates set low so that people can have a better chance of buying? Is a crash in the works again.

All this said, whats the purpose of this article?

The article should be emphasizing that the price of housing way to high. And the next question is who is responsible? Will there be another housing crash?

The whole thing is a viscous cycle, whereby China, Mexico, corporations, businesses, illegal aliens, (who make a fortune in our country as compared to Mexico), and other 3rd worlders all make money while true American Citizens are driven down! If I’m wrong please explain why so that I can see the “light”.

Your information is helpful. It only, really, raises more important questions, thoughts and ideas as I’ve posed above.

Technology is putting people out of jobs not people that want low wage jobs and come here. Just look around you at the tech that can do part or all of what people were doing. The other factor is 80 million boomers that companies feel are paid too much and want them replaced with younger cheaper workers and those same boomers will off load houses as the face retirement and health issues. There will be more renters than home buyers.

If you buy a house in Riverside county especially in rural ar es as you better be aware of every detail of that property. RIP Off Riverside county doesn’t even know where property lines are, they dont know if the land is developed or not. They are CLUELESS. We recieved a tax bill for undeveloped land, and wanting to do the right thing we advised the assessor that there was a house on this land. To make a long story short $10,000 later we had to 2nd our house. Now as we are trying to sell the county says our address doesn’t exist and that our property lines are all wrong. Of course we have to pay to find them. AVOID RIVERSIDE COUNTY LIKE THE PLAGUE.

Unfortunately you are right. Technology is replacing some jobs but not the ones being filled by immigrants. Construction, Landscaping, Food Service, Maid Service, just to name a few. Low cost immigrants have been taking these jobs at a pretty good clip for the last 30 years. Not just in California but the entire Southern States and Midwest. Lawn mowing and fast food jobs were primarily filled by young kids willing to work for extra money 30 years ago. Now these jobs are filled by adult immigrants who need money to live. This is why housing prices are outpacing wages. We are filling jobs with people who will work for less than a living wage. The divide between poor and rich is growing as a result. Liberals typically do not understand this dynamic in our economy and that is why it is getting worse. To talk like this will label you a racist or a bigot. Although there is nothing racist about it, Liberals like to use name calling and labeling as a weapon to make their points rather than relying on sound evidence for their arguments or listen to other viewpoints. Their answer is to legislate a “Living Wage” for our minimum wage. It sounds good except that it will increase prices 2 fold, if not more, which will further widen the gap between rich and poor. The problem is simple supply and demand. There are too many low wage and or low skilled workers in the labor force and more on the way. The only benefits are that Corporations profit and increase their bottom line which makes their stocks go up, and Government is adding a new tax base and voter block to vote for and pay for future Government dept. Only in America.

yeah – they don’t have vicious cycles in Cuba – didn’t in USSR. That’s why our Owners keep attacking them. If people get to understand that the for-the-people social set-up is beneficial, our Owners are out of business – as they were in those states. US attacks any-everywhere people rise up – to take their property out of Owners’ – profiteers’ – hands.

You know Cuba would long have gotten itself into better shape if the US hadn’t kept invading it –

Is there a way to separate out retirement communities from the overall residential real estate market? It seems to me that retirees are a market unto themselves and that buying group is growing very fast. I own a property in Heritage Palms.